Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Alright, let’s dive in…

Funding & Infrastructure Surge:

SoftBank sold its $5.83B Nvidia stake to fuel AI plays, including $30B+ into OpenAI, the $500B Stargate data center (with Oracle), Ampere chips, and ABB robotics.

Vertical AI’s “trillion-dollar SaaS future” narrative persists, targeting $11T U.S. labor spend via value-based pricing (5–10x traditional SaaS).

Expect more barbell plays: Big iron clouds feeding specialized agents. Power constraints (e.g., delayed data centers) loom, but alternatives like nuclear/liquid cooling are accelerating.

A data-driven look at startup growth from $0 to ~$25 M ARR.

Reaching meaningful scale is slower and rarer than most founders or investors assume.

Most software startups plateau at modest growth—true breakout success is the exception.

Longevity (10+ years) matters more than early speed in determining outcomes.

Challenges the myth of “overnight success” and urges founders to recalibrate expectations.

Mercor Quintuples valuation to $10B with $350M Series C

Raised $350M Series C led by Felicis, valuing Mercor at $10B.

Pivoted from hiring to supplying domain experts for AI training and RL infrastructure.

Traction: Claims pace to $500M ARR; pays $1.5M/day to contractors; 30k+ experts, $85/hr average.

ChatGPT’s everything strategy is drawing parralels to what google has beend oing for the last decade. More reason to focus on verticals.

Dan Friedman, Founder @ Moxie

How Dan Friedman turned a fragmented $15B industry into a business-in-a-box empire with 140%+ net revenue retention. And he and Moxie might just end up owning a massive slice of it.

When Dan Friedman sold Thinkful to Chegg for over $100 million, he could have retired. Instead, he asked himself a simple question:

“What was I put on earth to do?”

The answer led him to build one of the most fascinating business models in vertical software.

Fresh off managing Thinkful as a Chegg division for two and a half years, Friedman realized something crucial about himself. He loved the chaos—years one, two, three, when every week brought trajectory-changing decisions. The later years of scaling through people management? Less fulfilling.

So he teamed up with longtime friend Sam and started Bolton & Watt (named after the inventors of the steam engine), not as a venture studio, but as what they call an incubator. The distinction matters: they don’t just fund companies. They start them, grow them to scale, hire a CEO to replace themselves, and do it all over again.

Their first creation? Moxie—a business that defies simple categorization. It’s vertical SaaS. It’s a franchise without the franchise. It’s an MSO. It’s all of the above.

The Origin Story: Finding the Perfect Market

Bolton & Watt’s approach to company formation is methodical but not rigid. They look for “big messy kind of hairy combinations of problems versus the more narrow point solution.” They love regulated industries with compliance pain. But most

Bolton & Watt’s approach to company formation is methodical but not rigid. They look for “big messy kind of hairy combinations of problems versus the more narrow point solution.” They love regulated industries with compliance pain. But most distinctively, they’re drawn to enabling individual producers to become business owners.

Med spas checked every box. Here was a $15 billion US market (roughly $45-50B globally) filled with first-time small business owners navigating an incredibly complex business model. Think about it: injectable treatments are low capex with high retention, while device-based treatments require expensive equipment but deliver large one-time packages with high margins. Different services reach new audiences versus retain existing ones versus increase average order value.

And these business owners? They were “feeling their way through all these decisions. Not necessarily making bad ones, but not necessarily using all the best practices that are out there.”

How To Build A Business In A Box

The Launch Wedge: Stripe Atlas for Med Spas

Most vertical software companies look at an existing market and ask: “How do we sell to these businesses?” Friedman asked a different question: “What if we could create the businesses?”

Moxie’s wedge was brilliantly simple: be the Stripe Atlas for med spas. Make it easy, fast, and cheap to follow the default path from “I want to start a med spa” to “I have a compliantly formed, operational med spa.”

Validation was old school but effective: a landing page, an AdWords campaign (”literally I built our AdWords campaign and I’m not an AdWords expert by any stretch”), and conversations with potential customers. The pull was immediate and undeniable.

“I like the midwit meme… There are 75 different questions you can ask, but fundamentally, its hard to outsmart the YC truism of just building something people want.

-Dan Friedman

Here’s what’s crucial: they didn’t build custom software on day one. Moxie started as essentially a consulting service, setting up customers with off-the-shelf software like Square for payments and booking. Only after understanding exactly what their customers needed—and couldn’t get from existing solutions—did they build Moxie Suite.

Cracking the Retention Code

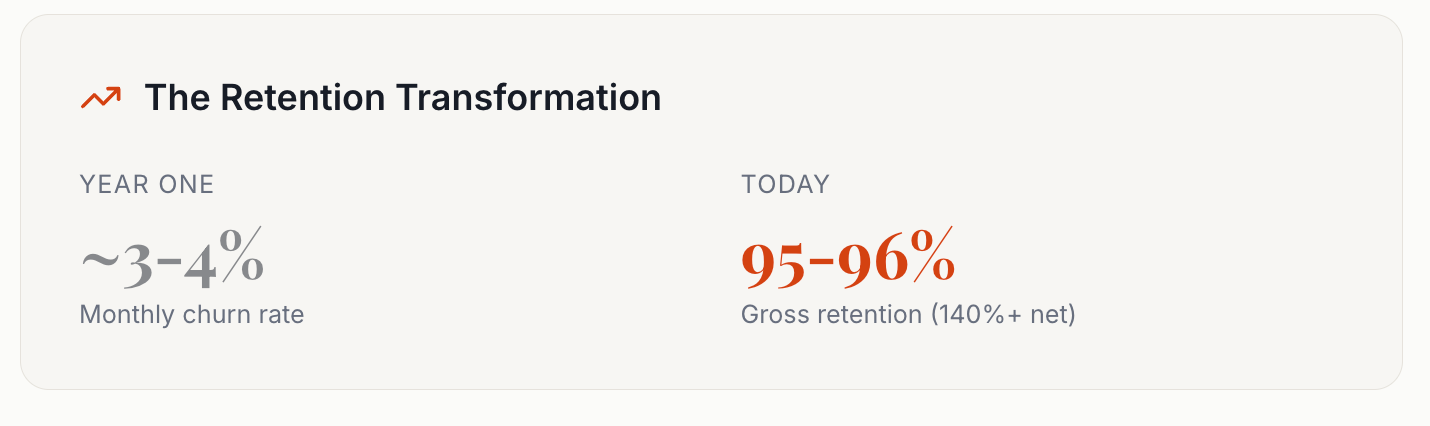

A year in, Moxie’s retention wasn’t great. Friedman called around to industry veterans. The response was sobering: “In that segment we saw three to four percent monthly churn. It just is what it is.”

But Friedman refused to accept it. His logic: “Our churn should be way lower than that. It’s easier to switch out Booker or MindBody for another solution than it is the all-in-one. If we’re doing enough of it and well enough, the hit to your profit should be so large if you leave us that you really shouldn’t leave us.”

The journey to world-class retention came through relentless focus on micro-monopolies. Friedman learned this lesson the hard way at Thinkful, watching competitors slice away 10-15% of his audience by launching “Front-End Development for Marketers” or “Front-End Development for Designers.”

It was totally impossible to be the best for everyone as the biggest. You just had to cede that ground and then pick some micro monopoly.

— Dan Friedman

The Three Criteria Framework

As Moxie’s success became known, Friedman started getting calls from investors looking at business-in-a-box plays in other categories. This forced him to articulate why Moxie worked—and why many imitators don’t.

#1. Latent Entrepreneurship Desire

“We’ve never convinced a single person that they should start a med spa. We’ve only served people who already knew they wanted to.” Convincing people to become entrepreneurs would be 10-100x harder.

#2. Unit Economics That Work

Do a high enough share of the businesses succeed? “I have seen some fail on this basis where they can sell the franchise, but the franchises don’t work.”

#3. Economies of Scale

Is there benefit to being bigger? Can you provide more value as you grow? This creates a flywheel where growth compounds your competitive advantage.

Friedman is blunt about the hit rate: “Only about half of our ideas today still have this phenomenon because we just think the actual hit rate within business in a box has not been very high overall. We’ve seen a lot more of it out there than we’ve seen work.”

The Services Debate: Moat or Mistake?

Perhaps the most provocative insight from Friedman: “It still doesn’t make sense to me why more vertical SaaS companies don’t act like Moxie. Why they’re not open-minded to having service arms, why they’re not looking to aggressively eat every dollar of spend their customers have.”

Moxie’s pricing model reflects this philosophy: a flat 9% of revenue, with enterprise tiering for larger customers. Many add-ons are offered at break-even or even a loss. The logic? Higher retention and more gross margin per customer is worth more than optimizing each line item.

I am gross margin percentage insensitive, as long as the underlying gross margin is itself durable. I would take the 40% margin business if it’s three times easier to earn than the 90%.

— Dan Friedman

The counterpoint is real: pure services without defensibility becomes a knife fight to the bottom. But the synthesis is powerful—use services as both a wedge and a moat, then build proprietary technology underneath. As one participant noted: “If you’re pulling out a function and have elements that are super proprietary, then great. How is that different than software at the end of the day?”

What’s Next

Moxie is now in “early growth”—tens of millions in ARR, supporting customers earning into the low hundreds of millions collectively. The goal is ambitious: capture a third to half of the lower and middle market segments, then expand globally.

As for Bolton & Watt, they’re deep in ideation for Company 3, running three potential ideas in parallel. True to form, Friedman won’t discuss them—”so in-flight as to be kind of meaningless.” But given their track record, one thing seems certain: they’ll find another messy, regulated industry full of latent entrepreneurs waiting for someone to make their dreams achievable.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com