Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Hi friends —

Trailer only in the above.

Please watch / subscribe to the video on YouTube at button below :-)

From SDR to $200M Quotas to Founder: How Mike Powers Is Rewiring Construction Procurement

The CEO of BuildVision spent a decade understanding how equipment moves through construction’s supply chain. Now he’s building the infrastructure to capture billions in transaction value—by giving away the software for free.

The Construction Guy Who Became a Tech Guy

Mike Powers didn’t stumble into construction technology by accident. His journey began at Turner Construction—a $20 billion general contractor that happens to run one of the most sophisticated procurement operations in commercial construction. “I spent the early part of my career working in their strategic procurement arm,” Mike explains. This wasn’t just about buying equipment. It was about understanding how to leverage massive scale.

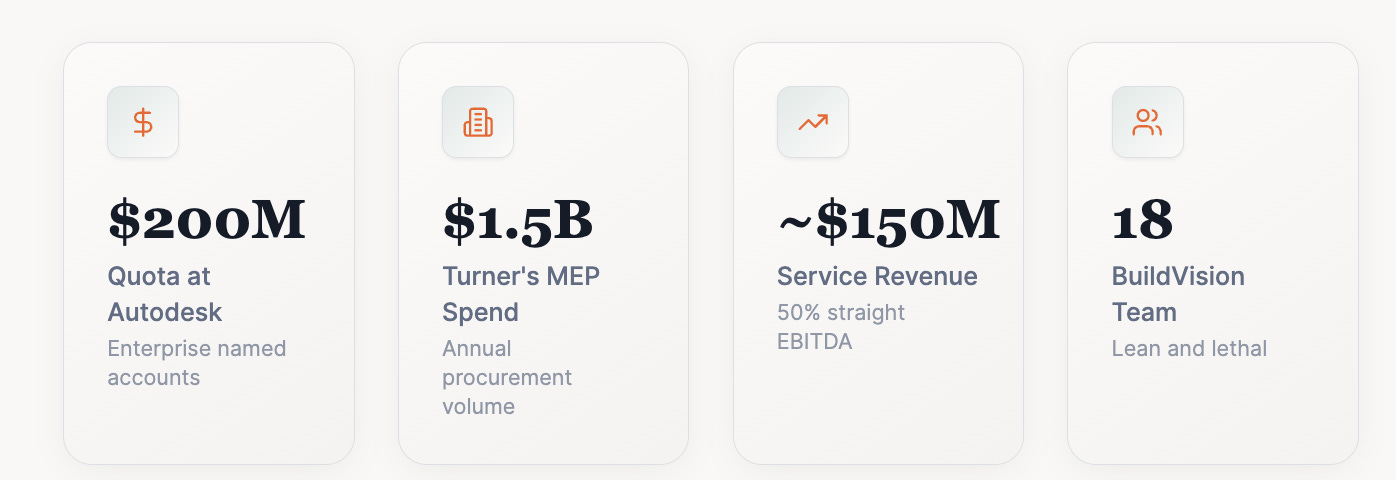

Turner’s procurement operation is a masterclass in aggregated buying power. Instead of purchasing equipment project-by-project through local reps, Turner consolidates demand across every job site in the country. The numbers are staggering: $1.5 to $1.6 billion in mechanical, electrical, and plumbing equipment annually. The company charges owners approximately 10% for this service—generating roughly $150 million in revenue, with about half dropping straight to EBITDA.

This observation would prove foundational. But first, Mike needed to understand the technology side. While at Turner, he started using a software product called Building Connected for bid management. He became what he calls a “whiz kid of a feedback loop,” constantly providing suggestions to the product team. Eventually, he convinced the CEO to bring him out to San Francisco as an SDR.

“I joined as an SDR in 2016, moved up the ranks, ended up running a sales team. We got acquired by Autodesk in 2018. I ran an enterprise sales team there carrying about a $200 million quota.”

—Mike Powers

At Autodesk, working with the top 100 general contractors in the US, Mike kept hearing the same question: How do we build what Turner built? “After like the 30th GC asked about it,” he recalls, “I partnered with an early general contractor out of New York City and we said, let’s go build this together.”

And that is how BuildVision was born…

How To Successfully Serve Multi-Stakeholder Ecosystems

BuildVision isn’t just another construction SaaS tool. It’s an attempt to become what Mike calls “the event ledger for equipment”—tracking everything that’s engineered in one location and shipped to a construction project in another. This includes how equipment is designed, procured, financed, transacted, and delivered to the job site.

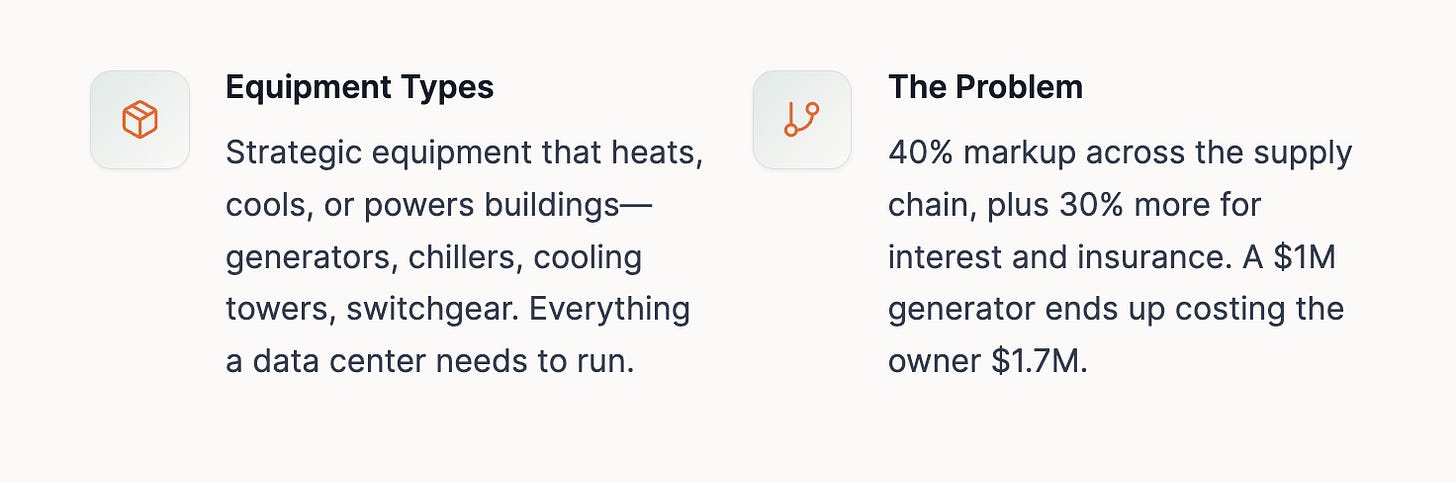

The focus is specifically on what Mike terms “strategic equipment”: anything that heats, cools, or powers a building. Generators, switchgear, chillers, cooling towers. This is the infrastructure that data centers run on, that hospitals depend on, that high-rises require. Unlike the forklifts and scissor lifts that United Rentals rents out, this equipment becomes permanent. It stays with the building.

The economics of this supply chain are brutal. A generator that comes off the Caterpillar line for $1 million ends up costing the building owner $1.7 million. There’s approximately 40% markup baked into the supply chain itself, and another 30% tacked on for interest and insurance costs. BuildVision’s thesis: they can dramatically reduce that 30% down toward zero, capturing value in the process while letting the rest of the supply chain keep their margins.

“Our end goal is for every dollar that flows through the application, we start taking what we call capture. Right now we’re at 25 to 50 bips. We’re building toward one, two, three, five points of that transaction.”

— Mike Powers

Give Away the SaaS, Charge for the Outcome

Here’s where BuildVision’s approach gets interesting—and potentially represents a new playbook for vertical AI companies. The company has taken a deliberately unconventional position: what they consider “table stakes tools” are free. Permanently free. For both buyers and sellers.

Want to send out RFQs? Free. Need to leverage their takeoff tool that uses AI to scrape 3,000 pages of construction documents? Free. Want to respond to quotes as a supplier? Free. BuildVision has built what they believe is the best-in-class procurement tool in the market—and they’re giving it away to build network effects.

The monetization happens on outcome-based work. If you’re a contractor who has a team that can click buttons, use the application for free. But if you can’t find the headcount to manage procurement—and in construction, talent is perpetually scarce—BuildVision can do it on your behalf and share in the upside.

The Monetization Model

BuildVision goes to enterprise executive offices and asks: what’s your biggest problem? They pitch solutions worth five to ten million dollars annually, tied directly to increasing sales or reducing claims. If they don’t deliver, they don’t charge. But if they do, they participate in the upside—typically targeting 30% of outcome value on the buy side and 10% on the sell side.

This creates an interesting dynamic. The free tier drives network effects and generates lead flow. The enterprise tier creates seven-figure contracts that don’t require a massive sales team to pursue. “I don’t need 10, 15, 20 AEs to go get $10-20 million of revenue,” Mike explains. “We’ll stay very lean with just that team.”

Why Point Solutions Will Get Eaten

Mike has a provocatively bearish view on standalone AI point solutions in construction: “The foundational models are continually getting better and they start eating away at these pieces. You need to have a specific data moat, network effect, or insight to continue providing value.”

He points to an uncomfortable truth: Claude can already do a lot of things that agentic point solutions claim to do. BuildVision has started releasing benchmarking reports showing near-100% accuracy on “very complex construction extraction processes that companies have raised hundreds of millions of dollars to solve.”

“We don’t have the carrot to hire a researcher from OpenAI. So we’re going to bet that OpenAI, Claude, Gemini continually get better. We can just switch out those models and switch out the workflows.”

— Mike Powers

This is why BuildVision focuses on being the transaction and data layer rather than an AI-powered feature. They’ve built integrations that read and send emails, process documents, and feed information back to users—but the value isn’t the AI. The value is being the trusted platform where decisions happen and transactions flow.

Enterprise Sales Without the Enterprise Bloat

The contrast with Building Connected is instructive. At Building Connected, the ASP was $7,500. The motion was pure velocity: smile, dial, get the user into the application same day, close the deal. “You could mathematically figure out which reps were hitting quota based on the number of calls they made,” Mike recalls. Demo to close rate was 50%—if someone got on a demo, half the time they’d sign.

BuildVision operates in a different universe. The go-to-market is Mike himself, plus two salespeople: a mechanical rep who started a construction tech company that BuildVision acquired, and an electrical rep who did the same. Everything is relationship-driven, built on a decade of connections.

The Pilot Model

Instead of free pilots, BuildVision runs “very, very structured” paid engagements with clear milestones. For a large company with 80 offices, they might get executive buy-in, then embed with five offices for 30-60 days to figure out workflows and digitize them. Hit the KPIs, and it rolls into a larger agreement.

The key insight from Building Connected’s experience: they had a good exit, but ran into a TAM ceiling. Pre-construction isn’t where the money flows—estimators using Building Connected on every project weren’t winning more projects because they weren’t trying to. “It was hard to tie to revenue,” Mike admits.

Now at BuildVision, every conversation ties directly to revenue outcomes. They’re named in business plans. They find champions whose bonus structures depend on BuildVision’s success. “We want to go make you an extra $200 million in EBITDA this year,” Mike tells customers. “We want a percentage of that. If we don’t deliver, we don’t charge.”

Reading the Procore-DataGRID Tea Leaves

The recent Procore acquisition of DataGRID signals where the industry might be headed. DataGRID built integrations connecting Procore, Autodesk, email, and other systems, then helped contractors build agentic workflows on top. They became the “glue” layer—and now they’re part of the largest system of record in commercial construction.

Mike sees interesting implications. Construction tech has limited M&A buyers—Procore, Autodesk, Trimble, Oracle, and maybe a few others. Now that Procore has made an agentic AI play, competitors will need to respond. Will they acquire? Build in-house? The shakeout is coming.

The strategic lesson: tying to outcomes might be the defensive moat that keeps horizontal AI players at bay. Claude isn’t going to tie its success to whether a construction project delivers on time. That’s where vertical players have room to operate.

The Transition from Sales Leader to CEO

Mike officially started BuildVision three days after his son was born. (”Shout out to my wife for being supportive of that,” he notes.) The transition from sales leader to founder wasn’t entirely foreign—you’re still selling, just to different audiences. Selling to recruits on your vision. Selling to customers who are betting on you. Selling to the fundraising market.

But the muscle that was missing? Financial management. “You’re now responsible for 18 employees’ livelihoods,” Mike explains. “You need to make sure there’s enough capital in the bank. In sales, you eat what you hunt—if an AE isn’t producing, you let them go. In the CEO world, it’s harder.”

If he were starting over, Mike says he’d spend more time with customers earlier—sitting in their offices, solving their problems. And he’d charge faster. “No more free pilots. No more giving away engineering resources. You really start monetizing on the outcome value you provide.”

The Bigger Picture

BuildVision represents a specific bet on the future of vertical AI: that the value isn’t in the AI itself, but in owning the transaction layer where decisions happen. The foundational models will keep improving. Point solutions will get commoditized. But the company that becomes the trusted platform for billion-dollar equipment purchases? That’s a different kind of business entirely.

“Regardless of whether it’s agentic or not, we will be the biggest buyers and sellers of mechanical electrical plumbing equipment. That’s the moat.”

Mike’s decade in the industry—from Turner’s procurement desk to Building Connected’s sales floor to Autodesk’s enterprise accounts—gave him an unusual vantage point. He saw how equipment really moves through construction. He understood why the supply chain is so inefficient. And now he’s building the infrastructure to fix it.

The question isn’t whether construction needs better procurement software. The question is whether BuildVision can execute on the ambitious vision of becoming the event ledger for equipment—the trusted layer where $1.5 billion in annual transactions (and eventually much more) flows through their platform.

If they pull it off, they’ll have built something that can’t be replicated by a foundation model, no matter how capable it becomes. And that, in the age of AI commoditization, might be exactly what defensibility looks like.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com