Given the holidays, we will be coming to you a day early this week (12.23 versus tomorrow) + a day early next week (12.30 versus 12.31).

Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow.

Check out what Parafin can do to drive revenue, retention, and TAM at your business!

GC AI—an emerging name in legal AI that just raised a $60 million Series B led by Scale and North Zone at over a half-billion dollar valuation.

$60M Series B

1,000+ Customers

$10M ARR in ~1 year

Unlike Harvey, which sells into law firms, GC AI targets in-house legal teams and corporate counsel—a different motion with different incentives. They’ve also integrated directly into Microsoft Office, which is genius for legal workflows. I think this company can be much bigger than Harvey and the other Legal AI growers were there has been a bunch of chatter about actual usage at law firms. This is not the case with GC AI

I studied every Vertical SaaS monopoly and did a big write up on exactly How To Monopolize your vertical. Check it out here.

Martin Roth, Former CRO @ Levelset

This week on Verticals, we brought on Martin Roth—our “Vertical Titan” of the week. Martin was the CRO of Levelset from literally their first dollar of recurring revenue all the way through their half-billion dollar acquisition by Procore. What followed was one of the most tactical, no-BS conversations we’ve ever had about scaling a vertical SaaS go-to-market machine.

Martin joined Levelset (then called ZLien) as the seventh employee and first sales hire when there was zero recurring revenue. The founder, Scott Wolfe, was a construction attorney who built a website where contractors could file liens online—something that didn’t exist anywhere else.

“I joined, we had zero recurring revenue. I joke that we couldn’t even spell ARR. We didn’t know any of this stuff. We started this company in New Orleans, Louisiana. There’s no other SaaS companies here.”

— Martin Roth

Martin’s onboarding was simple: Scott gave him a book called The Ultimate Sales Machine by Chet Holmes and told him to start calling customers. That’s it.

He turned that into a massive GTM machine and a $500M exit by Procore…

But my favorite part? The notion of hiring PSD’s in early stage tech companies. What is a PSD you ask?

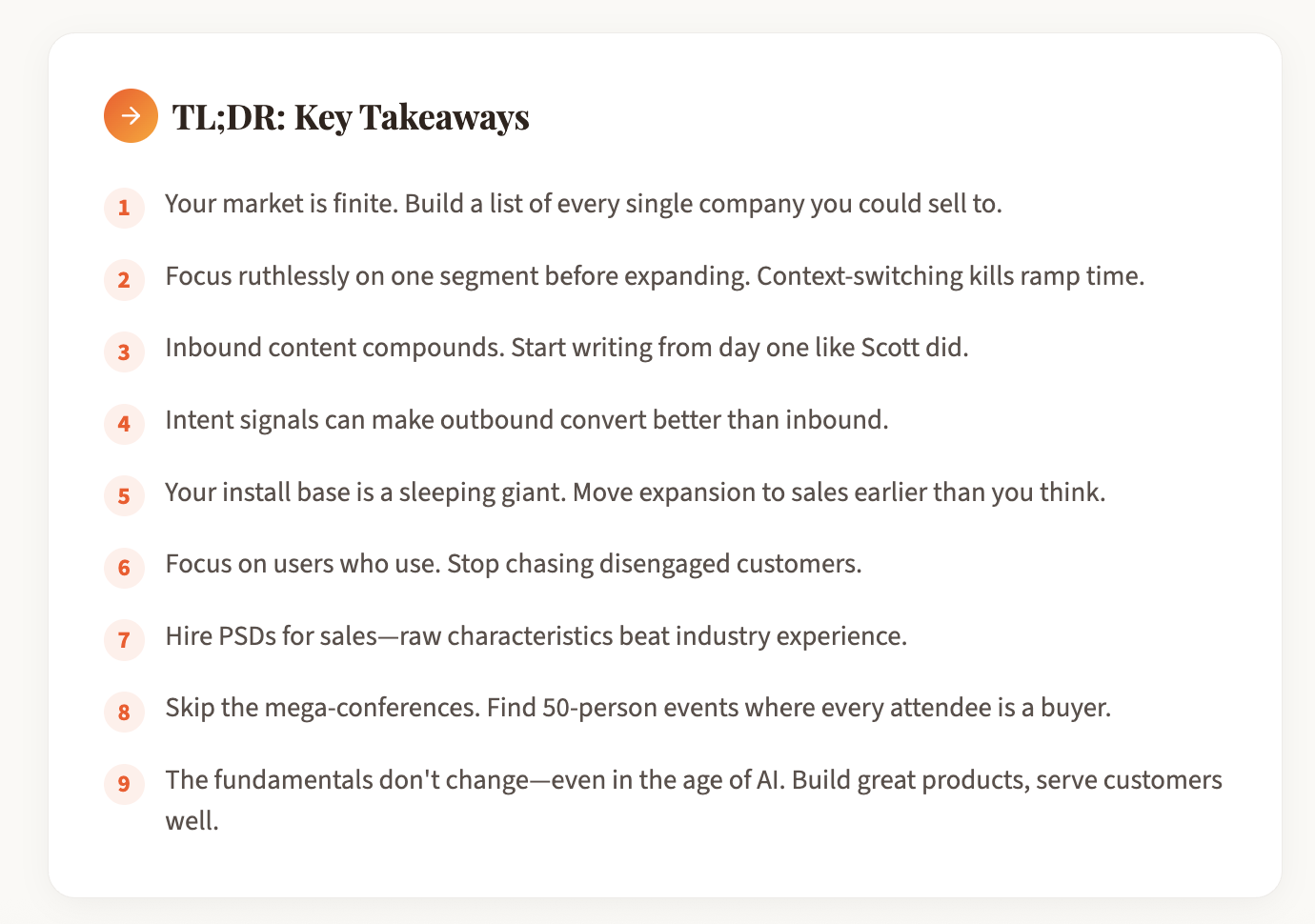

Scaling GTM from $0 ARR to a $500M Exit by Procore

Zero to One: The Dream 100 Era

In those early days, Martin targeted the biggest companies he could possibly sell to—ABC Supply, Thyssenkrupp Elevator, Caterpillar dealers, Martin Marietta Materials. Billion-dollar publicly traded companies. A 23-year-old with no sales experience trying to get meetings with CFOs.

One famous story: Martin and Scott pretended they were already “in Atlanta” to secure a meeting with an elevator company. They drove overnight from New Orleans, showed up in suits, and closed one of their first real enterprise customers—a $400,000/year deal.

“When we got up there, the executive saw a Tulane sticker on our car and said, ‘Did y’all drive here?’ And we’re like, ‘Oh yeah, New Orleans is just around the corner. We get up here all the time.’”

— Martin Roth

But here’s the critical insight: while Martin spent six months closing an $80K enterprise deal, the SMB inbound engine had closed $200K in smaller $3-4K deals. That was the aha moment—they were focused on the wrong part of the market.

The Go-To-Market Playbook by Stage

1. Zero to $1M ARR

Be the founder-seller – Nobody can sell your vision like you can. Live in the field.

Build relationships with customers – They’ll tell you what to build next and become your advocates.

Just start selling – Don’t overthink tooling or process. Get in the trenches.

Don’t worry about repeatability yet – You’re learning. Every call teaches you something.

Key Takeaways at this stage:

✅ Pick one outbound motion and commit - Dream 100 worked because they stuck with it for 6-8 months

✅ Content > Ads in vertical markets - Rank for high-intent searches in your vertical

✅ Hustle covers a multitude of sins - Drive overnight. Promise features. Do whatever it takes to get in the room

✅ Follow the path of least resistance - Don't let ego drive your ICP

✅ Volume covers a lot of flaws - At this stage, you need deals, not perfect process

2. $1M to $10M ARR

Focus ruthlessly on one segment – Levelset chose SMB to the exclusion of everything else.

Build your total addressable list – Know every single firm in your market. Tag them in your CRM.

Invest in inbound and content – Scott was writing blog posts from day one. It compounds.

Go to niche events – Skip Dreamforce. Find the 50-100 person conferences in Cleveland where every attendee is a buyer.

Don’t wait on install-base expansion – “I wish we’d done this at $5M instead of $10M.”

Key Takeaways at this stage:

✅ Pick a lane: Enterprise or SMB - You can't do both well until you're much bigger

✅ Infrastructure > headcount - Train your second rep before you hire your fifth

✅ Content-driven inbound > cold outbound - Especially in traditional verticals

✅ Test 5-10 channels, double down on 2-3 - Most won't work, that's fine

✅ Measure everything - Response times, conversion rates, objections, win/loss reasons

3. $10M+ ARR

Go multi-product – Levelset added data products, payments, and financing.

Specialize your sales teams – Different products often mean different buyers and different motions.

Move expansion from CS to Sales – CS is too busy. Let them focus on retention; sales handles commercial conversations.

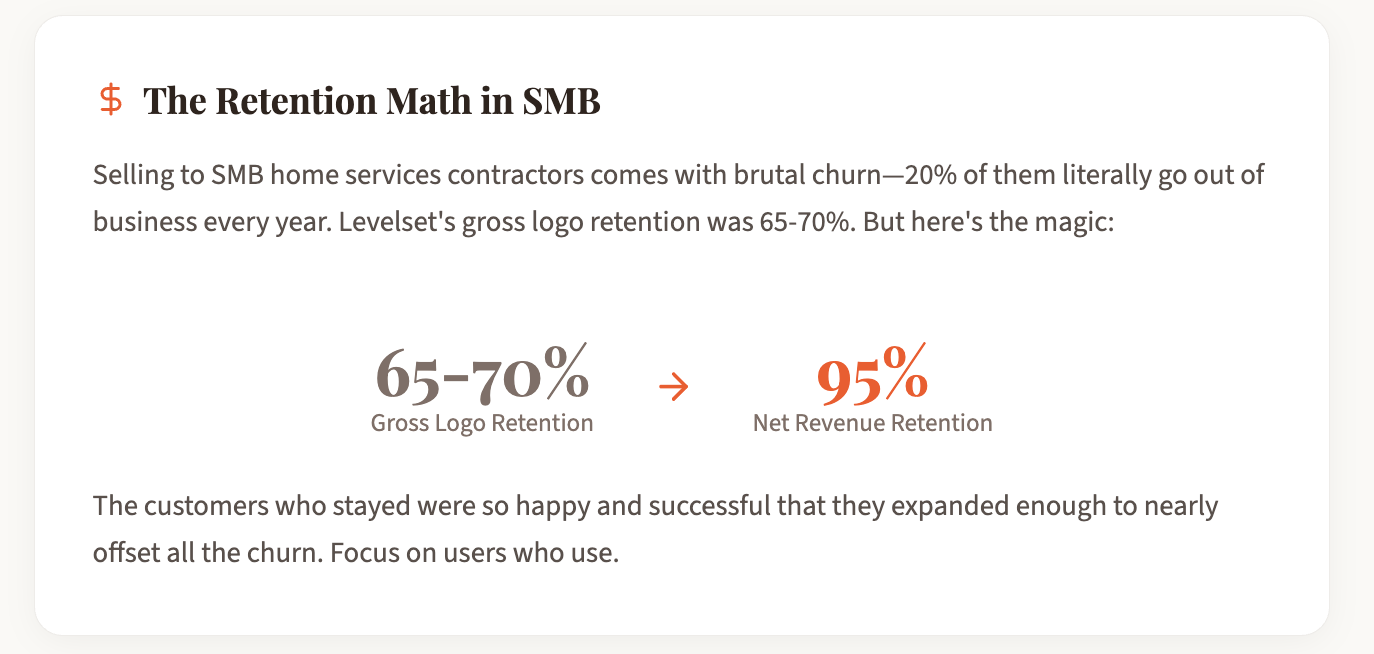

Focus on users who use – Stop chasing customers who don’t engage. Double down on happy ones.

Key Takeaways at this stage:

✅ Segmentation is mandatory - Different customers need different everything

✅ Revisit enterprise with leverage - Use your SMB success as proof

✅ Expansion > acquisition - Easier to grow existing customers than find new ones

✅ Partnerships = distribution - Integrations become your most efficient channel

✅ Brand matters - Category creation makes every competitor play your game

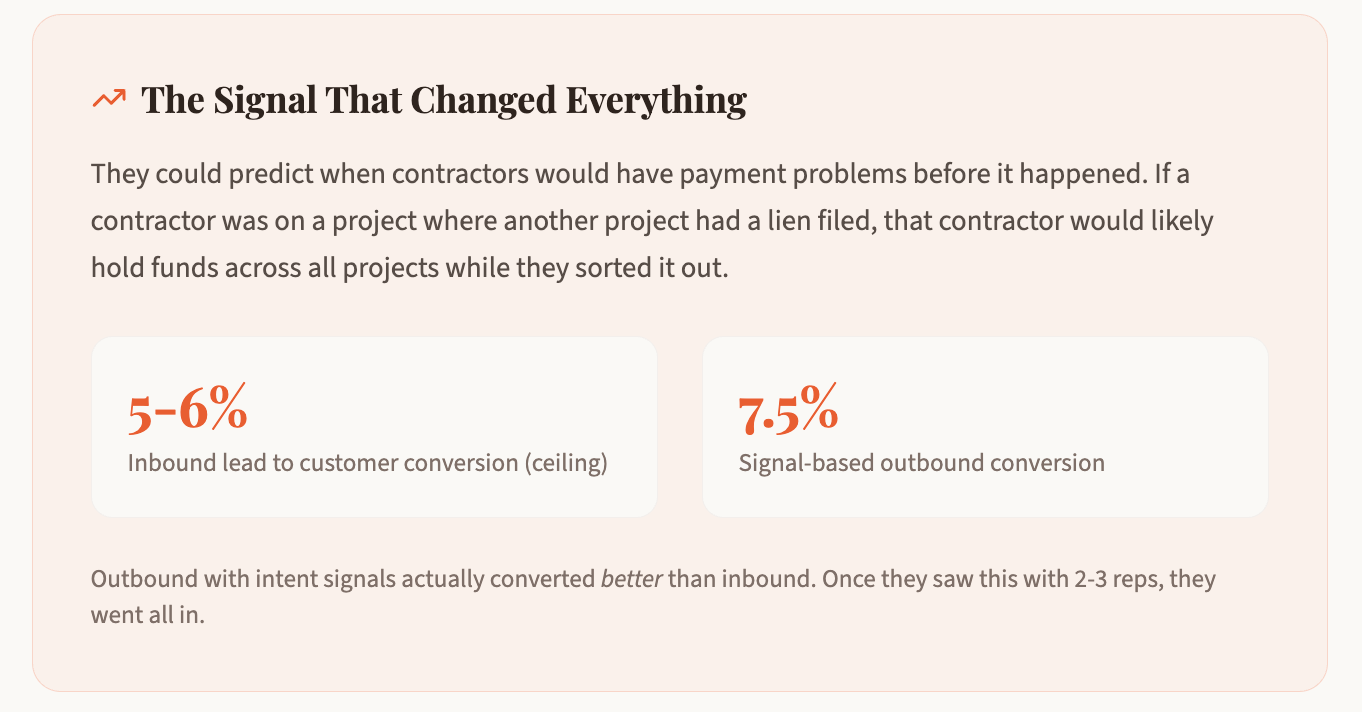

The Data Breakthrough

Around $7-8M ARR, Levelset unlocked something powerful. They’d been sitting on the largest database of active construction projects in the world—connected data showing who worked with whom, who was getting paid, who wasn’t.

The Sleeping Giant: Install-Base Expansion

One of Martin’s biggest regrets? Not building an install-base sales motion earlier. Customer Success had owned upsell and expansion, but they were overwhelmed—running QBRs, fighting fires, asking for reviews, seeking referrals. Adding commercial conversations on top was too much.

“We were sitting on a sleeping giant. We had $10 million of install base that nobody had really intentionally sold into in a thoughtful way.”

— Martin Roth

The results after moving expansion to sales: they went from $50-60K/month in upsell to $800K/month. Combined with strong net-new, they were adding $2M in net-new ARR every month. “It felt like we had caught a tiger by the tail.”

Hiring: Raw Characteristics Over Experience

Martin’s early approach was straight from Mark Roberge’s playbook—find former Olympic hopefuls, people with commitment and grit. But over time, the lesson crystallized: raw characteristics matter more than prior experience.

“I’ll take an Uber driver, a bartender—I don’t care if they have the PSD. Find me PSDs and we can put them to work. There’s a million and a half construction firms in America. I just need people with hunger, ambition, curiosity, grit, and humility.”

— Martin Roth

They made all the classic mistakes—hiring from construction tech competitors thinking industry experience would translate. Most didn’t work out within 12 months. For sales, at least in SMB, domain experience was less valuable than raw hustle and coachability.

What Changes in the Age of AI?

We asked Martin how he sees the go-to-market playbook evolving with AI. His take?Not as much as you’d think.

“A lot of the growth I see doesn’t quite make sense to me. It’s real, I’m not challenging the numbers—but switching costs are so low right now. There has to be something deeper than just the functionality and workflow.”

— Martin Roth

Martin believes the fundamentals haven’t changed: build a great product, find a great customer segment, have a strong point of view, and genuinely care about serving customers. Porter’s Five Forces still applies. The tactics from Chet Holmes’s 1980s sales book still work. The tooling has evolved dramatically—Orum, Nooks, AI-powered everything—but the strategy remains timeless.

What’s Next for Martin?

Martin’s starting a new software company. Of course, it’s in construction. He still lives four blocks from Scott Wolfe in New Orleans and they talk all the time. The next chapter is just beginning.

You can find Martin at MartinRoth.com, on Twitter, and LinkedIn. He loves working with vertical SaaS companies and has a wealth of knowledge to share.

“If I can learn from a dude who wrote a book in 1980 on how to do enterprise sales, I’m pretty sure that’s still gonna be true 20 years from now. All the rest is just details.”

— Martin Roth

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com