Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Michael Saltzman, Co-Founder & C0-CEO @ EvolutionIQ ($730M Exit)

Co-founder & Co-CEO of Evolution IQ—the vertical AI company that just pulled off the first major exit in the category. Former Bridgewater analyst turned insurance outsider. Pilot. Stanford MBA. The guy who asked:

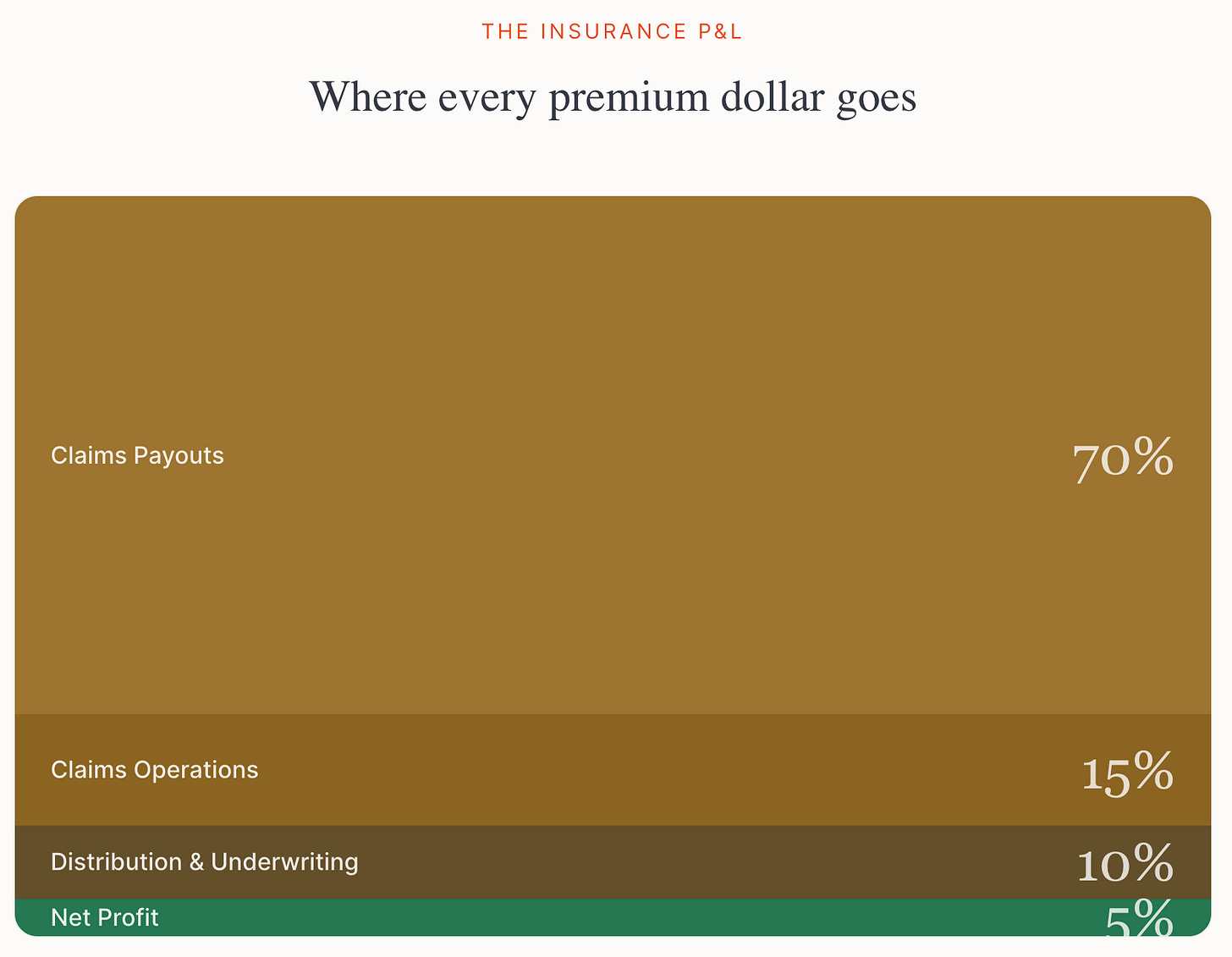

“What if we stopped ignoring 80% of the P&L?”

The Origin:

Two pilots meet on a tarmac.

An industry will never be the same.

Mike spent years at Bridgewater Associates studying insurance companies from the outside—how they talked about their businesses, how they reported performance, where they were investing in technology. At Bridgewater, he learned to see patterns that insiders often miss. The hedge fund’s famous “radical transparency” culture trained him to question assumptions that everyone else took for granted.

The pattern was unmistakable. Every CEO was talking transformation. CIOs were making massive technology investments. But all that capital flowed to the same places: distribution and underwriting—selling policies and pricing them. Billions poured into sleek customer portals, chatbots for quotes, and sophisticated pricing algorithms. The front office was getting a complete makeover.

Meanwhile, the claims operation—where 80% of revenue actually goes—was treated like the ugly stepchild. A back-office cost center to be minimized, not optimized. The irony was staggering: insurance companies were spending fortunes to acquire customers they’d inevitably disappoint when it came time to actually use the product they’d purchased.

The claims floor looked like a time capsule. Adjusters worked with paper files, fax machines, and software from the early 2000s. Their institutional knowledge—decades of expertise in reading between the lines of medical records, understanding which claimants needed support versus surveillance—lived entirely in their heads. When they retired, that knowledge walked out the door.

His co-founder Tom had spent 11 years at Google building AI systems. He wanted to find an industry drowning in unstructured data that couldn’t use it. Insurance claims—a chaos of correspondence, medical documents, and handwritten notes—was the perfect target.

Tom had seen what happened when you threw AI at a problem without deep domain understanding: impressive demos, failed deployments. Google’s scale meant you could brute-force your way to solutions. Enterprise software required something different. You needed to understand not just the data, but the humans who would use the insights.

They met on a tarmac in 2017—both pilots, both restless. Mike was at Stanford for his MBA, technically “taking a break” from his career but really looking for the right problem. Tom was looking for the right partner. Over the roar of prop engines, they sketched out what would become Evolution IQ: an AI company that would go deeper into one industry than any horizontal platform could ever go.

The Insight:

Everyone was optimizing the 20%.

They went after the 80%.

How To Win In The Enterprise With Massive Insurance Carriers

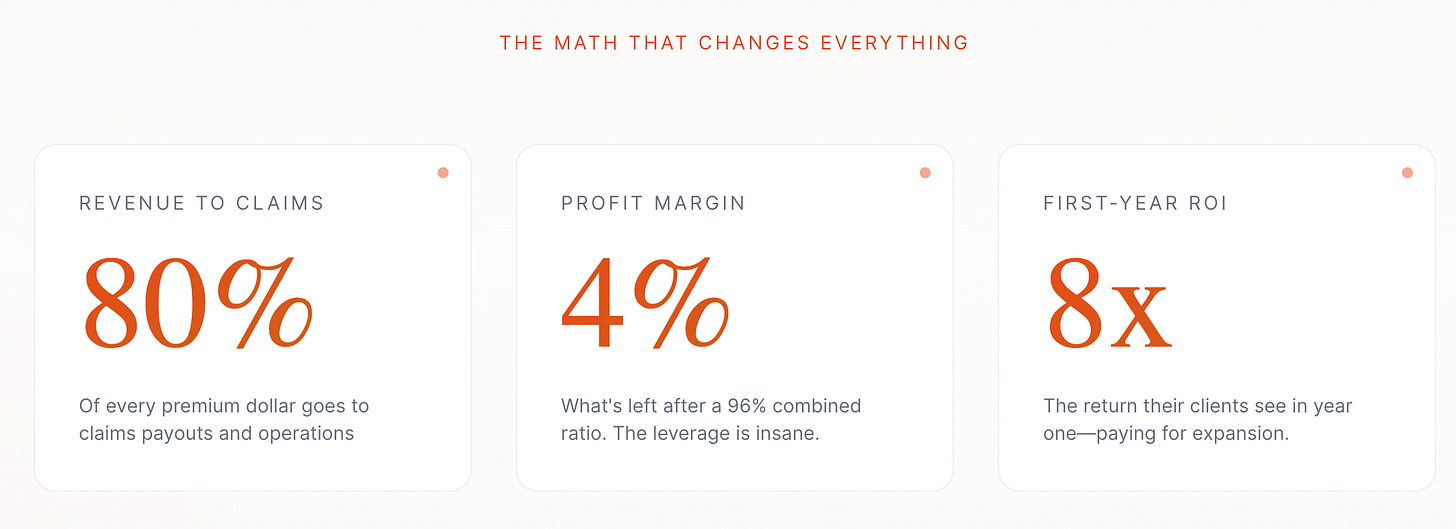

Here’s the leverage: If you sell an extra dollar of insurance, you make an extra four cents. But if you save a dollar in claim cost, you save the whole dollar. One-for-one.

Think about what this means for a company operating at a 96% combined ratio. A 1% improvement in claims efficiency has the same bottom-line impact as a 25% increase in premium revenue. Yet every insurance technology investment was chasing the revenue side of that equation.

The industry was scaling the existing problem bigger and bigger. More sales meant more claims, which meant hiring more adjusters, which meant more variability in outcomes. Evolution IQ chose to change the cost curve itself—to make every adjuster perform like their best adjuster.

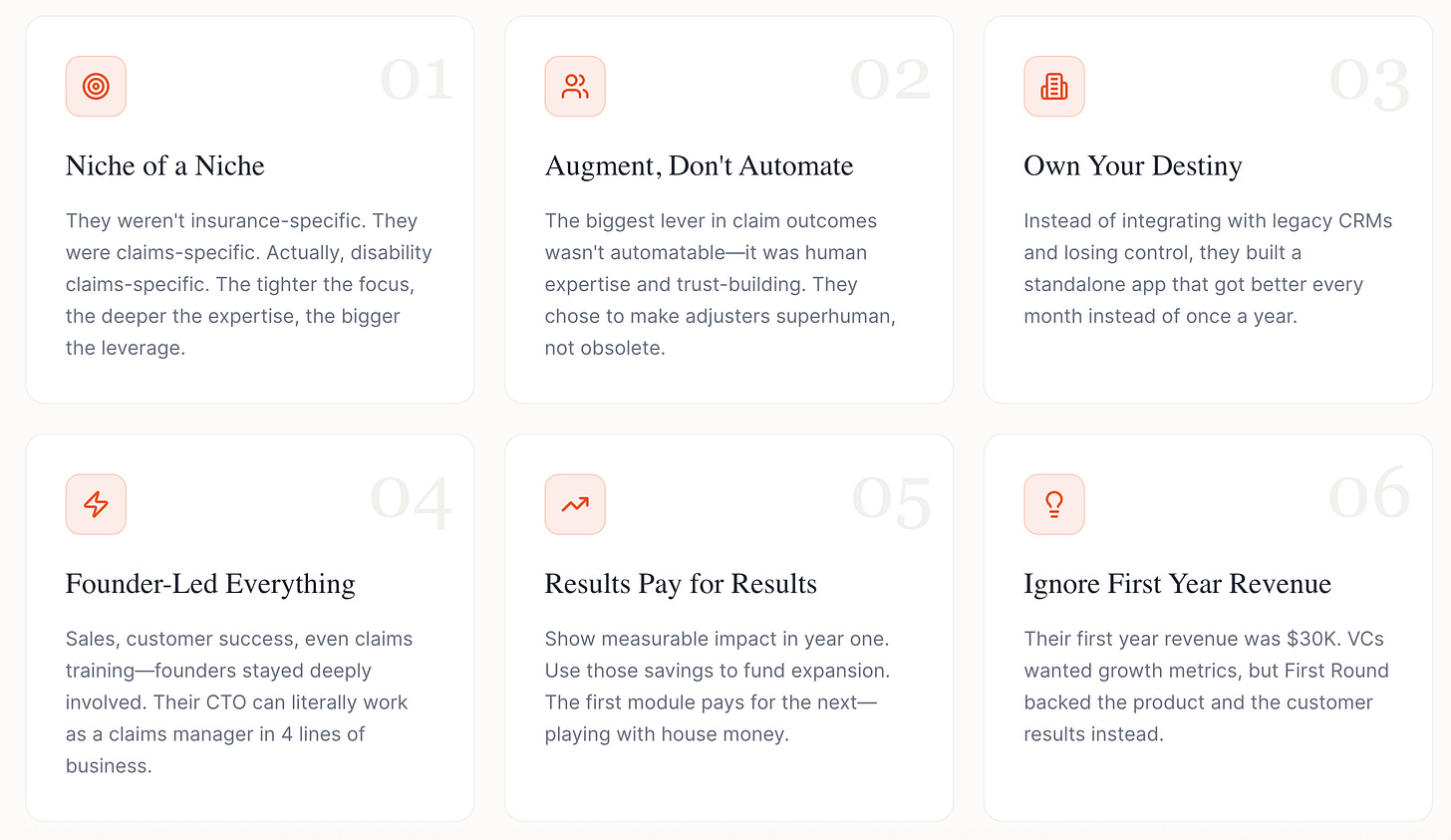

But here’s the counterintuitive part: they didn’t try to replace the adjusters. Early AI companies in insurance focused on automation—processing simple claims without human involvement. Evolution IQ realized that the hardest claims were also the highest-value claims. These were the cases that required human judgment, relationship-building, and creative problem-solving. AI couldn’t replace that. But it could supercharge it.

The Architecture:

Building the foundation that makes everything else possible

Insurance runs on ancient infrastructure. Every carrier has their own core system—some built in COBOL in the 1980s, some acquired through mergers with incompatible data models. Getting clean data out of these systems isn’t just difficult; for most AI companies, it’s the reason they fail.

Evolution IQ made a crucial architectural decision: they would build a normalization layer. This wasn’t a feature—it was the foundation. Every messy data feed, every idiosyncratic field name, every carrier-specific quirk would be translated into a single unified format. It took years to build properly. But once it existed, adding a new customer became a matter of weeks, not months.

They also made a controversial choice: build a standalone application rather than integrate into existing systems. The conventional wisdom said enterprises want integrations—meet them where they are. But integrations meant inheriting legacy limitations. Updates would require carrier involvement. New features would need approval cycles measured in quarters.

Their standalone app got better every month. Competitors who integrated with Salesforce or legacy claim systems updated maybe once a year—if they were lucky. This velocity gap compounded over time. By year three, Evolution IQ’s product was so far ahead that switching costs became almost irrelevant to the buying decision.

The Journey:

From tarmac to exit: Seven years of going deep

2017

The Spark

Mike leaves Bridgewater for Stanford MBA. His friend Tom, an 11-year Google AI veteran, wants to start something. They meet on a tarmac—both are pilots.

2018

The Insight

Insurance CEOs talk transformation, but 80% of costs (claims) get zero innovation. AI can’t automate the human parts, but it can supercharge expertise.

2019

First Customer

$50K pilot with an innovative Philadelphia carrier. The team is in their office 3 days a week, learning claims handling from the ground up.

2021

The Architecture

Build the normalization layer—translate messy data from any core system into one unified format. The foundation for true scale.

2024

The Exit

First major vertical AI acquisition. Proof that going deep—not wide—can build category-defining value in enterprise software.

The timeline looks clean in retrospect. It wasn’t. There were moments when the company almost ran out of money. Deals that took 18 months to close. A pandemic that froze enterprise purchasing just as they were hitting their stride. But each obstacle reinforced the same lesson: depth protects you when breadth would leave you exposed.

When COVID hit, Evolution IQ’s existing customers were overwhelmed with claims. A horizontal AI tool might have been cut from budgets. But Evolution IQ had become so embedded in their customers’ operations—so critical to how they managed workload—that expansion actually accelerated. The crisis proved the value proposition in a way no sales deck ever could.

The Enterprise AI Playbook:

Six lessons that buck conventional VC wisdom

They spent two years with one customer. Not because they couldn’t sell—because they chose depth over breadth. Three days a week in a Philadelphia claims center, learning every nuance of the business. They sat next to adjusters, watched them work, asked why they made the decisions they made.

Most enterprise software companies would have taken that first $50K contract and immediately gone hunting for more logos. The pressure from investors, the allure of “ARR growth”—it’s almost irresistible. But Mike and Tom understood something most founders miss: in enterprise software, depth compounds.

Every month they spent with that first customer, they discovered new edge cases, new workflows, new opportunities. They learned why certain claims took months to resolve while others closed in days. They saw how a single doctor’s note could change everything—if the adjuster knew what to look for. They built features no one had asked for, because they’d seen problems no one else knew existed.

That customer became their greatest advocate—willing to tell direct competitors how incredible Evolution IQ was, because they wanted them to stay in business. In an industry where vendors are typically treated as adversaries, Evolution IQ had become a true partner.

By the time they went to their second customer, they weren’t selling software—they were selling a proven playbook. They knew exactly what the ROI would be, exactly how long implementation would take, exactly which metrics would improve and by how much. That certainty was worth more than any feature list.

The Lightning Round:

Final thoughts on building in enterprise

On enterprise relationships:

“Enterprises are not monolithic skyscrapers. There are people inside with names. As much as it’s intimidating looking up at the skyscraper, inside they’re asking—how do we make our business work five years from now? They’re looking for you on the street.”

The highest high:

“A train ride back from Philadelphia. We’d just learned about the next segment of their claims process. We built the entire product spec on the Amtrak. Went back the next day and said—we have the next thing now. That product became a massive success.”

The advice for founders:

“When you get to growth stage, there’s plenty of revenue pressure. You’ll get there. The benefit of early stage is nobody cares how you got to Series A. When you’re ready, you go. When you’re not ready, you build.”

That’s it for this weeks episode.

Check out the full video below. This ones a goldmine…

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com