Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Scott Wolfe, Founder & CEO @ LevelSet

Scott Wolfe is the rare founder whose eclectic background became his superpower. Part entrepreneur, part technologist, part lawyer—he spent over a decade building Levelset into the dominant bottoms-up platform for construction payments before its acquisition by Procore in 2021.

Based in New Orleans, Scott now serves on multiple boards, advising companies on both the buy and sell side of M&A. He remains deeply connected to the construction tech ecosystem and is a vocal advocate for founders who dare to look where others won’t.

“My background is just kind of touching and playing with a lot of different things, which really came together. My entrepreneurial background, my software background, my legal background, and then a construction background kind of all collided into Levelset.”

Fun fact: Scott’s relatives still think he’s a lawyer. He has to send the bar a letter every year confirming he doesn’t practice. “Once you get a law degree, they don’t let you escape.”

When Hurricane Katrina devastated New Orleans in 2005, it left behind more than destruction. It created one of the most productive construction ecosystems the region had ever seen—and thrust a young lawyer named Scott Wolfe into an industry that would define his next two decades.

What started as a frustrating first court case defending a mechanic’s lien evolved into Levelset, a construction payment platform that would eventually sell to Procore in 2021. But the path from that courtroom to exit wasn’t linear—it was a masterclass in patience, differentiation, and the art of getting bought rather than sold.

In a recent podcast conversation, Scott sat down to share the unfiltered story of building Levelset—from tinkering with websites in the ‘90s, to running a law firm, to raising a seed round that lasted three years, to ultimately deciding whether to sell when Procore came knocking. What emerged was a conversation rich with insights for any founder navigating the messy, non-linear path of building something meaningful.

The Spark After the Storm

Scott’s background reads like a patchwork of entrepreneurial experiments. He grew up in a grocery business with an entrepreneurial family, spent time in retail, and was always tinkering with software. In the ‘90s—before most people knew what a website was—he was building them. By college and law school, he was adding functionality to those sites, experimenting with what software could do.

But it was law school that set the stage. After graduating, Scott started his own law firm in 2005-2006—one with a very digital interface, which was remarkably uncommon at the time. Law, as he puts it, was just “one of the little pots on the stove.” The other pots were more software-oriented, more digital, more business-focused.

Then Katrina hit. And suddenly, New Orleans became one of the most active construction markets in America. Insurance money was flowing. Contractors were rebuilding. And disputes about payment were everywhere.

I thought I was going to be able to go to something like LegalZoom and file a lien for these people. But then I had to go read the law and figure out how to do it myself.

Scott Wolfe

Founder & Former CEO, Levelset

Picture this: A 25-year-old freshly minted attorney shows up to what he thinks is a simple motion hearing. He’s there to defend a mechanic’s lien for a client who hasn’t been paid. Instead, he walks into a full court proceeding requiring witnesses and evidence—completely unprepared.

That baptism by fire became Scott’s obsession. In the post-Katrina construction boom, payment disputes flooded his inbox. Contractors and suppliers were waiting on insurance money, and nobody could figure out the byzantine lien process that varied wildly from state to state.

Scott had been building websites since the ‘90s—tinkering with software was in his DNA. When he saw how absurdly difficult it was to file a simple lien, the entrepreneur in him saw an opportunity. He started building a wizard to streamline the process, first for Louisiana, then expanding state by state.

For years, he ran it on the side of his desk. The tool grew to $200,000 in revenue while he juggled a law firm, a software development business, and helping his parents with their company. It was a slow burn—but it was burning.

💡 The Vertical Insight Advantage

Scott emphasizes that this spark—born from actually doing the work—is critical in vertical spaces. “I don’t know if there’s any way I could have come up with Levelset but for having the insights, being kind of plugged into working on the problem for somebody,” he says. “It took me years to figure out how to even explain the problem to people... investors, employees, whoever. I don’t know how you can come from outer space and see this problem.”

The Slow, Deliberate Build

By 2012, Scott made a decision. He cut bait with everything else—the software development business, the law firm, the family business. He was going all in on Levelset.

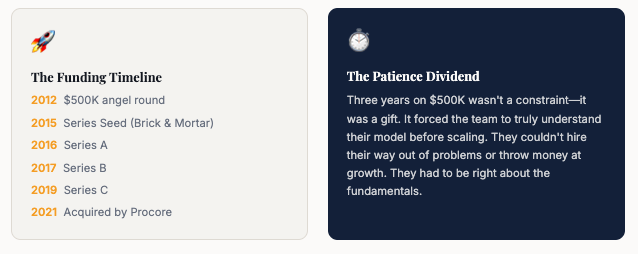

A scrappy New Orleans startup fund (literally called the “New Orleans Startup Fund”) led a $500,000 angel round. In today’s environment, that sounds quaint—almost cute. But Scott and his team lived on that capital for three years. They hired their first person. They grew from about $200,000 to $2 million in revenue. They bounced in and out of cash flow positivity throughout.

Those three years were crucial. The team got deeply steeped in the problem. They experimented with different models—moving from a transactional, LegalZoom-style approach to a pure SaaS model. They built out the technology. By the time they raised their first true venture round from Brick and Mortar Ventures in San Francisco (about $1.3 million), they had a team of 15, a proven tool, and an intimate understanding of their customer.

The Contrarian Bet

Here’s where Levelset diverged from the construction tech playbook in a way that would define everything that followed.

At the time, Procore was just starting to emerge. PlanGrid, Building Connected, and Fieldwire were all “cousins” in the Brick and Mortar portfolio—funded around the same time, seeing each other at the annual Brick and Mortar summit. Everyone was watching everyone else. And almost everyone was building for general contractors.

Scott went the other way. He looked at the market from the bottom up. His customers were the subcontractors and material suppliers—the thousands of companies that actually build things and often wait months (or never) to get paid.

I want to claw my eyeballs out when I see another deck with a tool for some general contractor pain point on the job site. A lot of those are a dead end.

Scott Wolfe

Founder & Former CEO, Levelset

This wasn’t just positioning—it was a fundamentally different view of how construction works. The nuance that often gets lost: when people hear “subcontractors,” they think SMB. But Levelset’s go-to-market was actually bifurcated. On one side, SMB deals averaging $4,500-$5,000 with thousands of users. On the other, mid-market and enterprise sales to material suppliers—enormous companies that brought in seven-figure contracts.

The key insight: they just never chased general contractors. And because of that, even as Procore grew into a behemoth, Levelset never felt like a competitor. They were building on opposite ends of the same ecosystem—which would become very relevant later.

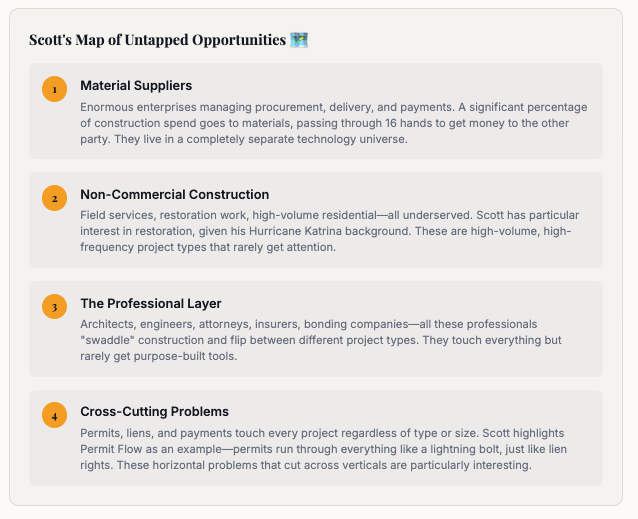

The Underserved Opportunity

Scott’s frustration with the industry’s tunnel vision runs deep. Even now, construction tech remains fixated on commercial general contractors while ignoring massive adjacent markets. Material suppliers—enormous enterprise companies—don’t even know who Procore is. As late as 2020-2021, when Levelset sold, their material supplier customers had never heard of Procore. That’s how far away they are.

Scott draws a parallel to “Extra Life,” a book by Steven Johnson about the advancement of human lifespan. Some innovations just sit there waiting to be discovered. Why didn’t we have wheels on suitcases until 1995? Construction tech is having that moment—but most founders are looking in the wrong places.

An electrical subcontractor works on residential, restoration, sometimes commercial. They don’t say ‘I’m in commercial construction.’ That’s just where the tech has gotten stuck.

Scott Wolfe

Founder & Former CEO, Levelset

When asked about newer construction tech companies, Scott is characteristically blunt. He’s not a fan of raising enormous amounts of capital—cycles come and go, and he’s seen plenty of companies struggle after big rounds when things change.

But he does see promise in companies attacking cross-cutting problems. Permit Flow interests him because permits touch everything—general contractors have issues with permits, so do owners, so do trades, even governments. Part Three, working for architects, catches his attention because the professional layer flips around between different project types.

The through-line: the path to building a true platform for construction probably doesn’t come through general contractors. It comes from stakeholders who are more diverse by nature.

How To Sell Your vSaaS Business For $500M

Procore first knocked on Levelset’s door in 2016. They were trying to build what would become Procore Pay and were exploring partnerships. Some Procore people visited Levelset’s office. Scott understood they were building a “build vs. buy vs. partner” matrix with Levelset on it.

Ultimately, Procore tried to build it themselves and fumbled. The partnership conversations went nowhere. Years passed. Procore went public.

But from those early conversations, Scott saw two things clearly. First, Procore was highly interested in the construction payment category—that could be interesting later. Second, they were going to approach it completely differently. They were looking at it from the Textura point of view. Levelset was the anti-Textura—the opposite approach. Both working on construction payment, but from opposite ends.

They were dressed to kill. I didn’t want to sell. I wasn’t playing hard to get—I really didn’t want to sell.

Scott Wolfe

Founder & Former CEO, Levelset

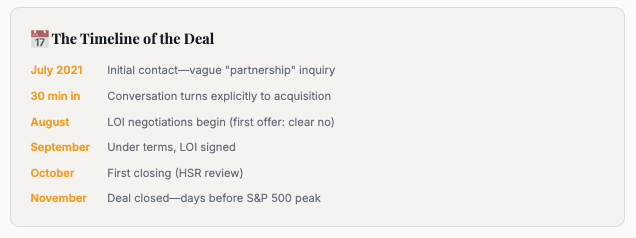

Then, in July 2021, Procore came back. Scott was preparing for a Series D. He wasn’t on the market. They contacted him wanting to talk about “partnership or something vague.”

Within the first 30 minutes of that conversation, it was explicit: they wanted to talk about acquisition. Tooey Courtemanche was there. They brought everyone. They were, as Scott puts it, “in heat” to acquire in this category. He understood they were talking to a few others in the space—though there weren’t many.

Scott describes himself as “the poster child for companies get bought, they don’t get sold.” He wasn’t playing hard to get—he genuinely didn’t want to sell. His mind started to change as the deal kept getting more compelling, more difficult to not engage with.

The first offer was low—maybe less than half of what they’d eventually agree to. “It was a pretty clear no. It wasn’t even negotiation posturing no. Just no.” Then the offer went up. Aggressively.

Because things moved so fast, they had to create a market quickly—no investment bankers, no long runway. They got another company to look at the deal and received a competing LOI that was actually higher than Procore’s. That created real leverage.

The terms were really clean the whole time. It felt like negotiating with a venture capital group, not a private equity group.

Scott Wolfe

Founder & Former CEO, Levelset

The Decision to Sell

What made Scott ultimately decide to sell? It wasn’t one thing—it was a constellation of factors coming together.

First, the economics. When you start looking at what the deal means to people on paper— team members who’d worked on it for seven, eight, nine years—it gets hard to say “let’s just keep going” because Scott is interested in continuing. Those checks represent real life-changing outcomes for people who believed in the vision.

Second, timing. The deal closed four or five days before the top of the S&P 500 in 2021. Scott wasn’t predicting that—he’s no Nostradamus—but he could feel that valuations were stretched, M&A activity was off the charts, and it wasn’t going to last forever.

Third, the vision alignment. Tooey was extremely interested. They were putting so much toward the deal, putting so many eggs in the basket, that Scott started seeing a real opportunity for Levelset’s vision to accelerate within Procore.

🤔 The CEO’s Dilemma

Scott frames the decision through the lens of capitalization. As a CEO, your job is to build the vision, execute the vision, and capitalize the vision. You can capitalize with the money your business makes. You can capitalize with investment capital. Or you can capitalize through acquisition.

“Every equity round you have, you’re selling shares, you’re getting acquired just in small chunks. I started to see: I have all this vision, it seems to match really well with what this company thinks. This may be the best way to get it to go forward.”

Looking Back—And Forward

When asked if he’d do anything differently, Scott pauses. Maybe he wouldn’t have sold. Maybe he would have found other capital solutions to reward the team without forcing the ultimate exit. Ways to solve the worry about how much money people were getting while carving a Goldilocks path to keep going.

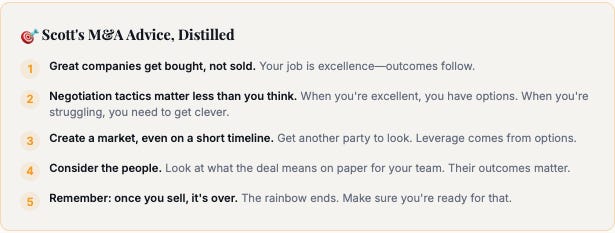

Because once you sell, that’s it. The rainbow ends. That transaction is over. You can’t keep building on that particular dream.

But there’s no regret in his voice about the core business itself. “There’s a lot about it that I would just do again the same way. That’s actually one of the reasons why I don’t do it—because I don’t want to do it again.”

My psychology isn’t ‘I got it all to work out, so I can do it again.’ It’s ‘Wow, that was crazy how I got all that to work out. I don’t know if I can get that to work out again.’

Scott Wolfe

Founder & Former CEO, Levelset

The journey wasn’t painful—it was work. It required things out of his control: timing, luck, the right people. Thousands of little pits and peaks along a decade-plus of laying railroad track. Scott can’t point to one war story that stands out as extremely painful. He’s probably compartmentalized them somewhere, he jokes.

His advice to founders eyeing M&A? Focus on excellence. Build the vision, execute the vision, capitalize the vision. When you’re in the class of excellence, options find you. Investment bankers and negotiation tactics only matter when your plans aren’t working.

Scott Wolfe’s journey with Levelset is a reminder that the best outcomes in startups come from a combination of insight, patience, differentiation, and yes—luck. But the luck only finds you if you’ve done the work.

Lessons from his journey include:

Different Never Goes Out of Style

While everyone chased general contractors, Levelset focused on subcontractors and material suppliers—an overlooked goldmine.Problems Need Proximity

Scott only discovered the opportunity because he was doing the work. You can’t see vertical insights from outer space.

Bootstrap Teaches Discipline

Three years on $500K forced the team to truly understand their model before scaling. That foundation was invaluable.

Great Companies Get Bought

The best M&A outcomes happen when you’re not trying to sell. Build excellence, and options will find you.

Timing + Luck + Skill

The acquisition closed days before the market peak. You need all three ingredients for a great outcome.

PermitFlow raised a $54M Series B—the AI platform for construction permitting, has successfully raised $54 million in Series B funding led by Accel, with participation from prominent investors including Kleiner Perkins, Felicis, Initialized Capital, Altos Ventures, Y Combinator, and existing investors.

Unlimited Industries, an AI-native construction company, has successfully raised $12 million in seed funding co-led by Andreessen Horowitz (a16z’s American Dynamism Fund) and CIV, with participation from leading industry investors. The announcement was made on December 3, 2025.

Founded in 2025 by serial entrepreneurs Alex Modon (CEO), Jordan Stern, and Tara Viswanathan, Unlimited Industries represents a radical departure from traditional construction firms. The San Francisco-based company is building an AI-native construction platform that both designs and builds infrastructure, eliminating the inefficiencies that have plagued the industry for decades.

Trunk Tools, the AI-powered platform revolutionizing construction project data management, has successfully raised $40 million in Series B funding led by Insight Partners, with participation from Redpoint Ventures, Innovation Endeavors, Stepstone, Liberty Mutual Strategic Ventures, and Prudence.

Founded in 2021 by Dr. Sarah Buchner, Trunk Tools has built what the CEO describes as "ChatGPT for your job site" — an AI platform that transforms unstructured construction data (documents, drawings, blueprints, schedules) into actionable insights. The company now has $70 million in total funding, including a $20 million Series A round in 2024.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com