Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Rahul Hampole, VP & GM of FinTech @ Service Titan

In the rapidly evolving landscape of vertical software, embedded fintech has emerged as the defining battleground for sustainable growth. But the path from “we should add payments” to a thriving fintech ecosystem is littered with costly mistakes and false starts.

Rahul Hampole has seen it all—from the early days at Yahoo, to building Yelp’s enterprise business from zero to 30%+ of revenue, to running the payments business at Plaid, and now leading fintech at ServiceTitan. In this deep dive, he shares the hard-won lessons that separate successful vertical fintech plays from expensive experiments.

The FinTech Playbook for Vertical SaaS Founders

ServiceTitan calls itself “the operating system for the trades”—serving plumbers, HVAC technicians, roofers, and a variety of other verticals. It’s a positioning that reflects the evolution of vertical SaaS from point solutions to comprehensive platforms.

“When Service Titan and I started speaking, they’re like, you can kind of merge these two together and really serve our customers,” Rahul explains. His background at Yelp gave him familiarity with trades businesses—many became customers—while his time at Plaid immersed him in the fintech ecosystem.

The vertical SaaS opportunity wasn’t always obvious. Luke recalls pitching VCs on Sand Hill Road 12 years ago for a trade school vertical SaaS business: “Every single person was like, trade schools. There’s no way this is venture scale.” Today, companies like Toast have proven the playbook—layer in financial products and payments, and suddenly those “small” verticals become massive TAM opportunities.

Starting with the Customer

The common thread behind every successful fintech integration

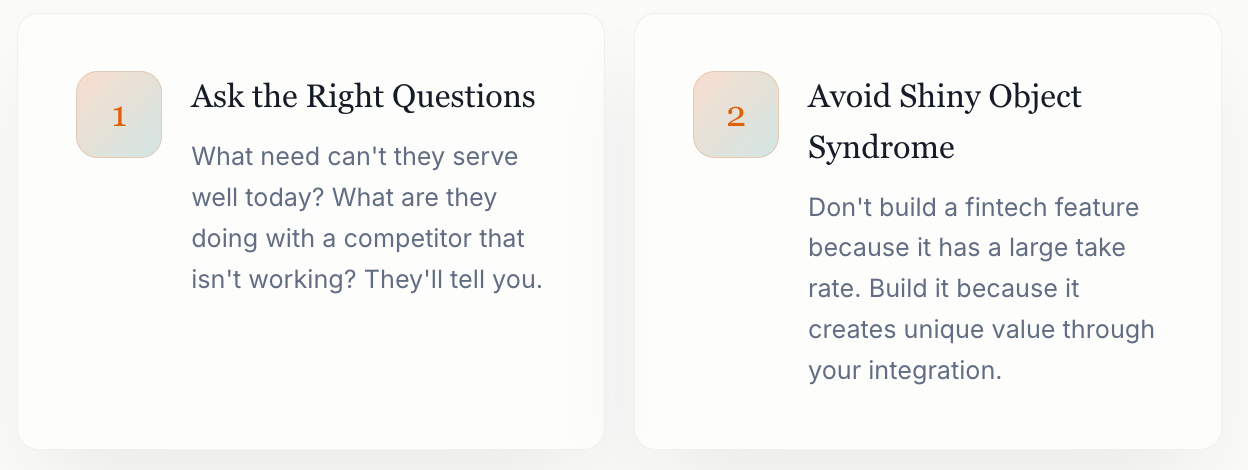

The most important lesson from Rahul’s experience across multiple companies is deceptively simple: start with your customers.

“The common thread which I saw at Plaid and I saw at a bunch of vertical SaaS companies, as well as I see it in action now when I’m living it every day at ServiceTitan is like, you start with your customers. You start to ask them like, hey, what is the core need that you have?”

The beauty of vertical SaaS is that your customers are your biggest feedback loop. To the extent that you’re creating value for them, they’ll tell you what else you can create value for them for.

Rahul recommends a simple practice: have 20 of your best customers on a text channel—WhatsApp, iMessage, whatever works. “They’re telling you very, very transparently what’s keeping them up at night.” This isn’t just for feature feedback—it’s your early warning system for what fintech products to build next.

Payments: The Foundation

How to think about interchange, vendors, and take rate as a founder

For most vertical SaaS companies, payments is the starting point. But the decisions you make early can dramatically impact your long-term economics.

The Vendor Trade-off

“Embedded fintech was not a thing,” Rahul notes about the landscape 10+ years ago. Today, you can sign up with Stripe or Rainforest and get started quickly. But there’s a trade-off: “What take rate do you end up having? What flexibilities? What ways can you create experiences and how much control you have?”

My recommendation always to founders is: you need to show value to customers and you need to show it yesterday. Not like you’ve got a plan six months from now.

The advice is clear: optimize for customer value first, take rate second. “If you can prove customer value, then the pie gets bigger over time. But then you can start to optimize that pie.” ServiceTitan works with Adyen, which “definitely leans more enterprise heavy” with more controls and customization—leading to different take outcomes than plug-and-play solutions.

Take Rate Benchmarks

For vertical SaaS players focused on SMBs, aspire for 80-100 basis points on card transactions as a starting point. This changes based on customer size, whether you’re doing interchange-plus or flat-fee models, and the vertical specifics. The card business differs significantly from ACH and other payment types.

Luke shares his own experience: “I made a controversial decision where I found kind of a no-name company that was willing to give us like 1.25%. All of my engineers were up in arms because they wanted to go with Stripe. But I was getting like 60 basis points with Stripe.” The six-month delay was worth the significant difference in economics—and it helped during the PE exit.

When to Go Multi-Product

The art of timing your fintech expansion

One of the hardest questions in vertical fintech is timing: when do you move from one product to the next? Too early and you spread yourself thin. Too late and you leave value on the table.

You got to nail one thing at a time. You got to get your ICP right. You got to make sure you get that ICP to start attaching to your product pretty well and using that product really well.

Rahul points to a specific feeling: “There’s that inflection point in the S curve where you’re like, you know what? At this point now I am not doing so much work to sell every customer. I’m not doing so much work to onboard every customer and get the customer to use it. And you will feel it in the product.”

ServiceTitan’s Financing Story

At ServiceTitan, the expansion beyond payments came from customer demand. “Customers told us this is a need for us. We could do it better if we worked with you.” Contractors replacing HVAC units and roofs needed to offer financing for big-ticket jobs.

“You’re at the kitchen table, you’re trying to replace a roof. It’s a pretty expensive job. We have to make it really simple and easy for the technician to be able to explain, to be able to understand, provide compelling price points.” A technician can’t possibly understand all the APR dynamics—so ServiceTitan built an experience that translates complex financing into something a homeowner can understand and convert on.

Is FinTech a Commodity?

When payments are a checkbox vs. a differentiator

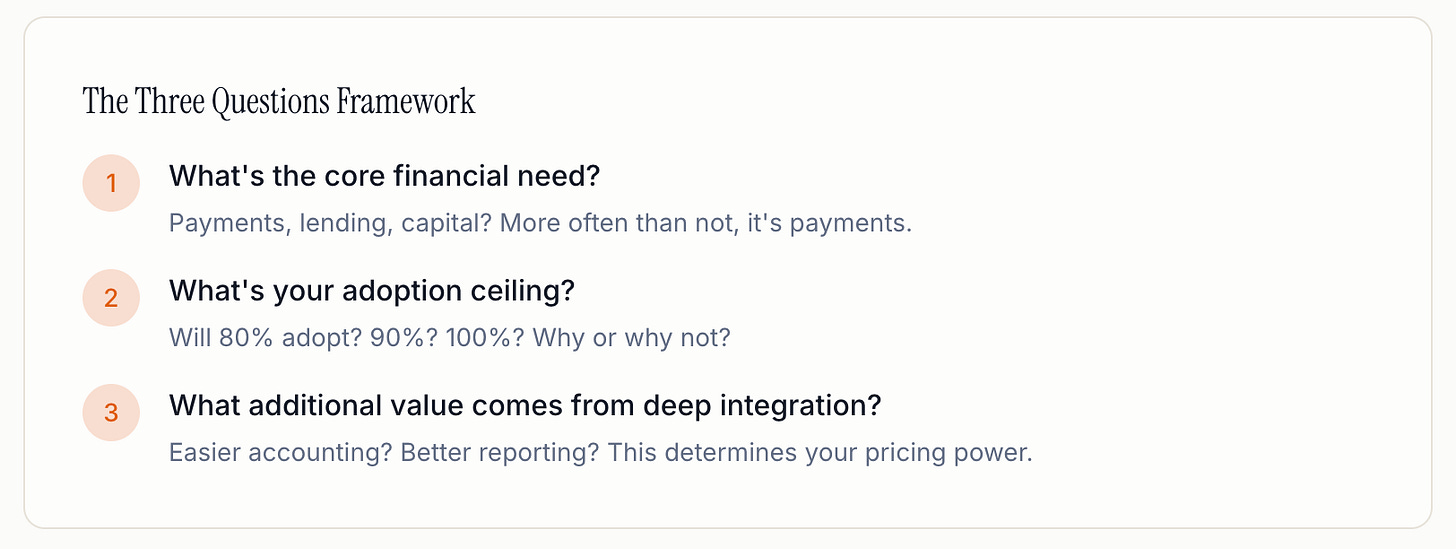

A critical question every founder must answer: is your fintech offering a commodity that works because your core product is great, or is it a distinct differentiator?

You can’t make FinTech work if the rest of your product’s kind of like not working that well in the first place.

Rahul uses Toast as the gold standard: “You don’t think twice when you’re a restaurant owner that you’re buying Toast that you have to accept payments through it. It just feels natural. Because that’s just part of the natural experience you have to provide to your customers.”

The Tap-to-Pay Revolution

ServiceTitan’s tap-to-pay product illustrates how fintech can create genuine delight. “It is just a game changer for the technician in the field. They were fidgeting around with the old school puck to collect payment or worse yet, asking for a check. And they’re like, I can take my phone out, take a payment and walk out.” One customer told Rahul that technicians would sometimes leave checks in the truck—”and it’ll literally fly out of the window.”

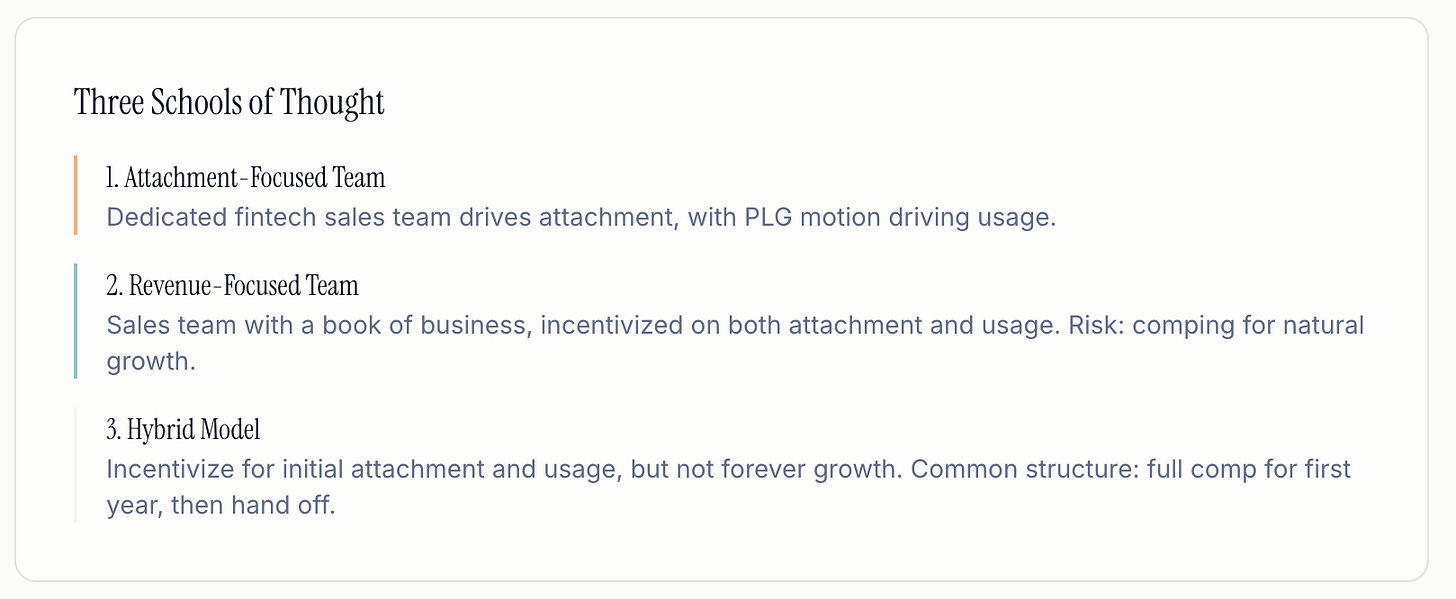

Go-to-Market & Sales Compensation

The hardest problem nobody talks about

“This is a fun topic,” Rahul says. “We could chat for the next hour, I think, because there’s so many variations of this that I’ve heard over the years—that work, don’t work, work for a little while.”

The more down-market you are, the stronger you have to build the PLG motion. You have to get really good at driving attachment and usage through that PLG motion so your sales teams drive higher-value activities.

The Sales vs. CS Question

Luke shares a structure that worked: “We comped similarly to 7-12% of first-year ACV on the payments side, but they received like 10-20% upfront. Then they got the other 80% once that customer achieved full utilization.” This prevented sellers from putting in crazy GMV expectations and kept them engaged through implementation.

Rahul’s approach: “The salesperson is in charge for the first year of that contract fully—the outcome is tied to them. The CS after that is there to make the customer successful in that journey.” CS compensation was mostly flat with a small incentive tied to post-handoff success.

Build vs. Buy

When to own your fintech stack vs. partner

As a mature vertical SaaS player, the build-vs-buy question becomes increasingly important. Rahul offers a three-part framework:

Unique Differentiation

Does owning this create differentiation you couldn’t get with a vendor?

Maintenance Burden

How hard is it to build and maintain over time?

Durability

Will the differentiation last, or can vendors catch up?

You want to avoid the regulatory hairball to the extent possible. If you can keep it simple and still get most of the value, trust me, it’s much, much better.

The lending example illustrates this well: interest rates change, regulations shift, you might need an MTL or bank charter. “You don’t want to think about all that when you’re a startup. Transparently, you want to avoid the regulatory hairball to the extent possible.”

The Future: Agents & Stablecoins

What’s coming in vertical fintech?

Rahul sees two major trends shaping the future of vertical fintech:

Agentic Payments

“100%. I think the future will be there’ll be some form of agentic payment experiences.” But he cautions patience: “It may not happen overnight... The networks need to play ball. There’s compliance and regulatory parts. The processors and gateways need to play ball. Consumer comfort is still an open question.”

His analogy: Apple Pay. “Merchant adoption actually happened fairly quickly, but then consumer adoption took a while and then it grew like crazy. You can expect a similar thing happening here.”

Stablecoins

“I’m really excited about what’s happening in the stablecoin space because one angle to look at it is the networks are pushed out in some ways. If the thesis fully holds true, then there’s a world in the future where interchange goes down dramatically and stablecoins is the way that we effectively transact.”

For the Trades

At ServiceTitan specifically, Rahul is focused on two metrics: revenue per tech and back-office efficiency. “The worst trades businesses are ones where they have one tech and one back office person. That’s a bad outcome for the business.” The goal: use AI and automation to dramatically improve that ratio.

Disclaimer:

The views and opinions expressed by Rahul Hampole in this podcast are solely his own and do not necessarily reflect the views, opinions, or positions of ServiceTitan, Inc., its affiliates, or its employees. ServiceTitan, Inc. does not endorse or assume responsibility for the content of these personal views.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com