Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

Alright, let’s dive in…

Ketryx raises $39M Series B: Regulated AI for Life Sciences. Regulation is a very strong / incredible moat

Augment raises $85M Series B bringing their total capital raised to $110 million in just five months. The Series A round was led by Redpoint Ventures, with participation from 8VC, Shopify Ventures, Autotech Ventures, and other leading investors in logistics and AI.

Is supply chain back? Happy Robot also just raised a $44M Series B led by Base 10 at reported $500M valuation. Automates communications including rate negotiation and appointment booking for freight operators.

"Is Venture Broken?" Beezer Clarkson from Sapphire pens a thought provoking piece.

Mega funds leading 30% of seeds

Meanwhile, the sub-$5m seed is getting less and less common

Here’s the paradox : despite these larger rounds, startups are actually shrinking. Carta data shows SaaS companies are 20% smaller at Series A today than in H1 2020. Smaller teams are more than offsetting inflation costs through increased productivity.

Nearly 50% of LP dollars in 2025 so far have gone into just 12 venture firms.

Her Questions:

Are mega-funds paying up to win the best founders — or just the biggest deals?

Are boutiques/stage-focused funds focusing on smaller rounds out of discipline — or because of adverse selection?

Will $100B–$1T exits become commonplace a decade from now? Don’t they have to to support this level of capital deployment?

Tom Tunguz supports the thesis with his piece, The Death of Small Seed Rounds

Brian Litvack, Founder & CEO of LeagueApps (vSaaS for Youth Sports)

Brian Litvack didn't set out to build a "vertical SaaS payments-enabled fintech platform." He wanted to help communities organize sports. What emerged is a masterclass in attacking hyper-fragmented SMB markets that most VCs would run from.

He’s built an incredible business and just had a big financing round just take place with Accel-KKR. But it’s all because he genuinely cares about building communities through sports. He just happens to do it with software. Talk about putting the customer first!

Attacking Hyper SMB Markets:

How To Do It Successfully

In 2007, Brian Litvack had no intention of building what would become one of the most successful hyper SMB vertical SaaS companies in America. Like many entrepreneurs, he started with a simple consumer problem: helping adults find people to play sports with in their communities. Sportsvite, as it was called, was essentially "eVite for sports" – a noble mission that quickly revealed the harsh realities of consumer business models.

But failure has a way of illuminating opportunity. As Brian and his team struggled to monetize their consumer platform, they discovered something far more valuable than a social network: there were passionate individuals throughout communities who desperately wanted to organize sports but had virtually no tools to help them succeed. These weren't professional event managers or tech-savvy operators – they were parents, volunteers, and sports enthusiasts armed with little more than spreadsheets and determination.

The pivot from Sportsvite to League Apps wasn't just a business model change – it was a fundamental shift in understanding who needed to be served. While adults might casually join a pickup game, youth sports represented something entirely different: a massive, fragmented ecosystem of approximately 150,000 organizations across major team sports, most generating between hundreds of thousands to millions of dollars annually, yet operating with volunteer-level resources and Stone Age technology.

Decoding the Hyper SMB Puzzle

The youth sports market that Brian encountered in the early 2010s was the definition of what venture capitalists today call "hyper SMB" – a sector so fragmented and small-scale that most investors would run in the opposite direction. Each organization was typically run by passionate volunteers or part-time operators managing complex logistics with minimal budgets, no procurement departments, and seasonal cash flows that created unique operational challenges.

Traditional SaaS wisdom suggested this market was untouchable. How do you sell software to organizations that don't have IT budgets? How do you scale when your customers operate out of community centers and school gymnasiums rather than corporate offices? How do you achieve meaningful revenue when each potential customer represents just a few thousand dollars in annual contract value?

Brian recognized that this professionalization trend created a massive opportunity, but only for those willing to build solutions specifically designed for the unique constraints and workflows of sports operators. Generic business software wouldn't work – these customers needed tools that understood the seasonal nature of sports, the complexity of team formation, the critical importance of payment processing, and the communication challenges inherent in managing hundreds of families simultaneously.

The Pricing Breakthrough That Changed Everything

Perhaps no decision was more critical to League Apps' success than Brian's radical approach to pricing. Faced with customers who had no software budgets, no procurement processes, and unpredictable seasonal cash flows, traditional SaaS subscription models were dead on arrival. How do you convince a volunteer-run baseball league to commit to monthly software fees when they might only collect revenue during registration periods?

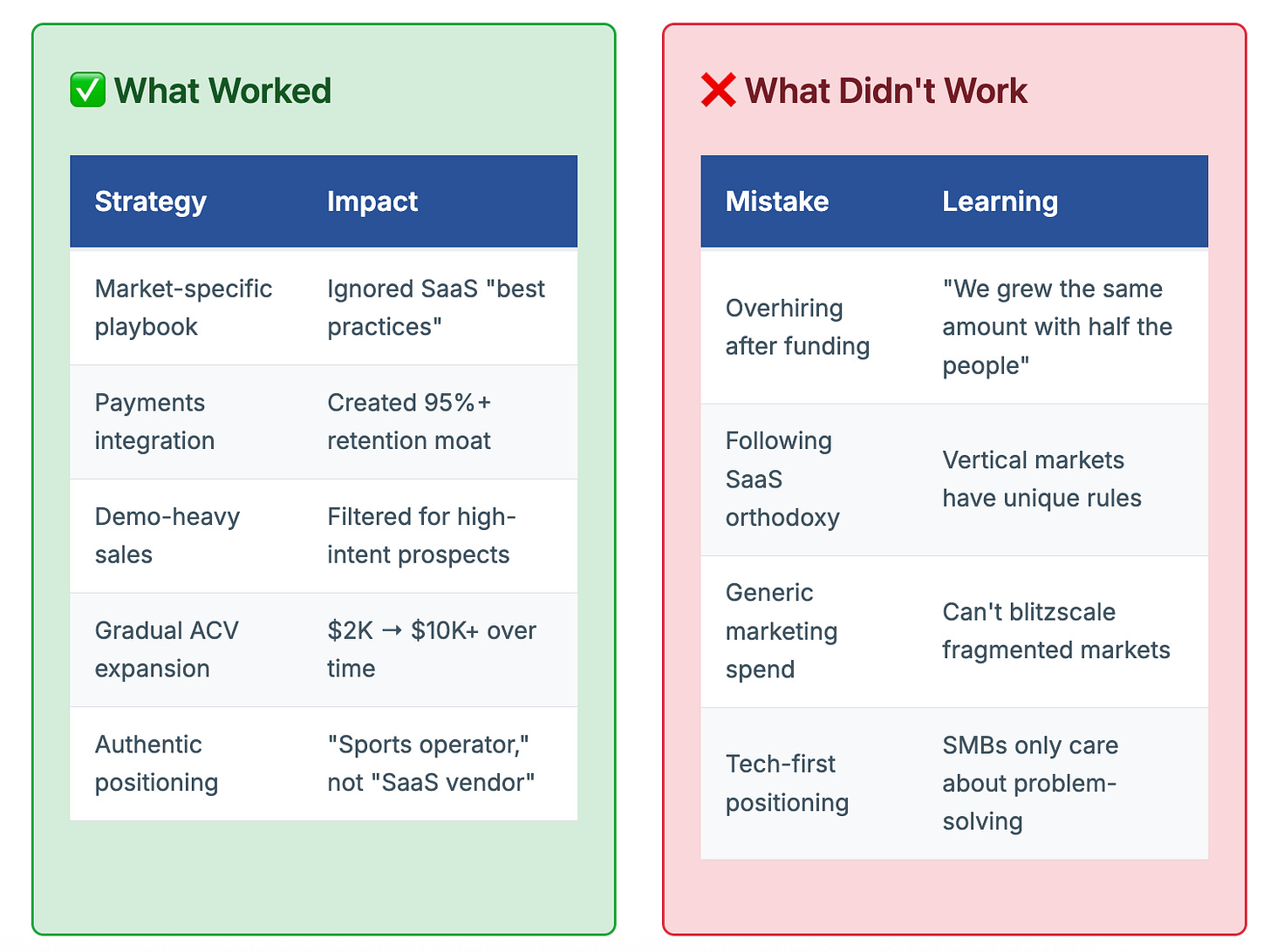

The solution came from studying a company called Active Network, which had pioneered consumption-based pricing in the events space. Brian realized that by taking a small percentage of payment transactions rather than charging upfront software fees, League Apps could align its revenue model perfectly with customer cash flows. Organizations only paid when they were actually collecting money, and they could either absorb the fee or pass it along to parents – eliminating the budget approval process entirely.

This wasn't just pricing innovation; it was a fundamental reimagining of how software could be sold to cash-constrained SMBs. The pay-as-you-go model removed every traditional barrier to adoption while creating a natural expansion mechanism – as organizations grew their programs and processed more payments, League Apps' revenue grew proportionally.

Building a Demo-Driven Sales Machine

If League Apps' pricing model solved the "how to buy" problem, their sales approach solved the equally challenging "how to sell" problem in hyper SMB markets. Traditional lead generation tactics were largely useless – platforms like ZoomInfo provided virtually no coverage of youth sports organizations, and these operators weren't browsing vendor websites or attending software conferences.

Brian's solution was refreshingly direct: build a manual research operation capable of identifying and reaching the right people, then optimize everything around getting them into product demonstrations. This wasn't scalable in the traditional SaaS sense, but it was effective in a way that automated approaches simply couldn't match.

The League Apps sales machine operated on impressive volume metrics: 10,000+ calls per month generated through meticulous prospecting and research. But volume alone wasn't the secret – it was the recognition that in this market, product demos served as powerful qualifying mechanisms. When busy sports operators agreed to spend 45 minutes on a screen share, it signaled genuine intent and serious consideration.

Against conventional SaaS wisdom, Brian maintained a strict separation between business development representatives (focused solely on generating demos) and account executives (who handled demonstrations and closing) regardless of deal size. Even when average contract values were just $2-3K, this specialization proved more effective than having full-cycle sales representatives trying to do everything.

The demo-centric approach worked because it matched the buying behavior of the target market. Sports operators weren't impulse purchasers – they were deeply committed to their organizations and needed to see exactly how software would integrate with their existing workflows. The 45-minute demonstration became a crucial trust-building exercise where League Apps could showcase their deep understanding of youth sports operations.

Product Evolution: From Simple Tools to Operating System

League Apps' product journey represents a masterclass in vertical software development – starting with a crucial pain point and systematically expanding to own entire workflows. The initial wedge was elegantly simple: registration and payment processing. For seasonal organizations collecting thousands of dollars in registration fees, having a reliable system to handle payments wasn't just convenient – it was mission-critical.

But Brian understood that solving payments was just the beginning. Youth sports organizations operate through interconnected workflows where registration data feeds into team formation, which drives scheduling, which requires communication tools, which generates the need for websites and mobile access for parents. Rather than building isolated features, League Apps constructed what Brian calls "one long workflow" that mirrors how sports operators actually run their programs.

The expansion strategy was methodical and customer-driven. Once organizations were successfully using League Apps for registration and payments, they naturally needed tools for creating teams from registered players. Team formation led to scheduling requirements. Scheduling created communication needs – coaches and parents needed to stay informed about practices, games, and changes. Communication capabilities enabled website and mobile app generation, giving organizations professional digital presence without technical expertise.

Each new capability strengthened the platform's lock-in effect. By the time an organization was using League Apps for payments, team management, scheduling, communication, and their web presence, switching costs became prohibitive. As Brian notes, "This is them running their whole organization" – and organizations don't casually replace their operational backbone.

The latest product evolution focuses on analytics and business intelligence, recognizing that as the market has professionalized, operators need sophisticated insights into their businesses. Using embedded analytics from Sigma Computing, League Apps now provides white-labeled reporting tools covering everything from customer acquisition costs to lifetime value analysis – capabilities that would have been unthinkable for SMB customers just a few years ago.

Perhaps most importantly, the product evolution never outpaced customer sophistication. While League Apps could have built complex enterprise features years earlier, Brian maintained discipline around building for actual customer needs rather than theoretical possibilities. This constraint-based approach ensured that every feature added genuine value while maintaining the simplicity that SMB customers required.

The Accel-KKR Transformation

After 15 years of bootstrapped growth, strategic investments from entities like Major League Baseball and the Los Angeles Dodgers pros, and reaching profitability, League Apps faced a decision that many successful vertical SaaS companies encounter: how to accelerate growth while providing liquidity for early stakeholders. The answer came in the form of a partnership with Accel-KKR, marking League Apps' transition from scrappy startup to institutional-backed growth company.

The timing was ideal for multiple reasons. League Apps had achieved the scale and operational maturity that private equity firms seek – processing billions of dollars annually, serving thousands of organizations, and demonstrating the kind of retention rates (95%+ gross retention) that create predictable revenue streams. Equally important, the youth sports market had evolved to support higher-value customers, with average contract values exceeding $10,000 and growing.

Brian's decision to partner with Accel-KKR wasn't just about capital – it was about accessing institutional expertise in scaling vertical software businesses. Private equity firms like Accel-KKR specialize in finding software companies in unexpected markets and applying proven playbooks for growth acceleration. For League Apps, this meant access to resources for geographic expansion, product development, and market penetration strategies that would have taken years to develop independently.

The partnership also enabled League Apps to clean up a complex cap table accumulated over 15 years of fundraising from 60+ different investors. This simplification created clearer governance structures while providing liquidity opportunities for early employees and investors who had supported the company through its bootstrapped years.

Most significantly, the Accel-KKR partnership validated the broader thesis that hyper SMB vertical markets can support substantial enterprise value. By backing League Apps, a sophisticated institutional investor was essentially betting that fragmented, small-customer markets could generate the kind of returns traditionally associated with enterprise software companies.

Lessons from the Hyper SMB Trenches

Perhaps the most valuable insights from Brian's journey come from understanding what didn't work as much as what did. The League Apps story is filled with counterintuitive lessons that challenge conventional SaaS wisdom and provide a roadmap for other entrepreneurs attacking fragmented markets.

The most critical lesson involves capital efficiency and the dangers of premature scaling. When League Apps finally raised significant venture capital and hired "experts" from larger SaaS companies, the results were disappointing. As Brian candidly admits, "We grew the same amount with half the people" after scaling back the team. This experience taught him that hyper SMB markets can't be blitzscaled – they require patient, methodical development of product, go-to-market, and operations capabilities in parallel.

The retention story provides another crucial insight. While VCs often assume SMB customers churn frequently due to business failures or price sensitivity, League Apps achieved enterprise-level retention rates by becoming truly essential to customer operations. When your software processes payments, manages teams, handles scheduling, and provides communication tools, customers don't leave unless you fail them – not because of external factors.

Brian's approach to market authenticity offers a masterclass in vertical positioning. Rather than emphasizing technology or software capabilities, League Apps consistently positioned itself as a sports company that happened to use software as its primary tool. This authenticity resonated with customers who saw Brian and his team as fellow sports operators rather than outside vendors trying to sell them something.

"SMBs don't care about fancy or flash. They're just saying, can you solve my problem and how much do I believe you that you can solve my problem?"

— Brian Litvack

The pricing evolution reveals how vertical SaaS companies can drive ACV expansion without losing their core value proposition. League Apps grew average contract values from $2-3K to over $10K not by raising prices, but by adding genuine value as customers' businesses became more sophisticated. This organic expansion proved more sustainable than aggressive pricing strategies.

Finally, Brian's experience illustrates the importance of market timing in vertical software. League Apps succeeded not just because they built good software, but because they caught the youth sports market during a critical professionalization phase. Understanding macro trends within target verticals can be as important as understanding customer workflows.

The Curse of Easy Capital

Brian's reflection on capital availability is sobering: "This whole notion of crazy amounts of capital being available in some vertical SaaS businesses, it's literally a curse. Like it's going to mess up your business." Success in hyper SMB requires discipline that easy money can undermine.

Today, as League Apps processes billions of dollars annually and serves thousands of organizations, the company stands as proof that hyper SMB markets can support massive, profitable businesses. But the path requires different strategies, different metrics, and different thinking than traditional SaaS companies. For entrepreneurs willing to go deep into fragmented markets, Brian's journey provides both inspiration and a practical roadmap for success.

The youth sports market that seemed impossibly fragmented in 2007 became the foundation for a business that achieved institutional scale while maintaining the authentic relationships and deep vertical focus that made it successful in the first place. That balance – between growth and authenticity, between scale and specialization – may be the most important lesson of all.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com