Today’s episode is brought to you by Parafin - the leading provider of ready-to-launch financial products that help your merchants grow. Check out what Parafin can do to drive revenue, retention, and TAM at your business!

• Euclid’s overview on the AI-First Roll-Up. A few incarnations of roll-up strategy stand out to us as most credible:

(A) Test-bed acquisition(s) at the growth stage that serve to optimize the software product and opportunities for vertical integration (rather than as an ongoing growth strategy)

(B) high-initial-ownership plays (e.g. incubations) that offset heavy downstream dilution

(C) companies leveraging M&A to accelerate G2M acceleration but able to compartmentalize those efforts, keeping focus on the core software platform and maintaining the ability to divest the roll-up down the road.

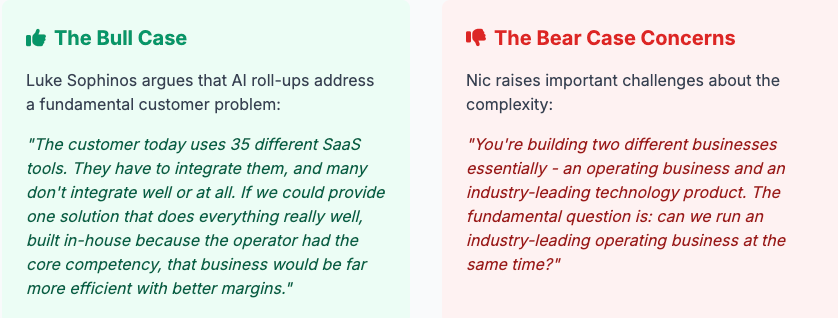

The strongest argument against AI Roll Ups is the simplest:

Namely, that success requires building two separate industry-leading enterprises under one roof: an AI-driven software company and an operating company (e.g., dentistry, accounting).

Software is about rapidly building enterprise value: build a product once and sell it to many customers, with minimal marginal cost to distribute and (hopefully) happy recurring users.

Consolidation plays, on the other hand, are about financial engineering, integration, cost management, and of course the nitty-gritty of running the successful underlying operating business.

• VC's have PE Envy from Matt Brown

• GC's Latest AI Bet Is in IT (WSJ)

Venture-capital firm leads $74 million investment in holding company Titan, aiming to inject AI into the humdrum aspects of IT.

Last year, General Catalyst said it had amassed $1.5 billion for its Creation fund, about half of which is dedicated to AI-enabled roll-ups. The fund, overall, was set up to incubate and acquire businesses across industries and use artificial intelligence to improve their workforce productivity.

Potentially, there are 70 industries with targets for its fund, but General Catalyst said it has chosen to focus on 15 to 20 to go after. They include legal, insurance, business-process outsourcing and mobile gaming.

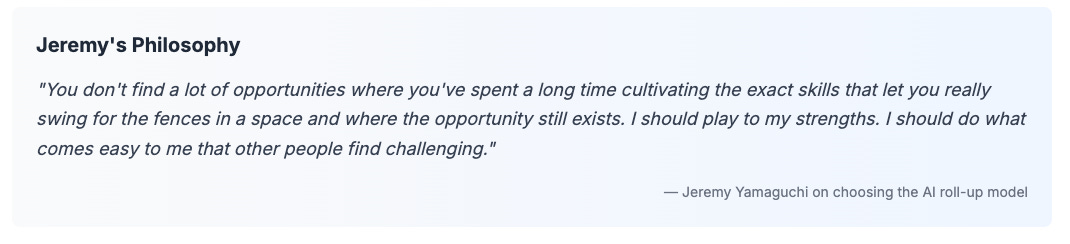

Jeremy Yamaguchi, Founder & CEO of Cabana (Technology Roll Up of Pool Cleaning Co’s)

Jeremy is a career entrepreneur with over 15 years of experience building, scaling, and selling companies at the intersection of home services and SaaS. He sold his last two companies and founded Cabana, a technology roll-up in the pool cleaning space ~2 years ago.

Or listen on: | Spotify | Amazon | Pod Bean |

AI Roll Ups With Jeremy Yamaguchi:

A Venture-Scale Bet?

The venture capital world is witnessing a fascinating evolution. A new breed of companies is emerging that challenges traditional boundaries between software startups and private equity acquisitions. These "AI roll-ups" are capturing the attention of major investors and operators alike, promising to transform fragmented service industries through strategic acquisitions powered by artificial intelligence and custom technology.

AI roll-ups represent a hybrid business model that combines the acquisition strategy of private equity with the technology-first approach of venture capital. Instead of building software to sell to fragmented industries, these companies buy the fragmented operators themselves, integrate them operationally, and then build proprietary AI and software tools to drive efficiency, margins, and competitive advantages.

The Cabana Case Study: Pools as a Perfect Roll-Up Target

Jeremy Yamaguchi's journey to founding Cabana illustrates both the strategic thinking and operational realities behind successful AI roll-ups. After previously building and selling LawnLove, a national lawn care brand, Yamaguchi spent 18 months evaluating various home service verticals before settling on pool cleaning.

"I landed on pools mostly because it's pretty synonymous to lawns," Yamaguchi explains. "It's small ticket, it's out of home, it's highly recurring, it's density driven, it's non-cyclical, it grows through every macro environment, and it's massively fragmented with no 800-pound gorilla and no national brand in the space."

The numbers tell a compelling story. In pest control, public companies like Rollins trade at ~32x EBITDA multiples. In pool services, no such national player exists, despite the industry's attractive characteristics. This represents a clear opportunity for the first mover to build a household name in pools.

The Economics That Make It Work

Cabana's financial model demonstrates the capital efficiency potential of AI roll-ups. The company has achieved remarkable efficiency in its capital deployment:

"This bet is very capital efficient because we are buying cash flows for some reasonable multiple and then we're recycling those cash flows to buy more cash flows and to invest in R&D," Yamaguchi notes.

The company achieved HoldCo-level profitability within one year and estimates reaching IPO scale would require only $20-30 million in total venture funding.

The Technology Advantage: Why Build vs. Buy?

A critical question in the AI roll-up model is whether to build proprietary technology or integrate existing SaaS solutions. For Cabana, the answer was clear: build internal tools rather than rely on off-the-shelf solutions.

"Off-the-shelf pool SaaS solutions are built for small, non-scaled operators, lacking features for scaled, multi-market, or highly operationally complex businesses. For us, building in-house tools is necessary to reach target margins - we can achieve 90-95% optimization versus 70-80% with ready-made SaaS."

— Jeremy Yamaguchi on the build vs. buy decision

Importantly, Cabana doesn't plan to sell their software externally. "Doing so is a distraction and dilutes the competitive and M&A advantage," Yamaguchi emphasizes. This approach creates a sustainable moat while avoiding the challenging go-to-market dynamics that plague many vertical SaaS companies.

The Venture Capital Perspective: Why VCs Are Taking Notice

The traditional venture capital model focuses on massive scalability and 100x returns from software companies. AI roll-ups present a different value proposition that's causing significant debate in the investment community.

The Funding Landscape: VCs Enter PE Territory

Major venture firms are allocating significant resources to AI roll-ups, blurring traditional lines between venture capital and private equity. This shift represents a fundamental change in how capital allocators think about value creation.

Major VC Funds Entering the Space

General Catalyst → Creation Fund (Billions dedicated to AI roll-ups)

Thrive Capital → $1B Hold-co dedicated to this strategy

Khosla, Elad Gill, Bessemer, and GV all have done some deals with this thesis.

However, the funding journey isn't always straightforward. Yamaguchi notes an interesting dynamic in the fundraising process:

"Many VCs invested personally in their capacity as individuals but didn't do it through their funds because their LPs wouldn't get it. We smelt too much like PE to them."

This highlights the evolving nature of venture investment categories.

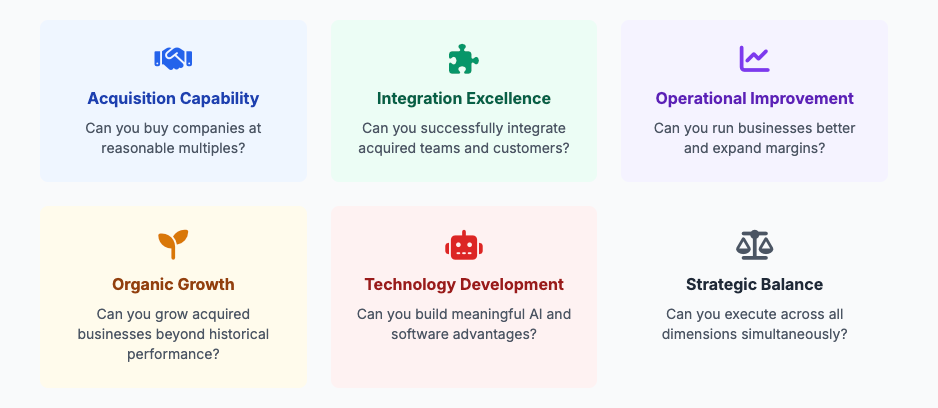

Execution Risks: The Operational Reality

Success in AI roll-ups requires de-risking multiple challenge areas simultaneously. Yamaguchi emphasizes that founder strengths should determine execution order and priority.

"If you're not good at building software, you should probably start with the software. If you're not good at M&A and that's critical, you should probably make sure you can buy some stuff first."

— Jeremy Yamaguchi on risk prioritization

Industry Applications: Beyond Pool Cleaning

AI roll-ups are gaining traction across numerous fragmented service industries. The common thread is industries where traditional SaaS adoption has been challenging due to fragmentation, low average contract values, or resistance to technology adoption. A few example spaces getting attention include IT Services, Legal practices, Accounting Firms, Home Services, and BPO Services.

The Future of AI Roll-Ups: 10-Year Outlook

Industry observers predict a bifurcated future for service industries, with AI roll-ups playing a crucial role in the transformation:

Large Consolidated Players

Will build and own proprietary AI-driven software

Create significant competitive advantages

Achieve superior margins through technology

Dominate their respective markets

Small Fragmented Operators

Will continue relying on vertical SaaS

Pay for simplicity and ease of use

Avoid complexity of building in-house

Remain niche or regional players

The "AI roll-up" model appears particularly attractive in what some call "SaaS graveyards" - industries where traditional software companies have repeatedly failed due to market dynamics or go-to-market challenges.

Key Success Factors and Lessons Learned

Based on the experiences shared by Jeremy and insights from industry observers, several critical success factors emerge for AI roll-up success:

#1. Industry Selection is Paramount

Favorable characteristics → Recurring Revenue, density-driven economics, non-cyclical demand.

Market structure → Highly fragmented, no dominant national player, homogenous business models

Integration Potential → Similar operations across different businesses, standardizable processes, technology adoption barriers.

#2. Capital Efficiency Focus

Self Sustaining Model → Structure the model to be self-sustaining through cash flow recycling from acquired businesses.

Avoid Over-Leveraging → Learn from failed Amazon/Shopify aggregators that over leveraged with variable interest rates.

#3. Proprietary Technology Development

Build technology for internal use rather than external sales. Focus on achieving 90-95% operational optimization vs. 70-80% with off-the-shelf solutions. Maintain technology as a competitive moat rather than a revenue stream.

#4. Operational Excellence

Develop repeatable integration processes, build systems for managing inherited teams, create standardized operating procedures, maintain customer relationships through transitions.

Conclusion: A New Model for Value Creation

AI roll-ups represent a fascinating evolution in how entrepreneurs and investors think about value creation. By combining the best aspects of venture capital's technology focus with private equity's operational excellence, these companies are creating new pathways to build valuable, defensible businesses.

The model isn't without risks - it requires executing successfully across multiple complex dimensions simultaneously. However, for the right entrepreneurs in the right industries, AI roll-ups offer the potential to create "venture-style returns with PE-style downside protection."

"There are constraints - I don't think this model works in every business. But if you can find an industry where businesses are largely homogeneous and can integrate reasonably well, and you have the right combination of timing, experience, and opportunity, you can build something really significant."

— Jeremy Yamaguchi, Founder & CEO of Cabana

The AI roll-up revolution is still in its early stages, but the combination of available capital, proven operators, and fragmented industries ripe for consolidation suggests this model will continue gaining momentum.

For entrepreneurs with the right skill sets and risk tolerance, it represents one of the most interesting new approaches to building billion-dollar companies in traditionally low-tech industries.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com