Linear #158: OpenEvidence Just Turned On The Money Printer & How To Run Their Embedded Ads Playbook

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Xplor Pay, a full-service payment provider. They make it simple for software companies to accept payments, enhance the customer experience, and boost revenue. Their flexible partnerships, including PayFac as a Service, are structured to help SaaS providers scale with confidence and streamline their payments operations.

Learn more at xplorpay.com

Happy new year friends! I’m fired up for a big 2026!!!

So let’s get to it…!

OpenEvidence Just Turned the Money Printer On. Went From $0 to $150M of ARR (And How They Did It)

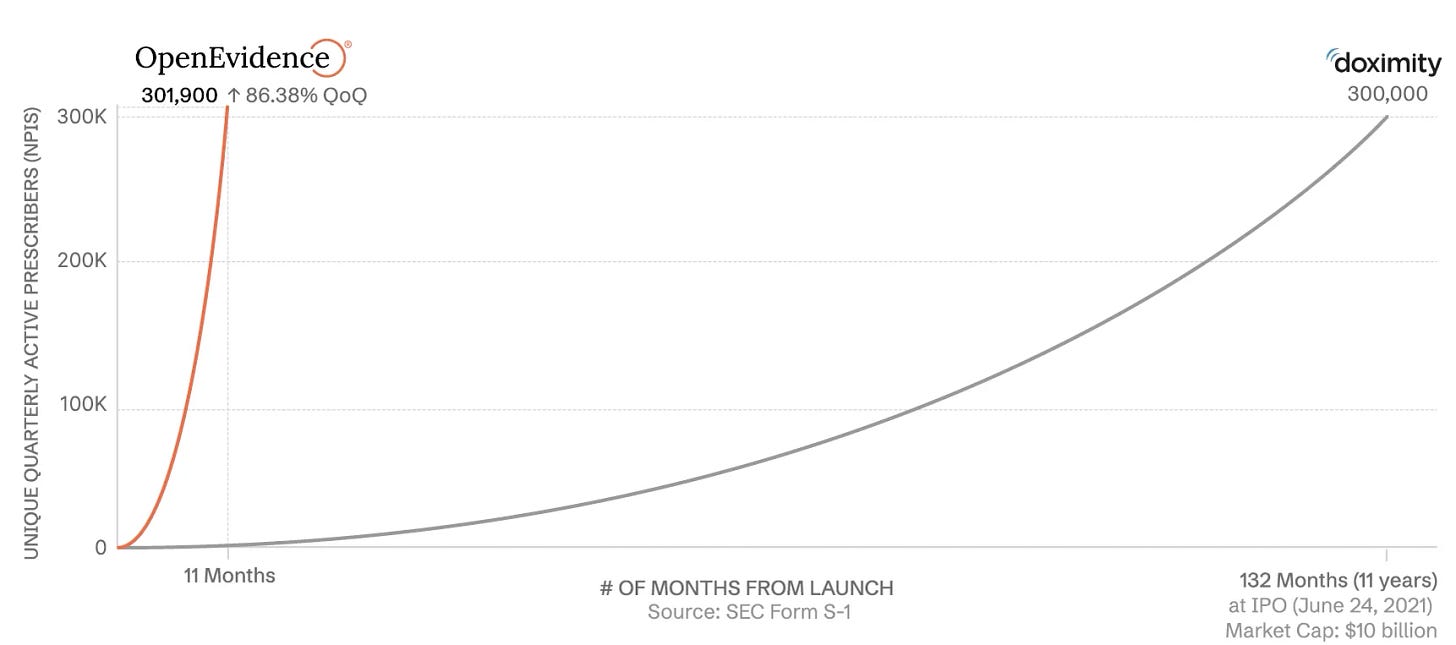

Back in July 2025 I broke down OpenEvidence - the “ChatGPT for Doctors” that was making waves in healthcare AI. Read my original breakdown here.

At the time, they were crushing it with physician adoption but the monetization story was still early and they we’re pre-revenue.

Well, they figured it out.

The quick refresher: They built a vertical AI search tool for physicians, licensed content from JAMA, NEJM, AMA, and Mayo Clinic to build credibility, and got 40%+ of all U.S. doctors using their platform by mid-2025.

That’s approximately 440,000+ physicians. Insane distribution.

But here’s what’s NEW and what you need to pay attention to...

The Numbers That’ll Make You Do a Double-Take:

📈 Valuation doubled in TWO months — from $6B to $12B

💰 $150M in annualized ad revenue — up from zero

👨⚕️ 40%+ of U.S. physicians using the platform

📊 Growing by 35,000+ doctors per month

💎 90%+ gross margins on ad revenue

Say whaaaaaaaat.

Let me break down what actually happened here, because this is a masterclass in vertical SaaS monetization.

What They Built:

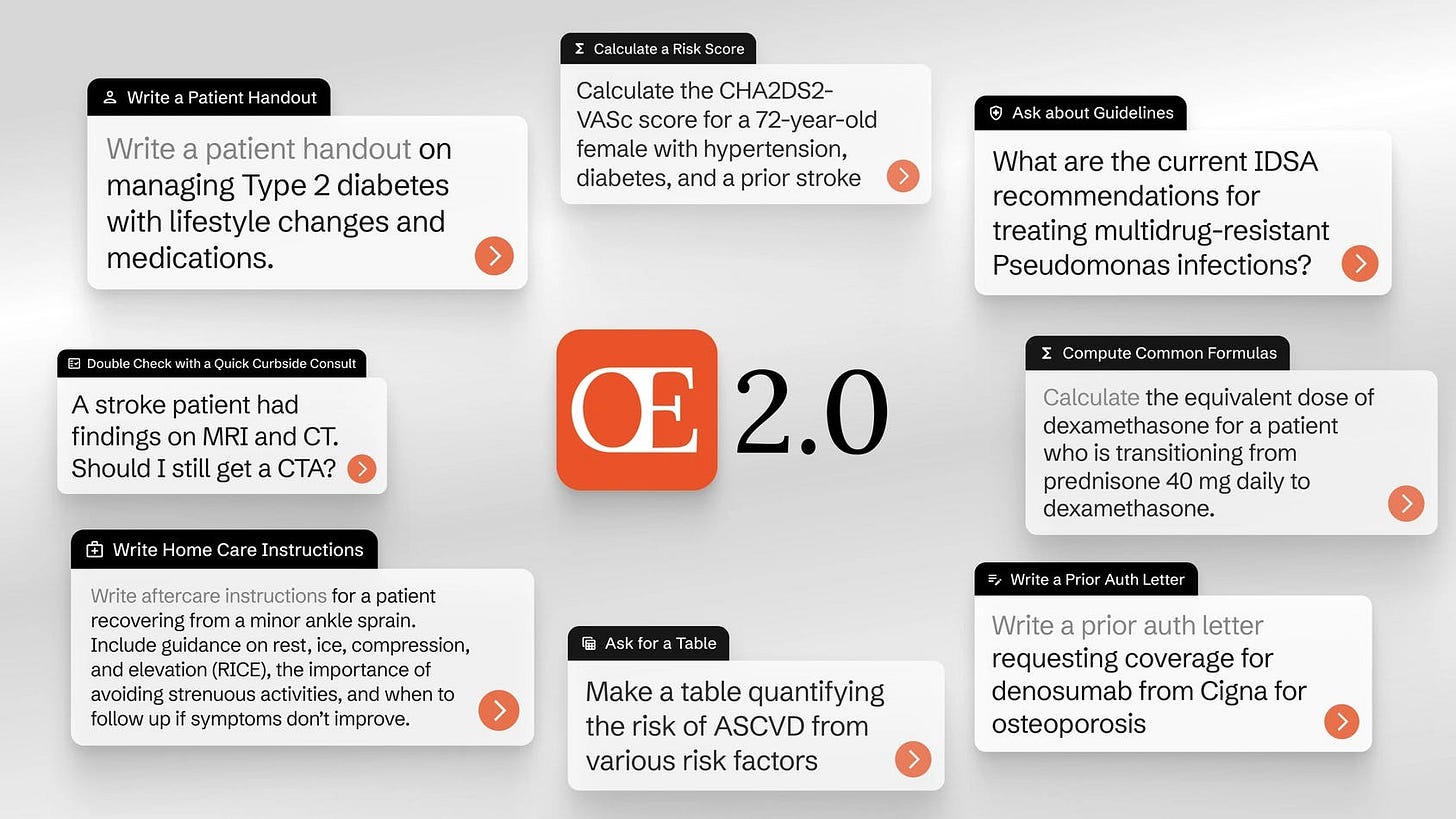

OpenEvidence isn’t just another AI wrapper. They built an AI-powered clinical search engine that:

Pulls from peer-reviewed journals (JAMA, NEJM, Lancet, BMJ)

Integrates licensed content from the AMA, Mayo Clinic, ACC, NCCN

Gives doctors instant answers to clinical questions backed by actual research

Works at the point of care (when doctors are literally treating patients)

Gets used daily by physicians (multiple times per day on average)

The Monetization Flip:

Here’s the genius part - they got massive adoption FIRST (440,000+ physicians), then turned on ads.

Not crappy banner ads. Contextual pharma ads.

When a doctor searches for “treatment options for Type 2 diabetes,” pharmaceutical companies and medical device makers can surface their FDA-approved treatments right there in the results.

It’s Google AdWords meets clinical decision support.

The Revenue Model:

Pharma and device companies pay to appear alongside relevant clinical content.

Think about the value prop here:

For doctors: Free AI tool backed by trusted medical sources

For pharma: Access to physicians at the exact moment they’re making treatment decisions

For OpenEvidence: High-margin ad revenue (90%+ gross margins on ad inventory)

They’re printing money at the intersection of three things:

Massive distribution (440K+ doctors, 10K+ hospitals)

High commercial intent (point-of-care treatment decisions)

Deep-pocketed advertisers (pharma has BIG budgets)

Why The Valuation Doubled:

When you can show investors that you have:

40%+ market penetration in your vertical

$150M in annualized revenue by simply turning on the ad switch.

This is a playbook we’ve never seen in Vertical SaaS - it’s one we’ve seen from Snapchat, Facebook, etc.

90%+ gross margins (ad revenue is mostly margin)

Defensibility through content licensing deals with AMA, NEJM, etc.

Amazing daily active usage by physicians

You get a $12B valuation. That’s 80x revenue. In SaaS terms, that’s “we think this becomes a $1B+ ARR company in the next 12 months.”

The Playbook They Ran:

Build for a specific vertical (physicians, not all healthcare workers)

Solve a real pain point (information overload, need for evidence-based answers fast)

Establish credibility (license content from trusted medical sources)

Get massive free adoption (freemium model, doctors love free tools)

Monetize through a third party (pharma pays, doctors use for free)

Scale the money printer (more doctors = more valuable ad inventory)

This is the embedded ads playbook for vertical SaaS, executed perfectly.

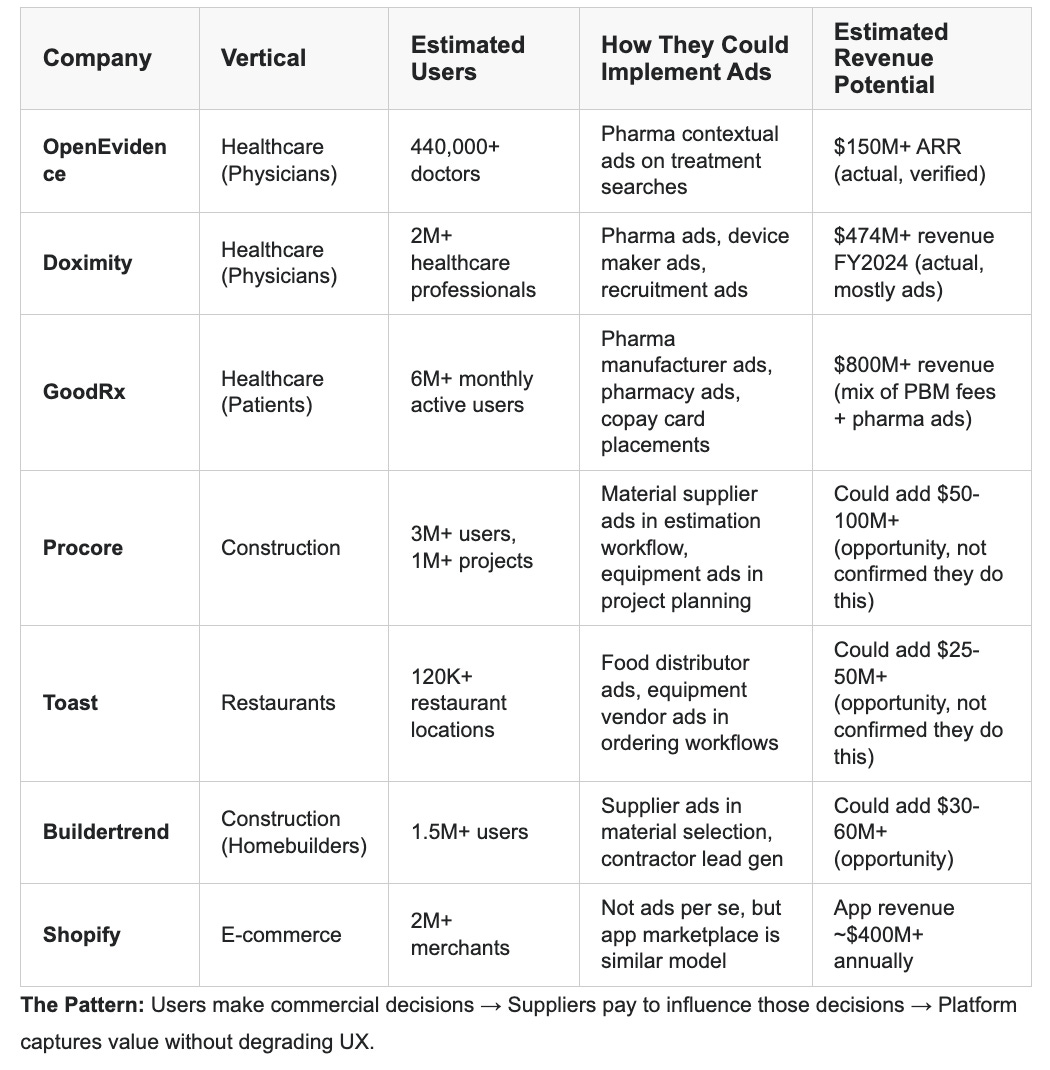

The Question You Should Be Asking:

Could this work in YOUR vertical?

If you’re building vertical SaaS with:

High user engagement

Commercial intent in user behavior

Third-party companies wanting access to your users

You might be sitting on an ad revenue goldmine.

How to Add Embedded Ads to Your vSaaS Platform (The $150M OpenEvidence Playbook)

Look, I know what you’re thinking: “Ads? That feels gross. I’m not building a media company.”

I get it. I had the same reaction when I thought about doing this at my company.

But here’s the thing - embedded ads aren’t display ads. They’re not banners that users ignore. When done right in vertical SaaS, they’re contextual recommendations that actually add value.

Let me show you how to think about this…

Step 1: Do You Even Have an Ads Business Hiding in Your Platform?

Not every vSaaS can or should do ads. Here’s the checklist:

✅ You have 10,000+ active users (need meaningful inventory)

✅ Your users spend significant time in your product (5+ sessions/week)

✅ Your users make commercial decisions in your platform (buying, prescribing, specifying products)

✅ There are vendors/suppliers in your vertical with marketing budgets

✅ You have a “moment of intent” (searches, product selection, purchasing workflows)

If you checked 3+, you probably have an ads opportunity.

Real examples of vertical companies monetizing ads:

Step 2: Build the Foundation (Before You Sell a Single Ad)

You can’t just slap Google AdSense on your app and call it a day. Here’s what you need:

A. Capture Intent Signals

Track what matters:

Search queries

Product views/comparisons

Purchase patterns

Category browsing

Workflow stages (early research vs. ready to buy)

B. Build Inventory Buckets

Create “ad placement zones” that make sense:

Search results (pay-per-click on keywords)

Category pages (sponsored listings)

Comparison views (promoted alternatives)

Dashboards (relevant product spotlights)

Email digests (sponsored content)

C. Set Up Basic Tracking

You need to measure:

Impressions (how many times ads are shown)

Click-through rate (CTR)

Conversion tracking (if they buy, you know)

Advertiser ROI (they need proof this works)

Use something simple like Segment + your own database. Don’t overcomplicate it.

Step 3: Start With Your Biggest Power Users (Not Random Advertisers)

Here’s the mistake most founders make: They try to build a self-serve ad platform from day one.

Don’t.

Instead:

Identify the top 5-10 vendors/suppliers your users already buy from

Reach out directly: “Hey, 40% of our users already buy your product. Want to sponsor it?”

Run a pilot for 3 months at a fixed price ($2K-5K/month is a good starting point)

Manually place their ads (no tech needed yet - just hardcode placements)

Track results obsessively (send them weekly reports)

If they get 5-10x ROI, they’ll renew. That’s your signal to scale.

Step 4: Price Your Ads Based on Value, Not Just Impressions

There are three main pricing models:

CPM (Cost Per Thousand Impressions)

Best for: Brand awareness campaigns

Typical range: $5-50 CPM depending on vertical

Example: Construction software might charge $20 CPM for equipment ads

CPC (Cost Per Click)

Best for: Performance marketing

Typical range: $1-20 CPC depending on intent

Example: Healthcare might charge $5-15 CPC for pharma searches

CPA (Cost Per Acquisition) / Revenue Share

Best for: High-value transactions

Typical range: 5-20% of transaction value

Example: Marketplace takes 10% when user books supplier through platform

My recommendation: Start with flat-rate sponsorships ($2-10K/month), move to CPC once you have volume, consider CPA for high-value verticals.

Step 5: The Math That Makes This Worth It

Let’s say you have a vSaaS platform with:

10,000 active users

Each user visits 20 times/month = 200,000 monthly sessions

You show 1 ad per session = 200,000 monthly impressions

$20 CPM = $4,000/month = $48K/year per 10K users

But here’s where it gets interesting...

If those users make commercial decisions (like OpenEvidence doctors choosing treatments), your CPM could be $50-200.

At $100 CPM with the same volume: $240K/year in ad revenue.

Now scale that to 100K users: $2.4M/year.

And that’s just display ads. If you add:

Sponsored search (CPC model)

Marketplace fees (transaction %)

Lead generation (cost per lead)

You can easily hit 20-30% of total revenue from ads in mature vSaaS platforms.

If you have a user base there is serious power of flipping the ads switch. We haven’t seen it a whole lot in vSaaS but there are PROS at this that have done it at every media/social media/consumer app.

Have a big user base? Maybe 2026 is the year you think about bringing one of them in?

The Bottom Line:

OpenEvidence went from near-zero to $150M in ad revenue because they:

Built massive distribution first (440K+ doctors)

Identified a high-value “moment of intent” (treatment decisions)

Connected that intent to advertisers with deep pockets (pharma)

Made ads feel like helpful recommendations backed by evidence, not spam

Maintained 90%+ gross margins (pure software economics)

You can do this too.

Start small. Run a pilot with 3-5 advertisers. Prove ROI. Then scale.

You’ve got this.

Love vSaaS Biz Stories? Check out VERTICALS: A Weekly Biz Show On Vertical SaaS & AI to get your weekly fill

Verticals: A Weekly Biz Show Presented by Parafin where a founder (aka me / Luke Sophinos) intellectually spars with a VC (Nic Poulos from Euclid VC) on all things Vertical Tech & AI. We will bring on an incredible guest every week, but not to chat about their background, to discuss playbooks, practical advice, and where the puck is heading next. Do us a solid and subscribe today!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com