#134: OpenEvidence: Vertical AI for Clinicians, The Power of Value-Based Pricing

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by Rainforest, the embedded payment provider purpose-built for vertical software platforms.

Grow revenue with the only payfac-as-a-service provider optimized to help you drive more payments volume at higher margins, without risk or compliance headaches.

Learn more at rainforestpay.com

Alright, let’s get to it…

One Biz Story:

OpenEvidence: ChatGPT For Clinicians

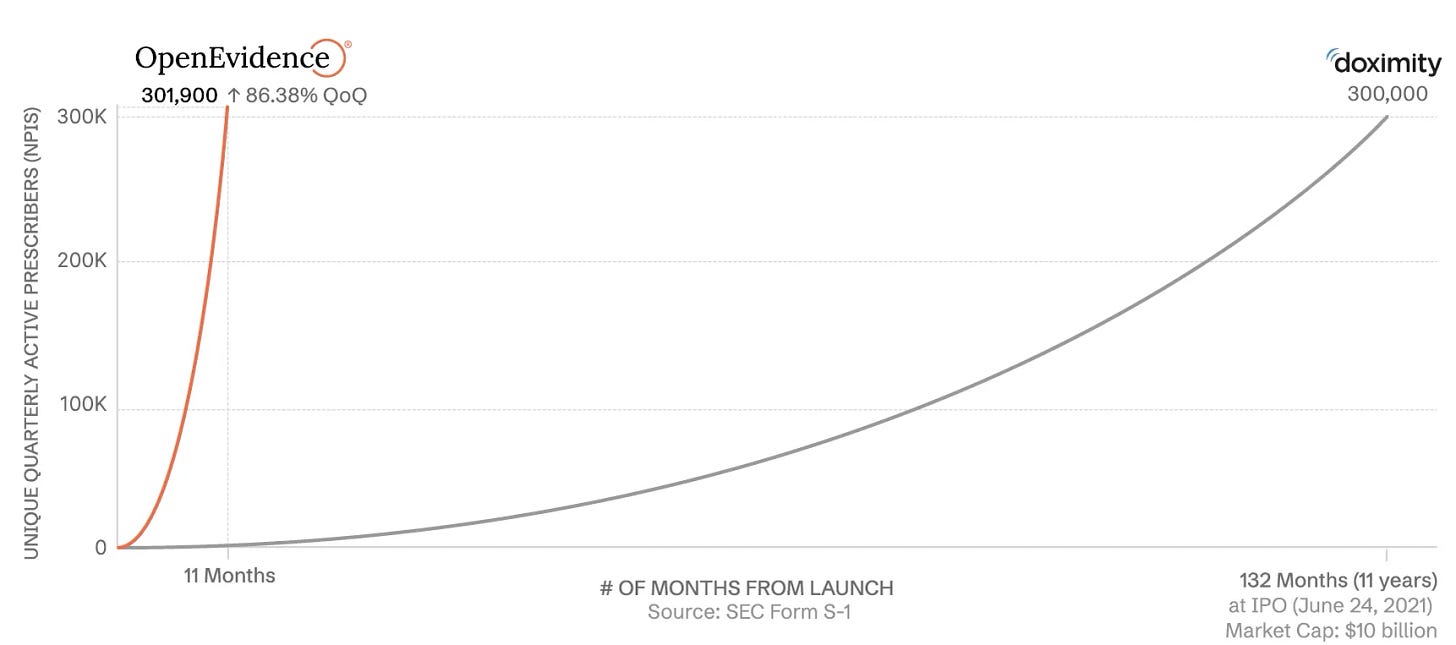

OpenEvidence - which is essentially ChatGPT but trained on medical data, AI has achieved what many thought impossible – capturing the attention and trust of over 350,000 doctors in less than two years, making it perhaps the fastest-growing healthcare platform in history.

With its recent $75 million Series A funding round at a $1 billion valuation, OpenEvidence is redefining how physicians access and utilize medical knowledge.

I wanted to go deep on OpenEvidence, because it is perhaps the most compelling Vertical AI business the market has seen yet…

The Founding Story

OpenEvidence was founded in 2022 by Daniel Nadler, a serial entrepreneur with a remarkable track record in AI. Nadler, who holds a PhD from Harvard, previously founded Kensho Technologies, a groundbreaking financial AI company that was acquired by S&P Global for $700 million in 2018.

The inspiration for OpenEvidence came during the COVID-19 pandemic when Nadler recognized a fundamental problem plaguing modern medicine: the exponential growth of medical knowledge was creating an impossible burden for physicians. "There's two new medical papers published every minute, 24 hours per day," Nadler explained. "Medical knowledge doubles every 73 days according to some studies. It's simply impossible for doctors to keep up with this fire hose of information."

Nadler assembled a world-class team of AI researchers, primarily from Harvard and MIT, including co-founder Zachary Ziegler, a brilliant computer scientist from Harvard who worked with Alexander Rush in his Natural Language Processing Lab.

The team took a radically different approach from other AI companies, focusing on smaller, highly-specialized models trained exclusively on peer-reviewed medical literature rather than the public internet.

Revolutionary Go-to-Market Strategy

OpenEvidence's go-to-market strategy represents a fundamental departure from traditional healthcare technology companies. Instead of pursuing lengthy enterprise sales cycles, Nadler chose to treat doctors as consumers.

"Doctors are people, too. Doctors are consumers, too," Nadler emphasized. "What we got right is we realized that if you make something awesome that is life-changing and game-changing for knowledge workers, and you put it out on the app store for free, people will start using it."

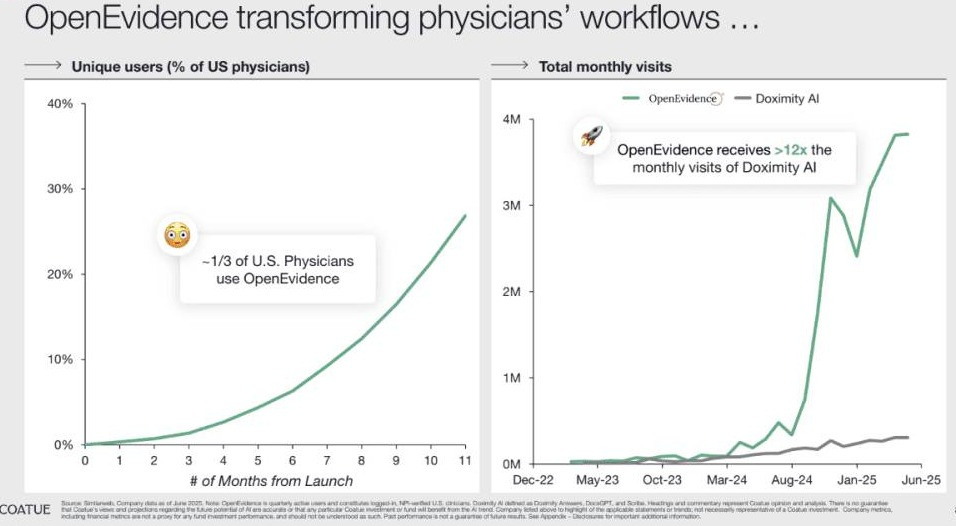

This direct-to-physician approach proved revolutionary. OpenEvidence launched directly on mobile app stores, making the platform freely available to verified U.S. doctors. The results: growth from zero to over 350,000 verified doctors in less than two years, with 50,000 new physicians registering monthly.

This is CRAZY. 1/3rd of all U.S. physicians use OpenEvidence in 11 months since launch. Selling software into this category, pre-AI, was BRUTAL.

They just flipped the script…

Product Suite

OpenEvidence has evolved from a simple medical search engine into a comprehensive clinical decision support platform:

Core Features:

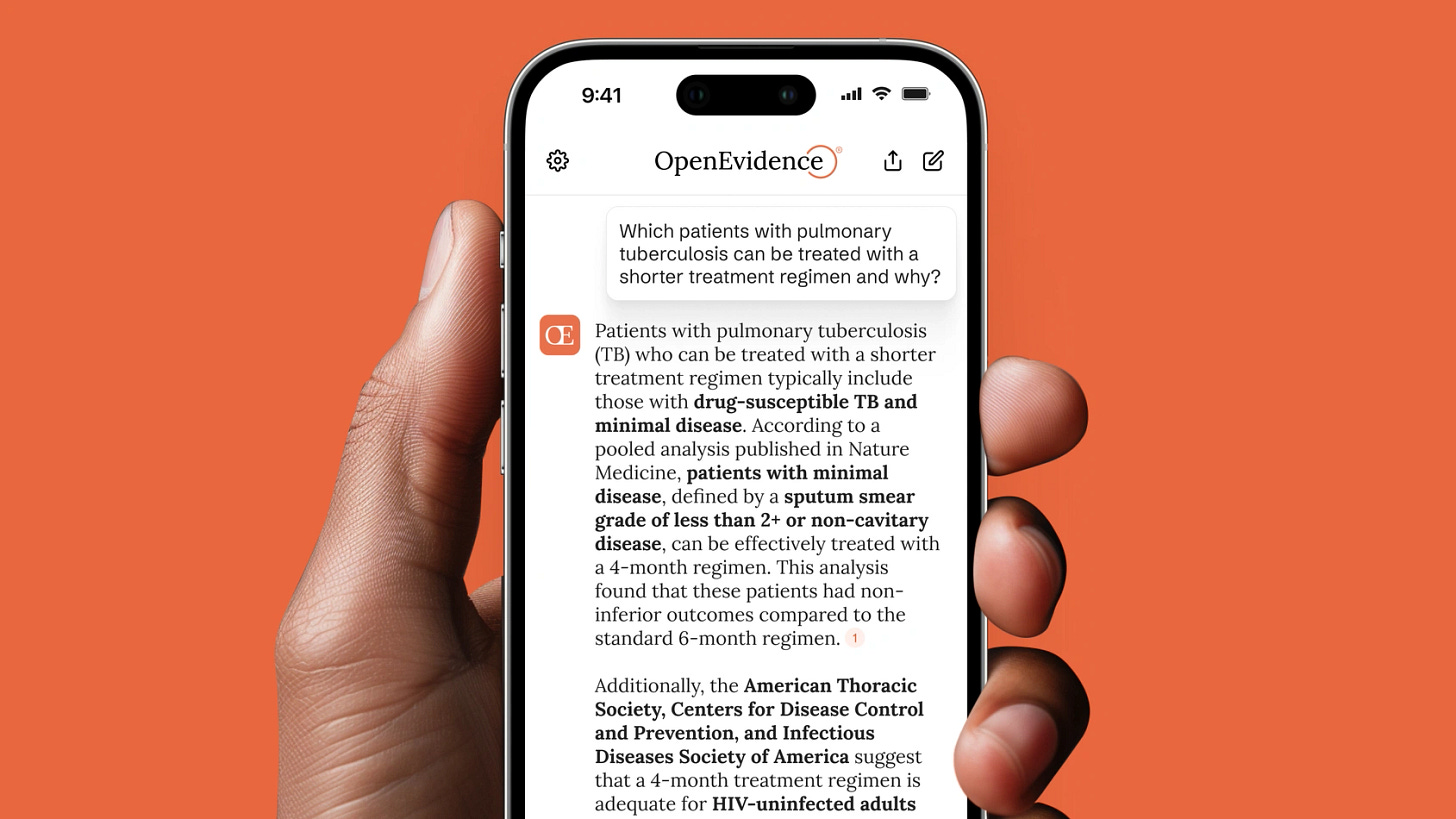

AI-powered search across 35 million peer-reviewed publications

Clinical decision support and diagnostic reasoning

Administrative tools including prior authorization letters and patient handouts

50+ integrated clinical calculators

Drug monograph modules and clinical guidelines

Strategic Content Partnerships: The company's competitive advantage lies in exclusive partnerships with premier medical publishers:

The New England Journal of Medicine (NEJM): Making OpenEvidence the only AI platform trained on the full text of NEJM

JAMA Network: Access to 13 journals including the Journal of the American Medical Association

These partnerships weren't achieved through traditional business development but through organic adoption – senior editorial board members became power users and approached the company seeking partnerships.

Revenue Growth and Business Model

OpenEvidence currently operates on a freemium model, offering unlimited access to verified U.S. physicians at no cost while generating revenue through advertising, similar to successful healthcare platforms like Doximity.

Current Metrics:

350,000+ verified doctor users

50,000 new registrations monthly

7.2 million clinical consultations monthly

75% of users utilize the platform during office hours

But unlike Doximity, they have grown WAYYYYY faster…

Customer Retention

OpenEvidence has achieved remarkable retention with high engagement metrics – 75% of users accessing the platform during office hours and multiple daily uses per active user. The platform benefits from strong network effects, with doctors discovering the tool through colleagues and sharing positive experiences.

Fundraising Milestones

2021: Self-funded by Daniel Nadler

2023: Friends and family funding round

February 2025: $75 million Series A led by Sequoia Capital at $1 billion valuation

July 2025: $210 million Series B co-led by Google Ventures & Kleiner Perkins at a $3.5B billion valuation. This round reportedly made the founder, Daniel Nadler, a billionaire.

They added $2.5B of value in ~6 months this year….

Legendary investor and Kleiner Perkins Chairman John Doerr—who co-led Google's original Series A and has served on its board since 1999—said,

"It's hard to imagine a better use for AI than OpenEvidence. Daniel Nadler and his world-class team are building what I believe will become an AI-era treasure, a life-saving resource for doctors, patients, and their families. I can't imagine the future without it."

Vision for the Future

OpenEvidence's long-term vision extends far beyond medical search to encompass a comprehensive transformation of healthcare knowledge access:

Global Expansion: Plans to serve millions of physicians worldwide who face similar challenges in staying current with medical literature.

Advanced AI Capabilities: Investment in next-generation medical AI models for sophisticated diagnostic reasoning, personalized treatment recommendations, and EHR integration.

Ecosystem Development: Becoming the central hub for medical knowledge through EHR integration, APIs for third-party applications, and specialized modules for different medical specialties.

Research and Innovation: Advancing medical AI through original research, proprietary knowledge databases, and new AI architectures specifically designed for healthcare.

As Daniel Nadler stated, "We're here to organize the world's medical knowledge and make it more useful, open, accessible, and understandable."

Conclusion

OpenEvidence's journey from startup to billion-dollar valuation in less than three years represents one of the most remarkable success stories in healthcare technology. Innovating with product is one thing, but getting to this scale of doctors in an industry that has been historically BRUTAL when it comes to GTM is INSANE.

A question I’ve been asking myself, what other industries need an OpenEvidence??

Vertical AI may just change EVERYTHING.

One vSaaS Breakdown:

Hear about the future of Vertical AI from billion dollar vSaaS founders & investors at the the vSaaS Summit !

I am also going to give away ~5 free tickets to Pre-Seed and Seed Stage vertical software / AI founders. If this is you reply to this email :-).

We will sell out soon!

(vSaaS founders/operators/investors only).

One ‘How To’:

Value-Based Pricing

Most vSaaS founders leave a lot money on the table because they price like horizontal SaaS companies.

This is becoming even worse in the AI era, everyone is just copying ChatGPT’s $20 a month and, when industry-focused, you can go a lot deeper.

If you're charging $99/month per user while your software saves each customer $50,000/year. That's insane. Most early-stager companies don’t actually understand the $$ impact of their product.

That’s a problem!

The Solution: Value-Based Pricing

Value-based pricing = Discovering what your customer currently spends (time + money) on the problem you solve, then pricing at 30-50% of that total cost.

Here's the exact 3-step process:

Step 1: Map Their Current "Shadow Costs"

During discovery calls, ask:

"Walk me through how you handle [process] today"

"How many hours per week does your team spend on this?"

"What tools are you currently paying for?"

"What does it cost when this process fails?"

Example: Restaurant owner manually schedules staff:

8 hours/week × $25/hour = $200/week

Scheduling mistakes = $500/week in overtime

Current scheduling software = $150/month

Total shadow cost = $3,650/month

Step 2: Calculate Your Value Proposition

Your price ceiling = Shadow cost × 0.5 Your price floor = Shadow cost × 0.2

Using the restaurant example:

Price ceiling = $1,825/month

Price floor = $730/month

Optimal price = $1,200/month (vs. typical $99/month SaaS pricing)

Step 3: Present Value-Based Pricing

Never lead with price. Lead with cost savings:

"Based on what you've told me, you're spending roughly $3,650/month on scheduling between labor costs, mistakes, and current tools. Our software typically saves restaurants like yours $2,400/month while improving accuracy. The investment is $1,200/month, so you're looking at $1,200/month in pure savings."

Pro Tips for Shadow Pricing Success

🎯 Focus on quantifiable outcomes: Time saved, errors prevented, revenue increased

🎯 Use industry benchmarks: "Similar restaurants typically spend..."

🎯 Create pricing tiers around value: Basic = 20% of shadow cost, Pro = 35%, Enterprise = 50%

🎯 Build ROI calculators: Make the math obvious for prospects

🎯 Follow-Up Every Quarter: Send your customers a quarterly report showing how much money their saving relative to their spend. HARDLY ANY COMPANIES DO THIS and it will massively improve your customer retention.

The Result: Customers Who Pay Happily

When you price based on true value:

Customers see clear ROI

Price objections disappear

Deal sizes increase dramatically

Retention improves (they're saving money)

Bottom line: Stop pricing like a horizontal SaaS tool. Start pricing like the industry-specific value creator you actually are.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com