#117: Stop Making Excuses & Launch Payments, How Embedded FinTech Can Transform SMB's, vSaaS Resources

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One Quick Question:

It’s been a while since I polled our community on your roles. Knowing your job helps me craft the right content. Help a brother out and let me know what you do!

One ‘How To’:

Stop Making Excuses & Launch Payments Already

I have one serious regret of my eleven years building a vertical SaaS business. It wasn’t that huge customer that fired me, it wasn’t that I didn’t close that million dollar deal with the blue-chip enterprise customer, it’s one glaring regret that stares me in the face…

I didn’t launch payments soon enough.

I am reminded of this regret EVERY TIME I see Toast’s quarterly earnings. It still blows my mind every time I see their breakdown…

Q4 2024 was no different.

Let’s take a quick look:

~$1.1 Billion / ~81% comes from FinTech

~$200M / ~14% comes from SaaS

~$50M / ~5% comes from ProServ

If you want some more data, Stripe recently published their 2024 annual report. They highlighted Vertical SaaS as one of the key growth levers of their 38% 2024 growth into $1.4 TRILLION of total payments processed. They cited that 60% of small businesses in the U.S. are using Vertical SaaS to process payments. That means there is still roughly half of the entire U.S. economy that is not. And internationally still has SIGNIFICANT opportunity.

I had a great institutional investor that led our Series B — and he’d constantly ask me when we were going to launch payments.

There were a few good reasons (I thought) of why we just couldn’t do it yet.

We needed to get our BI tool spun up first, because the payments tool wouldn’t be as valuable without it.

We needed to clean up some things in our core product before we could expand customers into it

We needed to corner the market on the pre and post transaction workflows before

All these were valid. But I should have just done it sooner.

I eventually did it, launching it early 2024, and it juiced our revenue, our retention, and nearly doubled our TAM.

If I would have done it 1 year, 2 years, 5 years sooner — I would have sold the business for a hell of a lot more than I got. It’s my one serious regret.

So - learn from my mistakes.

STOP MAKING EXCUSES and just launch payments. It will have a serious chance of changing the trajectory of your vertical SaaS business.

One Biz Story:

How Embedded FinTech Can Transform Small Businesses

Small businesses make up 99.9% of American companies, and employ more than 61 million people. Yet for many of these businesses, managing financial operations remains a time-consuming and fragmented process. Embedded fintech can transform work for these businesses by streamlining workflows and allowing owners to focus on their growth rather than their administrative burdens.

The Burden of Manual Management

Take Andy, a solo entrepreneur running a small landscaping business with seasonal help. To keep his business running, he must track job schedules, invoice customers, manage payments, and ensure accurate payroll and tax filings. Currently, these tasks are handled using a mix of sticky notes, spreadsheets, and disconnected software tools—leading to inefficiencies, errors, and lost time. Every two weeks, reconciling hours worked and determining payroll amounts consumes valuable time, requiring the help of an accountant to process payments and handle tax obligations.

This scenario is all too common among small business owners. Despite their significant contribution to the economy, most still lack integrated tools that simplify employee operations and financial management.

The Benefits of Embedded Fintech

Embedded fintech can allow platforms to offer small business owners seamless, all-in-one solutions without having to build each product from scratch. For our landscaper, let’s look at Embedded Payroll. By adding payroll to his business management software, the platform can eliminate Andy’s need for separate systems, accountants, manual data entry, (and sticky notes), improving both the efficiency and accuracy of his financial workflow. When a platform integrates payroll with their scheduling, time tracking, or invoicing products, they offer Andy several key benefits:

Time Savings & Efficiency

Payroll processing becomes automated—reducing the time spent on calculations, tax filings, and employee payments.Reduced Errors & Worry-free Compliance

Automatically calculating wages, deducting the correct taxes, and generating required state and federal filings reduces the risk of miscalculations, tax errors, and missed deadlines.Improved Cash Flow Awareness & Payment Processing

Embedded payroll solutions that integrate with invoicing and payment tools ensure easier disbursement of wages to employees and increased visibility into the full financial health of the business.A Better Employee Experience When employees and contractors can track hours, view paystubs, and manage direct deposits all within the same system, onboarding and pay management become significantly more streamlined — improving employer and employee satisfaction.

Last Words

For small business owners juggling their brand and their books, all-in-one platforms are more than just convenient—they’re game-changing.

By embedding financial tools like payroll, benefits, or accounting tools into existing employee management software, platforms can streamline a customer’s operations, reduce their costs, and allow them to focus on what matters most: growing their business.

The embedded finance market is projected to grow 148% over the next four years, reaching an estimated $228 billion by 2028. As the market for embedded finance expands, the adoption of integrated fintech solutions will only continue to rise, further supporting the backbone of the U.S. economy: small businesses.

One Biz Story:

Vertical SaaS Group Community Resources

Over time we’ve added A LOT of great resources for our newsletter community. I still talk to many of our readers that inform me they had no idea we had so many great other resources beyond just the newsletter so I wanted to take a moment to highlight all of them them for you —

The Bible is our most popular — it’s 1,000+ pages on vertical software with hundreds of case studies, operating playbooks, how-to’s, and industry scorecards. It’s the exact thing I wish I had during my time founding, building, and doing my first few investments in vertical SaaS.

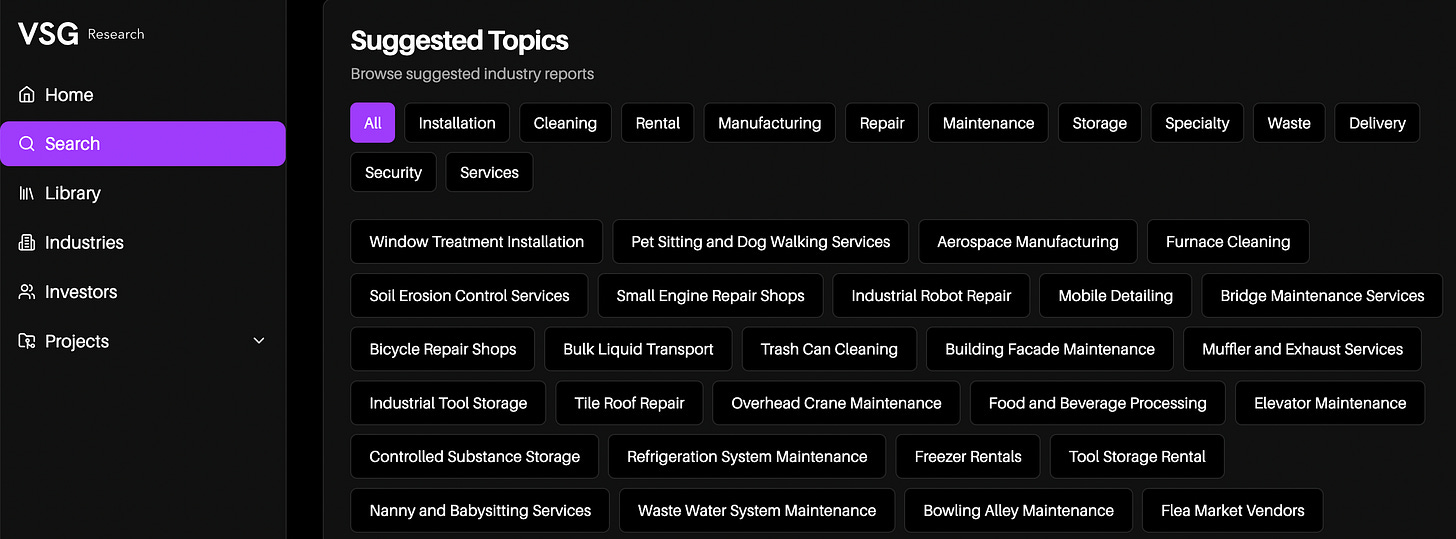

The Research App is very new but getting a ton of great feedback. I’ve personally been using it almost every day. The tool is designed to help you find the right industry to build a SaaS solution for OR if you’re an investor, find the right industry AND the right company to get behind. It has generative AI built into it and trained on all of our content, so you can have it answer any questions or do some work for you like draft emails, identify whitespace, etc. It’s crazy cool…

We recently launched a vSaaS job board after getting a lot of outreach by folks asking where the vSaaS jobs/opportunities are. So we’ve aggregated thousands of open roles at vertical SaaS companies. If you’d like to add your job listings here reply to this email and we’ll get your company added :-).

We’ve invested nearly ~20 vertical SaaS, vertical AI, and/or venture buy out companies over the last few years and love to see opportunities. If you are raising an open to a small angel check by me and my close friends of vertical SaaS founders/operators. Send your pitch deck and tell me more about what you’re building here. If you’d like to be an investor in our small syndicate reach out to me too, we’d love to have you.

So — that’s what we have for you all above and beyond the newsletter.

Have an idea for something we could add that would be valuable? Reply to this email and let us know!

Thanks for being a reader ❤️❤️❤️

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Spot on as always, Luke. Any thoughts on how vsaas should decide which embedded finance product to prioritize implementing first after payments: lending, payroll, accounting, or other?