#091: The vSaaS + Payments Playbook, vSaaS Company Formation Checklist

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Vaya.

vSaaS companies use Vaya’s embedded credit to gamify adoption of their most important features.

Embed Vaya to accelerate your growth and retention.

Alright, let’s get to it…

One vSaaS Breakdown

vSaaS Company Formation Research Checklist

Want to build an industry specific software business?

I put together a checklist to see if you have the right opportunity on your hands...

This is the exact checklist I use :-).

One Biz Story:

We are going DEEP on payments today so no vertical SaaS case study this week BUT, friendly reminder, if you’re itching for one go check out the Vertical SaaS Bible, I’ve got nearly 100 there including 💈 Squire: vSaaS for Barber Shops, 👨🔧 Service Titan: vSaaS for Field Services, 🏦 nCino: vSaaS for Banks, & 🌿 Dutchie: vSaaS for Dispensaries.

One ‘How To’:

The vSaaS + Payments Playbook

The vSaaS + Payments playbook is still one of the most under-rated ways to build a big business. It’s likely you have heard of it before, or at least have some general understanding of it. But I want to cut through the high level BS and show you EXACTLY what it is and how to do it.

First off, what is it?

When you build industry specific software - often workflow software, and then launch a new payments product line after you have some decent traction and scale. If you can own key workflows BEFORE or AFTER the actual transaction takes place, you can easily expand into OWNING the transaction.

Nearly EVERY SINGLE large scale Vertical Software player has successfully launched payments and scaled massively through it.

A few examples:

Toast (Restaurant Software)

Cloudbeds (Hotel Software)

Storable (Storage Unit Software)

Tribute Technology (Funeral Home Software)

Tithely (Church Software)

Dutchie (Cannabis Store Software)

The common theme in nearly all large vertical software players? They’re monetizing through payments.

Ok, so why do it?

#1. TAM Expansion: In vertical software you are limited by Total Addressable Market (TAM). If you’re just going after one industry there's only so much SaaS revenue you can drive.

So the natural extension is to make your customers customers YOUR customer. You need to own a piece of the actual revenue that flows through the industry. Not just an expense line item on the P&L. This is how industries that look somewhat small on the surface can actually be massive.

Some quick math to illustrate this point…

There are roughly 1 million restaurants in the US. At $50 / restaurant a month. We’re only looking at a $600M market size. That’s too small for a VC opportunity…

But wait a second, those 1 million restaurants do nearly $1 TRILLION in revenue. If you get a piece of that, that’s a very different market size.

VC’s didn’t realize this until relatively recently, and refused to fund a lot of vSaaS companies due to TAM concerns.

See how Toast view’s their market size, directly from their IPO filing:

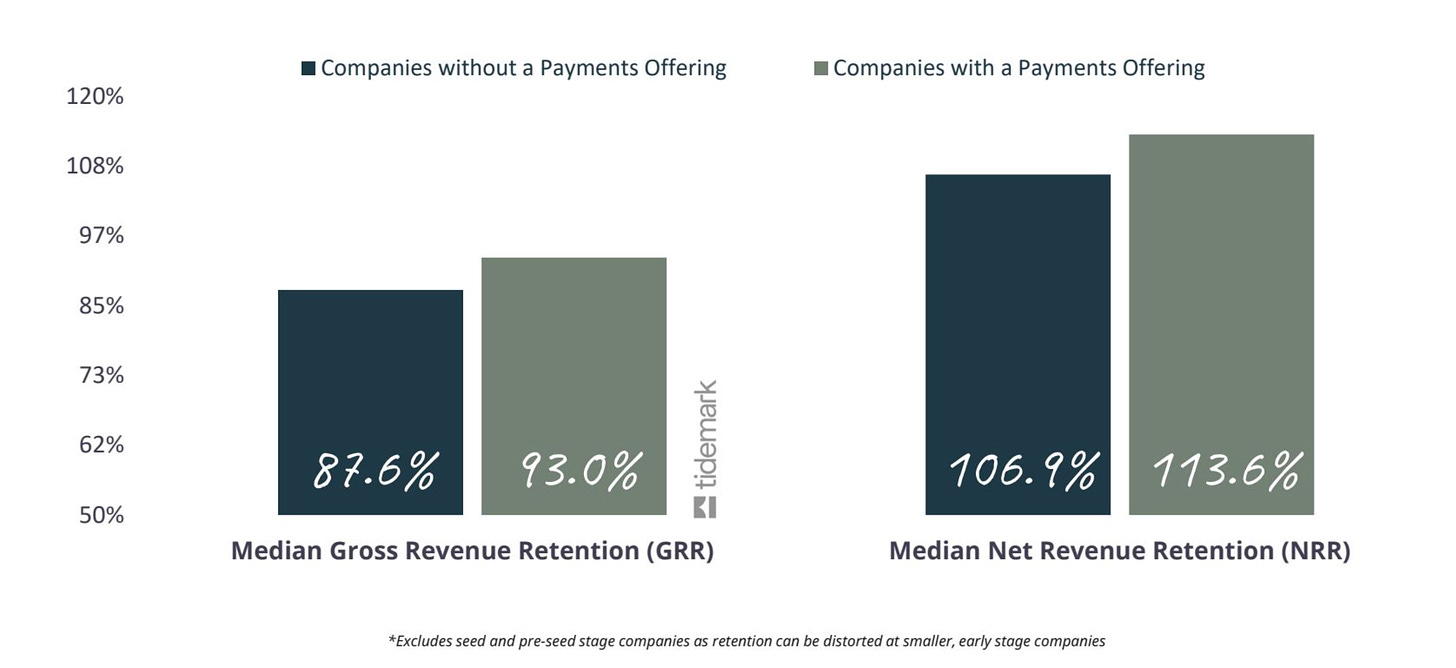

#2. Improved Retention: If you can own the transaction you’ve got yourself an AMAZING moat. People don’t like messing with payments. Now you're probably saying, “Well then how am I going to sell my product to them?” The crazy reality in a ton of industries is that they're using horizontal payments tools. The result? It’s not BUILT for their industry and their specific use case. They are not happy with it!

In the Trade School space, schools we’re leveraging freaking PayPal. In 2024. We built payments and nearly doubled our growth rate…

If you’re doing a good job they are not going to get rid of you. Especially if you're industry-specific.

#3. It’s a “free” product: My favorite part about embedded payments is you don’t need to charge a monthly SaaS fee for it. You can literally make it free, and just monetize the transaction that the consumer pays. We’re all accustomed to this, whether you're buying movie tickets, or paying the bill at a restaurant. If you’ve been solely selling SaaS based products, your customer base will be extremely excited that this is “free”. What does that mean? Well sales are going to be FAR easier, especially to existing customers.

#4. It should MASSIVELY scale your revenue. The combination of selling your first “free” product, stronger retention, and the fact that you just drastically improved your TAM leads to only one destination. A. Lot. More. Revenue.

At my business, CourseKey, which offers software for Trade Schools. Our SaaS business is growing about ~20% (we’re at a good scale, ~300 enterprise customers), but payments is looking like it’s going to grow at ~200% (!!!!). Say whaaaaaaaat.

Remember, my disclaimer here is that this is ONLY if you have some scale and own the before/after transaction workflow.

Ok, so here’s exactly how to do it…

Step #1: Build / scale a wedge product

Your wedge product is your “get-in-the-door” product. It needs to be easy to implement, prove your reputation, and have a fast GTM.

Launch this into in industry, and own a SPECIFIC workflow.

If you want to go deeper here you can check out this.

Step #2: Build / scale a few other additional product lines with the goal of owning workflows that are BEFORE or AFTER the transaction workflow that you want to own.

Not that you’ve proven your reputation, it’s time to launch a SaaS product before or after the transaction and ideally own one or both of those workflows.

A few examples:

If you're building software for restaurants, you could launch a menu-based SaaS product with demand-based pricing.

If you’re building software for hotels, you could launch a marketing automation tool that helps hotels find prospective customers. You could also launch a review tool for hotel guests following their stay.

If you’re building software for schools, you could launch a CRM, and then an attendance product, see how these are immediately before and after the payment takes place?

Step #3: Speak to your existing customers about payments, if you own the before/after transaction it’s likely they will be VERY receptive to you also owning the transaction itself.

Now it’s time to put your product hat on. Go out and survey the market. Talk to as many customers as you can. Study their workflow. What are they using for payments today? If it’s a horizontal provider (PayPal, Bill.com, etc.) you just hit the jackpot. If it’s an industry-specific provider, but they aren’t owning before/after the transaction you also will have a great opportunity in front of you.

Step #4: Pick a Payments Vendor

The classic go-to’s are Stripe and Adyen. But there are a lot of providers that you can adopt that will require more engineering work but give you significantly better economics. An example of this is Fidelity Payments or Cardknox. Reach out to me and I can send you my big list.

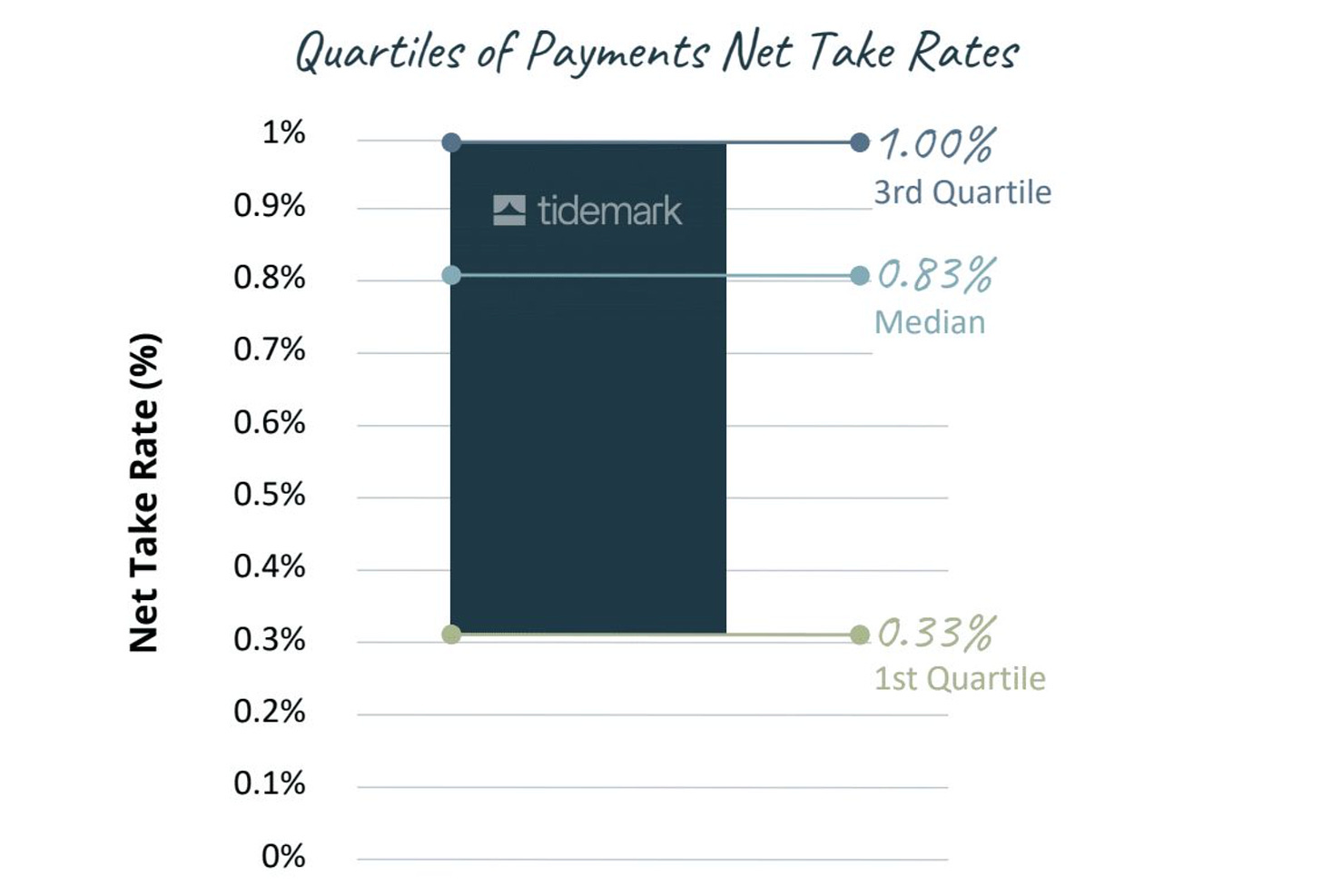

Step #5: Negotiate Your Take Rate

Here’s a good overview of take rates. I’ve seen folks get as high as 1.25%. Just think of this for a second. You can do the math and see how much $ are currently flowing through your existing customer base. In schools, we were amazed to see that BILLIONS were flowing through our 300+ enterprise customers.

Step #5: Launch to SMB customers, then refine and launch to Mid Market Enterprise Customers.

Ensure you’re at feature parody with their existing provider. If you are, and you match their take rate, there is no reason they would not go with you if you own the workflow before and after the transaction.

Don’t launch an MVP here. Payments are TOO important and you can’t screw them up. Launch a real strong V1. Do it with a few design partners. Rushing it to market can get you into trouble. But with embedded solutions you should have A TON of great features relatively quickly.

Other features you can add to improve the odds of prospects going with you?

Automated A/R notifications, text messages, emails

Integration with their ERP (you’d be shocked at the number of payment solutions out there that don’t do this yet)

Create dashboards and/or reports on everything/anything they are doing in excel

Now what happens? Well keep selling, keep building other features, add more integrations and watch a few magical things happen…

Growth rate increase

Retention increase

ARR increase

Attach rate increase

I’ve run this playbook myself and have many friends that have done the same. It’s an absolutely beautiful playbook. So much so, that there are Private Equity and Growth Equity firms that have raised billions of dollars with the goal of buying vertical SaaS companies, implementing payments, and then selling them.

Don’t let them capture all the value here. It’s a straightforward, beautiful playbook.

I wish you luck out there. You’ve got this!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com