#089: Usage Pricing > SaaS Pricing For Wedge Products, Dream Product, Private Equity ❤️'s Vertical SaaS

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Vaya.

vSaaS companies use Vaya’s embedded credit to gamify adoption of their most important features.

Embed Vaya to accelerate your growth and retention.

Alright, let’s get to it…

One ‘How To’ / Biz Story:

Usage Business Model > SaaS Business Model

For Your INITIAL Wedge Product

I’ve written a lot about wedge products in the past.

For a quick refresher, a wedge product is the initial tool you launch.

It’s your “get-in-the-door” product.

It quite literally determines your success. Wedge products solve very specific problems in a relatively short amount of time. They are easy to use and they offer a magical experience for the customer. They should have very little or strongly inferior competition.

The wedge product gets you in the door with hundreds of customers. It enables you to build a good early reputation within your space. It enables you to LEARN about your customer and your market. Once successful, you can leverage it as a 'jump off' point into more offerings.

BUT, Lately I’ve been seeing some Wedge products grow and accelerate businesses faster than I’ve EVER SEEN historically.

How? By going with USAGE & PERFORMANCE based pricing instead of traditional SAAS pricing for their initial wedge product.

Let me walk you through it...

One of the hardest parts of any early stage business venture is actually charging people — it’s especially difficult in software. Why? Because people expect a lot from their software, even when it’s free.

Most wedge products end up falling flat on their face, which in turn typically means the company fails.

Freemium models are great, but the conversion is almost always incredibly low.

Usage is an amazing model for wedge products. Let me walk you through a concrete example and show you why…

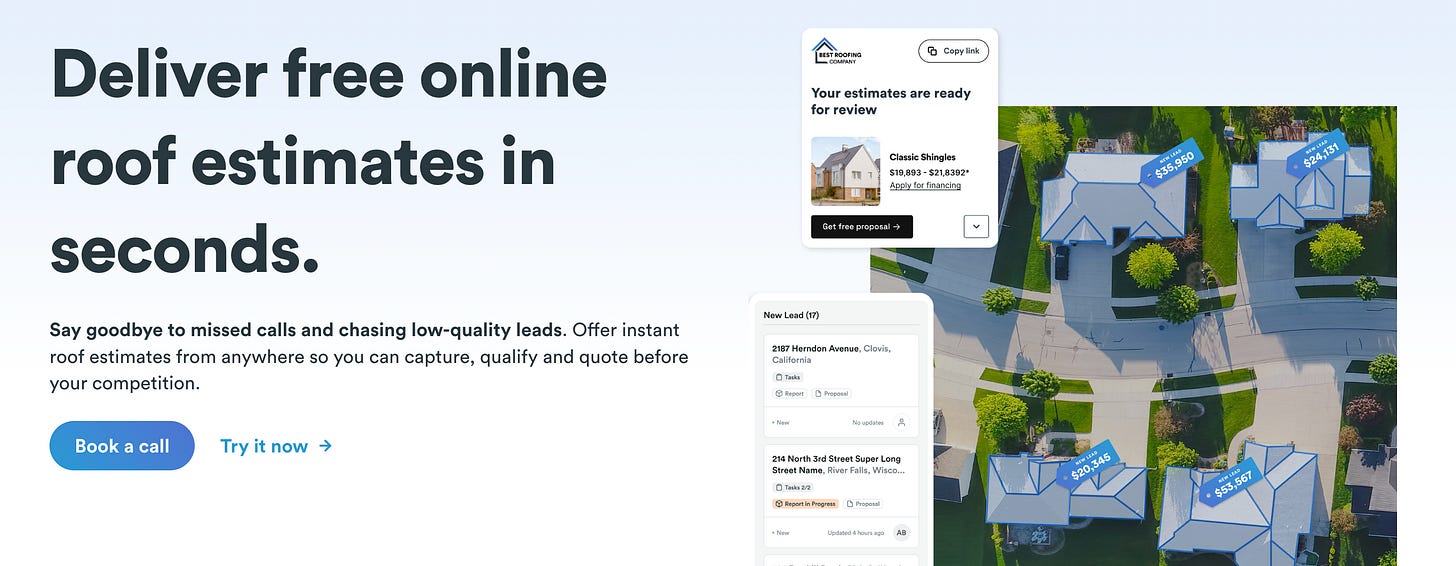

Roofr.com is building a vSaaS for roofing companies. It has a lot of the tools that we see in vSaaS - payments, scheduling, CRM, etc.

But what Roofr absolutely nailed is their wedge product — a usage based proposal tool.

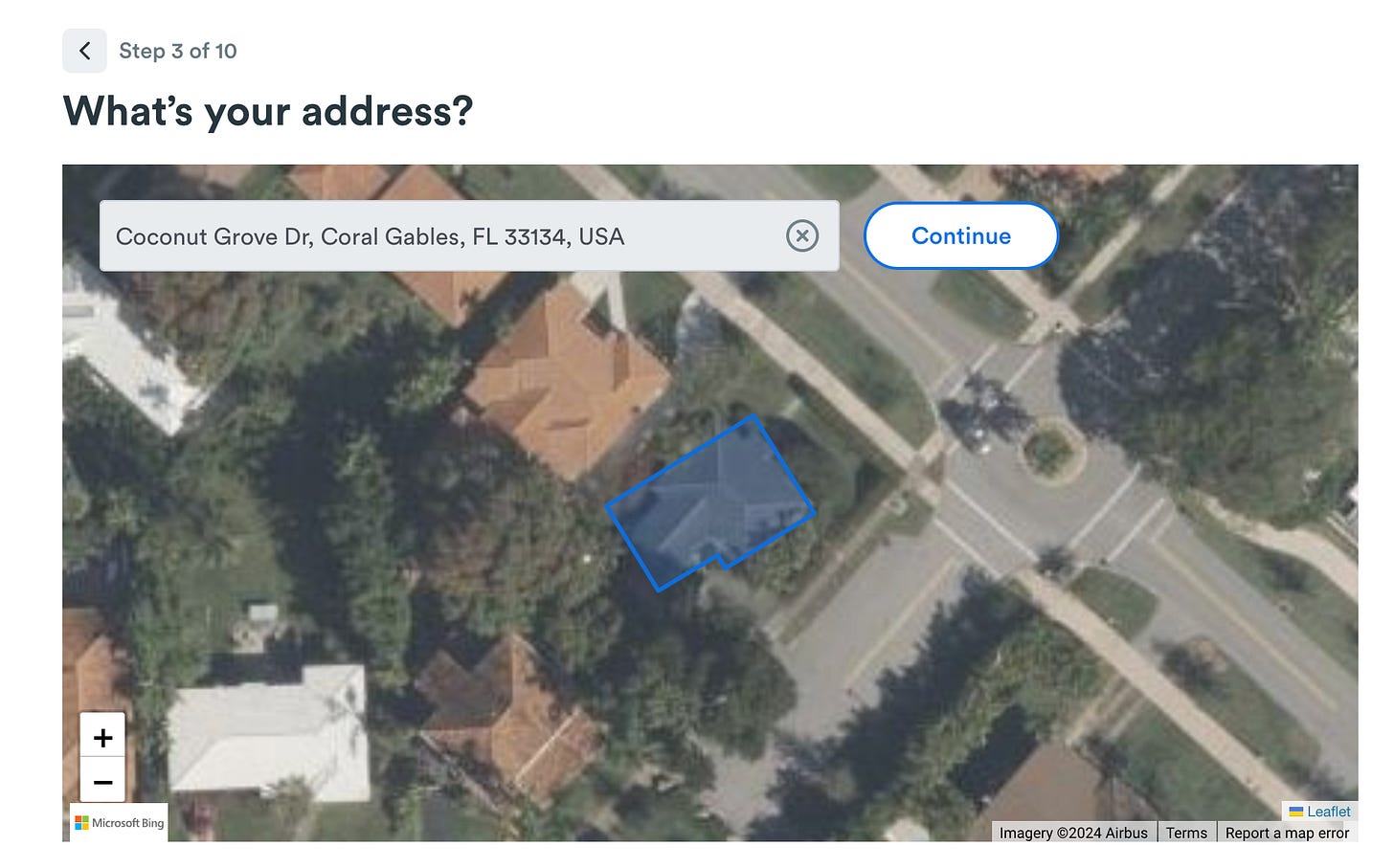

What did the tool do? It is very basic - it essentially a survey that a consumer fills out, once that happens they receive an automated estimate (based on price controls by the roofer themselves). You can see it here.

But the beautiful thing here is they made it usage/performance based instead of SaaS based. So the roofing companies only paid for the tool when a customer actually selected a quote and moved forward with it.

This exact wedge product enabled a very critical thing to happen for Roofr:

They acquired a massive amount of roofing companies with a really basic tool ENTIRELY THROUGH marketing and referrals. No sales people. Which is unheard of in home services.

Let me walk you through exactly how it worked:

Roofr runs paid ads to roofing operators / owners advertising a FREE estimating tool and pitching them to ditch their pen and paper estimates.

They plaster a ‘Try it Now’ button right on their website.

The roofing company owner / operator clicks try now and actually uses the free estimate tool. The first screen is below:

The roofing company owner / operator clicks try now and actually uses the free estimate tool. They see how intuitive / easy / accurate it is for the consumer. A few of the screens they click through are below:

After the owner/operator clicks through it, they get a CTA to sign up and actually use the tool for their business. BUT WAIT — it gets better, the first few estimate proposals are free, and then the owner ONLY pays for the tool when someone actually books a paid visit.

Word on the street is Roofr was able to get to $10M ARR insanely quickly, with <2 sales people by absolutely nailing this wedge product.

So what happened next? Roofr built out a CRM platform with traditional SaaS based pricing. When they launched it, they sold it directly to all of their usage-based customers.

When they launched it, they sold it directly to all of their usage-based customers.

You know what is 1000x easier than selling a CRM to a new customer?

Selling it to an existing customer…

I LOVE the concept of a usage based wedge product, especially one that doesn’t take sales people. Just massively lowers the adoption wall.

Usage based is not a new concept, but it hasn’t been done that often in vertical SaaS. So think about it and how it could work for your business. I bet many of you could be incredibly successful with this approach :-).

One Biz Story

Question For You:

Dream Product

I’ve wanted a really simple product for a long time. In fact I’ve asked a bunch of friends to build it as I’ve never been able to find anything that does it.

So what is it?

A tool that looks at my calendar, sees who I’m meeting with, and sends me everything they can dig up online about the person or persons I’m about to meet with.

I wan’t to know the following things:

What’s their role?

How long have they been in that role?

What did they do before?

An overview of the company they are at - how is it performing, how many employees, funding rounds, recent news clippings, etc.

I also want to know where they are located, what the weather is currently like, and any other relevant insights on THEM - recent trips, etc.

Why? Because Dale Carnegie 101 is walking into a meeting and knowing the person you’re going to be meet with and being able to leave them saying, “Wow, that guy was thoughtful. He did his homework. He really knows me.”

I finally have a friend that is building it. And I’m super excited about it.

You connect your Calendar, LinkedIn, and it sends an auto email 10 minutes before each meeting that you have.

Simple.

Powerful.

Easy to use.

Everything I love in a good tool.

So he asked me to ask you guys a simple question :-)…

One vSaaS Breakdown:

Private Equity LOVES Vertical SaaS

vSaaS companies almost always have gotten valued lower than their horizontal peers when raising VC. In fact, in my experience, VC’s don’t LOVE vertical SaaS.

Why? Probably growth, they just typically grow slower. GTM's are harder. Less marketing/product led due to industry requirements. More sales led.

Most vSaaS companies historically have been singles/doubles/triples. There are obviously the outliers — Toast, ServiceTitan, Procore, etc.

PE is the defacto buyer in singles/doubles/triples.

Additionally, vSaaS is typically stickier than horizontal, with far better retention.

I compiled a two charts from Euclid Ventures illustrating Private Equities love for Vertical SaaS…

Private Equity has always loved vertical SaaS.

But as of late it seems like they really, really, really do.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com