Linear #156: 2026 Planning Edition

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Does Your Org Have Strategic Congruence? How To Actually Set Yourself Up To Achieve It in 2026

Everyone is focused on two things right now…

Finishing out 2025 and (ideally) meeting or exceeding their targets for the year.

Planning for 2026.

In the spirit of this I thought it’d be helpful to map out a really good exercise that has been helpful for me in EVERY company I’ve been evolved with.

Before doing that, my friend Kyle Norton, CRO at Owner.com coined this term that I love, called Strategic Congruence? Let me quickly define it for you…

Your product, ACV, and GTM need to align and they need to be MARRIED.

Not dating. Not “figuring it out.” Married...

When they’re misaligned, everything downstream breaks.

Here’s the pattern:

Founder says: “We’re building the core data platform for X industry.” Cool. That’s a complex product. Requires ripping out existing systems. 6-month implementations. Solutions Engineers on every call.

Then they say: “Our ACV is $25K.”

That’s where it breaks. The math doesn’t work. You can’t sell a high-complexity product at a low price point. The friction of the sale and implementation will eat you alive.

You need to charge 4x that—or change your entire strategy to a wedge product with land-and-expand. But here’s what most people miss:

This isn’t just a pricing problem.Once you lock in Product × ACV × Strategy, everything else must align with it:

• The sales leader you hire

• The reps you recruit

• The culture you build

• The operations you design

• The customer success motion

A $25K ACV business requires completely different humans, processes, and culture than a $100K ACV business.You can’t mix and match.

The hard truth: I’ve watched companies hire world-class sales leaders, build incredible products, and still fail—because the three core elements weren’t married.

You had enterprise product complexity with SMB pricing. Or wedge product with enterprise sales reps. Or platform ambitions with PLG motions.

The mismatch is invisible at first. But it compounds.Deals take too long. Churn is high. Teams are frustrated. Something always feels off.

That’s the tax of incongruence.So before you hire another rep, build another feature, or pivot your messaging:

Ask yourself: Are my Product, ACV, and GTM Strategy actually aligned. Are they really married? Or are they just awkwardly living together and trying to make it work?

Ok, so now that we are all on the same page. How do we actually achieve it?

Step #1. Identify where your product actually is (with brutal intellectual honest)

This is not a lazy exercise of where you think your product is. You need to work with the management team to actually identify where it is. They need to bring data, customer interviews, etc. This is hyper critical.

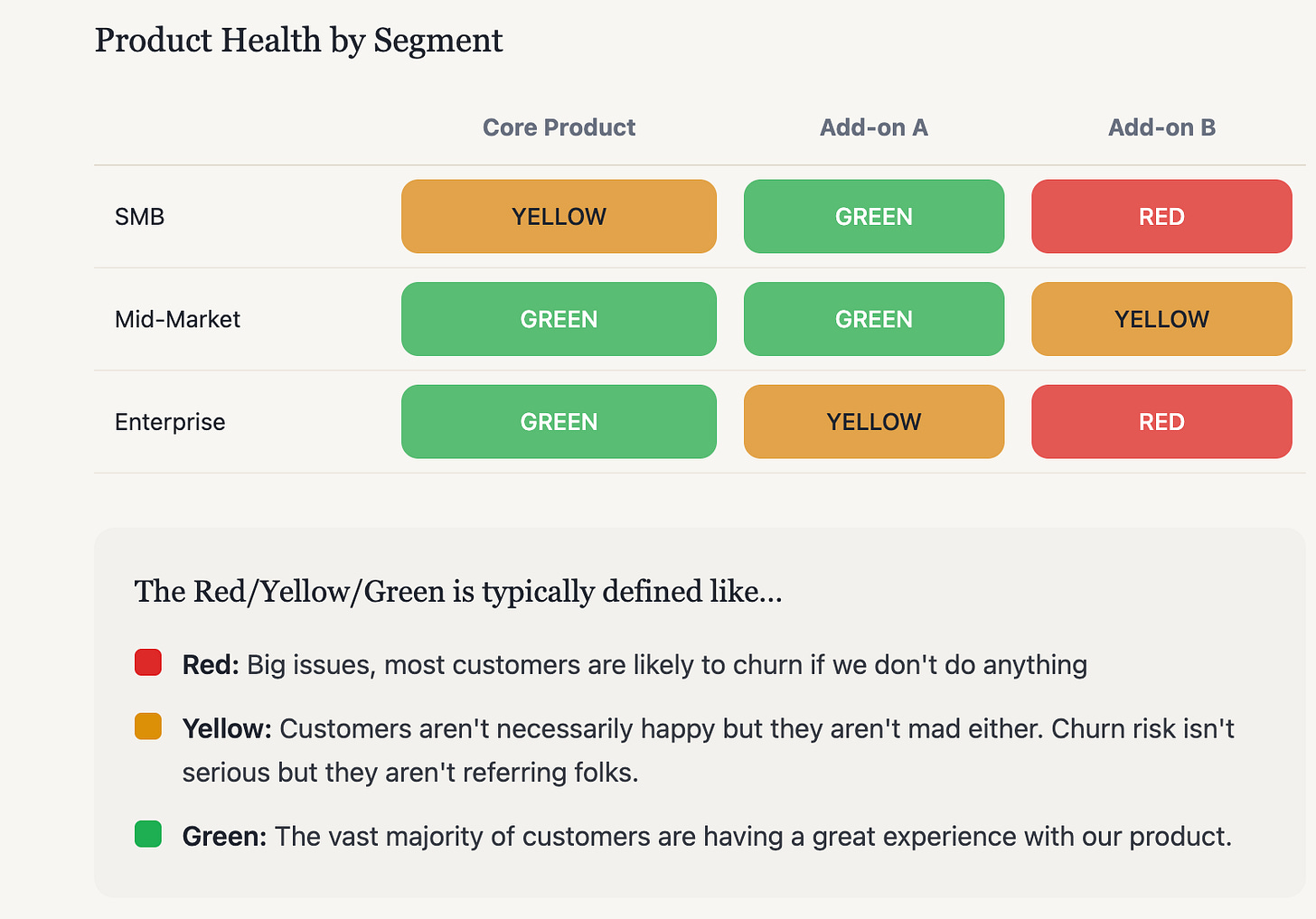

The result of this should look like the below:

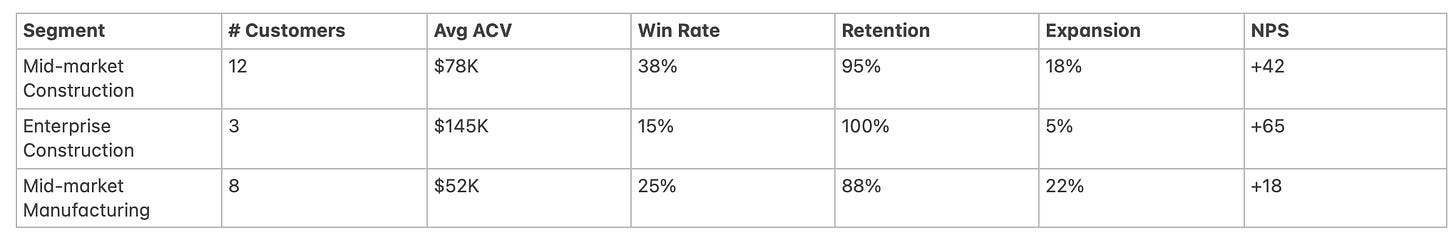

You need to define your segments (SMB, MM, ENT, etc) May be there are more, but you should know a few key segments based on quantiative qualities that they exhibit.

The Red/Yellow/Green is typically defined like…

Red: Big issues, most customers are likely to churn if we don’t do anything

Yellow: Customers aren’t necessarily happy but they aren’t mad either. Churn risk isn’t that serious but they aren’t referring folks or speaking volumes about our offering.

Green: The vast majority of customers are having a great experience with our product.

Step #2. Do A Pricing Analysis

Once you’ve done this you need to do a real pricing analysis. SO MANY founders aren’t charging enough for their offering.

Part A) I know you don’t want to charge customers more but maybe your providing 10X the value and people feel like their getting away with murder.

When you have a box like the above, ask yourself, could I raise prices 5-10% in my green boxes? It’s probably highly likely that you can… There are legit PE funds who buy companies and just do this, and make millions taking advantage of doing something most founders are just scared to do. You typically only get into trouble raising prices when your product is in a Yellow/Red state. Almost NEVER green.

Part B) You need to then look at your Customer Acquisition Cost, what your charging, what your customers are getting for it, and ensure it actually is making sense. If your offering a complex product where sales engineers are on every call, and charging a low ACV it will literally KILL YOU. My friend Kyle dropped some wisdom on this recently:

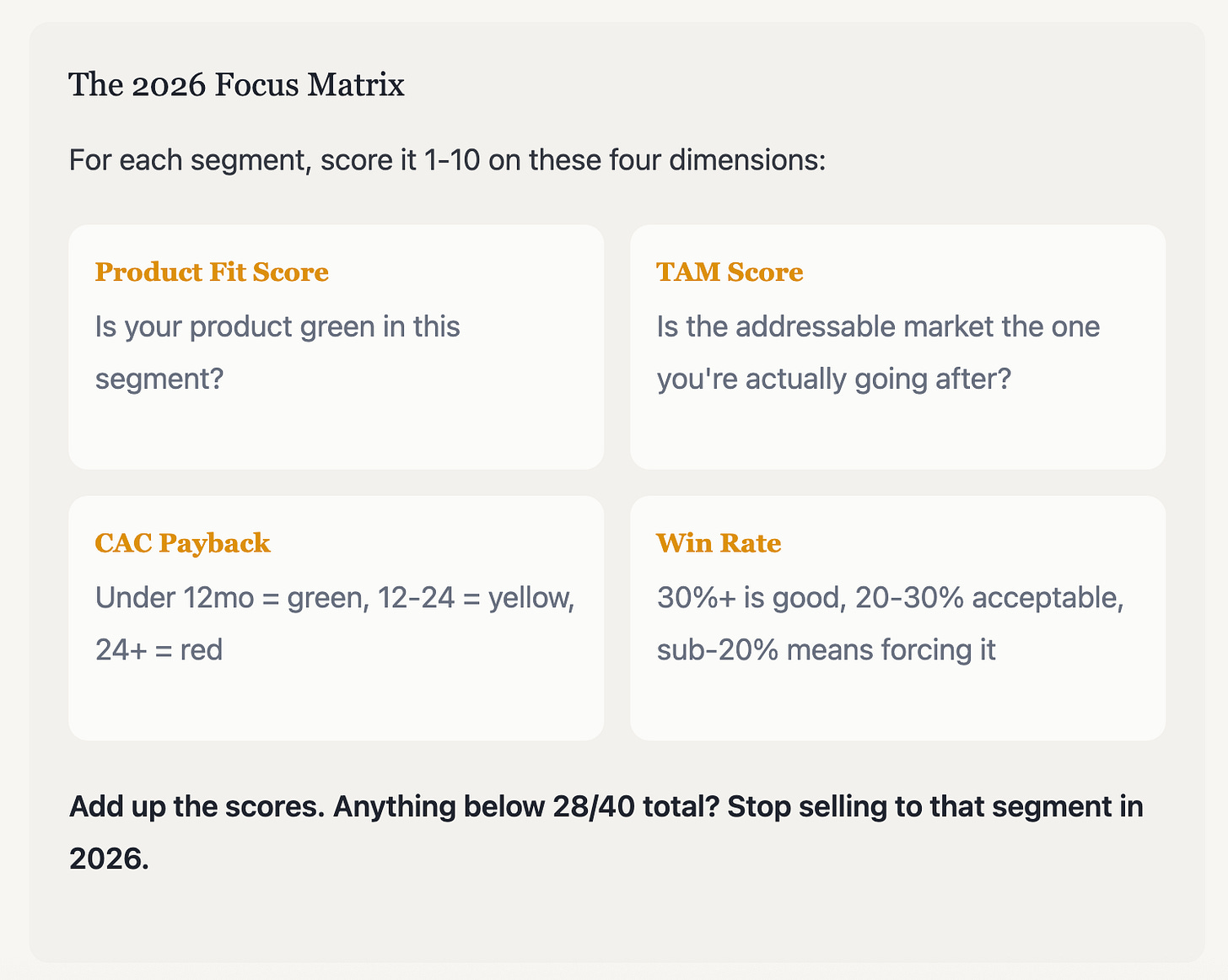

Step #3. Do A Focus Analysis

This is where most companies completely fall apart.

You know what kills more vSaaS companies than anything else? Trying to be everything to everyone.

Here’s what I want you to do: Take that matrix you built in Step #1 and draw a big red circle around your GREEN boxes. Those are your winners. That’s where you have product-market fit TODAY.

Now here’s the hard part...

You need to ruthlessly prioritize WHERE you’re going to play in 2026.

I learned this the hard way at CourseKey. We had green boxes in MM/ENT Trade Schools, yellow boxes in SMB Trade Schools, and red boxes in Community Colleges. Every quarter, some rep would close a Community Colleges and they’d celebrate. Then 6 months later, that customer would churn because our product wasn’t built for them.

It was a tax on the entire organization. Engineering had to build a Community College feature because the contract was huge, and we were scared to turn it away. Customer success needed different playbooks. The Sales Rep should have never even been allowed to chase that deal.

Here’s the framework I use now:

I know what you’re thinking: “But Luke, we can’t just abandon revenue!”

Yes. You. Can.

And more importantly, you MUST. Because every dollar you make in a red or yellow segment costs you three dollars in opportunity cost from not doubling down on your green segments.

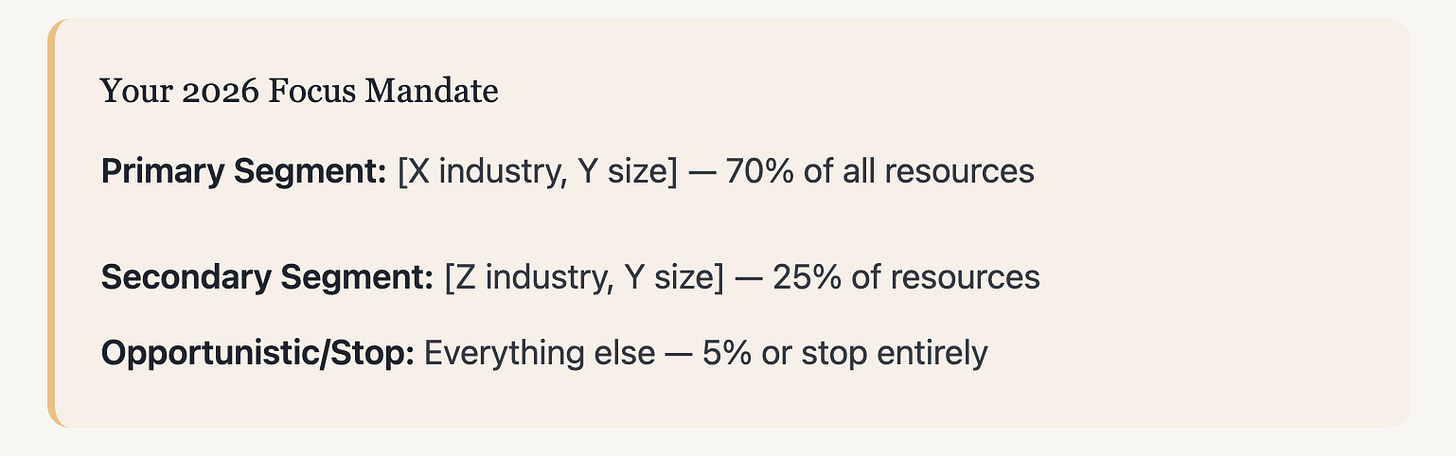

Your 2026 Focus Mandate should look like this:

The output of this step should be crystal clear:

We are going ALL IN on [X segment] with our [platform/wedge] approach

We are EXPERIMENTING in [Y segment] with our [wedge] product

We are STOPPING all efforts in [Z segment]

Step #4. Do A Numbers Analysis

Leveraging the prior chart look at your key numbers. This one is straight forward but it’s probably pretty eye opening. Which targets did we hit? Which ones did we miss? Why/why not? Look at these qualitatively / qualitatively. Your prior exercise will help greatly here…

Pull up your 2025 plan and create a side-by-side comparison. Projected vs. Actual.

Revenue Metrics:

ARR/MRR target vs. actual

New bookings target vs. actual

Net retention target vs. actual

Churn rate target vs. actual

Sales Metrics:

Number of deals projected vs. closed

ACV projected vs. actual (and look at the DISTRIBUTION - are you closing mostly small deals?)

Win rate projected vs. actual

Sales cycle length projected vs. actual

Pipeline generation projected vs. actual

Demo-to-close rate projected vs. actual

Efficiency Metrics:

CAC projected vs. actual

Payback period projected vs. actual

Magic Number projected vs. actual (if you don’t know this, it’s: Net New ARR / Sales & Marketing Spend. You want 0.75+)

Sales rep productivity projected vs. actual (quota attainment by rep)

Customer Metrics BY SEGMENT: This is critical. Don’t just look at aggregate numbers.

For EACH segment you sold into:

How many customers did you close?

What was the average ACV?

What was the win rate?

What’s the retention rate?

What’s the expansion rate?

What does NPS look like?

I’m serious about this. Create a spreadsheet that looks like this:

Now stare at this for a while. What’s it telling you?

In this example, you’re winning more mid-market construction deals, at good ACV, with strong retention and decent expansion. That’s green.

You’re barely closing enterprise construction, even though the ACV is higher. Win rate is trash. That’s probably yellow or red.

And manufacturing? Lower ACV, weak retention, terrible NPS. That’s definitely red.

The numbers don’t lie. But you have to be willing to see what they’re saying.

Step #5. Do A Strategy Analysis

This one is always eye opening after going through the aforementioned steps. Many early stage companies will think they were doing something that they actually really weren’t. The best companies are LOCKED IN here. Everyone knows the strategy, the few special projects, etc.

Re-align on your 2026 strategy knowing exactly what you just uncovered. A few key questions I like to work on with the management team…

Synthesize Everything Into Insights

Okay, you’ve got a mountain of data and feedback. Now you need to turn it into insights.

Create a document with three sections:

1. What Worked in 2025 (Keep Doing This)

Example:

Our mid-market construction customers have 95% retention and $78K ACV with 38% win rates

Our wedge product (scheduling) is consistently getting us in the door

Our outbound motion through LinkedIn is generating 40% of our qualified pipeline

Our partnership with [Construction Software Vendor] delivered 8 deals

2. What Didn’t Work in 2025 (Stop Doing This)

Example:

Enterprise deals took 12+ months and we only closed 3 all year with 15% win rate

Manufacturing segment has 88% retention and +18 NPS - they’re not happy

Our inbound content marketing generated 200 leads but only 2 closed deals (terrible conversion)

We spent $150K on trade shows and got 1 customer from it

3. What We Learned in 2025 (Inform 2026 Strategy)

Example:

Our ICP is tighter than we thought: 100-500 person construction companies, not 50-1000

Price is NOT our issue - we lost only 10% of deals on price

Our biggest competitor is actually status quo (manual processes), not [Competitor X]

We need better implementation support - customers struggle in first 60 days

Our product is yellow/red for enterprise because we lack SSO, advanced permissions, and APIs

Step #6. Do A Team Analysis

Alright, this is where it gets real uncomfortable.

Your current team was hired for the business you WERE building. Not the business you NEED to build in 2026.

Let me give you an example from my CourseKey days...

We had this incredible AE named Sarah. Crushed quota for 18 months straight selling our $25K wedge product to small community colleges. Best cold caller I’d ever seen. Could get anyone on the phone. Closed deals in 45 days like clockwork.

Then we moved upmarket. Started targeting $100K+ deals with large university systems. 6-month sales cycles. Multi-threading. Dealing with procurement and IT security and committee decisions.

Sarah struggled. It wasn’t her fault. She was a hustler, not a navigator. And we needed navigators for enterprise deals.

Here’s the brutal truth: When your Product × ACV × GTM changes, your team needs to change too.

The 2026 Team Audit Framework:

Create a spreadsheet with every GTM role (Sales, CS, Solutions Engineers, Marketing, etc.) and score each person on these dimensions:

For Sales:

ACV Alignment - Are they calibrated for your target deal size?

$0-30K deals = Hunter mentality, high volume, transactional

$30-100K deals = Consultative seller, some complexity

$100K+ deals = Strategic seller, multi-threading, long cycles

Vertical Expertise - Do they understand your focus industry?

Green = 5+ years in the vertical

Yellow = 1-3 years or adjacent experience

Red = No industry knowledge

Product Complexity Match - Can they sell your product’s complexity?

Simple wedge product = Demo in 30 mins, minimal technical knowledge

Mid-complexity = Needs to coordinate with SEs, understand workflows

Platform sale = Must orchestrate technical resources, understand integration points

For Customer Success:

Segment Fit - Are they wired for your customer size?

SMB customers need CSMs who can manage 100+ accounts, create scalable plays, work async

Enterprise customers need CSMs who can manage 10-20 accounts, be strategic partners, do QBRs

Expansion Capability - Can they identify and close expansion opportunities?

If your business model requires 120% net retention, you need CSMs who can SELL

If you’re focused on retention only, you need different people

For Solutions Engineers:

Discovery vs. Demo - Are they order-takers or value-creators?

For complex products, you need SEs who can do discovery and architect solutions

For simple products, you need demo experts who can show value fast

Here’s what you do with this analysis:

Identify Mismatches - Who’s in the wrong seat for your 2026 strategy?

Have Honest Conversations - This is hard, but necessary. “Hey, we’re moving upmarket and this role is changing. Here’s what it looks like now. Do you want to grow into this or should we find you a better fit?”

Create A Hiring Plan - For every mismatch, determine: Can we train/coach this person to success? Or do we need to make a change?

Define Your 2026 Hiring Profile - Write down EXACTLY what your ideal rep/CSM/SE looks like for your new strategy. Get specific:

Years of experience in [X industry]

Sold [Y ACV range] products

At companies with [Z GTM motion]

Understands [technical concept/workflow]

The biggest mistake I see founders make?

They hire for skills instead of CONTEXT.

Skills can be taught. Context cannot.

If you’re selling a construction management platform, hire someone who’s worked in construction technology. They’ll understand the language, the pain points, the buying process, the politics.

If you’re selling a healthcare compliance tool, hire someone from healthcare IT. They’ll know HIPAA cold, they’ll understand hospital hierarchies, they’ll know which conferences to attend.

One more thing about compensation...

Your comp plans need to align with your strategy. This is part of strategic congruence too.

Transactional sales ($0-30K ACV)? → Higher base, lower variable, monthly quotas

Mid-market sales ($30-100K ACV)? → 50/50 split, quarterly quotas, accelerators

Enterprise sales ($100K+ ACV)? → Can go 40/60, annual quotas, big deal kickers

And for CS: If you need them to expand accounts, PAY THEM FOR EXPANSION. If you just need retention, comp them on renewal rate and NPS.

Your output from this step:

A color-coded team assessment (Green = right fit, Yellow = can develop, Red = wrong seat)

A development plan for your yellows

A hiring plan for your reds (with specific profiles and timelines)

Updated comp structures that drive the behavior you need

This is uncomfortable work. But it’s necessary work.

Because you can have the perfect strategy and the wrong team will still lose.

Step #5. Build Your 2026 Plan

Alright, you’ve done the hard work. You know where your product actually is. You know what you should charge. You know where you’re going to focus. You know what your team needs to look like.

Now it’s time to put it all together into a plan that will actually work.

Here’s my framework for building a 2026 plan that achieves strategic congruence:

I always like to open it with who do we want to be when we grow up? Who we are today (actually)? Knowing that, I begin the below exercise…

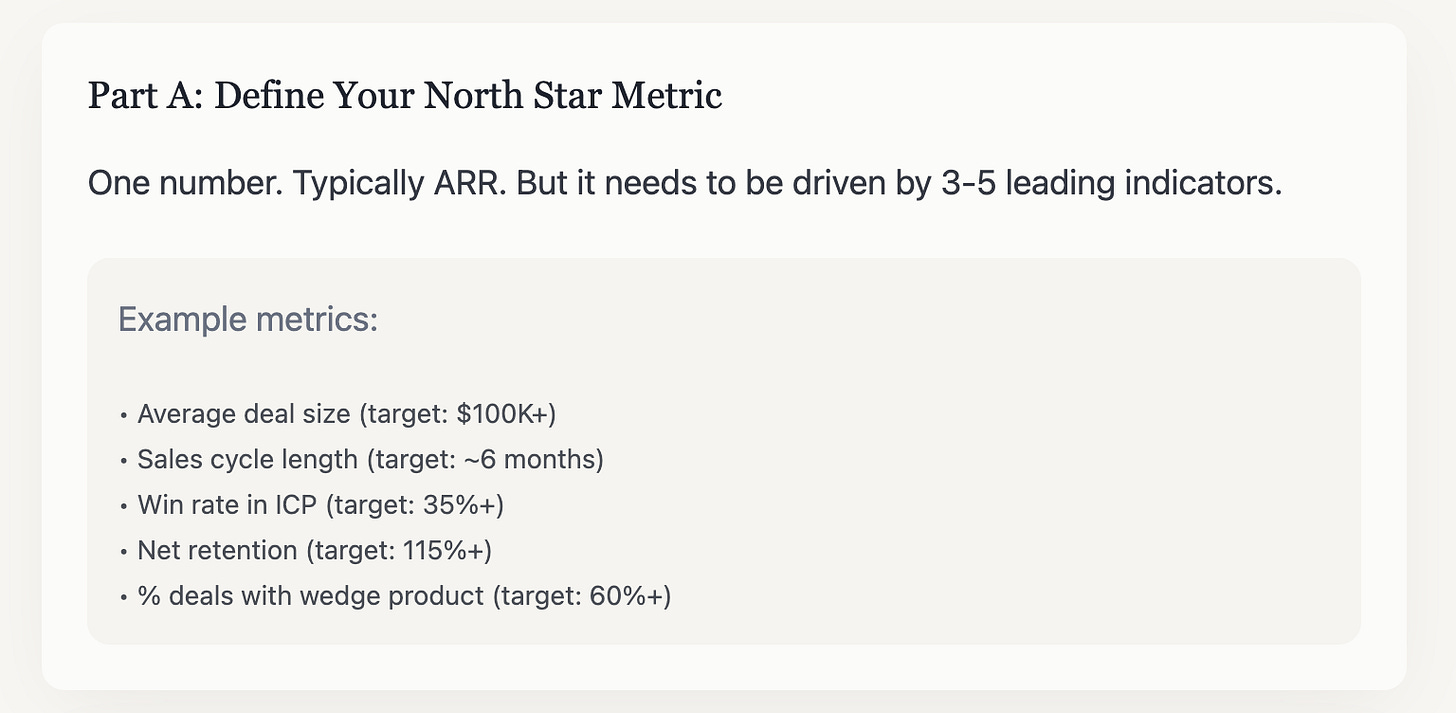

Every Monday morning, we reviewed these five numbers. Plus ARR. Plus pipeline. Plus Implementation. Customer Health. Plus Roadmap. Plus Cash.

If these things were green, the revenue would take care of itself.

Your task: Define your North Star metrics based on your strategic congruence. What numbers prove you have Product × ACV × GTM alignment?

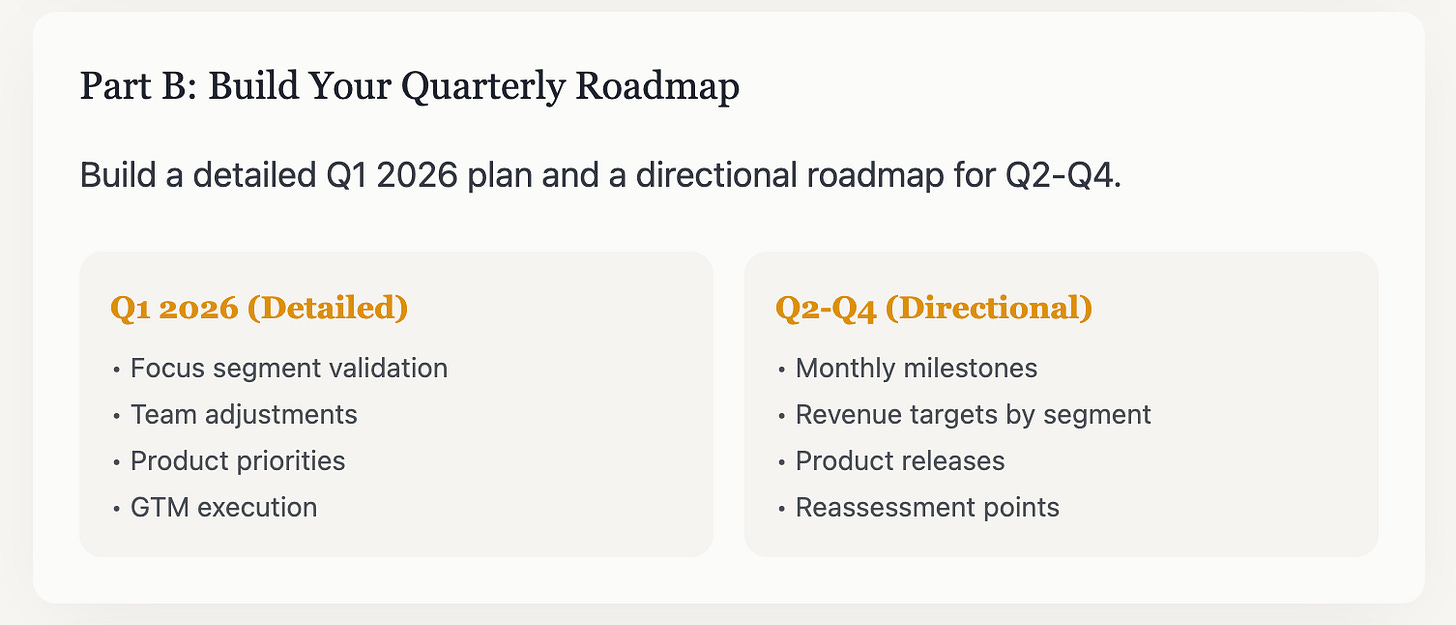

Part B: Build Your Quarterly Roadmap

Q1 2026 Should Include:

Focus Segment Validation

Run 20+ discovery calls in your primary segment

Document top 3 pain points

Validate your pricing with 10+ prospects

Identify 3-5 lighthouse customer targets

Team Adjustments

Complete all difficult conversations with mismatched team members

Start recruiting for 2-3 key roles you identified in your team audit

Launch new comp plans

Run training on new ICP and positioning

Product Priorities

Focus 80% of product resources on your green boxes

Deprioritize or kill features for segments you’re exiting

Build your wedge product if you’re entering a new segment

GTM Execution

Update all messaging and positioning for your focus segments

Rebuild your demo around your ICP

Create segment-specific case studies

Launch outbound motion focused on your primary segment only

Q2-Q4 2026 Should Include:

Monthly milestones for team hiring and development

Product releases aligned to your focus segments

Revenue targets BY SEGMENT (not just overall)

Key customer wins you’re targeting

When you’ll reassess your focus (I recommend every 6 months)

Part C: Create Your Investment Thesis

This is what I wish someone had taught me earlier...

Every dollar you spend should map back to your strategic congruence.

Create a simple framework:

For every dollar invested, ask:

Does this support our PRIMARY focus segment? (70% of budget should go here)

Does this align with our target ACV? (Don’t spend on $10K deals if you’re going after $100K deals)

Does this match our GTM motion? (If you’re doing outbound, don’t spend heavily on inbound content)

For example:

Let’s say you’re a construction tech company, focused on mid-market general contractors, selling a $75K project management platform through outbound + partner channels.

Your 2026 investment priorities should be:

70% on Primary Focus:

Hire 2 AEs with construction experience

Build partnerships with construction software vendors

Attend AGC and other construction conferences

Create construction-specific case studies and ROI tools

20% on Product/Market Expansion:

Build integrations with construction ERPs

Develop your payment facilitation feature (increases ACV)

Pilot your field management module (wedge into enterprise)

10% on Infrastructure:

Upgrade your CRM

Improve your demo environment

Scale your CS operations

See how EVERYTHING ties back to: construction + mid-market + $75K ACV + outbound/partner GTM?

That’s strategic congruence in action.

Your Final Output:

You should have a 5-10 page document (seriously, not more) that includes:

Strategic Foundation

Your primary focus segment and why

Your target ACV and pricing strategy

Your GTM motion

Your North Star metrics

Q1 2026 Execution Plan

Specific initiatives with owners and dates

Hiring plan

Product priorities

GTM activities

Q2-Q4 Directional Roadmap

Key milestones by quarter

Revenue targets by segment

Major product releases

Team growth plan

Investment Framework

Budget allocation by focus area

Key bets you’re making

What you’re explicitly NOT doing

Review Cadence

Weekly/Monthly/Quarterly meeting schedule

Who attends each

What you review

Final Thought:

Look, I know this seems like a ton of work. And it is.

But here’s what I’ve learned after building CourseKey brick by brick and watching hundreds of other vSaaS companies...

The companies that win in 2026 aren’t the ones with the best product. Or the most funding. Or the biggest TAM.

They’re the companies with STRATEGIC CONGRUENCE.

Product × ACV × GTM, perfectly aligned. Team, comp, and culture built to execute that strategy. Every dollar invested behind the same focus. Every team member knows what the company should look like by the end of the year (and the quarter), and exactly what they have to do.

It’s not sexy. It’s not a hack. It’s just disciplined execution of a coherent strategy.

And the companies that figure this out will compound their advantage every quarter while everyone else is spinning their wheels, wondering why nothing is working.

You’ve got this.

Now go build your 2026 plan.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Great stuff! Will be stealing this for use in our organization