Linear #155: The Vertical AI Gold Rush Has Begun, The Story of Valsoft, Embedded Everything Directory

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

2025: The Beginning Of The Vertical AI Gold Rush.

How industry-specific AI quietly became one of the biggest stories in tech—and why 2026 will be even bigger.

For the better part of a decade, venture capital played the same exhausting game.First it was horizontal SaaS: another sales engagement tool, another customer success dashboard, another “we’re the Salesforce for X” pitch that somehow still raised $200M at 25× ARR.

Then, starting around 2022, the entire asset class pivoted to a single religion: LLMs and the picks-and-shovels that feed them. Billions poured into foundation-model labs, inference optimizers, vector databases, orchestration layers, and every conceivable flavor of “AI infrastructure.” If your deck didn’t have the words “pre-training,” “MoE,” or “p95 latency,” you couldn’t get a partner meeting.

The result? A handful of horizontal giants valued in the hundreds of billions… and a graveyard of me-too sales tools quietly marking down to 4× revenue. Meanwhile, the real industries — healthcare, legal, construction, manufacturing, logistics, life sciences — kept spending $3.5 trillion a year on software and labor that barely worked. They kept waiting.

In 2025, the door finally swung open.

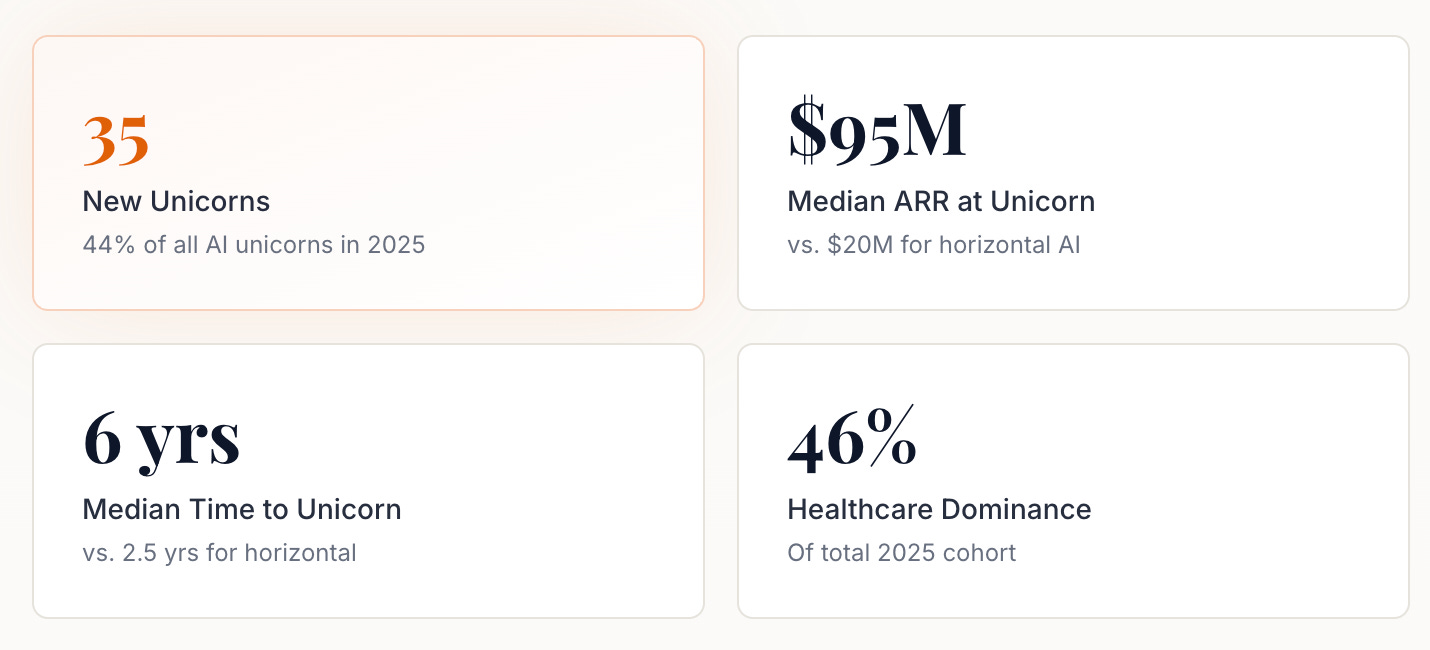

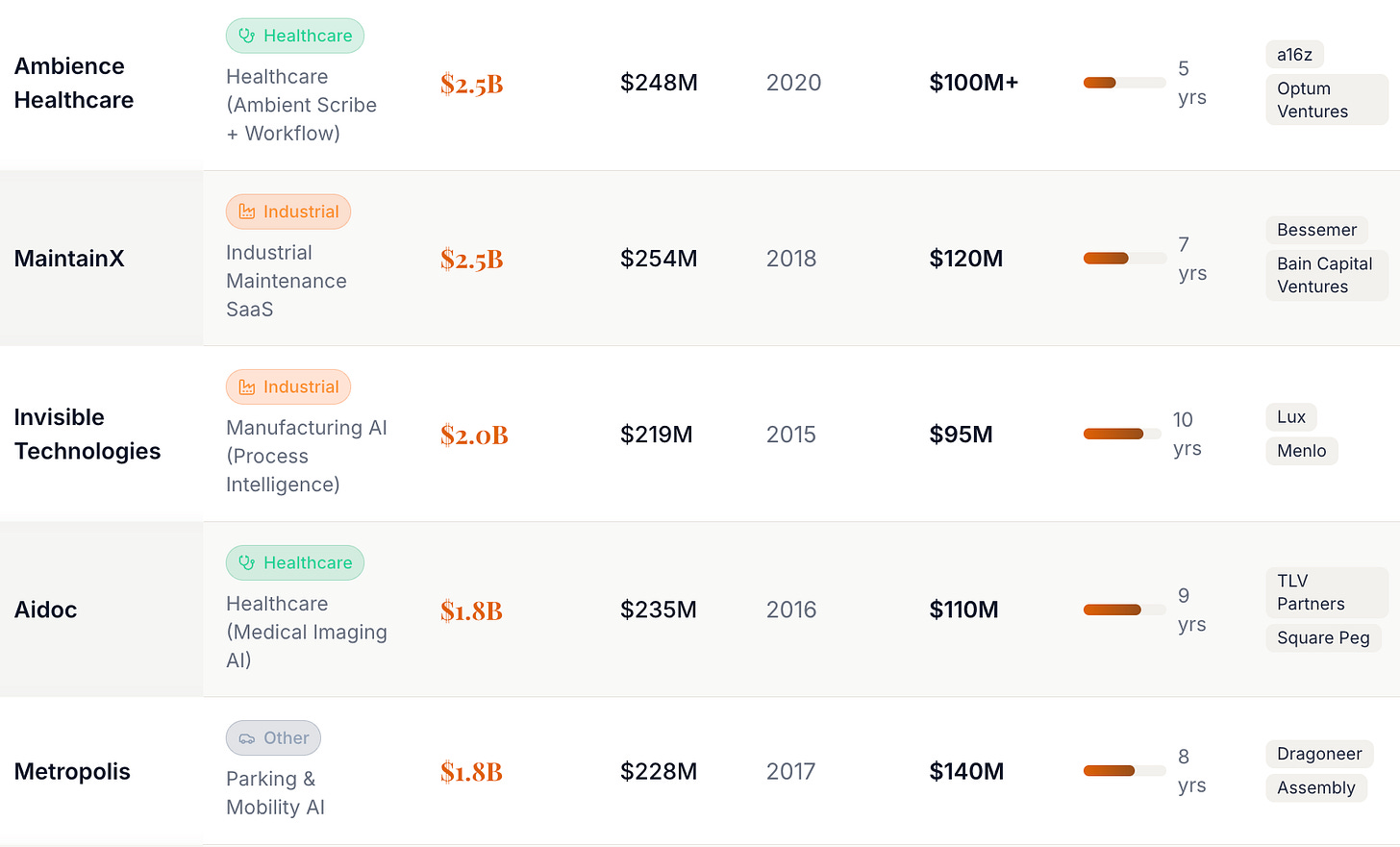

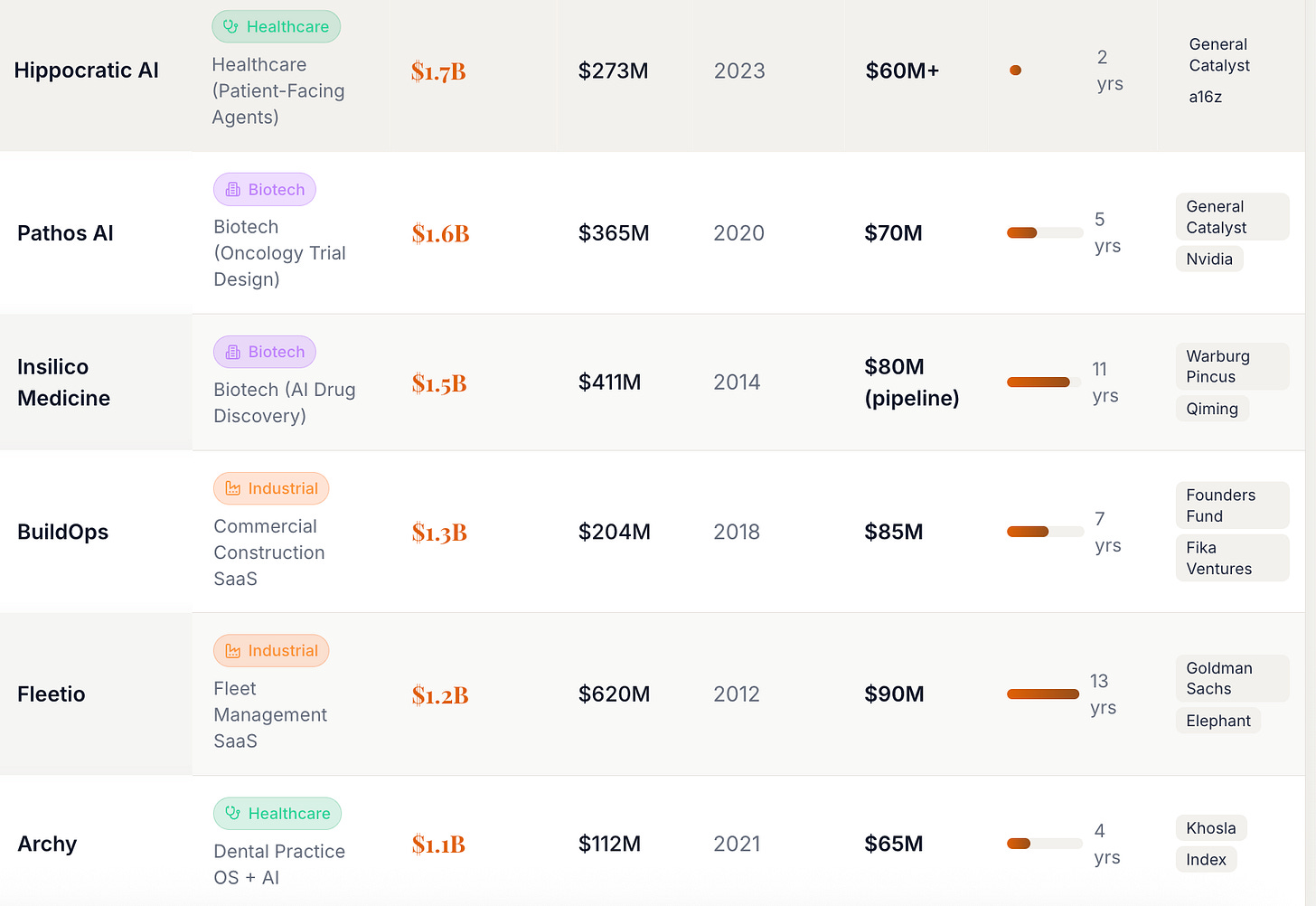

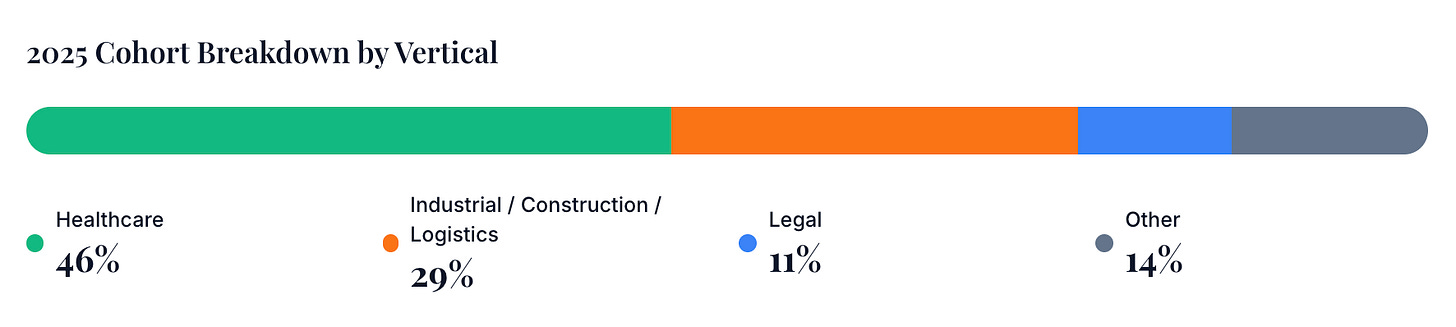

Capital didn’t just trickle into verticals. It sprinted. Thirty-five new vertical software and vertical AI unicorns were minted in a single year — almost all already north of ~$90M ARR when they crossed the billion-dollar line. Doctors, lawyers, fleet operators, and plant managers suddenly had tools that understood their actual workflows instead of forcing them into another horizontal abstraction.

But here’s the part that should keep every founder and investor up at night: We are still in the very first inning.

The horizontal distraction bought verticals five extra years of runway. The best teams are only now raising their Series B and C rounds. The integration moats are only now getting built. The regulator-approved datasets are only now getting labeled.2026 isn’t going to be another good year for verticals.

It is on track to be the single greatest year for vertical software and vertical AI in history.

The hangover is over.

The feast is just beginning.

Let’s Dive In: 2025’s Vertical Unicorn Class

Why 2025 Was the Tipping Point

Horizontal fatigue reached terminal velocity

Investors finally admitted that another 5% improvement in token throughput doesn’t move the needle when a hospital is still losing $12M a year to documentation burnout.The “AI moat” flipped from parameters to proprietary data + regulatory blessing

Abridge’s 2M+ hours of de-identified clinical audio is worth more than another 175B model trained on Reddit.Big Tech stopped competing and started shopping

Optum, Google Cloud Healthcare, and Siemens all shifted from building in-house to writing nine-figure checks to vertical leaders.Revenue multiples normalized — but only for verticals

Horizontal AI still trades at 30–100×. True verticals with $100M+ ARR are clearing rounds at 12–18× with 80–90% gross margins.

2026 will be the Greatest Vertical Year Ever (Yes, Really)

The numbers already in motion:

$42B of dry powder explicitly allocated to “vertical AI” across the top 25 firms (PitchBook Q4 survey)

180+ Series B/C vertical companies with $25M–$80M ARR raising in the next 12 months (my tracker)

Median go-to-market cycle in regulated verticals has collapsed from 30 months → 11 months thanks to 2025 reference architectures

Agentic workflows (the real killer app) only hit primetime in mid-2025 — most verticals haven’t shipped their first agent yet

The 2025 cohort was the opening act.

2026 will be the main event.

Forget the next “Copilot for X. The winners next year will be the teams who know the exact regulation that changes on July 1st, the union rule that kills productivity on Thursdays, the reimbursement code that quietly doubled last quarter. The horizontal wave has crested.

The vertical wave is accelerating —

See you in the niches.

The Story of Valsoft - Inside a Vertical M&A Machine

Sam Youssef, the founder and CEO of Valsoft, a company you probably have not have heard of them. But you really should.

130+ companies acquired

$750M+ in revenue

3,000+ employees

Multi-billion dollar valuation

Fastest Canadian company to reach $2B valuation

And he’s done it all following a playbook that’s equal parts Warren Buffett, Constellation Software, and hard-won operational experience.

We went deep on the podcast with Sam, and if you missed it, I highly encourage you to check it out :-)

Embedded Everything Directory

Unit recently dropped an “Embedded Everything Directory” – 80+ companies across 18+ categories you can plug into your platform.

This isn’t about solely embedding payments anymore. It’s about owning every workflow for your customer.

The pattern is clear:

ServiceTitan: $105k average revenue per customer. Not from dispatch software. From embedded payments, capital, insurance.

Shopify: $100B+ company Not from e-commerce software. From becoming the financial operating system for merchants.

Software + Embedded Services = Significant Revenue Per Customer

Here’s a glimpse of the menu:

Embedded Banking: Become the primary financial relationship. Switching costs are massive.

Embedded Lending: Your customers need capital. You have their data. Be the lender.

Embedded Accounting: Replace QuickBooks. Own the books.

Embedded Payroll: Highest frequency touchpoint. Ultimate stickiness.

Embedded Insurance: Offer risk protection to your customers customers.

Embedded Bill Pay: Control the full payables workflow.

Embedded Invoicing: Faster payment = better cash flow.

Embedded Cards: Interchange revenue + spend visibility.

Embedded Business Formation: Perfect for platforms serving new businesses.

Embedded Marketing: Small businesses don’t have a lot of time for marketing and often rely heavily on inbound. Do it for them.

And even more: Customer communication, scheduling, e-commerce, background checks, inventory ordering, FX payments, tax compliance...

Here’s what makes this wild:

70% of these embedded service companies were founded between 2018-2022.

This infrastructure is NEW.

It didn’t exist when Shopify and Toast were building.

They had to build a ton of this from scratch.

You don’t.

And that presents a big opportunity...

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

We made a mistake. Quick correction - Archy should not have been included on the list as it raised a $20M Series B and it was not at a $1B EV.

Regarding the topic of the article, this is spot on. The pivot to vertical AI was long overdue, especially for industries that needed practial tools, not just another horizontal abstraction. Glad to see capital finally figuring out real-world problems exist beyond the latest "Salesforce for X" clone.