Linear #154: GC AI, Is Embedded Accounting and Bookkeeping Next Up? We Need More Vertical AI Winners

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

How a 3x General Counsel Built a $555M Legal AI Company by Ignoring Law Firms

The Counterintuitive Bet That Created a Rocket Ship

There’s a company that just raised $60M at a $555M valuation, grew from $1M to $10M ARR in under a year, and is fundamentally changing how in-house legal teams work.

And they did it by making a counterintuitive bet: completely ignore law firms.

This is the story of GC AI, and it’s a masterclass in founder-market fit, contrarian thinking, and building something people actually use.

The Insight That Everyone Missed

Cecilia Ziniti had been a General Counsel three times – at Amazon, Replit, and other high-growth companies. She’d spent 15+ years as an in-house lawyer. And somewhere between reviewing her thousandth vendor contract and negotiating yet another commercial agreement at 11 PM, she noticed something obvious that every legal AI company was missing:

In-house counsel and law firm attorneys do completely different work.

Law firms draft complex litigation briefs, negotiate massive M&A deals, and specialize in narrow legal domains. Their work is deep, specialized, and billable by the hour. It’s the kind of work that looks impressive in case studies.

In-house legal teams? They’re doing everything:

Reviewing hundreds of vendor contracts (most are template agreements)

Advising on employment issues (terminations, offer letters, harassment claims)

Managing compliance across multiple jurisdictions (GDPR, CCPA, SOC 2)

Supporting product launches (reviewing marketing claims, terms of service)

Handling privacy matters (data processing agreements, vendor assessments)

Negotiating commercial deals (sales contracts, partnership agreements)

Corporate governance (board resolutions, equity grants, corporate filings)

And they need answers RIGHT NOW because the business is moving. Sales can’t wait three days for a redlined contract. Product can’t pause a launch for a legal review. Finance needs that vendor agreement signed today.

Yet it seemed like every legal AI company was building for solely law firms.

Harvey raised $100M+ to help law firms draft better briefs. LexisNexis and Thomson Reuters built AI for legal research and complex litigation. All focused on law firms. Because that’s where the “sophisticated” legal work happens, right?

Wrong.

The Market Opportunity Hiding in Plain Sight

Here’s the data that should have been obvious to everyone:

The in-house counsel population is growing at 2x the rate of law firm lawyers. There are now over 300,000 in-house lawyers in the US alone, and they control budgets of $300B+ in annual legal spend.

But here’s what makes this a vertical SaaS goldmine: in-house legal teams are very similar across every company.

A SaaS company needs contract review. So does a retail brand. So does a fintech startup. So does a healthcare company. The specific types of contracts differ slightly, but the workflow is identical:

Receive contract from vendor or customer

Review against company standards and risk tolerance

Redline problem clauses

Negotiate changes

Get approvals

Execute and store

Every in-house legal team does this hundreds or thousands of times per year. It’s the highest-volume, most time-consuming work. And before GC AI, there was no software actually built for it.

Legal AI companies were chasing the $1,000/hour BigLaw work. Cecilia saw the $300/hour repetitive work that happened 10x more often.

It’s a horizontal problem disguised as a vertical. And nobody was solving it.

The Product Built by Someone Who Actually Did the Job

Cecilia and her co-founder Bardia Pourvakil (ex-Replit AI engineer) built GC AI specifically for how in-house teams actually work. Not how they wish they worked. Not how law professors think they should work. How they actually work, every single day.

1. Microsoft Word Integration (Not Another Legal Platform)

Most legal AI tools want you to upload documents to their proprietary platform. That’s not how lawyers work. Lawyers live in Microsoft Word. That’s where contracts exist. That’s where redlines happen. That’s where negotiations play out.

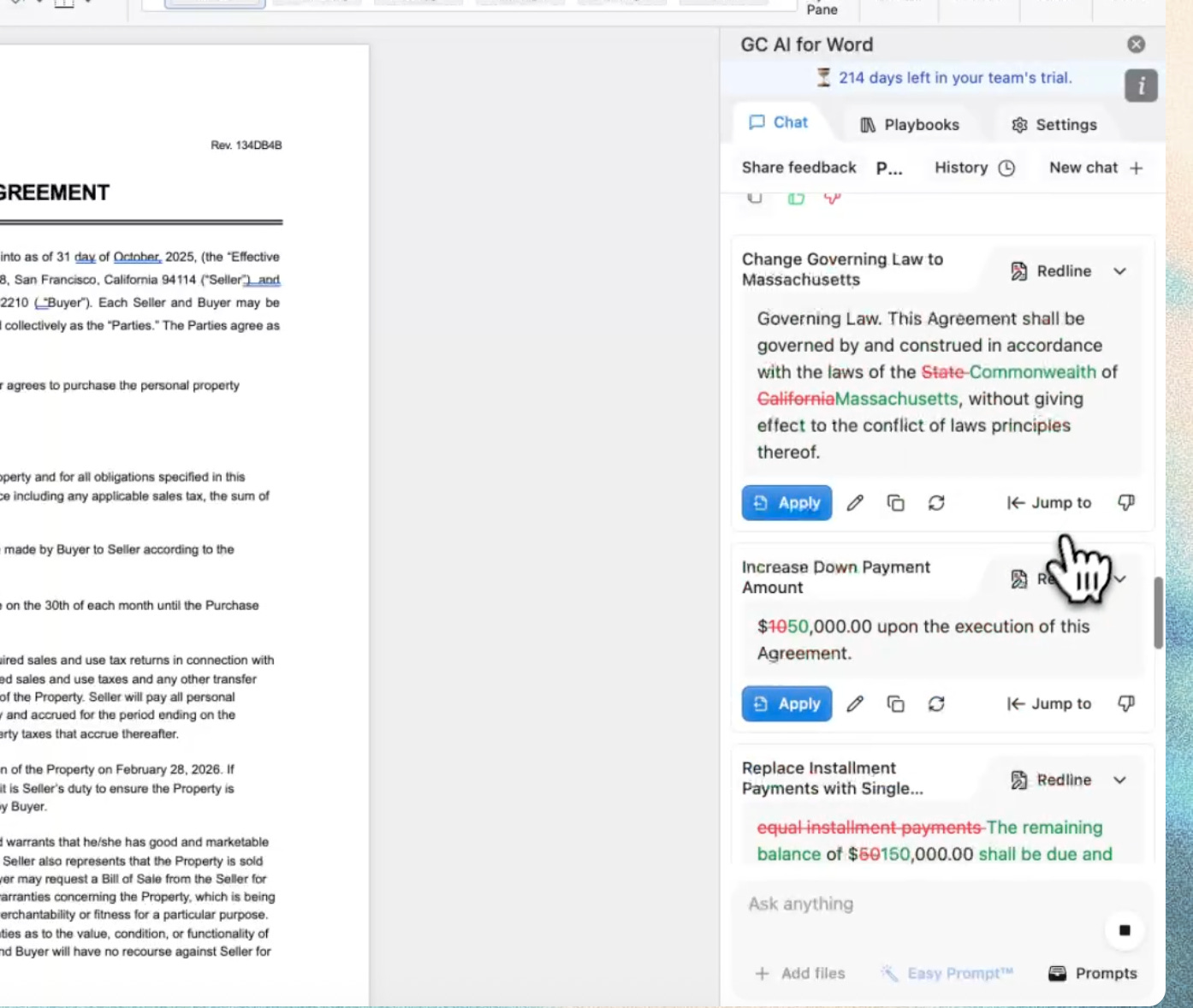

GC AI plugs directly into Word. You highlight a clause. GC AI analyzes it against your company’s playbook and suggests redlines. You accept or reject. That’s it.

No uploading. No copy-pasting. No switching between tools. The AI comes to where the work already happens.

2. Commercial Contract Agents (Pre-Built for Common Workflows)

Instead of a general “legal chatbot,” GC AI built specific agents for the most common workflows:

Vendor Agreement Agent: Knows to check indemnification clauses, limitation of liability, data security requirements

NDA Review Agent: Flags non-standard confidentiality definitions, problematic exclusions, term length issues

MSA Negotiation Agent: Reviews master service agreements for payment terms, IP ownership, termination rights

Employment Offer Agent: Checks equity clauses, non-compete provisions, benefits consistency

Privacy Compliance Agent: Reviews data processing agreements for GDPR/CCPA compliance

These aren’t generic AI responses. They’re purpose-built for specific legal documents that in-house teams review constantly.

3. Custom Negotiation Playbooks (Your Risk Tolerance, Applied Consistently)

Every company has different risk tolerances and standard positions. Your startup might accept more vendor risk than Amazon does. Your fintech needs stricter data security clauses than a media company.

GC AI learns your playbook and applies it consistently across every contract. Junior lawyers get the same quality of redlines as the General Counsel would provide. The company’s positions stay consistent across thousands of contracts.

This is the unsexy work that makes legal teams scalable.

4. Actually Accurate (Not “Good Enough”)

Here’s what separates GC AI from consumer AI tools: legal work requires precision.

When you’re advising on an employment termination or reviewing a $2M vendor contract, “pretty good” isn’t good enough. One missed clause can cost the company hundreds of thousands in liability.

GC AI is purpose-built for high-stakes document work. The accuracy matters more than speed. The system is designed to flag uncertainty rather than guess. It’s built by people who know that in legal, being 95% right is often worse than saying “I don’t know.”

The Growth Numbers That Prove Product-Market Fit

Let’s talk numbers because they tell the real story:

$1M to $10M ARR in under 12 months (averaging 23% month-over-month growth)

1,000+ customers including News Corp, Nextdoor, Skims, Zscaler, Liquid Death, Vercel, TIME Inc.

70 NPS (for context, anything above 50 is considered excellent)

5,000+ legal professionals trained on their platform

1.75M AI prompts processed across all customers

600,000 hours of legal work saved (at $500/hour blended rate, that’s $300M in value delivered to customers)

Most customers log in daily. Daily. For legal software.

When’s the last time you heard about lawyers using software every single day and loving it?

That’s not adoption. That’s dependency. That’s the product becoming part of the workflow.

The Go-To-Market Strategy That’s Actually Working

Here’s what’s brilliant about how GC AI is selling:

1. Education-Led Growth (Building the Curriculum)

Instead of traditional SaaS marketing, GC AI offers free courses: “AI for In-House Counsel,” “Prompting Best Practices for Legal Professionals,” “Implementing AI in Your Legal Department.”

Over 5,000 legal professionals have taken these courses. That’s not marketing. That’s building the standard curriculum for the next generation of legal leaders. When you teach someone how to use AI in their job, and your product is the best tool for doing it, that’s not a sales pitch. That’s education that happens to convert.

2. Bottom-Up Adoption (No Enterprise Sales Cycle Required)

Individual lawyers can start using GC AI immediately. No six-month enterprise procurement process. No IT security reviews to begin. No executive approvals needed to get started.

Sign up. Connect to Word. Start reviewing contracts.

The product sells itself through usage. One lawyer starts using it, saves 5 hours that week, tells two colleagues. Those colleagues try it. Within a month, half the legal team is using it. Then the General Counsel sees the value and buys an enterprise plan.

This is product-led growth in a category (legal) that everyone assumed required enterprise sales.

3. Economic Proof (Show Me the Money)

GC AI tracks a metric that CFOs actually care about: outside counsel spend reduction.

When you can show the CFO “We cut $200K in law firm fees this quarter because GC AI handled work we used to outsource,” the budget conversation changes completely. It’s not “Should we buy this tool?” It’s “Why didn’t we buy this sooner?”

The product pays for itself in reduced external legal spend. Everything after that is pure margin improvement.

The Expansion That’s Likely Coming

Right now, GC AI is at $10M ARR with 1,000 customers. That’s $10K average contract value. Not massive yet.

But here’s the expansion playbook I’m betting they execute:

Year 1: Contract review and redlining → $10K ACV

Year 2: Add employment law module (offer letters, terminations, policy guidance) → +$5K = $15K ACV

Year 3: Add privacy/compliance module (GDPR, CCPA, vendor assessments) → +$8K = $23K ACV

Year 4: Add full legal operations platform (matter management, outside counsel management, legal analytics) → +$15K = $38K ACV

At $38K per customer with 10,000 customers (still a small fraction of 300,000 in-house lawyers), that’s $380M in ARR.

And that’s before they expand internationally or add industry-specific modules.

The current $555M valuation on $10M ARR (55x revenue multiple) is significant but with the pace of growth you can see how investors are valuing tomorrows business.

They’re valuing it as a platform that becomes the operating system for every in-house legal team globally. And they’ve got some great vertical focused funds behind them.

This one will be fun to watch play out. Rooting for them!

Is Embedded Accounting and Bookkeeping Next Up?

If you’ve been following the embedded finance wave, the pattern is clear: every few years, another piece of financial infrastructure gets absorbed into the software platforms small businesses already use.

First it was payments. Then lending, payroll, & banking - now, it’s accounting and bookkeeping.

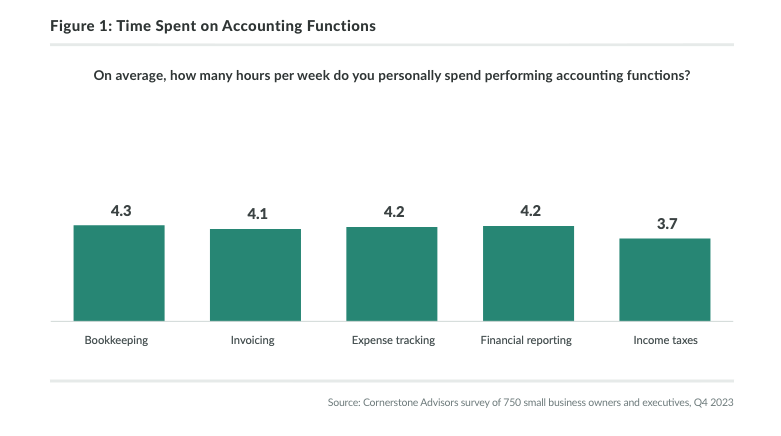

Accounting is required for every SMB, but it’s often a source of frustration and dread. Around 40% of SMBs say bookkeeping and taxes are the worst part of owning a business. If you’re running a gym, a salon, or a field-services company, you don’t want to think about boring, complex things like accounting. Most business owners just want a clear picture of their profitability and stress-free tax filing.

For Vertical SaaS platforms the value is just as clear. Why would a platform enable customers to manage their entire operation, but leave them on their own when it comes to the essential task of tracking finances! It’s a huge source of NPS drag and introduces yet another software vendor (QuickBooks), who will aggressively try to cross sell their own products.

One company already crushing this space is Layer. They offer both embedded accounting software AND an embedded bookkeeping service that handles all SMB financial organization each month. I see two obvious benefits here.

New revenue stream

Huge retention boost

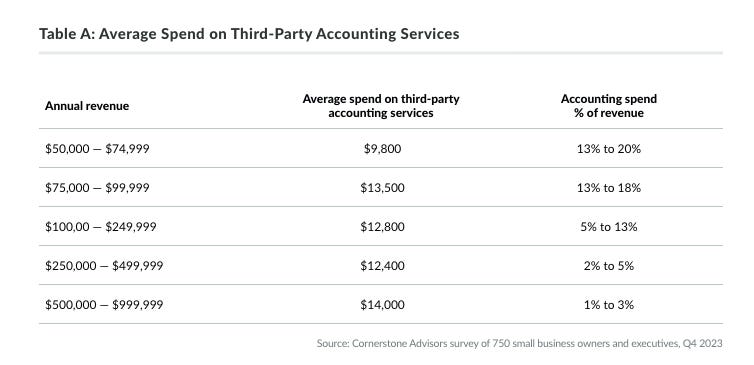

QuickBooks is now anywhere from $38 to $200/mo and typical bookkeepers charge another $300/mo on top of that. That’s a massive spend VSaaS platforms can now capture. Layer customers see a $1-4K increase in revenue per user.

In addition, offering accounting and bookkeeping makes you the financial home for your SMB customers, and creates serious lock-in. Layer customers report >25% lower churn from users on their embedded accounting products.

From what I’ve heard from other vSaaS founders, integrating Layer into a vSaaS platform isn’t much of a headache and can happen FAST. Accounting & Bookkeeping is just software. Unlike Lending, Banking, and other embedded products, there are no KYB processes or bank partner approvals to wait on, which means you can go live in days, not months.

We can see where this is going. Just like payments became table-stakes for SaaS platforms a decade ago, it’s only a matter of time before customers expect their SaaS platform to help them with accounting too. Once one or two players in a vertical start offering embedded accounting, everyone else will have to follow.

Check out Layer and LMK what you all think. Have heard good things.

The Market Needs More Vertical AI Winners

Everyone is talking about the AI boom... but nobody is talking about the bill.

The world is pouring hundreds of billions into AI infrastructure;

NVIDIA racks, hyperscale data centers, power-hungry hardware, the spending curve is vertical.But here’s the uncomfortable truth almost nobody mentions:

All that CAPEX ONLY makes sense if AI produces real-world economic value.

Not launch videos.

Not “assistant” features.

Not generic copilots.

Real financial ROI.

And that’s exactly why I’m so bullish on vertical AI.

Recently on VERTICALS, we sat down with Mike Kopko (Pearl Health), who is building very powerful Vertical AI for healthcare.

He offer’s AI that prevents a $30,000 hospitalization isn’t a nice-to-have.

Something clicked for me…

This is exactly the kind of use case that will actually justifies the AI infrastructure boom. And we need more of this and less of the noise.

The real AI flywheel looks like this👇

Infrastructure (NVIDIA / Hyperscalers)

Frontier + Reasoning Models

Vertical AI solving real-world workflows

If the application layer shows measurable cost removal, then the demand for infrastructure starts to work.

This is the missing link in the AI narrative.

If AI doesn’t deliver ROI, infrastructure becomes a bubble.

If AI removes undeniable cost, infrastructure becomes the most important investment of this decade.

It will make you rethink where the real value in AI is going to come from...

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com