Linear #152: Add Services To Your vSaaS, Buildstock, Product Development Buckets

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

Add HUMAN Services To Your vSaaS Offering

(I know it sounds odd, but this is important…)

Every single vSaaS founder I talk to is asking the same question:

“How do I build a moat when AI can replicate my software in 6 months?”

Product moats are getting shorter. Features that took you 12 months to build can now be copied in 90 days. Your beautiful UI? Claude and ChatGPT are helping your competitors ship similar experiences in weeks, not years.

And here’s the thing - you’re not wrong to be worried.

But while everyone is scrambling to add the latest AI features, there’s an immediate moat-building strategy that most vSaaS founders are completely ignoring.

Add services to your offering.

I’m not talking about consulting or implementation services that your team delivers. I’m talking about real, operational services that become part of your core product. Services where you employ actual humans to do work that your customers used to do themselves.

Let me give you a concrete example.

Say you’re selling a vSaaS for HVAC companies. Your software handles scheduling, dispatching, invoicing, inventory - the whole nine yards. It’s solid. But here’s what happens at every single one of your customers:

It’s 7 PM on a Tuesday. Someone’s AC dies in the middle of summer. They call the HVAC company. Nobody answers because the office is closed. The customer calls the next company. And the next. Someone picks up, and that’s who gets the $3,500 emergency service call.

Your customer just lost $3,500 in revenue because they didn’t have someone answering the phone.

Now multiply that by 5-10 missed calls per week. That’s $70K-$175K in annual lost revenue per location. And that’s just after-hours. During business hours, the phone rings while technicians are in the field, and the office admin is buried in paperwork.

What if you added call center and dispatch services?

You build a team of customer service specialists who know HVAC. They answer calls 24/7/365. They book appointments directly into your software. They handle emergency dispatch. They follow up on quotes. They manage customer communications.

The HVAC company owner wakes up every morning to a calendar full of booked jobs that came in overnight. They didn’t miss a single call. They didn’t hire night staff. Their entire customer communication operation just... runs.

Here’s why this is such a powerful move right now:

1. It’s an instant, defensible moat.

When a customer outsources an entire department to you, switching becomes incredibly painful. It’s not just changing software - it’s hiring and training a whole team. That’s 6-12 months of disruption minimum. Your retention goes from 85% to 97%+ on accounts with services attached.

I learned this at CourseKey. Our highest retaining customers weren’t the ones who loved our software the most (though they did). They were the ones where we had operationally embedded ourselves so deeply that removing us would require rebuilding internal departments from scratch.

2. You buy yourself time.

This is the part most founders miss. Adding services gives you breathing room while you iterate on your AI products. Your competitor ships an AI feature that threatens your core product? Cool. They still can’t replicate your services overnight.

3. The long game is even better.

Here’s where it gets really interesting. Over time, you systematically automate these services with AI agents. What started as a team of 50 people processing financial aid becomes 5 people + AI agents handling 10x the volume.

Your services revenue (valued at 1x-2x) gradually shifts to SaaS revenue (valued at 4x-8x) as your AI takes over. Your margins expand from 40% to 80%+. Your valuation multiple doubles. You can then sell those AI agents to other customers as a SaaS package.

You just turned a defensive moat into a category-defining advantage.

Here’s what this looks like in practice:

Start with ONE high-pain operational process that:

Every customer needs but hates doing

Requires specialized knowledge or compliance expertise

Is repetitive enough to systematize

Has enough volume to justify dedicated staff

Build the service offering. Hire specialists. Charge for it separately at first - don’t bundle it. Get to 20-30 customers using it and figure out the unit economics.

Then systematically automate. Document everything. Build internal tools. Train AI models on your processes. Replace humans one at a time.

Within 12-24 months, you’ll have:

A sustainable moat that AI can’t easily replicate

Customers who literally can’t leave you

A roadmap for automated services at 10x margins

A differentiated story for investors

Look, I get it. You became a software founder to build software, not to run a services operation.

I felt the same way. When we first started offering operational services at CourseKey, I thought it would distract us from product. I thought I was investing something that was just going to get valued at 1x. I was wrong. It made us invaluable to customers and bought us the time to build what actually mattered.

Everyone is looking for product moats right now. At our recent conference, this was the #1 question. And IMHO, everyone gave really squishy/high-level answers. Yes, you should absolutely keep building moats into your product, as much as possible. But this is a very simple straight-forward way to build a real moat, that can just become AI over time.

Don’t sleep on services as a moat. It’s the fastest way to make yourself indispensable while you figure out the longer AI game.

AI is coming for all of us. The question is whether you’ll have the time and customer loyalty to adapt when it does.

BuildStock - AI Agents for Construction Procurement

Meet Buildstock. They’re going after high-rise construction materials procurement. And when I say old-school, I mean this industry runs on phone calls, paper invoices, and decades-old supplier relationships.

Here’s the opportunity they saw:

General contractors and subcontractors building high-rises need to order massive volumes of materials - insulation, lumber, drywall, CMU blocks, stone, tile. We’re talking hundreds of thousands to hundreds of millions of dollars per project.

The procurement process today:

Buyers call 5-10 suppliers trying to get quotes

Everything is manual - pricing, ordering, tracking

Payment terms are rigid and often cash-flow negative

No centralized place to manage orders across projects

Supplier catalogs aren’t digitized

So what did Buildstock do?

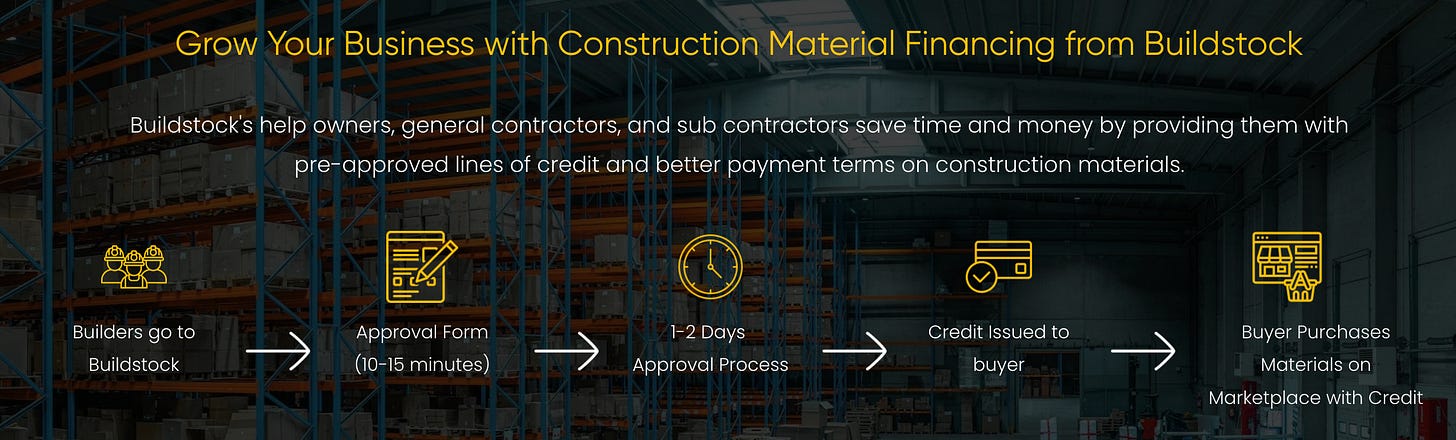

They built a two-sided marketplace + fintech platform specifically for high-rise construction materials.

For Buyers (GCs and subs):

Digital catalog across 6 major material categories

Real-time pricing and availability

Centralized order management for all projects

Net 5 payment terms (game-changer for cash flow)

3rd party financing approved in minutes

For Suppliers:

Access to vetted builders and major projects

Higher margins through Buildstock’s Net 5 terms

Digitization of their entire product catalog

Better payment certainty

New customer acquisition without sales overhead

The wedge here is brilliant. They started hyper-focused on high-rise construction in ONE geographic market. This isn’t a horizontal play trying to serve all construction. It’s deeply vertical.

They’re getting embedded at the project level. Once a builder starts ordering materials through Buildstock for one project, the switching cost becomes real. You’ve got your suppliers in the platform, your orders tracked, your financing terms negotiated.

And the fintech component is the real lock-in. When you’re offering builders better payment terms and instant financing, you’re not just software - you’re literally improving their working capital position. That’s HARD to replace.

But what gets me most excited is what they can do next…

All of these things, theoretically, can be done using AI Agents. Imagine if overtime AI agents use the marketplace to buy supplies instead of humans…

Your tapping into W-2 salaries + a transaction take at every order…

That’s crazy!

The numbers:

$1.6M pre-seed round (February 2024)

Backed by Precursor, MGV, XFactor, and Picus Capital

42% time savings for buyers

5x faster procurement process

6-24x faster financing approvals

Why this works:

Construction is a $2.1 trillion industry in the US. High-rise construction in major metro areas is a massive TAM. And this is exactly the kind of vertical where software has been slow to penetrate because it’s relationship-driven and complex.

But here’s what makes it winnable:

Clear buyer pain - procurement is genuinely broken

Fintech moat - payments and financing create real switching costs

Network effects - more suppliers = more buyers, more buyers = more suppliers

Geographic density - starting in NYC/NJ lets them own one market before expanding

Wedge potential - materials procurement can expand into project management, compliance, logistics, insurance

The founder, Kathryn Thiele, is an architect by training. She lived this problem. She knows the industry. That domain expertise matters when you’re selling into relationship-driven verticals.

Here’s what I love about this play:

They didn’t try to boil the ocean. They picked ONE construction type (high-rise), ONE geographic market (they are starting in the tri-state), and SIX material categories. That’s how you win in vertical SaaS.

Build density. Own the workflow. Expand from there.

They’re also attacking payments and financing early, not as an afterthought. That’s the Procore/Toast/ServiceTitan playbook. The software is the wedge. The fintech is the moat.

The risks?

Construction is relationship-driven. Incumbent suppliers have decades-old relationships with buyers. Breaking in requires ground game - boots on the ground at job sites, earning trust, proving reliability.

GTM is probably going to be pretty tough here.

They also need to nail the supply side. If suppliers don’t have inventory or pricing isn’t competitive, buyers won’t switch. Classic marketplace cold start problem.

But if they can get the flywheel spinning in NYC/NJ, this model is repeatable in every major metro with high-rise construction. Chicago, LA, SF, Boston, Miami, Seattle...

Will it be B2B marketplace that actually works?

Construction materials procurement is begging for digitization. The workflows are repetitive. The pain is universal. The TAM is massive.

This is exactly the kind of vertical SaaS opportunity that gets me fired up.

What do you think - can they pull off the marketplace model in construction, or will the relationship dynamics be too hard to crack?

Where do you classify each of your products? How do you decide when to move to the next one?

Alright, let’s talk about something that will save you from countless internal debates, frustrated customers, and burnt-out engineering teams.

How do you decide when to STOP focusing a bunch of time/money on one product, and move to the next one?

As your vSaaS scales, you inevitably go multi-product. You build new modules. You expand into adjacent workflows. You start serving different customer segments with different needs.

And suddenly, you’ve got products in wildly different states:

Some that customers absolutely love

Some that work but aren’t great

Some that are actively causing churn risk

The mistake most founders make is treating all products the same. Same quality bar. Same prioritization framework. Same release philosophy.

That’s how you end up with engineering teams that are stretched too thin, products that never reach “good enough,” and customers who are confused about what to expect from you.

Here’s the framework that worked for us at my last business:

Step 1: Classify Your Products Into Three Buckets

Bucket #1 - HAPPINESS:

The customer loves this product. It may not do everything, but they couldn’t imagine their business without it. This is your core. Your differentiator. The thing they tell their peers about.

Bucket #2 - TOLERABLE:

The customer isn’t thrilled, but they won’t churn over it. It works well enough. It solves the problem. But nobody is writing love letters about it. It’s... fine.

Bucket #3 - CHURN RISK:

The product is actively causing customer dissatisfaction. It’s buggy. It’s missing critical features. It’s causing them pain. There’s a real chance they leave over this.

Here’s the key: Be brutally honest about which bucket each product sits in.

Most founders lie to themselves. They think everything is in the Happiness bucket or will be soon. Reality is usually:

1-2 products in Happiness

3-5 products in Tolerable

1-3 products in Churn Risk

At CourseKey, we literally put this on a whiteboard during quarterly planning. Every product line. Every module. We debated, we argued, and we got to the truth. Every leader (but mostly Sales, Success, and Finance) had to bring in data that supported which bucket each product was in.

That clarity changed everything.

Step 2: Match Your Development Philosophy To The Product Stage

Once you know where each product sits, you have to make a decision on where to focus. Every company is different…

For HAPPINESS Products:

Companies that only ship things that are near-perfect. This is your Apple-level bar. Every release needs to delight. Every feature needs to be polished. You’re not moving fast here - you’re moving deliberately.

This is expensive and slow. This is really hard for most start-ups to pull off. But some start-ups think it’s worth taking the additional time, especially for your core products, because this is what drives word-of-mouth, case studies, and competitive wins.

For TOLERABLE Products:

Start-ups that ship products when they meet the customer tolerance level.

You’re not trying to wow anyone. You’re maintaining functionality and preventing regression. This is where most B2B companies operate. It’s the right place for mature, stable products that work well enough.

For CHURN RISK Products:

You have products in the wild that customers just aren’t happy with. It’s not that there are a few angry customers, it is angry customers everywhere, across the board. You probably don’t want to be here.

Step 3: Communicate The Philosophy To The Entire Team

This is where most founders fail. You need to decide when you move to a new product. Do you do it when it’s near perfection, do you get it to tolerance, and then over time get it to perfect? That’s what you need to define and what you need to be very intellectually honest about.

Beyond this, your philosophy needs to be communicated to EVERYONE at the company. CS needs to understand why you’re making certain decisions/tradeoffs. PM’s need to know. Most founders classify products internally but never explain WHY they’re making different trade-offs for different products.

Your engineering team sees you shipping fast for Product A and obsessing over polish for Product B. They get confused. They get frustrated. They think you don’t have standards.

Here’s what worked for us:

Our approach was launch at TOLERANCE, then move to the next product while slowly growing the TOLERANCE products to HAPPINESS products. We tried to NEVER ship at churn-risk level BUT it happened sometimes. We got it wrong, we thought the TOLERANCE bar was lower for a specific module than it was and we had to adapt…

We shared the framework with the entire company. We showed them the bucketing. We explained the philosophy for each bucket. We made it clear that different quality bars for different products was INTENTIONAL, not random.

Suddenly, everyone understood.

The engineer working on a Tolerable product wasn’t frustrated that we weren’t giving them time to perfect it. They understood the strategy.

The customer success team knew which products to over-deliver support on and which to manage expectations around.

The sales team knew which products to lead with and which to downplay until they improved.

It becomes about “WE” versus “I”.

People stopped fighting for resources based on what they personally wanted. They started thinking about what was right for the company and the customer.

Step 4: Revisit The Buckets Every Quarter

Your product philosophy isn’t static. What’s in Churn Risk today should (hopefully) move to Tolerable in 6 months. What’s Tolerable might become Happiness if you invest heavily in it.

We revisited the bucketing every quarter during planning:

What products moved buckets?

What new products do we need to add?

Has our overall philosophy shifted based on company stage?

That last point is critical. Your philosophy WILL change as your company evolves.

The Bottom Line

You cannot ship everything at the same quality bar. You don’t have infinite time, money, or engineering resources.

The companies that scale successfully make explicit trade-offs. They know which products deserve Apple-level polish and which products just need to work.

The companies that struggle try to make everything great simultaneously. They spread their teams too thin. They miss deadlines. They disappoint customers because expectations don’t match reality.

Here’s your homework:

List every product and module you have

Honestly bucket each one into Happiness, Tolerable, or Churn Risk

Define your development philosophy for each bucket

Share it with your entire team

Revisit quarterly and adjust

What bucket does YOUR business fall into right now? Why have you chosen that philosophy?

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Love this!