Linear #151: The Story of ChipAgents, How to Add Embedded Finance to your vSaaS, GenAI Wedges

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

ChipAgents: vSaaS for Chip Design

A startup called ChipAgents just raised a $21M Series A from Bessemer to transform one of the most technical, deeply vertical markets out there: semiconductor chip design and verification.

Let me paint the picture.,,

The Electronic Design Automation (EDA) market is worth roughly $16.5 billion today and growing at 9%+ annually. But here’s the kicker — design and verification consume 60-80% of total chip development time. We’re talking about hardware teams spending MONTHS navigating fragmented toolchains, manual verification workflows, and debugging waveform outputs line by line. It’s painstaking, expensive, and absolutely mission-critical.

Enter William Wang, a professor at UC Santa Barbara who spent the last decade building one of the leading AI research groups in natural language processing. His background? Theorem proving, formal methods, and deep reinforcement learning for reasoning models. Not your typical SaaS founder résumé, right?

But here’s where it gets interesting…

William realized that the same AI reasoning techniques that transformed natural language understanding could fundamentally reimagine how chips are designed at the Register Transfer Level (RTL) — where engineers describe logic in languages like Verilog or VHDL. So he started ChipAgents to build “agentic AI” systems that can analyze design specifications, reason about logical correctness, and automatically generate verification artifacts.

The go-to-market is chef’s kiss for vSaaS:

ChipAgents doesn’t try to replace existing EDA tools. Instead, they built their AI agents to work INSIDE the environments and tools engineers already rely on — their existing design flows, their code editors, their simulation tools. It’s the classic “land where they work” strategy that every vertical AI company should study.

Early customers are reporting that tasks requiring weeks of manual effort now take days. The company’s seeing 50x annual growth in usage and sales up 60x year-over-year in ARR. Bessemer led the round with backing from Micron, MediaTek, Ericsson, and other semiconductor giants.

Here’s what makes this a perfect vSaaS story:

Ultra-specific vertical — Not “software for engineers,” but “AI for RTL chip design and verification”

Massive embedded workflow complexity — You can’t just drop in a horizontal tool here

Industry-native solution — Built by someone who deeply understands both AI and semiconductor design

Integration-first approach — Works with existing tools rather than forcing a rip-and-replace

Strategic investor validation — When your customers become your investors, you know you’re solving a real problem

The mission isn’t to replace engineers — it’s to 10x (or eventually 100x) their productivity. William calls it shifting engineers “from implementation to innovation.”

Here’s my question for you: How many other deeply technical, fragmented markets are out there where GenAI can become the vertical wedge that finally makes the software work?

Because I think we’re just scratching the surface…

How to Launch Embedded Finance

Every small business—whether running a salon, construction company, or restaurant—needs solutions for the same four money tasks:

Money in – Getting paid by customers

Manage my money – Tracking cash flow and account balances

Money out – Paying vendors, employees, and bills

Get capital – Accessing funding to grow

If you’re a vertical SaaS platform, you’ve likely already mastered #1 with integrated payments. Your merchants accept payments seamlessly, and you’ve unlocked a powerful revenue stream while boosting stickiness.

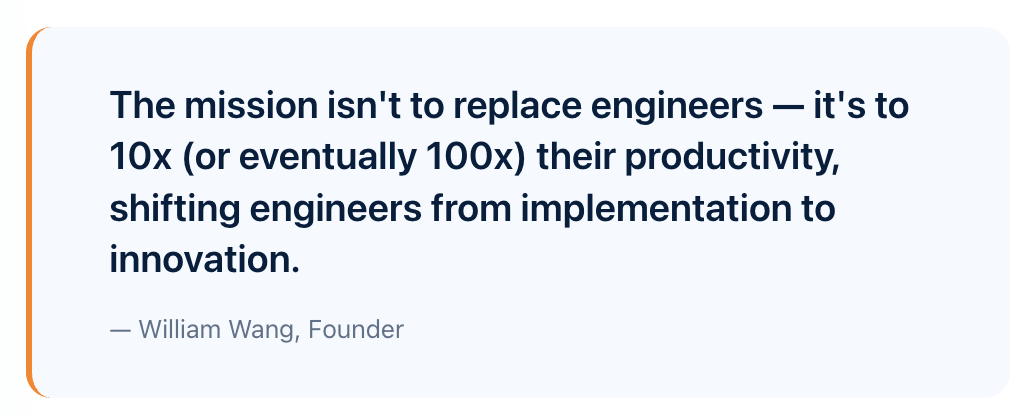

But here’s the opportunity: the other three money tasks represent a > $100 billion market that’s largely untapped by software providers. The platforms that move first will capture disproportionate value.

Why This Is Your Market to Win

Three structural advantages of vertical SaaS companies:

Underwriting data. You have real-time cash flow visibility that banks can only dream of. This allows you to underwrite more thoughtfully and serve previously underserved SMB niches.

Distribution channel. Your platform is used daily, the immediacy of SaaS platforms creates deeper, more consistent engagement vs logging into online banking or visiting a branch.

Deep connectivity. You understand your vertical’s nuances in ways other providers can’t. This lets you tailor products to specific use cases - like seasonal capital for construction companies.

The Fast Path: Ready-to-Launch Solutions

Traditionally, launching embedded finance meant 6-12 months of engineering work, hiring fintech experts, navigating regulatory complexity, and managing balance sheet risk. That’s why most platforms have been stuck offering only payments.

Unit’s Ready-to-Launch solutions eliminate these barriers. With just one line of code, you can launch a complete money dashboard for your merchants—capital, banking, and bill pay.

Here’s what makes it work:

Zero build time. The product is fully built and maintained. One line of code expands into a complete money dashboard that integrates seamlessly with payment processors like Worldpay, Stripe, Adyen, and others.

Fully managed operations. Unit handles customer support, compliance, KYC/AML, and regulatory reporting. You focus on your merchants.

Revenue share with no fraud exposure. You earn revenue without balance sheet risk or fraud losses.

Marketing materials included. Get automatic emails and hosted content to drive adoption, solving the go-to-market challenge that most platforms struggle with.

Where to start

Start with the biggest pain point. Survey your merchants to identify whether they need capital access, better cash flow visibility, or streamlined bill pay most urgently. Launch with that product first.

You can start with just one solution and expand or launch all 3:

Capital: Turn cash flow gaps into revenue opportunities with credit lines based on actual transaction data

Banking: Become your customers’ primary financial relationship with branded accounts, yield earnings, and physical + virtual cards

Bill Pay: Own the entire accounts payable workflow with same-day ACH, checks, push-to-card, and wires

The Bottom Line

The $185 billion embedded finance market is largely untapped beyond payments. The platforms that move now, with the right products and partners, won’t just add a revenue stream.

GenAI as a Wedge Product

Something I’ve been thinking about obsessively lately…

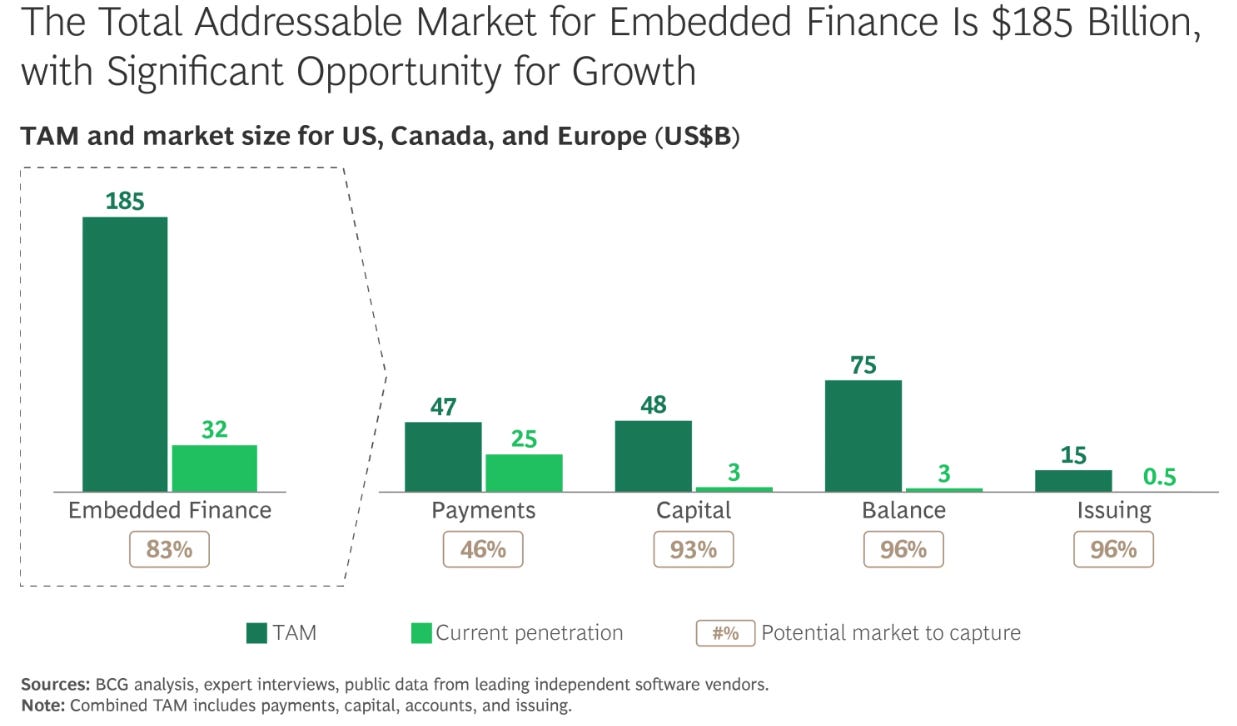

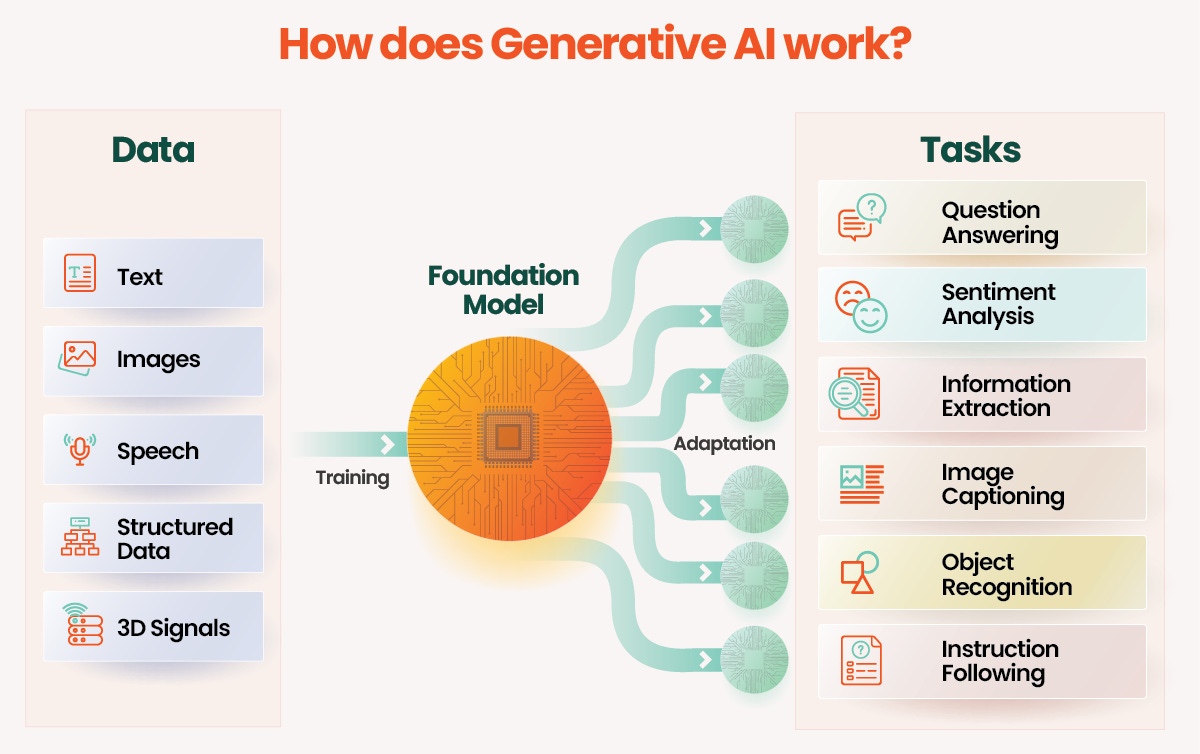

GenAI isn’t just “another feature” for vertical SaaS. It’s the wedge product that’s finally making vertical software work in industries that have resisted digitization for DECADES.

Let me break this down.

The Old vSaaS Wedge Playbook:

Traditionally, vertical SaaS companies found success with wedge products like:

Payments (Toast in restaurants, ServiceTitan in home services)

Scheduling/dispatch (Jobber in field services)

Inventory management (Procore in construction)

These wedges worked because they touched money or mission-critical operations. Once you owned that workflow, you could expand into the full platform.

The GenAI Wedge is Different — And Better:

Industry-specific AI tools are becoming wedges on steroids because they solve THE problem that’s held back vertical SaaS forever: adoption.

Here’s why this is huge:

1. They reduce time-to-value from months to minutes

Traditional vSaaS required extensive onboarding, data migration, workflow customization, and training. Industry-specific AI tools can start delivering value on day one because they understand domain context.

A legal AI tool that actually understands case law and regulatory compliance. A construction AI that knows OSHA requirements and local building codes. A healthcare AI that’s natively HIPAA-compliant and understands clinical workflows.

2. They solve the “selective integration” problem

One of the smartest takes I’ve seen a few founders execute on is building wedge products that achieve selective data integration with the source of record system, then expand from there.

You don’t need to replace the entire EHR system. You just need to integrate with the specific data that makes your AI valuable — patient notes for a clinical documentation tool, claims data for a billing assistant, lab results for a diagnostic aid.

3. They deliver ROI that’s impossible to ignore

Generic horizontal AI tools might improve productivity by 10-20%. Industry-specific AI tools? We’re seeing 50-80% productivity gains in narrow workflows. That’s the difference between a “nice to have” and a “must have.”

ChipAgents reports tasks that took weeks now take days. Harvey AI is helping law firms complete legal research in minutes instead of hours. Abridge is documenting clinical visits in real-time, saving physicians 2+ hours per day.

4. They create natural expansion paths

Once you own the AI layer for a specific workflow, you can expand into:

Adjacent workflows in the same vertical

The data infrastructure layer (becoming the system of record)

Embedded fintech (payments, lending, insurance)

Marketplace features (connecting buyers and sellers)

The Vertical AI Wedge Framework:

Here’s how I’d think about building this:

Phase 1: The AI Wedge (Months 0-12)

Pick ONE high-pain, high-frequency workflow

Build an AI tool that’s 10x better than manual processes

Ensure it integrates with existing systems (no rip-and-replace)

Make it industry-native (built-in compliance, terminology, best practices)

Price it as a standalone tool to maximize adoption

Phase 2: Data Capture (Months 12-24)

As users adopt your AI tool, you’re capturing workflow data

Build workflows that create new system-of-record data

Expand to adjacent use cases that leverage the same data

Add collaboration features that increase stickiness

Phase 3: Platform Expansion (Months 24-36+)

Introduce complementary products that leverage your data advantage

Add fintech features where money flows through your system

Build marketplace features connecting your user base

Become the operating system for that vertical

Real Examples in the Wild:

Harvey AI → Started with legal research (wedge) → Expanding to contract drafting, due diligence, regulatory compliance

Abridge → Started with clinical documentation (wedge) → Expanding to coding/billing, patient summaries, clinical decision support

Rogo → Started with investment research (wedge) → Expanding to deal sourcing, portfolio monitoring

In Summary:

Industry-specific GenAI tools are lowering the barrier to entry for vertical SaaS while simultaneously increasing the defensibility. They’re making it possible to win in complex, regulated industries that have historically been too hard to crack.

I’d bet that the biggest new winners in the AI wave will be those who nail the AI wedge strategy…

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

I resonate with what you wrote, realy seeing how critical it is that you so clearly explained the game-changing potential of AI for chip design with ChipAgents, multumesc!