Linear #147: GTM Motions Deep Dive, Announcing V E R T I C A L S

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

We Launched V E R T I C A L S

at the Vertical Software Summit!

We just wrapped up an INCREDIBLE few days at the Vertical Software Summit in Miami. The energy was pumping! Thank you all who came out. We will definetly be making it an annual thing going forward…

With that said, let’s unveil our new podcast to the newsletter, co-hosted with my VC friend, Nic Poulos.

Verticals: A Weekly Biz Show Presented by Parafin is where a founder (aka me / Luke Sophinos) intellectually spars with a VC (Nic Polous from Euclid VC) on all things Vertical Tech & AI. We will bring on an incredible guest every week, but NOT to chat about their background, to discuss playbooks, practical advice, and where the puck is heading next.

Every episode will include a VSAAS GREAT.

The first episode is with Ilir Sela, Founder & CEO of Slice.

And it’s all located at AntiAntiGrowthClub.com :-)

GTM Motions Deployed By Leading Vertical Software Companies

Every vertical SaaS company faces the same question: How do we actually sell this thing?

Each company started somewhere specific, driven by their ACV (Annual Contract Value), market maturity, and founding DNA. Then they evolved. Some added sales layers on top of PLG. Others went bottom-up after years of top-down selling. A few stubbornly stuck to their original motion—and won anyway.

This isn’t a “one size fits all” playbook. It’s a breakdown of what actually happened. We’ll examine:

What GTM motion each company started with

What motion they evolved into (if they changed at all)

How their ACV shaped everything

What worked, what didn’t, and why

How the founders background influenced their companies GTM motion

The GTM Motions: Your Playbook Options

Before we jump into the companies, let’s level-set on the five core GTM motions. Each one’s a different beast, shaped by your market, your product, and—most critically—your Annual Contract Value (ACV).

Outside Sales-Led: This is high-touch, face-to-face selling. Reps are on the road, hitting conferences, visiting prospects, or running intensive workshops. Think medical device sales or enterprise software for regulated industries. It’s expensive (CAC can hit $50K+ per deal), but it works for high-ACV ($50K+) deals where trust and relationships seal the deal. Long sales cycles, big payoffs.

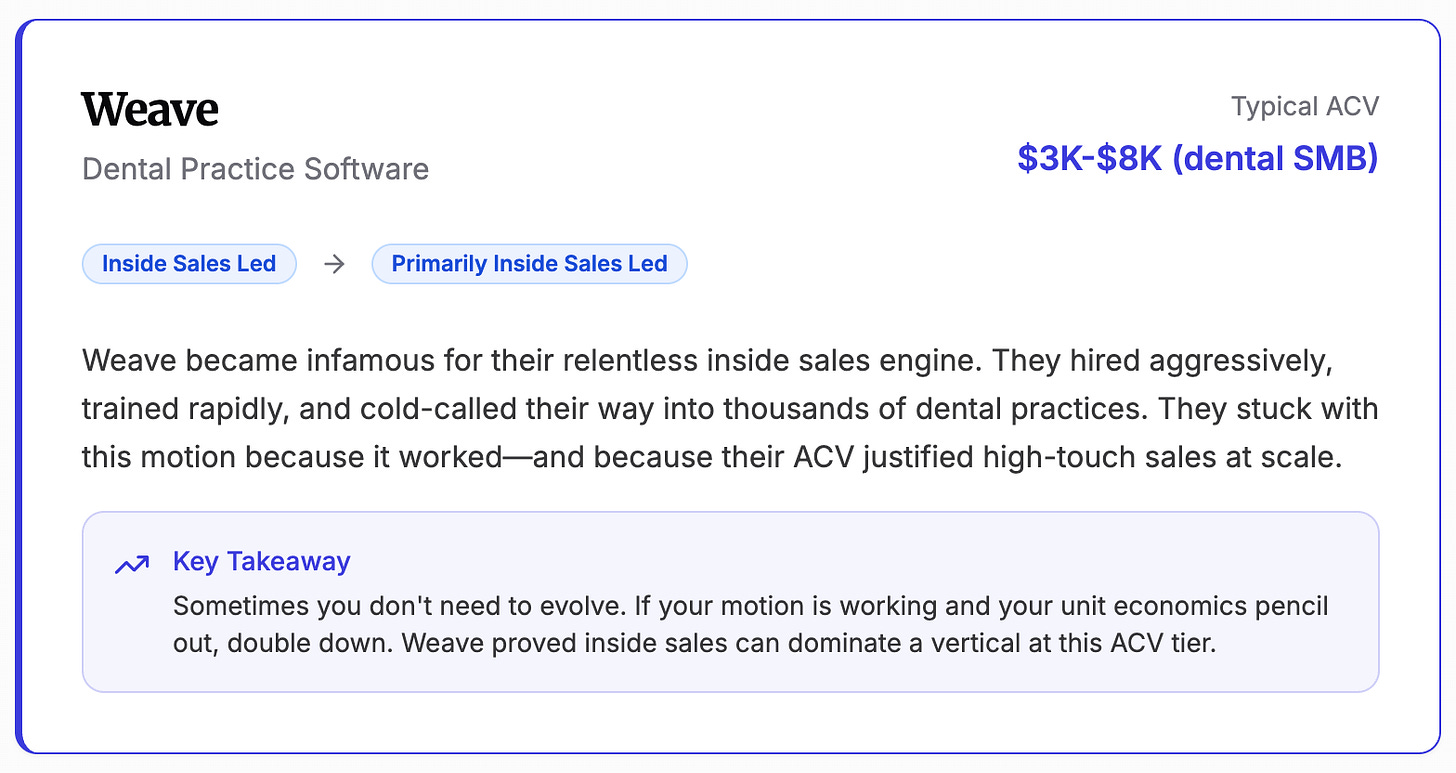

Inside Sales-Led: This is your cold-calling, cold-emailing, LinkedIn-DM-spamming machine. Reps work remotely, hammering phones or Zoom to close deals. It’s lower cost than outside sales (CAC ~$5K-20K), perfect for ACVs in the $5K-50K range. Weave’s dental SaaS army is the poster child here. Scalable, but you need a tight script and a big addressable market.

Marketing-Led: This is all about digital acquisition—SEO, paid ads (Google, Meta, X), content marketing, webinars. It’s low-touch, high-volume, and thrives for ACVs under $10K where self-serve onboarding rules. CAC can be sub-$1K if you nail it, but you’re at the mercy of ad platforms and algorithms.

Partnership-Led: Here, you lean on another company’s sales motion to push your product. Think co-selling with a complementary vendor or embedding your solution in their platform. It can be efficient (CAC varies but often split), great for scaling without bloating headcount. Works across ACVs but shines when you’ve got a niche product that can leverage someone else’s reach.

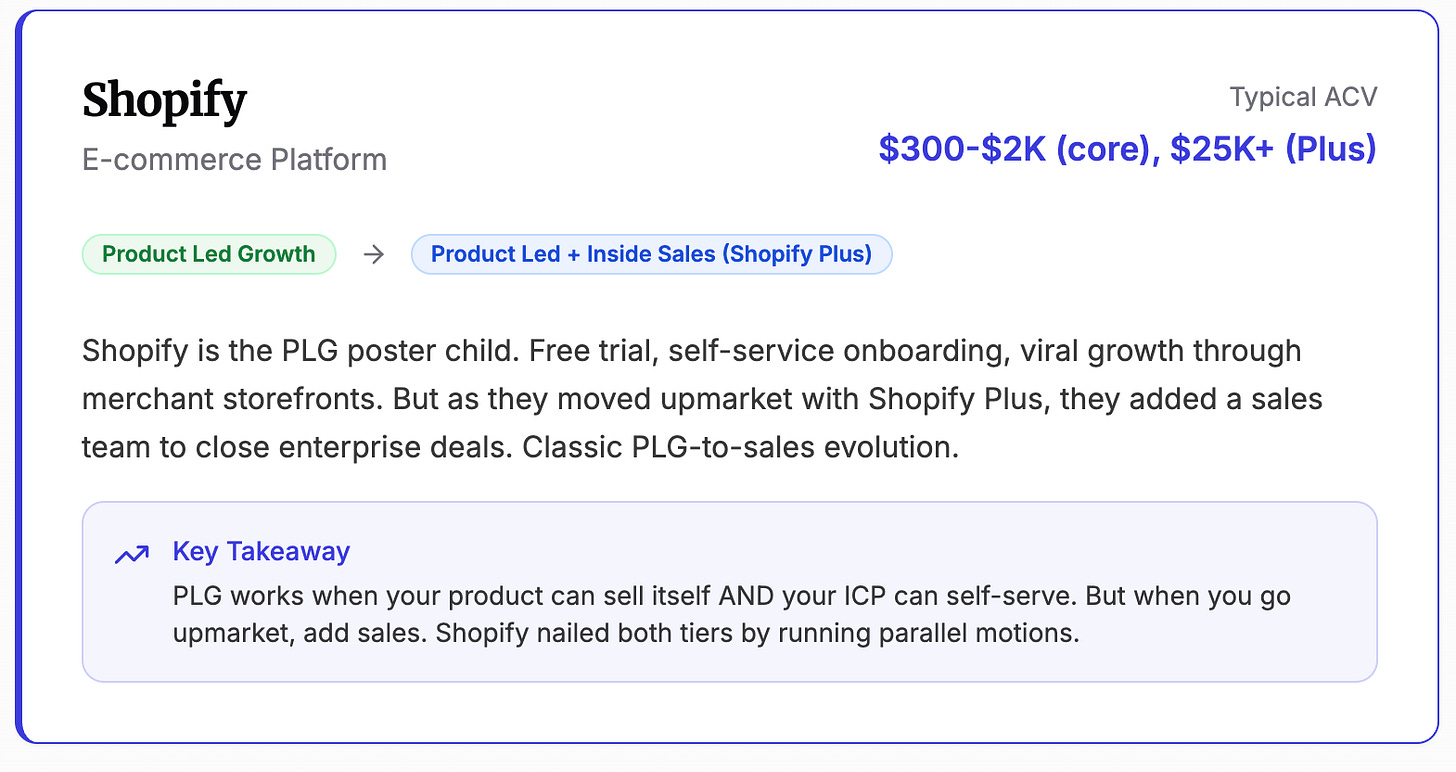

Product-Led Growth (PLG): The product itself is the acquisition engine. Free trials, freemium models, or viral referral loops (like Dropbox’s “invite a friend, get storage”) drive signups. CAC is dirt-cheap, but it’s hard to pull off without a product that’s intuitive and sticky. Best for low ACVs ($1K-10K) where volume is king.

Now, let’s see how the big players—Toast, Weave, ServiceTitan, Palantir, AppFolio, Veeva, Blackbaud, Shopify, Guidewire, and private names like OpenEvidence, Slice, and Harvey—started and evolved within these motions. I’ve grouped them by their primary GTM motion at scale, but most blend multiple motions over time.

Outside Sales-Led: Trust and Handshakes for Big Bets

This motion is for high-stakes verticals where ACV is chunky ($50K+) and buyers need face time to commit. It’s slow, expensive, but unbeatable for complex sales.

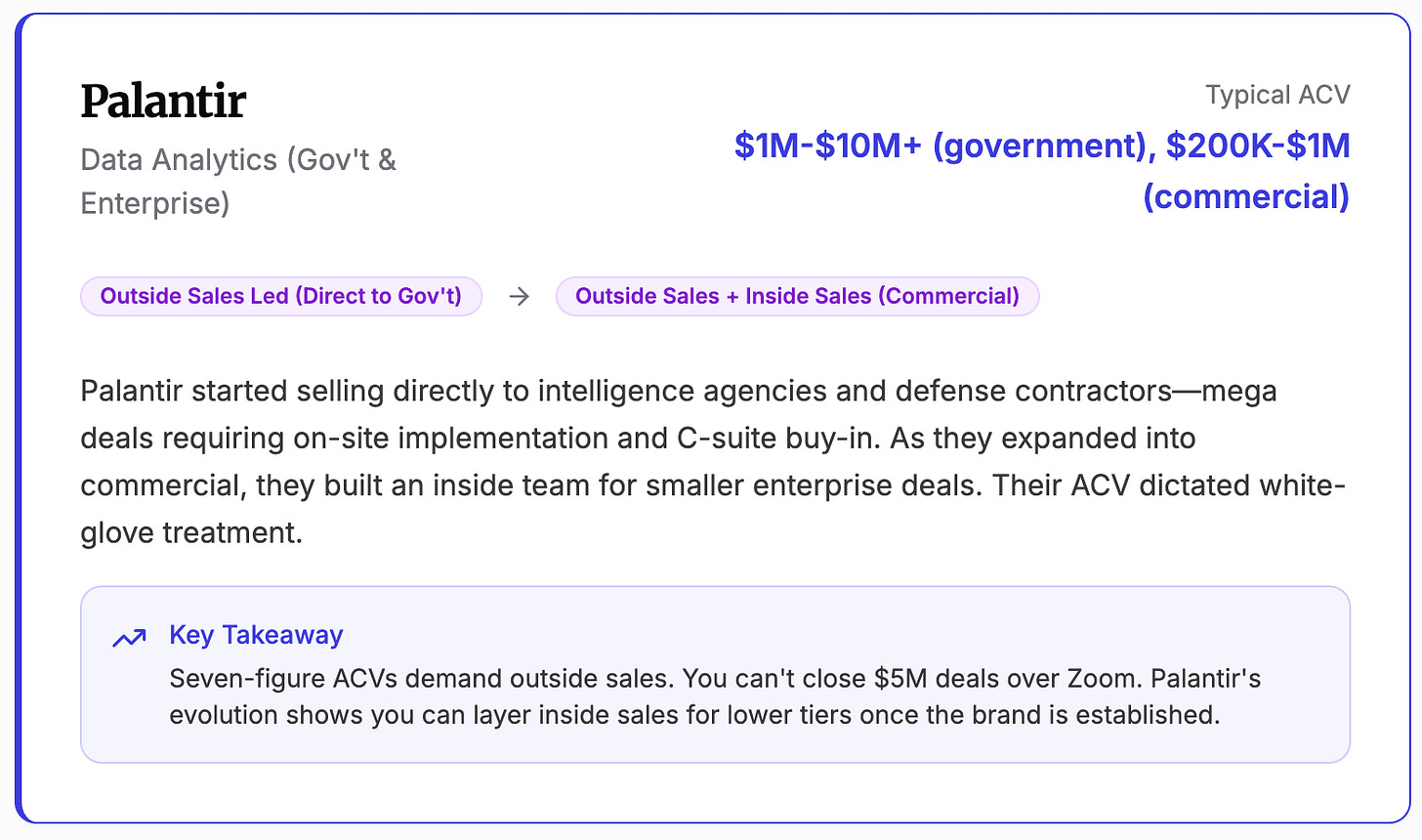

Palantir: Started in 2003 selling to government agencies (DoD, CIA) with outside sales—think reps navigating RFPs and building trust over months. ACV was $1M+ from day one, justifying 18-month cycles. Evolution? They’ve added “AI Bootcamps” (4-week pilots) to speed up commercial deals, with top clients now at $25M ACV via expansions. Still outside-led, but partners like Accenture amplify reach. High ACV demands this high touch—nobody signs million-dollar checks on a Zoom call.

Guidewire: Born in 2001 for P&C insurance, Guidewire went all-in on outside sales to carriers. ACV starts at $500K+, with 12-18 month cycles. Reps demo at industry events, close via pilots. Now? Cloud shift added partners (Cognizant for implementation), but it’s still field-heavy. AI for claims is the upsell hook. High ACV in regulated verticals like insurance makes outside sales non-negotiable.

Harvey (Private): Legal AI for AmLaw 100 firms, launched with outside sales to secure $100K+ ACV deals. Reps run bootcamp-style pilots to prove value. They’re evolving toward self-serve modules for smaller firms, but high ACV keeps field sales central. Trust is everything in legal—face-to-face closes the gap.

Why It Works: High ACV ($50K-$1M+) justifies the CAC. Regulated or complex verticals (government, insurance, legal) need reps who can navigate bureaucracy and build trust. Evolution often means adding partners or pilots to shorten cycles.

Inside Sales-Led: The Volume Game for SMBs and Mid-Market

Inside sales is the workhorse for ACVs in the $5K-50K range. It’s about disciplined outreach—cold calls, emails, LinkedIn—and scaling reps without breaking the bank.

Weave: Since 2008, Weave’s been the king of inside sales for dental practices. Reps cold-call and demo patient communication tools, closing $5K-6K ACV deals fast. Now? They’ve expanded to healthcare SMBs (optometry, vets), with ACV at $7K-10K. Partnerships with practice management software add 15% of leads, but inside sales drives 80%+ of revenue. Low ACV forced volume; stickiness (105% NDR) makes it pay off.

ServiceTitan: Launched in 2012 for contractors (HVAC, plumbing), they started with outside sales but quickly pivoted to inside for mid-market. ACV of $25K-50K let them scale reps while keeping CAC ~$10K. Now? Hybrid with field for enterprise ($300K+ ACV) and partners for referrals. Density in trades hubs drives 95%+ retention. Inside sales was the wedge; high ACV let them layer more.

Veeva: In 2007, Veeva attacked pharma CRM with inside sales, targeting mid-sized firms with $50K+ ACV. Reps closed via Salesforce migrations. Now? They’ve got the Vault ecosystem, with partnerships (IQVIA) and AI pushing ACV to $100K+. Inside sales still owns the mid-market, but partners scale globally. High ACV supports the motion, but efficiency keeps it lean. (No low-ACV phase here—they’ve always played in the big leagues for life sciences.)

Slice (Private): All-in-one platform for independent pizza shops since 2015, started with inside sales to onboard 19K+ locations, ACV $2K-5K. Now? Still inside-led.

Why It Works: ACVs of $5K-50K need fast cycles and moderate CAC. Inside sales hits SMBs and mid-market where trust is less about handshakes and more about quick demos. Evolution means adding partners or upsells as ACV grows.

Marketing-Led: Digital Funnels for Low-Touch Scale

Marketing-led shines for low ACV ($1K-10K) where self-serve is king. It’s all about SEO, ads, and content pulling prospects in.

AppFolio: Since 2006, AppFolio’s targeted small property managers with accounting tools via SEO and content. ACV ~$5K, self-serve onboarding. Now? ACV’s $10K+ with leasing add-ons, and a CRO owns the full funnel (marketing + inside sales). Still marketing-led for top-of-funnel, with 20% NRR from expansions. Low ACV built the base; marketing keeps CAC sub-$1K.

Blackbaud: Post-2010 SaaS pivot, Blackbaud used marketing (SEO on fundraising tips) to pull in mid-sized nonprofits, ACV $20K-50K. Inside sales closed the deals. Now? Marketing drives entry, with AI upsells for campaigns. Retention’s the moat—nonprofits rarely churn. Marketing-led keeps acquisition cheap; higher ACV supports layered sales.

OpenEvidence (Private): Healthcare AI search started marketing-led, with clinician demos and content pulling $10K ACV deals. They’re evolving to partner-led, embedding with EHRs. Low ACV demands digital scale early; partnerships unlock stickier revenue.

Why It Works: Low ACV ($1K-20K) needs low CAC. Marketing-led fills the funnel with self-serve or light-touch closes. Evolution often means layering sales for upsells as ACV creeps up.

Partnership-Led: Borrowing Someone Else’s Reach

Partnership-led is about piggybacking on another company’s sales motion. It’s efficient for any ACV but shines when you need scale without headcount.

Toast (Secondary Motion): Toast’s core is inside sales, but partnerships with restaurant suppliers now drive 20% of leads. ACV $15K+ supports it, but density (100K+ locations) makes partners a no-brainer for scale.

Veeva (Secondary Motion): Veeva’s inside sales led early, but partnerships with IQVIA now drive global reach for $100K+ ACV deals. Partners handle the boring stuff; Veeva focuses on product.

Why It Works: Partnerships lower CAC by tapping existing trust. They’re critical for scaling niche products or reaching fragmented markets. Low ACV leans on partners for volume; high ACV uses them for reach.

I will note that Partnership-Led GTM is very difficult to succeed with if you are aiming for massive scale (like all the players were looking at). It’s tough to get another company to care enough about pushing your product. I know a lot of founders that have great small businesses that run with this approach. So don’t discount it, but know it’s tough to achieve scale with.

Product-Led Growth: The Product Sells Itself

PLG is the dream—your product drives acquisition through trials, freemium, or referrals. It’s low-CAC magic but needs a viral hook.

Shopify: Since 2006, Shopify’s been the PLG king. Free trials and self-signup for solopreneurs, ACV $1K-5K. Now? Inside sales for Plus tier ($100K+ ACV), but PLG still rules with 2M+ stores. Payments (6% of revenue) fuel the flywheel. Low ACV drove volume; sales unlocks enterprise.

Why It Works: PLG needs low ACV ($1K-10K) and a product that’s dead-simple to adopt. Evolution means layering sales for bigger accounts while keeping the self-serve engine humming. PLG is very rare in vertical software and very common in horizontal software. If you can crack PLG in vSaaS you could have a beast of a business on your hands.

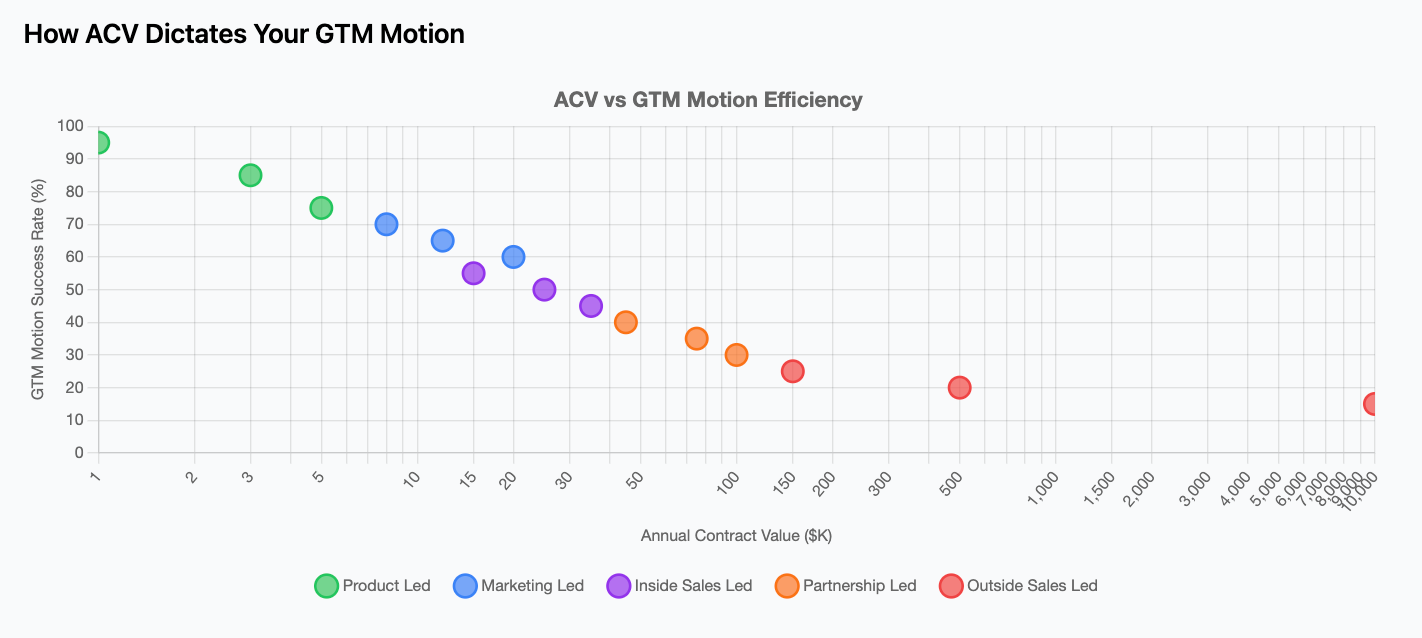

ACV: The GTM Puppet Master

ACV isn’t just a metric—it’s your GTM destiny. Low ACV ($1K-10K) screams PLG or marketing-led; you need volume to survive. Mid-range ($10K-50K) leans inside sales for efficiency. High ACV ($50K+) demands outside sales or partners to justify the CAC. Mess up the match, and you’re bleeding cash. Nail it, and you’re printing.

Low ACV ($1K-10K): Shopify, AppFolio, Weave, Slice, OpenEvidence. These folks leaned on PLG, marketing, or inside sales to pile up customers fast. Payback periods are tight (6-12 months), so CAC has to stay low.

Mid ACV ($10K-50K): ServiceTitan, Blackbaud. Inside sales with some marketing or field support balances speed and trust.

High ACV ($50K+): Palantir, Guidewire, Harvey, Veeva. Outside sales or partners are non-negotiable; expansions drive the real revenue (Palantir’s top clients grew 20x).

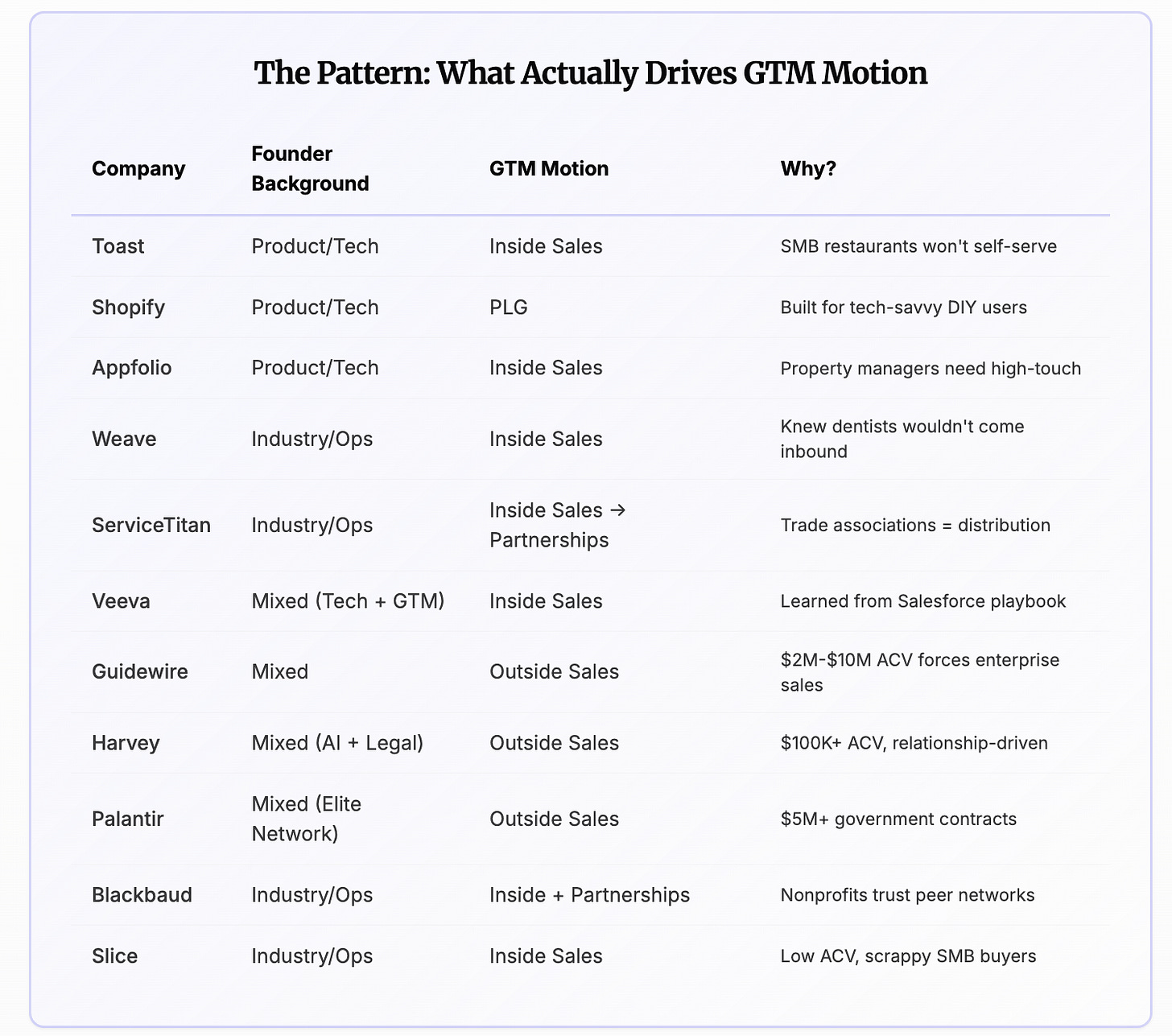

Do Founders Backgrounds Influence GTM Motions?

Here’s what everyone assumes: if you’re a technical founder, you build product-led. If you come from sales, you hire an army of BDRs. Your founder DNA determines your GTM motion.

I looked at eleven vertical software companies—public giants and late-stage startups—to see if this holds true. Spoiler: it doesn’t.

The Technical Founders Who Chose Sales

Take Toast. Founders came from Endeca and Google—pure product and engineering DNA. You’d expect PLG, right? Nope. They built an aggressive inside sales machine because they recognized that fragmented SMB restaurants wouldn’t self-serve. The market dictated the motion, not their résumés.

Or Appfolio. Klaus Schauser was a UCSB computer science professor—as academic as it gets. But property managers are busy operators, not early-adopter techies trying new SaaS tools on weekends. The market demanded high-touch sales, so that’s what they built.

Even Shopify—the rare true PLG success story—only worked because Tobi Lütke was literally building for himself. He tried to launch an online snowboard shop, hated the available e-commerce tools, and built his own. That’s the PLG origin story: engineer scratches own itch, realizes others have it too, makes it self-serve. But notice how specific the conditions had to be. It’s not just “technical founder = PLG.” It’s “technical founder building for a tech-savvy buyer who wants to self-serve.”

Industry Proximity Beats Everything

The clearest pattern? Founders who grew up in the vertical default to sales-led—because they know the buyer won’t come inbound.

Brandon Rodman (Weave) grew up around blue-collar work. His dad was a contractor, his mom became a dental hygienist. He knew dentists wouldn’t discover software via Product Hunt. So he built a cold-calling army and scaled Weave to $200M+ ARR on inside sales.

Ara Mahdessian and Vahe Kuzoyan (ServiceTitan) are immigrants whose families ran HVAC businesses. They watched their parents struggle with pen-and-paper workflows. They knew HVAC contractors weren’t browsing SaaS directories. They started with inside sales, then layered in partnerships when they realized trade associations could distribute at scale.

Ilir Sela (Slice) bootstrapped businesses in Macedonia before moving to NYC. Low ACV ($2K-$6K), scrappy SMB buyers (pizzerias), no inbound motion. He cold-called pizzerias one by one. Industry proximity told him what would work.

When ACV Is High Enough, Background Becomes Irrelevant

Once you cross into six-figure ACVs, founder background stops mattering. You’re selling into enterprise, and enterprise demands outside sales.

Marcus Ryu (Guidewire) studied philosophy at Princeton and Oxford. Not exactly your typical SaaS founder. But when you’re selling $2M-$10M deals to Fortune 500 insurance CIOs, it doesn’t matter if you have a philosophy PhD or an MBA. That’s a 12-month sales cycle with on-site demos, pilots, and procurement negotiations. Outside sales is the only option.

Harvey (AI for law firms) has the perfect pairing: Gabriel Pereyra from DeepMind/Meta (technical) and Winston Weinberg, a corporate lawyer from O’Melveny & Myers. Weinberg’s legal background gave them instant credibility, but here’s the thing—they were always going to do outside sales. $100K+ ACVs selling into elite law firms? That’s relationship-driven, high-touch sales. Founder domain expertise helps, but the deal size forces the motion.

Palantir is the extreme version. Peter Thiel had Pentagon connections from PayPal’s fraud detection work. When you’re selling $5M+ contracts to the CIA, you’re not running Facebook ads. Network + deal size = outside sales, end of story.

The Big Takeaway: Evolve or Bust

There’s no single “right” GTM motion for vertical SaaS.

What works depends on your ACV, your market maturity, your founding team’s DNA, and your ability to execute. Toast crushed it with inside sales. Shopify dominated with PLG. Palantir built an empire with enterprise sales. Guidewire stuck to their guns and won anyway.

The pattern? They all focused on a motion that matched their economics, proved it worked, then evolved deliberately as they scaled.

So here’s the key questions to answer:

What’s your ACV—and what does that demand from your GTM?

What GTM motion works in the industry you serve?

Do these two work with one another?

Answer that honestly, iterate accordingly, and you’re already ahead of 90% of founders.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Source for the IQVIA and Veeva thing? They had a pretty nasty antitrust lawsuit until a month or two ago