Linear #146: Product Paths To Building A vSaaS Monopoly, Vori: vSaaS for Grocery Stores

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

Product Paths to Building a Vertical Software Monopoly

I took some time to analyze the different product paths that leading vertical software companies have deployed to grow from 0 to significant scale. I was curious myself and thought you all would be too :-)

Path #1:

Wedge → Multi-Product → System of Record → FinTech

Strategy: Start with a niche tool solving a specific industry pain point, expand to a suite of modules (e.g., CRM, analytics), become the central system for all data/workflows, then integrate financial services like payments or lending to capture transaction revenue and lock-in.

Why It Works: Deep vertical expertise enables seamless upselling; fintech creates a revenue moat that’s tough to disrupt

Examples:

AppFolio (APPF, NASDAQ) – Property Managers

AppFolio started in 2006 solving tenant screening and rent collection for property managers. By 2015, they added leasing, maintenance, and analytics, becoming the system of record. Embedded payments and insurance followed, capturing fees. With $700M+ revenue and 20%+ market share, AppFolio’s 30% growth shows fintech’s lock-in power.ServiceTitan (TTAN, NASDAQ) - Home Services

Founded in 2012, ServiceTitan entered home services (plumbing, HVAC) with scheduling and dispatching tools, fixing field service chaos. They layered on job costing, inventory, and marketing, becoming the system of record for $1T+ in transactions. Embedded payments and financing boosted ACV, and recently crossed $1B of ARR. They own contractors’ workflows end-to-end.

Path #2:

POS → System of Record → Workflow Automation

Strategy: Launch with a vertical-specific POS, then expand to a full platform (e.g., inventory, analytics) for operational control and high switching costs.

Why It Works: POS captures real-time data, enables great transition to system of record and workflow dominance.

Examples:

Lightspeed Commerce (LSPD, NYSE/TSX) – Retail

Lightspeed launched in 2005 with POS for retailers, replacing manual cash registers. By 2019, they added e-commerce, inventory, and analytics, becoming a one-stop shop for retailers. With $1B+ revenue and ~10% global POS share in retail.Toast (TOST, NYSE) – Restaurants

In 2012, Toast launched a mobile POS for restaurants, tackling clunky legacy systems. By 2018, they added inventory, payroll, and loyalty, becoming a full restaurant OS. Embedding Toast Capital (lending) was the masterstroke, using transaction data for loans. Now with $4B+ revenue, Toast owns ~50% of the U.S. cloud POS market for restaurants and grows 24% YoY.

Path #3: Compliance → Workflow Automation → Vertical App Store

Strategy: Enter with a regulatory tool, automate workflows (e.g., approvals), then build an API ecosystem with 100-500+ integrations for network effects.

Why It Works: Regulation ensures quick adoption; ecosystems lock in users via data interoperability.

Examples:

Veeva Systems (VEEV, NYSE) – Life Sciences/Pharma

In 2007, Veeva solved pharma’s compliance pain with cloud-based content management. By 2015, they added CRM and clinical trial workflows, becoming the system of record. With 200+ integrations, $2.5B+ revenue, and 50%+ pharma CRM share, Veeva’s 30% CAGR proves ecosystems are glue for R&D.Blackbaud (BLKB, NASDAQ) – Non-Profit

Blackbaud started in 1981 with donor compliance for nonprofits. They expanded to fundraising automation and analytics, becoming the backbone of charities. With 200+ integrations, $1B+ revenue, and 40% nonprofit fundraising share, Blackbaud’s platform shows ecosystem-driven dominance.

Path #4: E-commerce → Merchant Tools → Vertical App Store:

Strategy: Launch with an industry-specific storefront builder, add merchant tools (e.g., inventory, marketing), then evolve into a marketplace with logistics, ads, or payments.

Why It Works: Merchants flock to platforms that simplify sales; marketplaces create a flywheel of buyers, sellers, and data.

Examples:

BigCommerce (BIGC, NASDAQ) – E-commerce/Retail

BigCommerce began in 2009 with retail-focused SaaS storefronts. By 2020, they added B2B tools and checkout APIs. Now with $300M+ revenue and 10% enterprise e-commerce share, BigCommerce grows through marketplace integrations that keep retailers hooked.Shopify (SHOP, NYSE/TSX) – E-commerce/Retail

Shopify launched in 2006 with store builders for retail SMBs. By 2013, they added payments and marketing, then Shopify Capital for lending. Powering 29% of U.S. e-commerce with $200B+ GMV, Shopify’s 30%+ growth makes it the go-to merchant platform.

Path #5: AP Automation → Payments → Integrated Industry-Specific Finance

Strategy: Begin with accounts payable automation for a vertical’s invoicing, embed payments for speed, then expand to lending or insurance along the supply chain. This captures 1-3% transaction fees and creates lock-in through financial workflows.

Why It Works: AP is a universal pain point; financial integration ties customers to your platform.

Examples:

AvidXchange (AVDX, NASDAQ) – Real Estate

Launched in 2001, AvidXchange automated AP for real estate and construction. By 2018, they added ACH payments, then lending and virtual cards. With $500M+ revenue and 5% mid-market AP share, their 20%+ growth shows financial lock-in’s power.Guidewire Software (GWRE, NYSE) – Insurance

Guidewire started in 2001 with claims automation for insurers. By 2010, they added billing and policy management, then predictive analytics and payments. With $1B+ revenue and 30%+ P&C insurance share, Guidewire’s 15% growth proves financial workflows drive dominance.

Path #6: Reverse Franchise → White Label EVERYTHING → Build it all in House → Discount via Shared Services

Strategy: White label the best tech you can find to be able to offer a one stop shop, build in industry specific features, then over time rip out the third-party tools and build your own, and drive massive discounts as you scale.

Why It Works: Independents (Often ~75% of a market) crave chain-scale benefits without cookie-cutter control; marketplace network effects fuel adoption.

Examples:

Slice – Pizza Shops

Launched in 2015, Slice built a marketplace for 16,000+ independent pizzerias, offering online ordering to compete with Domino’s in the $50B U.S. pizza market. They added shared services like marketing and group buying (e.g., discounted pizza boxes), then a business-in-a-box with 6% take rates, keeping shops’ unique branding.Odeko – Coffee Shops/Cafés

Founded in 2019 with a procurement wedge to cut supply costs, Odeko merged with Cloosiv in 2020 to add mobile ordering for 14,000+ cafés. They layered shared services like inventory and overnight delivery from 400+ vendors, saving shops 21% on goods and 10 hours/week. Their business-in-a-box model, with 300%+ YoY growth and $273M+ in funding, lets independents rival Starbucks.Moxie – MedSpas/Salons

Starting with salon scheduling, Moxie pivoted to medspas with a compliance and booking marketplace. They added marketing automation and VIP supply ordering, then a business-in-a-box with coaching and memberships, enabling solo practitioners to launch in 30 days and scale to $1M+. In the $20B+ medspa vertical, Moxie’s reverse franchise drives multimillion growth without practitioner burnout.

What Are the New Paths in an AI Age?

AI Path #1: Evidence Search → Content Partnerships → AI Agents:

Strategy: Launch a vertical specific GPT for evidence-based queries, secure premium content partnerships, then build autonomous AI agents for research and decisions.

Why It Works: Trusted, low-error AI in regulated verticals drives viral adoption; proprietary data creates moats.

Examples (Private):

OpenEvidence – Healthcare: Founded 2023, AI search answers medical queries in 5-10s, 90%+ USMLE accuracy. Partnerships with JAMA, NEJM fuel 8.5M+ monthly consultations, 40% U.S. physician share. DeepConsult™ AI agents generate PhD-level reports.

Harvey – Legal: Launched 2023, AI search for case law hits 95% bar exam accuracy. Westlaw, Bloomberg Law partnerships power 15,000+ lawyers, 200+ firms. AI agents draft contracts in minutes.

AI Path #2: Industry-Specific AI Agent Workforces

Strategy: Deploy AI agents for routine tasks, scale to orchestrated workforces for end-to-end processes, then add human oversight for hybrid teams, cutting costs 50%+ and boosting productivity 3-5x via subscriptions or outcome pricing.

Why It Works: Infinite-scaling agents replace labor in high-manpower verticals; orchestration creates network effects from interaction data. Examples (Private):

Caseflood.ai – Legal: Founded 2024, AI agents automate 70% of paralegal tasks (intake, review). Full case pipelines cut costs 33%, boost case value 20%. 500+ firms, $25M+ ARR, 300% YoY growth in $300B market.

Truewind – Accounting: Launched 2023, AI agents for bookkeeping save 40 hours/week. End-to-end workflows for 100+ firms, $50M+ ARR, 250% growth, $800M valuation.

AviaryAI – Financial Services: Founded 2024, AI agents for lead qualification scale to KYC and outreach. 200+ institutions, $40M+ funding, 400% growth.

Which Path Is Right for You?

This is obviously not an exact science but a helpful place to start…

Regulated industries (healthcare, pharma)? Paths #3, #5.

Transactional verticals (restaurants, retail)? Paths #1, #2, #4.

Financial workflows (real estate, insurance)? Path #6.

Independent-heavy niches (pizza, coffee, medspas)? Path #7.

AI-ready verticals (healthcare, legal)? AI Paths #1, #2.

No path is easy—regulation, complexity, or AI’s data demands can trip you up. Remember that this is just looking at product, not GTM. We will do GTM breakdown soon.

But we have enough proof points to see WHAT HAS WORKED and it’s up to us to study these and apply them to our own businesses…

The Grocery Rebels: How Vori is Arming Mom-and-Pop Grocers to Battle Big Grocery (Walmart, Costco, etc.)

While most vertical SaaS founders chase sexy verticals, Brandon Hill saw something different. He saw his parents’ 40-year grocery industry legacy. He saw independent grocers drowning in manual processes while Walmart deployed armies of data scientists.

And he saw a $2 trillion vertical ripe for disruption…

The grocery industry is one of the largest undigitized segments in America. While most other verticals have had their SaaS moment, independent grocers—who control 33% of the market—were still managing inventory with pencil and paper, printing price tags in batches, and playing phone tag with suppliers.

That’s where Vori comes in. Not as another enterprise software play, but as vertical SaaS rebels with a mission: “We’re arming the rebels.”

The Founding Story: When Legacy Meets Opportunity

The Vori story doesn’t start in Y Combinator or with a McKinsey consultant turned founder. It starts with a handwritten note in 2019 from Brandon Hill’s parents, Tori and Leon Hill, who spent four decades in the grocery and consumer products vertical.

They’d met and fallen in love in a grocery store—literally. Leon rose from the lowest sales position at Reynolds Consumer Products to the top North American role before a multi-billion dollar acquisition. Tori worked at Oscar Meyer and Kraft Heinz, with a computer science degree and deep food tech experience.

Their son Brandon was supposed to take a product management role at Uber or Facebook after Stanford. Instead, his parents presented him with a proposition: forget Big Tech. Come solve the problems they’d witnessed for decades in the grocery supply chain vertical.

The genesis moment came when Brandon was at Stanford and realized the potential of bringing modern technology to underserved industries. He saw massive opportunity in applying Silicon Valley innovation to traditional verticals that had been ignored by venture capital.

That’s when Brandon Hill, along with co-founders Tremaine Kirkman (Chief Product Officer) and Robert Pinkerton (Chief Technology Officer), decided to build Vori in late 2019. Three young founders, starting in East Palo Alto with a mission to bring modern software to the grocery vertical.

The first product scan happened in October 2019. Jaime Pineda at The Market at Edgewood scanned the first item and said: “Wow, that gave me goosebumps!” The first wholesale order? $200 worth of kombucha. Today, that’s scaled to serving 600+ retailers.

The Value Proposition: Vertical SaaS Meets David vs. Goliath

Here’s the brutal reality of the grocery vertical: Walmart employs teams of data scientists and software engineers to build their inventory management stack. Independent grocers get... nothing. They’re managing 30,000 SKUs with fluctuating daily costs using the same tools their grandparents used.

Vori’s value prop is classic vertical SaaS:

Take enterprise-grade capabilities used by the Walmart’s and Albertsons of the world and package them for an independents at a cost they can afford.

Their platform does what enterprise solutions do for Walmart:

Automated inventory management that reduces restocking time by 80%

Real-time cost change monitoring across thousands of suppliers

AI-powered pricing optimization that protects margins during inflation

Digital order management that eliminates phone tag with vendors

Built-in customer loyalty programs that rival enterprise solutions

The result? Classic vertical SaaS ROI. Customers like The Willows Market saw +9.7% increase in total sales, +10.7% basket size, and +13.5% order count within 16 months. The Market at Edgewood? +23% sales increase after switching from NCR’s legacy system.

This is what vertical SaaS is supposed to do—deliver immediate, measurable ROI to an underserved industry.

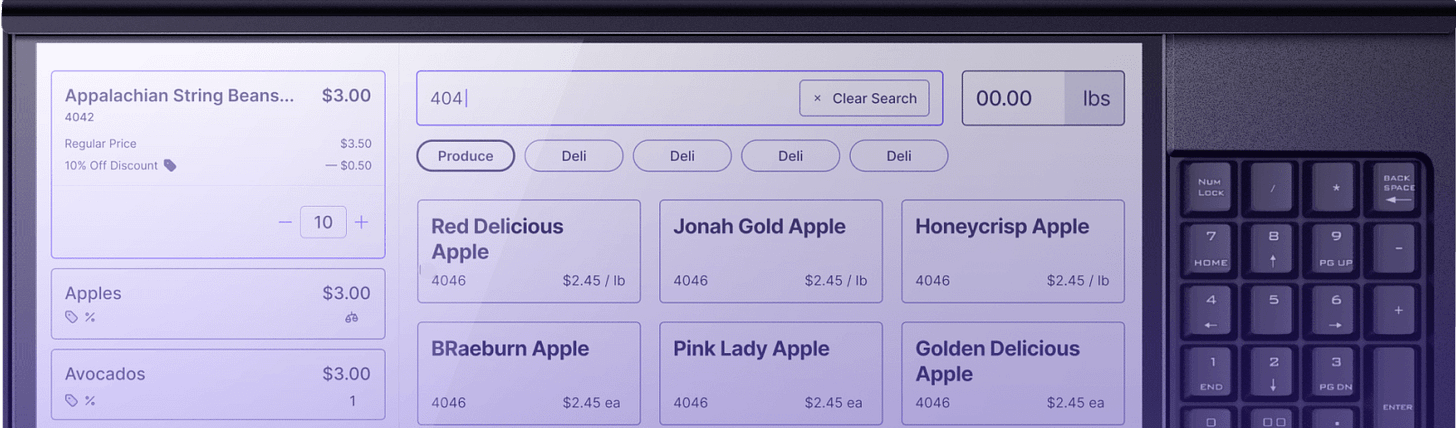

The Product Suite: VoriOS - The Grocery Vertical’s Operating System

In July 2024, Vori launched their crown jewel: VoriOS. This isn’t just another SaaS tool—it’s a complete vertical operating system for grocers.

The product launch video is genuinely spectacular. It positions VoriOS as the grocery vertical’s NetSuite moment—comprehensive, intuitive, and powerful enough to “double the profitability of the independent grocer.”

VoriOS Core Features:

Cloud-based POS system that works even when internet goes down

Supplier-integrated back office with automated invoicing

AI-powered margin protection with real-time pricing updates

Digital price tags (goodbye manual price changes!)

Built-in CRM and loyalty tools with SMS messaging

One-click accounting integration with dozens of systems

As Brandon Hill puts it:

“Our new cloud-based platform gives grocers the freedom to run their stores from anywhere. VoriOS even puts a pricing coordinator, a CFO, and a marketing director in the owner’s back pocket.”

This is vertical SaaS done right—deeply integrated workflows that understand the specific pain points of the grocery industry.

Go-to-Market Strategy: Classic Vertical SaaS Playbook

Vori’s GTM strategy is textbook vertical SaaS:

Start with early adopters in a concentrated geography (Bay Area) and founder-sell your way in the door.

Deliver ROI as fast as possible and make them a champion to all other prospects

Build word-of-mouth within the tight-knit grocery community

Expand geographically once product-market fit was proven

Create ecosystem partnerships with distributors and suppliers

The genius is in their positioning. They’re not selling generic inventory management software or a very legacy solution (like the market is littered with today)—they’re selling grocery-specific workflow automation. Every feature speaks the language of grocers: shrink reduction, protect your margins, improve relationships with suppliers.

Instead of competing on features, they’re competing on industry expertise.

Customer Retention: Vertical SaaS Stickiness

The retention story is where vertical SaaS really shines, and Vori delivers. Listen to Scott from The Willows Market: “Now we’re super fans of the software... We were kind of in the stone ages and we just jumped to the future.”

Customer testimonials are serious…

“I think God sent you because I was just sitting here so frustrated”

“One of the best decisions I’ve made in the last 20 years”

“The support experience has been world class”

This is classic vertical SaaS switching cost magic. Once grocers digitize their core workflows on Vori, the switching costs become enormous. They’re not just changing software—they’re changing how they run their entire business.

Vision for the Future: Expanding the Vertical

Hill’s vision is classic vertical SaaS expansion strategy. Start with one core workflow (inventory management), then expand into adjacent workflows within the same vertical:

Current: Inventory management and POS (already processing $150M+ in volume), shopper engagement, back office accounting and analytics. Future: Supply chain optimization, marketplace

Recent partnerships with Fujitsu for self-checkout solutions and Good Stuff Distribution show they’re building an ecosystem around the grocery vertical.

The Bigger Picture:

Why Grocery Vertical SaaS Matters

Vori represents everything compelling about vertical SaaS. While horizontal solutions fight feature wars, vertical SaaS companies like Vori win by deeply understanding industry-specific workflows.

The grocery vertical is particularly attractive for SaaS:

$2 trillion market size with 30,000 independent operators

Recession-resistant (people don’t stop eating)

Massive technology gap between enterprise and SMB solutions

Fragmented market perfect for software-enabled consolidation

High switching costs once workflows are digitized

As Hill says: “We’re essentially building critical software for a trillion-dollar segment of the fundamental part of the American economy during a once-in-a-lifetime set of macro forces.”

Excited to see this one play out.

And very quick disclaimer — I’m a tiny angel investor in Vori :-)

If you made it this far you’ve found the Easter Egg :-)

Something exciting is coming next week. I’m launching a podcast with my VC friend, Nic Polous that’s exclusively focused on Vertical SaaS!

Verticals: A Weekly Biz Show Presented by Parafin where a founder (aka me / Luke Sophinos) intellectually spars with a VC (Nic Polous from Euclid VC) on all things Vertical Tech & AI. We will bring on an incredible guest every week, but not to chat about their background, to discuss playbooks, practical advice, and where the puck is heading nex.t

Stay tuned for the big launch coming in a few days.

Every episode will include VSAAS GREATS.

Hit the subscribe button to be notified when our first episode drops!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Let me know what you think about my latest post on Saas metrics https://theirgirl.substack.com/p/retail-investors-guide-to-saas-metrics

Love the framework in this one. However the Veeva example isn't right - CRM was first in 2007 and eMTF was second in 2011