Linear #145: Do We Need To Worry About AI Gross Margins? Kertyx’s Raise & Why Regulatory Moats Are Beautiful

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

AI Gross Margins: A Temporary Storm or Permanent Shift?

The AI industry faces unprecedented margin pressures, but history suggests a different narrative. From mainframes to mobile phones, technology's economic evolution follows predictable patterns.

The venture capital world is having a bit of panic attack. AI companies are reporting gross margins that would make a SaaS executive break out in cold sweats—some even dipping into negative territory. Bessemer’s state of the union showed companies between 0 and 25% gross margins. For context, Vertical SaaS + payments public companies have been hammered for being in the 40-60% range…

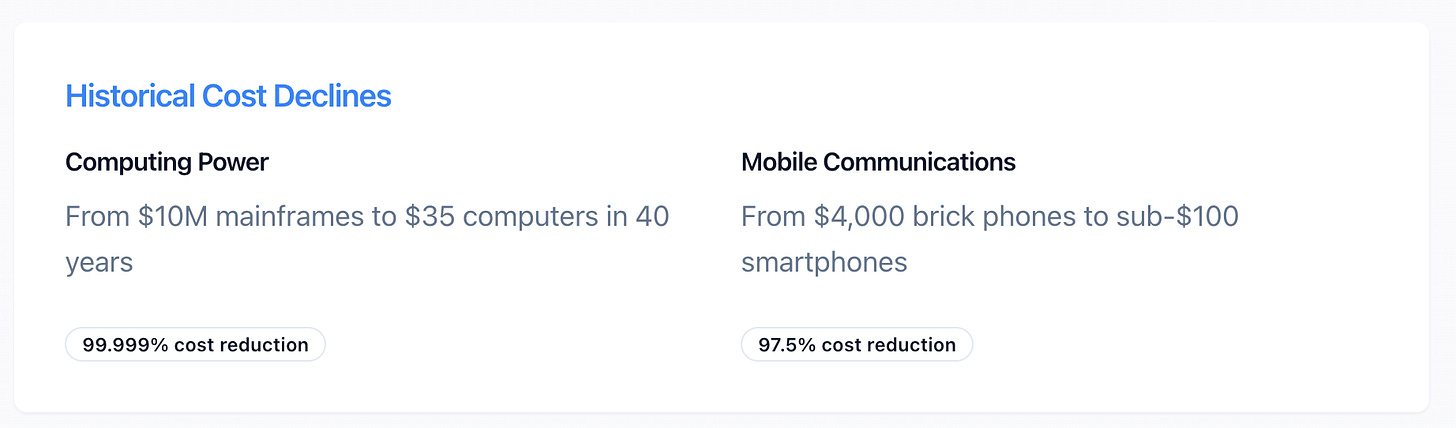

But before we sound the alarm bells, let's take a step back and examine what history teaches us about technology economics:

I've spent the better part of two decades watching technology cycles unfold, from the dot-com boom to the mobile revolution to the cloud migration. Each time, the same pattern emerges: revolutionary technologies start expensive, get commoditized, then become the foundation for the next wave of innovation.

Let me paint you a picture of technological inevitability. In 1981, the IBM PC cost $1,565—roughly $5,000 in today's money—for a machine with 16KB of RAM. Today, a $5 Raspberry Pi Zero has 512MB of RAM and processing power that would have been unimaginable to IBM's engineers.

The pattern is unmistakable: breakthrough technologies follow a predictable cost curve. They start as expensive curiosities for early adopters, become the domain of enterprises with deep pockets, then eventually democratize as the underlying infrastructure matures and economies of scale kick in.

The AI Margin Panic

Today's AI companies are caught in what I call the "infrastructure tax" phase. They're building on top of expensive foundation models, paying premium prices for GPU compute, and absorbing the costs of an immature ecosystem. Sound familiar? It should—it's the exact same playbook we saw with early cloud companies.

"Snowflake reported negative gross margins in their growth stages but achieved solid margins by IPO. The infrastructure layer always starts expensive and gets commoditized over time."

The venture community's hand-wringing over AI gross margins reminds me of similar concerns during the early SaaS era. Remember when hosting costs ate up 40-50% of revenue for early cloud companies? Those same companies today enjoy 80%+ gross margins because the underlying infrastructure became commoditized.

Why AI Margins Will Improve

Scale Economics

As AI companies grow, they can negotiate better rates with compute providers, optimize their infrastructure, and spread fixed costs across larger revenue bases.

Hardware Evolution

Specialized AI chips, more efficient architectures, and competition among chip manufacturers will drive down the cost of inference and training.

Model Optimization

Techniques like model compression, quantization, and edge deployment will dramatically reduce the computational requirements for AI applications.

Infrastructure Maturity

The AI infrastructure stack will mature, creating standardized, efficient platforms that reduce costs for application developers.

The fundamental forces that drove down costs in previous technology cycles are already at work in AI. Competition among cloud providers, advances in chip design, algorithmic improvements, and the relentless march of Moore's Law (in various forms) will inevitably make AI compute cheaper and more efficient.

My Verdict: Temporary Storm

Will we solve the AI margin problem? Absolutely. Not because I'm an optimist, but because I'm a student of history. Every transformative technology has followed this same arc, and AI won't be different.

The companies complaining about margins today will be the ones with sustainable competitive advantages tomorrow. They're learning to operate efficiently in a high-cost environment, building superior products, and establishing market positions that will be hard to dislodge when the infrastructure costs inevitably fall.

Kertyx’s Series B & Why Regulatory Moats Are A Beautiful Thing

Transformation Capital's $39 million Series B investment in Ketryx demonstrates why regulatory expertise represents one of the best competitive moats in vertical AI—and how founder-market fit in complex domains creates sustainable advantages.

The Founder's Journey: From Amgen to Building the Future

Erez Kaminski's path to founding Ketryx exemplifies how deep domain expertise creates unassailable competitive advantages. With an MS in Electrical Engineering and Computer Science plus an MBA from MIT, Kaminski spent a decade at the intersection of AI and life sciences, including as head of AI/ML for Amgen's medical device division—the world's largest biotechnology company.

This background matters immensely. Regulatory compliance isn't theoretical for Kaminski—it's lived experience at enterprise scale. Having navigated FDA approvals for AI-powered medical devices at Amgen, he intimately understands both the technical challenges and institutional dynamics that create years-long development cycles.

"I've spent the last decade at the intersection of AI and life sciences, watching it evolve from an emerging tool to a critical application for patients. It's now time to accelerate adoption and ensure AI is safe, reliable, and ready for regulated environments."

— Erez Kaminski, CEO and founder of Ketryx

Working alongside co-founder Jan and recruiting regulatory expert Paul Jones (former head of the FDA's Software Engineering Lab), Kaminski assembled a team with institutional knowledge that can't be replicated through hiring or partnerships alone.

Why Regulatory Moats Are Extraordinarily Powerful

Regulatory compliance creates a unique form of competitive protection that differs fundamentally from technological or network effect moats. Unlike patents that expire or technologies that can be reverse-engineered, regulatory expertise compounds over time and becomes more valuable as industries evolve.

Knowledge Barriers Scale Exponentially

FDA regulations span thousands of pages across multiple frameworks—21 CFR Part 820 for quality systems, ISO 14971 for risk management, IEC 62304 for medical device software lifecycle processes. But beyond memorizing rules, successful compliance requires understanding how these frameworks interact with specific technologies, organizational structures, and evolving regulatory interpretations.

This creates what economists call "tacit knowledge"—expertise that can't be easily codified or transferred. Ketryx's team didn't just read about FDA compliance; they've implemented it at scale, seen where theoretical frameworks break down in practice, and developed institutional relationships with regulatory bodies.

Time-to-Competence Creates Unscalable Advantages

Building regulatory expertise requires years of direct experience. New competitors can't simply hire their way to competence—regulatory knowledge is developed through successful submissions, failed attempts, and iterative feedback from agencies. This creates massive time advantages for incumbents.

Ketryx's platform reflects this deep expertise through automated compliance workflows that would take competitors years to develop and validate. Their six specialized AI agents understand regulatory nuances that took the team years to codify into software.

Customer Trust and Switching Costs

In regulated industries, compliance failures carry catastrophic risks—FDA warning letters, product recalls, criminal liability. This creates incredibly strong preferences for proven solutions. Ketryx already serves three of the top five medical device manufacturers, relationships that took years to build and would be extremely difficult for competitors to replicate.

These customers don't switch compliance systems lightly. The integration complexity, training requirements, and regulatory review processes create switching costs measured in years and millions of dollars.

The Ketryx Platform: Regulatory Expertise as Code

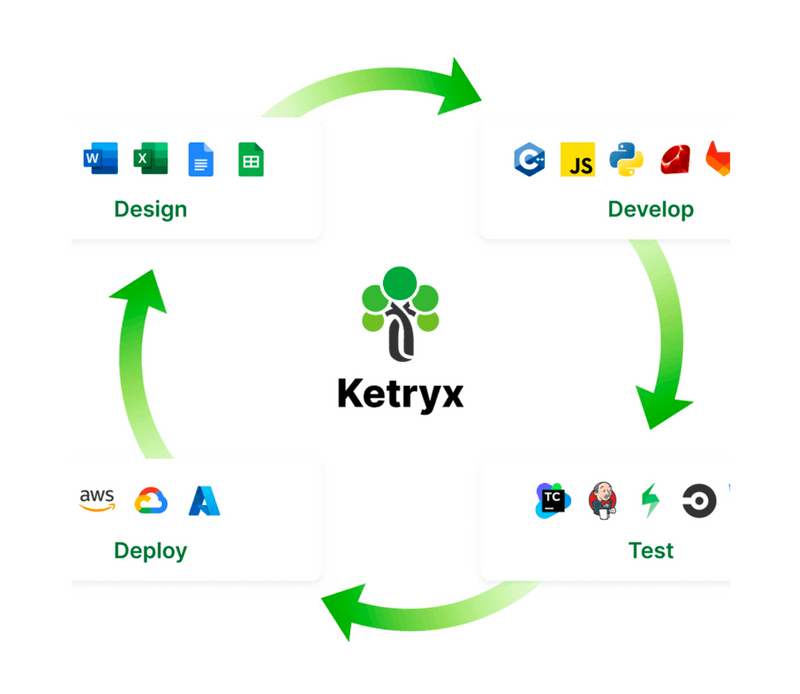

Ketryx has built what amounts to "regulatory expertise as code"—a connected lifecycle management platform that embeds FDA compliance directly into development workflows. The platform features six specialized AI agents that handle everything from traceability to risk management to automated documentation generation.

The architectural insight is profound: rather than adding compliance as an afterthought, Ketryx makes regulatory requirements invisible to developers by automating them within existing tools like Jira and GitHub. Teams report 90% reductions in documentation time and 10x faster release cycles—metrics that represent dramatic competitive advantages in slow-moving regulated markets.

Market Position and Financial Performance

With $57 million in total funding and a $39 million Series B closed in just 14 days, Ketryx has achieved remarkable capital efficiency for an enterprise infrastructure company. The speed of their Series B suggests strong unit economics and customer validation—metrics that align with the company's reported customer base of three of the top five medical device manufacturers.

While specific revenue figures aren't disclosed, serving the largest medical device manufacturers suggests significant contract values. Enterprise compliance software typically commands six-to-seven figure annual contracts, particularly when providing mission-critical regulatory infrastructure.

Expansion Beyond Core Market

The regulatory compliance challenges Ketryx solves extend far beyond medical devices. As AI regulation expands into financial services, automotive, and aerospace, the company's expertise becomes increasingly valuable. However, each regulated industry has distinct requirements—expanding would require significant additional regulatory expertise while maintaining focus on the core life sciences market.

The Broader Thesis: Regulation as Sustainable Advantage

Ketryx's success validates a broader investment thesis: in an era where most technological advantages are temporary, regulatory expertise creates some of the most durable competitive moats. As governments worldwide expand oversight of AI systems, companies with deep compliance expertise will capture disproportionate value.

The key insight is that regulatory complexity isn't a market friction to be eliminated—it's a sustainable source of competitive advantage for companies with the expertise to navigate it efficiently. Ketryx has built institutional knowledge and technical infrastructure that would take competitors years to replicate, creating precisely the kind of durable business advantages that generate exceptional returns.

For investors and entrepreneurs, Ketryx demonstrates why founder-market fit in complex regulated industries can create virtually unassailable market positions. When regulatory expertise meets modern technology architecture, the result is competitive moats that strengthen rather than erode over time.

Friendly Reminder / Introduction For Those That Don’t Know Me :-)

Hi Friends,

For those of you that don’t know me, I’m Luke. Thanks for being here.

I built my vertical SaaS business brick by brick over the last decade and have the battle scars to prove it.

From our founding in my college dorm room, to a high-flying Series B stage vc-backed company with nearly 100 employees, to enduring the SaaS Crash of 2021 and cutting 50% of headcount, and ultimately selling the business to PSG (and retaining a minority stake) last year.

I’ve seen a lot on this journey. I’ve had <1 week of cash. I’ve done big layoffs, I’ve made multiple phone calls to make payroll, I’ve walked into meetings where the outcome was life or death. Quite frankly, I’ve made every mistake in the book over the last decade.

But through the help of so many others, the team and I have persevered to build something special.

I package all my learnings into this newsletter (free), the Vertical SaaS Bible (paid), an annual Vertical SaaS Conference, and something new/free coming very soon :-).

If you haven’t checked out the bible, give it a go! It’s jam packed with the stuff they don't teach you in school. The things that I've learned the hard way so (hopefully) you don't have to. It’s a library for you to enjoy.

What’s included?

1k+ industries ranked by revenue and segmentation

500+ SaaS investors

100+ founding and operating playbooks

~100 vSaaS company case studies

And more…

Maybe, just maybe, it will help you build, operate, or invest in the next great Vertical Software company.

Thanks for checking it out.

I hope you enjoy it…

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com