Linear #141: Why VC's Are Racing Towards Vertical AI, Earned Wealth Breakdown, Last Call for vSaaS Summit

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

Why are VC’s Running to Vertical AI?

Something funny has been happening over the past year. VC’s, who have traditionally HATED Vertical Software, have been dropping blogs left and right about how Vertical AI is the future.

I agree with them! And I welcome them. The more folks in the community the better. I’ve been asked why this is happening and I think there are a few reasons why. I thought I’d share all of those with you :-)

Before we get into WHY, let’s talk about what the AI landscape looks like today…

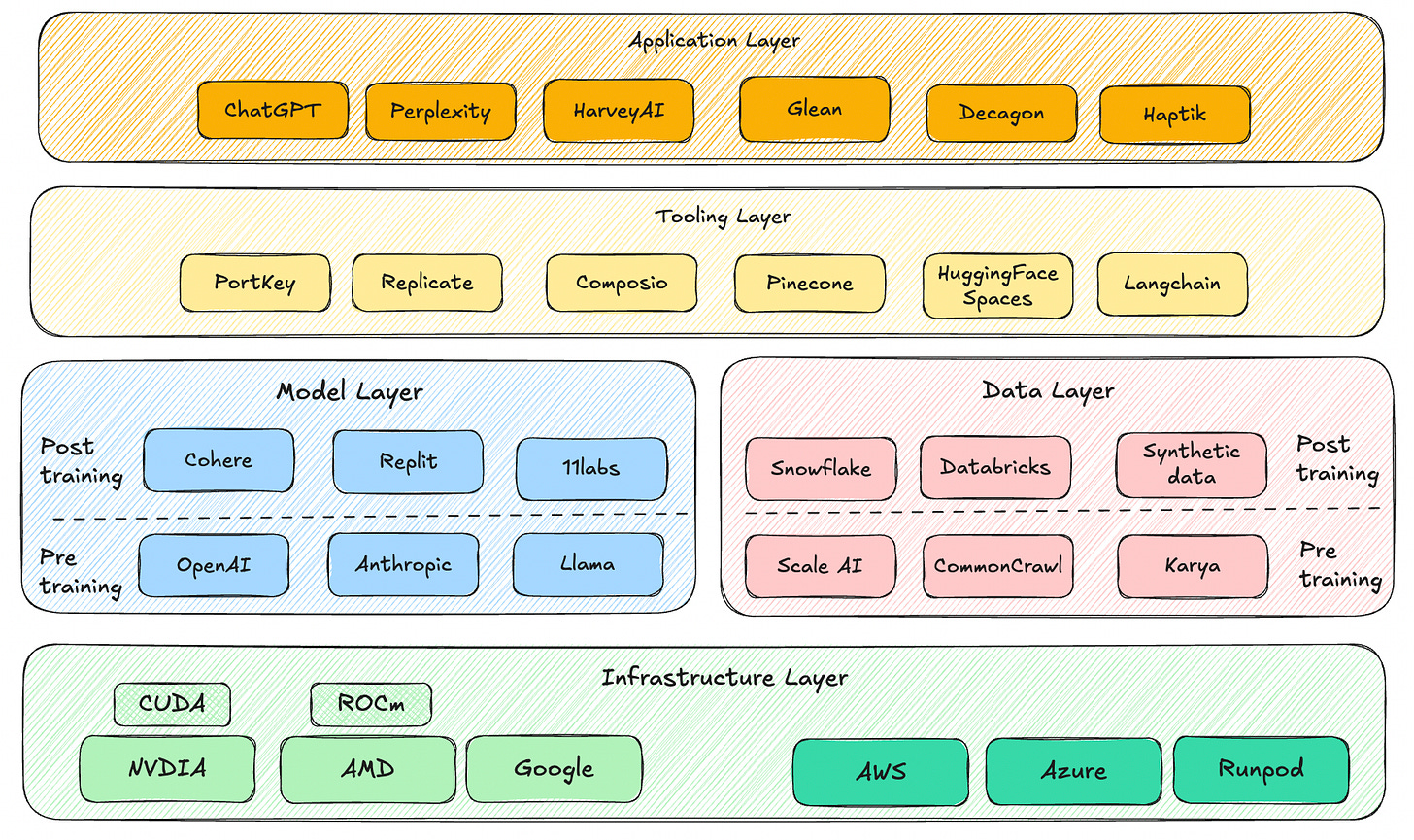

I know the image is a bit overwhelming, but the general thesis you need to understand is the following:

Infrastructure Layer: Hardware, chips, and some software that enables everything to happen. This is the powerful computers and electricity that make AI work - think of it as the super-strong brain muscles (like fancy computer chips) that AI needs to think and learn.

Model Layer: These are the actual AI "brains" like ChatGPT or Siri that have been taught how to understand and respond to people - it's like having a really smart robot friend that knows how to talk and help you.

Data Layer: This is all the information that AI learns from, like millions of books, pictures, and conversations that teach the AI how to be smart - imagine feeding your brain with every book in the library to make it super knowledgeable.

Tooling Layer: These are the special tools and programs that help people build and control AI systems - like having a toolbox full of wrenches and screwdrivers, but for making AI work properly.

Application Layer: This is the fun stuff you actually use every day, like asking Alexa questions, using Google Translate, or playing with AI art generators - it's where all that AI power gets turned into cool apps and websites that help people do things.

So knowing the landscape, why are so many VC’s racing towards Vertical AI?

#1. Most Venture Funds Can’t Afford To Fund the Infrastructure, Model, Data, or Tooling Layer:

The foundational layers of AI development—such as infrastructure, large-scale models, data aggregation, and tooling—demand enormous capital investments that most funds simply cannot sustain. Building general-purpose AI models like those from OpenAI or Anthropic requires billions in funding for compute resources, talent, and data acquisition, often leading to high burn rates and uncertain returns. Have you seen the offers Zuck is dishing out? Do you think your typical $100M VC fund can compete there?

#2. History has taught us that the App Layer has A LOT MORE winners then other Layers:

The venture capital playbook has consistently shown that application layers generate the most diverse and numerous success stories. In the SaaS era, we saw thousands of successful application companies built on top of a handful of infrastructure winners (AWS, Microsoft Azure). The same pattern is emerging in AI—while only a few foundation models and infrastructure providers will dominate, the application layer can support hundreds of billion-dollar companies across countless verticals and use cases.

#3. Most entrepreneurs & investors aren’t proficient in areas OTHER THAN the App Layer:

The technical expertise required to evaluate infrastructure, model, and data layer investments has created a natural filter that excludes most VCs from meaningful participation. Understanding the nuances of GPU architectures, transformer model innovations, or vector database performance characteristics requires deep technical backgrounds that most generalist investors lack. In contrast, application layer investments allow VCs to leverage their core competencies: understanding market dynamics, customer pain points, go-to-market strategies, and business model validation.

#4. Horizontal AI Applications have very weak barriers to entry and poor customer retention:

The horizontal AI space has become a race to the bottom, with most applications serving as thin wrappers around foundation models that can be easily replicated or cannibalized by the model providers themselves. ChatGPT's disruption of Chegg (85% market cap loss) and Stack Overflow (50% traffic decline) demonstrates how quickly horizontal solutions can be commoditized. Generic AI writing assistants, summarization tools, and chatbots face constant pressure from free alternatives and platform integration by OpenAI, Google, and Microsoft. Vertical AI applications, however, benefit from domain-specific data moats, regulatory compliance requirements, and deeply integrated workflows that create genuine switching costs.

#5. If Vertical AI can actually eat services / human costs the TAM’s are exponentially larger than they were in the SaaS era:

The emergence of agentic AI represents a fundamental shift from software augmentation to services replacement, unlocking Total Addressable Markets that dwarf the traditional SaaS era. While SaaS companies typically captured 1-3% of a workflow's value through software licensing, vertical AI agents can potentially capture 20-50% of the economic value by directly replacing human labor costs. The U.S. services economy represents $10 trillion annually, compared to the $400 billion software market—meaning successful vertical AI companies that truly automate end-to-end processes could achieve TAMs 25x larger than their SaaS predecessors.

///

To wrap this up, the surge of venture capital into vertical AI isn't just a fleeting trend, it's a pivot driven by practicality, historical precedents, and serious potential.

You will continue to see every fund, that use to laugh at vertical SaaS companies, drop blog posts about how Vertical AI is the future.

But…

I do think they are right.

One Week Left To Get Tix to the Vertical Software Summit:

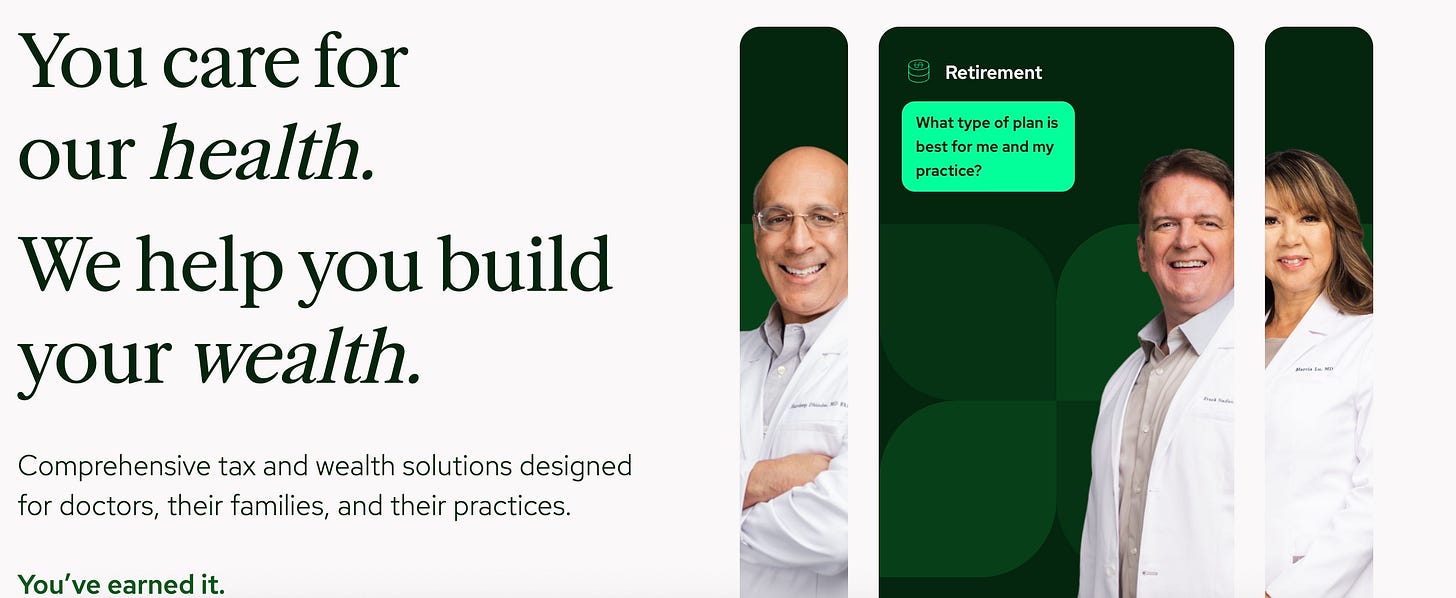

Earned Wealth - vSaaS + Financial Services for Doctors:

Picture this: You're 32 years old, you just finished your medical residency, and overnight your salary jumps from $60,000 to $350,000. Life-changing money, right?

Except you're also sitting on $300,000 in student debt, you've never taken a finance class in your life, and you have exactly zero idea what to do with this windfall. Oh, and you're working 80-hour weeks saving lives, so you don't exactly have time to figure it out.

This is the reality for nearly every physician in America. And it's exactly the massive market inefficiency that John Clendening spotted when he decided to leave his CEO role at a publicly-traded financial services company to start something new.

The result? Earned Wealth – a company that just raised $200 million and is quietly building what could become the financial services monopoly for America's highest-earning professional class.

The U.S. Physician Market:

I've written about vertical SaaS opportunities for years, but the physician wealth management market might be the most obvious massive opportunity that everyone was somehow missing.

Think about the numbers for a second.

There are over 1 million practicing physicians in the United States.

They collectively spend $13 billion annually on financial services.

The average doctor will earn between $10-25 million over their career.

And yet, until Earned Wealth came along, literally nobody was building a comprehensive financial platform specifically designed for their unique needs.

Why was this market so underserved? Because most wealth managers looked at doctors and saw "just another high-net-worth client." But that's completely wrong. Doctors aren't like other wealthy people at all.

They start their wealth-building journey 10 years later than everyone else because of medical school and residency. They graduate with crushing debt loads that would bankrupt most people. They experience massive, sudden income increases that they're completely unprepared for. And they work in one of the most demanding professions on earth, which means they have zero time to manage their finances properly.

Traditional wealth managers were trying to force doctors into generic financial planning boxes. It wasn't working, and the market was screaming for someone to build a better solution.

The Founding Story: From Schwab Exec to Doctor-Focused Change Agent

Enter John Clendening, a fintech veteran who saw the opportunity to "verticalize" wealth management. After spending over a decade at Charles Schwab—where he helped scale Schwab Bank from scratch to $200B in assets and served as EVP of Investor Services—John became CEO of Blucora, growing it into a $1B+ tax and wealth firm before its $1.1B sale.

This isn't some 25-year-old Stanford CS grad who read about the healthcare market in a McKinsey report.

But here's what makes him special: instead of just applying his traditional wealth management playbook to doctors, he spent nearly two years in deep customer discovery mode, working directly with physicians across 24 states to understand exactly what they needed.

What he found was eye-opening. Doctors weren't just underserved by existing wealth managers – they needed a completely different approach. Their financial lives were fragmented across five or six different providers. Their tax planning was completely disconnected from their investment strategy. Nobody was helping them navigate career decisions that could impact their lifetime earnings by millions of dollars.

So Clendening did what great vertical SaaS founders do: he rebuilt everything from the ground up, specifically for this market.

Building The Anti-Wealth Manager

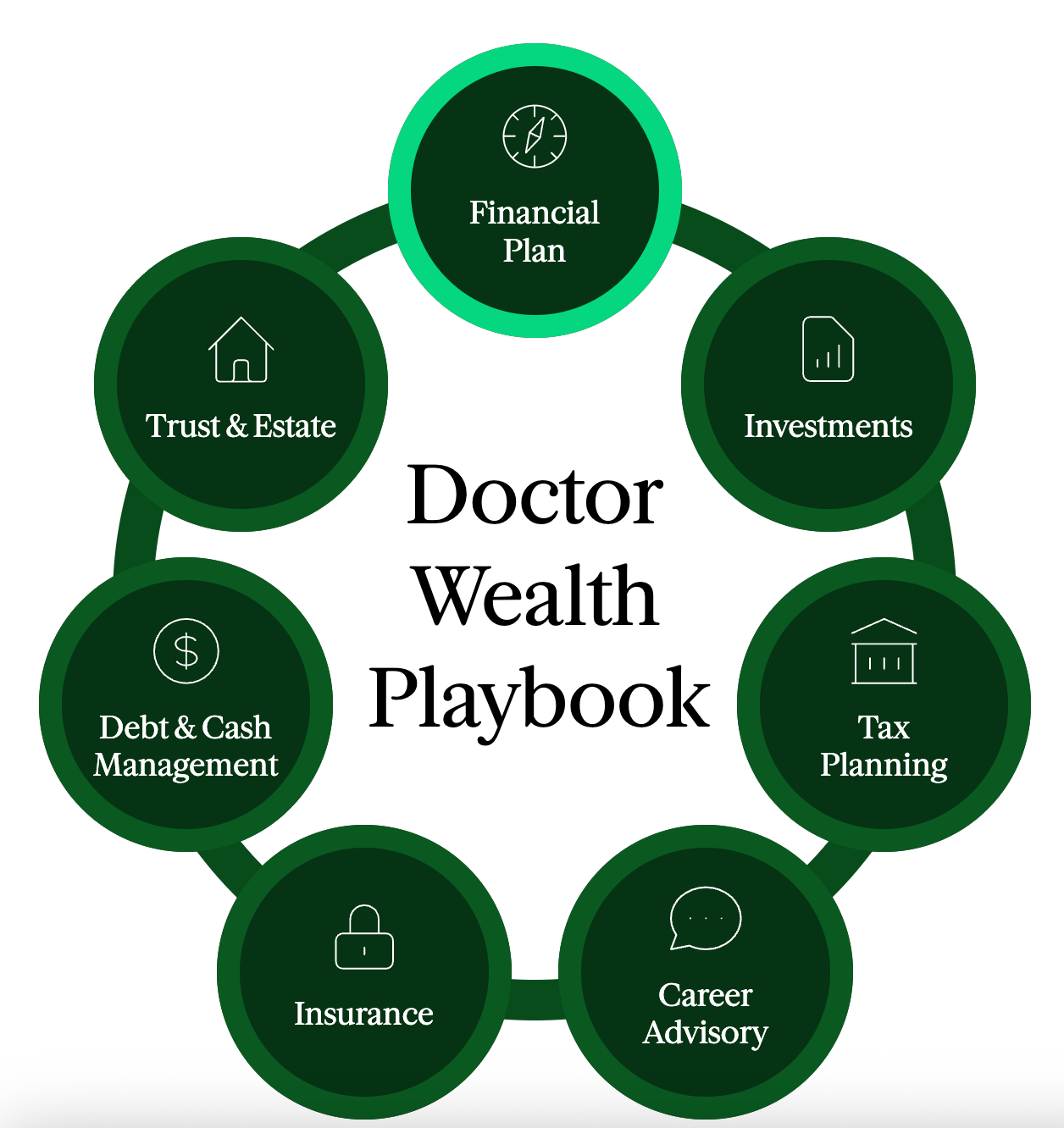

The more I studied Earned Wealth's approach, the more I realized they're not really a wealth management company at all. They're a vertical SaaS platform that happens to be in financial services.

Traditional wealth managers basically offer investment management with some tax prep thrown in. Earned Wealth built something completely different: a comprehensive financial operating system designed specifically for physicians.

Here's what that actually looks like in practice. When a doctor signs up with Earned Wealth, they get paired with a physician-trained Certified Financial Planner who understands the unique aspects of medical careers. But that CFP isn't working with spreadsheets and generic planning software. They're using Earned's proprietary platform that integrates everything from investment management to career advisory to tax optimization.

The platform uses predictive algorithms to make personalized recommendations based on the specific financial patterns of physicians. It tracks not just investment performance, but career progression, practice ownership opportunities, and even things like malpractice insurance optimization.

And here's the brilliant part: instead of charging separate fees for tax prep, investment management, insurance review, and financial planning like traditional providers, Earned bundles everything into a single assets-under-management fee. One relationship, one platform, one bill.

The results speak for themselves. After working with Earned Wealth for just 18 months, their clients were saving an average of $77,000 annually in taxes alone. That's not including the investment performance improvements, career optimization, or any of the other value they're creating.

The SaaS-Like Economics That VCs Dream About

What really gets me excited about Earned Wealth isn't just the market opportunity – it's the business model. They've essentially created SaaS-like economics in the wealth management industry.

Think about it: they're generating $10,000 to $20,000 in annual revenue per client at roughly 80% gross margins. They have 107% net revenue retention, which means their existing clients are not only staying but increasing their fees over time. And because they're managing people's entire financial lives, the switching costs are enormous.

This isn't just a services business with good margins. This is a technology platform with network effects, data advantages, and genuine defensive moats. The more physicians they serve, the better their algorithms get at making recommendations. The more data they have about physician career patterns, the more valuable their career advisory becomes.

And unlike most SaaS businesses that have to constantly fight churn, Earned Wealth is serving clients who genuinely want long-term relationships. Doctors don't want to switch financial advisors every two years. They want to find someone they trust and stick with them for decades.

When you combine high unit economics, strong retention, and long customer lifetimes, you get the kind of business model that can scale to massive size while maintaining profitability.

The $200 Million War Chest and What It Means

In July 2024, Earned Wealth announced a $200 million funding round led by Summit Partners and Silversmith Capital Partners. For context, this came just 15 months after their $12 million Series A. That kind of funding acceleration tells you everything you need to know about their traction.

But what's really interesting is how they're planning to use that capital. This isn't just about hiring more advisors and marketing to more doctors. Clendening is using the money to execute a sophisticated acquisition strategy that could fundamentally reshape the market.

The wealth management industry serving physicians is incredibly fragmented. There are hundreds of small registered investment advisors across the country who focus on doctors, but most of them are stuck in the old model: limited technology, manual processes, and narrow service offerings.

Earned Wealth's strategy has evolved to now acquire these firms and integrate them onto their platform. They get immediate access to established client relationships and experienced advisors who understand the physician market. The acquired firms get access to Earned's technology platform and expanded service capabilities.

Their first major acquisition was Thomas Doll, a California-based RIA that added in-house tax planning and retirement program capabilities. But this is just the beginning. With $200 million in the bank, they have the firepower to consolidate this fragmented market at scale.

This is the Vertical Integration playbook from my vertical SaaS taxonomy, and when it works, it works spectacularly. Think about what Toast did in restaurants or what ServiceTitan did in field services. They used technology and capital to roll up fragmented markets and create dominant platforms.

The Competitive Moats Are Real

One of the things I love about great vertical SaaS businesses is how defensible they become once they reach scale. Earned Wealth is already building some serious competitive advantages.

First, there's the data network effect. The more physicians they serve, the better their platform gets at making personalized recommendations. They're building the largest dataset of physician financial patterns in the country, and that becomes increasingly valuable as it grows.

Second, there are genuine switching costs. When someone is managing your investments, handling your taxes, advising on career decisions, and planning your estate, switching providers is incredibly disruptive. It's not like canceling a software subscription.

Third, there's the brand and community aspect. Physicians talk to each other. They refer colleagues to services they trust. Once Earned Wealth becomes the go-to financial platform in medical communities, that network effect becomes self-reinforcing.

And finally, there are regulatory barriers. Financial services is a heavily regulated industry with licensing requirements and compliance obligations. That creates natural barriers to entry that protect established players.

The Road Ahead

If I had to bet, I think we're looking at a company is worth a few billion in the next few years. With their current unit economics and the market opportunity in front of them, that's entirely achievable.

From there, the path to IPO becomes clear. Public market investors love predictable, high-margin businesses serving essential needs in large markets. If Earned Wealth can demonstrate consistent growth and strong retention metrics at scale, they'll have no trouble accessing public markets when the time is right.

But honestly, the IPO might not even be the end game. If they execute their platform strategy successfully, they could become an acquisition target for larger financial services companies looking to access the physician market. Or they could become the acquirer themselves, using their platform to roll up healthcare financial management practices inside all the major firms.

Wrapping It Up

This is going to be fun to watch unfold. And if I'm right about the trajectory, we might be looking at the next $10 billion vertical SaaS success story.

Where are other verticals that could use a dedicated financial services + SaaS business? Will all of these go vertical over time?

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com