Linear #140: Management Team Finger Pointing, Last Day For vSaaS Summit Tix, Vertical Agents Market Map

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

Management Team Finger Pointing

Something that happens IN EVERY single company is some iteration of the following:

“If Sales just sold what we had we wouldn’t have a churn problem.”

“If Product actually built what sales needed we would hit our numbers.”

“If Customer Success implemented faster we could sell more product to existing customers.”

Does this sound familiar? If you’ve ever been in a management meeting or off-site this can become one of the most frequent points of friction. Folks will spend entire off-sites debating these things. And what typically insues? The CEO sitting in the middle of a Spiderman esque-finger pointing session:

I struggled with this dynamic A LOT for many years. I took a lot of different approaches, most of them DID NOT work. A few did. I wanted to break down a combination of solutions that I ultimately helped solve these points of friction:

Approach #1: Listen, Mediate, and “Hash-it-out”

Effectiveness: 6/10

This is what most CEO’s do. They try to ask a bunch of questions, get everybody in the room, and just try their best to hash it out. This can work but I feel it’s typically the lazy approach to problem solving. What I experienced happens here is the loudest in the room just eventually overpowers the opposition and gets their way, even if it’s not necessarily the right approach for the business. Sometimes you just have to do this, but I tried to avoid this approach for the most part. If something was so time sensitive that this was the only thing we could do, we would do it. But I’d be damned if folks didn’t bring data to support the problems that were arising…

Approach #2: Incentives drive behavior

Effectiveness: 8/10

I use to just have departments solely bonused/commissioned on THEIR teams key metric. IE Sales got paid on driving bookings and nothing else. Customer Success was paid on driving retention and nothing else.

I got sick and tired of this happening and so I decided to change up the compensation structure to try and avoid these situations from arising.

I changed EVERYONES compensation structure to the following:

40% was tied to hitting their individual goal

20% was tied to hitting the companies bookings goal

20% was tied to hitting the companies customer retention goal

20% was tied to hitting the companies EBITDA goal

This helped a lot. Sales stopped selling everything at all costs. They knew that if they sold garbage, that would eventually churn, it would impact them. Product wanted to prioritize features that drove new business but also drove retention. Everyone was laser focused on ensuring they didn’t spend more than their budget allocated for. This was a good approach. Not perfect. But pretty good.

Approach #3: Problems can only be presented with prospective solutions, in concert with all department leaders it is effecting

Effectiveness: 10/10

Eventually, I got tired of the finger pointing, and I created a new rule. You can only bring problems with solutions. I think this is often the difference between Director and VP level. No VP or higher should EVER bring a problem to the executive team with out a few ideas of how to solve it. They don’t have to be perfect, but they have to have at least put in some thought about how to solve it. I also required, if it is a cross-departmental problem, that they work on a few prospective solutions WITH the other department leader before they brought it to the management team.

For example, if Customer Success is experiencing a bunch of customers that were sold things the company’s technology just doesn’t actually have the ability to solve. They’d need to do the following.

Gather real-data. Videos of implementation calls, examples of this happening in the wild.

Write up a one-pager on the problem with a few prospective solutions.

Go sit with the Sales Leader.

Allow the sales leader to participate in the problem/solution crafting.

Bring it to the management team to discuss/debate/make a decision

This process can take a few days but it worked. It eliminated the feeling of folks feeling blind-sided / caught off guard in management meetings. It built trust amongst the management team. It is important that the CEO ENCOURAGES this behavior, this stuff HAPPENS all the time in companies. It’s better to encourage folks to go to each other with problems. If another leader refuses to participate and sweeps it under the rug, then that’s when it must get taken to the CEO and they need to get involved - it’s likely you have the wrong leader if that’s happening.

Additionally, the CEO needs to be able to step in and make the hard calls when the team is split. Once I created this structure, I found the management team was able to solve the problem 90% of the time. A few times a year, they’d end up split, and I’d need to step in and make the hard call. That’s ok, that’s part of the process. You having to do make a few tough calls IS important, and it’s far better than making a call EVERY TIME their is a conflict. That’s not an efficient operation…

In conclusion…

I think you need to do all of the above. Different scenarios call for different measures. Sometimes you all just need to get together and hash something out. Sometimes you need the team to dig deep on a problem together and craft a solution. Sometimes you need to tweak incentives so everyone is working on growing the COMPANY, not their individual department.

But when I implemented all three of these things, we were running a solid shop where folks trusted one another, they knew we could always get together to try and quickly solve to something, they knew to bring solutions and not just problems with their peers, and they were all incentivized for the company to do well, not just their individual departments.

One of the CEO’s key tasks is to create the guard rails that allow the management team to effectively run. It doesn’t get talked about enough. Being a visionary is great, but you need to give your team the ability to run an operationally sound shop. It will make your life easier, but it will also make your company better.

Give it a go and see what happens. I think you’ll be pleasantly surprised about how simple yet impactful these guardrails can be…

It’s Your Last Day To Get Regular Priced Tix For the vSaaS Summit!

Prices go way up TOMORROW, September 1st. If you’ve been putting off buying your ticket, now is the time to pull the trigger.

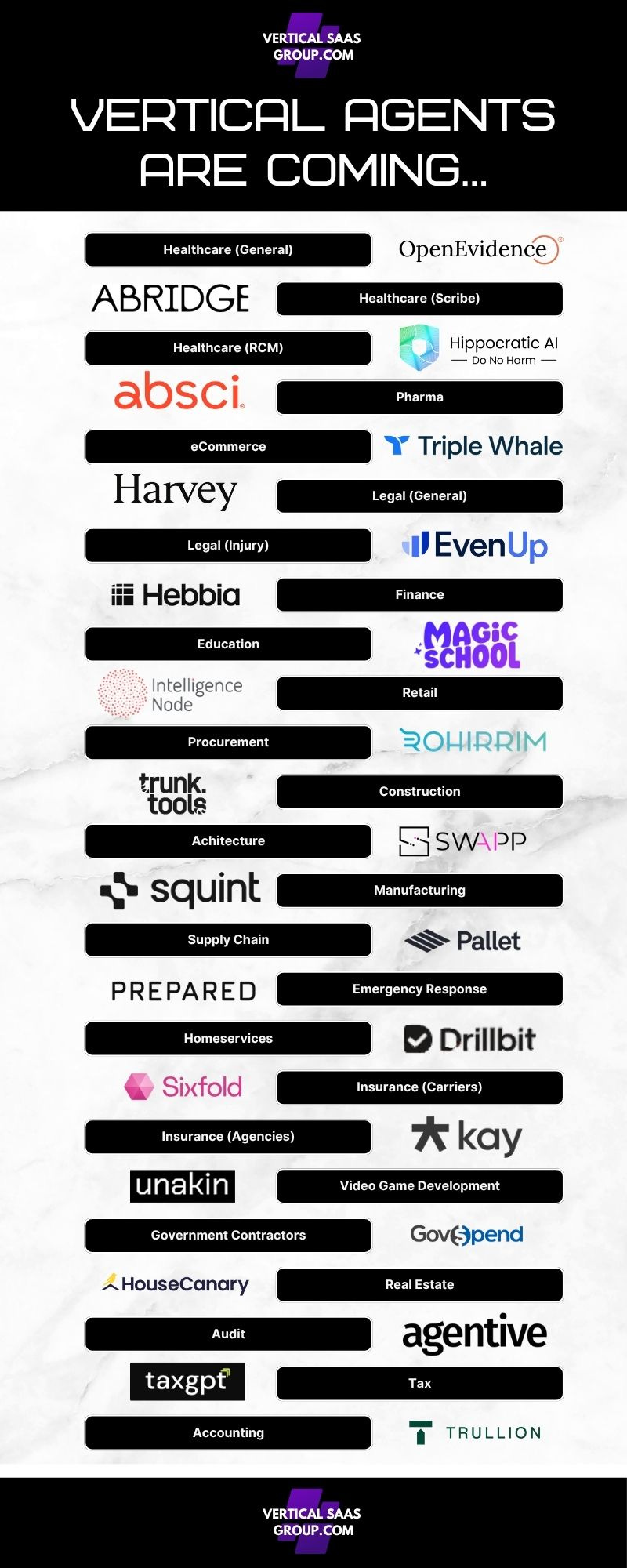

Linear’s Industry/Vertical AI

Market Map

It is still early days in Vertical AI. I do expect that every industry, and I mean EVERY one, will have dedicated AI Agent platforms. The writing is on the wall.

Every customer wants to go to a platform where they can directly hire AI Agents that will do the work at the same level of quality for far less than what their paying human employees. For many industries, it will take a long time to get there, some, we are already seeing it unfold.

I scoured all the latest Vertical AI market maps, read up on as many companies as possible and put together a list of top Vertical AI companies that are doing some very interesting things.

I’m sure I’m missing any, so take a spin through it, and let me know who should be included on the next Vertical AI market mapping / deep dive…

Healthcare (General): OpenEvidence

OpenEvidence develops an AI-powered medical information platform that helps clinicians access and apply evidence-based research quickly at the point of care, reducing information overload. The company has raised over $300 million, including a $210 million Series B round valuing it at $3.5 billion. Notable investors include Google Ventures, Kleiner Perkins, Sequoia Capital, Coatue, Conviction, and Thrive.

Healthcare (Scribe): Abridge

Abridge provides generative AI solutions for clinical documentation, transforming patient-clinician conversations into structured notes with deep EHR integrations. The company has raised $480 million, including a $300 million Series E at a $5.3 billion valuation. Notable investors include Andreessen Horowitz, Khosla Ventures, Lightspeed Venture Partners, Redpoint Ventures, and Union Square Ventures.

Healthcare (RCM): Hippocratic AI

Hippocratic AI builds safety-focused large language models for non-diagnostic, patient-facing tasks like remote patient monitoring and appointment preparation to address healthcare staffing shortages. It has raised $278 million, with a $141 million Series B valuing the company at $1.64 billion. Notable investors include Kleiner Perkins, Andreessen Horowitz, General Catalyst, NVIDIA’s NVentures, and Premji Invest.

Pharma: Absci

Absci is a data-first generative AI drug creation company focused on accelerating biologics discovery and development. The company has raised approximately $300 million since its founding, including public offerings as a Nasdaq-listed company (ABSI). Notable investors include Phoenix Venture Partners, Fidelity Management, and Merck Global Health Innovation Fund.

eCommerce: TripleWhale

TripleWhale offers an eCommerce analytics platform that helps Shopify brands optimize marketing, track performance, and make data-driven decisions. The company has raised $27.7 million, including a $25 million Series B. Notable investors include NFX, Shopify Ventures, and Elefund.

Legal (General): Harvey

Harvey provides AI-powered tools to assist law firms with legal research, document analysis, and case strategy. The company has raised $206 million, including an $80 million Series B at a $715 million valuation. Notable investors include Sequoia Capital, Kleiner Perkins, and OpenAI.

Legal (Injury): EvenUp

EvenUp develops AI-driven software to streamline personal injury case management, helping law firms evaluate claims and maximize settlements. The company has raised $135 million, including a $50 million Series B. Notable investors include Bessemer Venture Partners, Bain Capital Ventures, and SignalFire.

Finance: Hebbia

Hebbia offers AI-powered search and analysis tools to help financial institutions process and extract insights from complex documents. The company has raised $161 million, including a $100 million Series B. Notable investors include Andreessen Horowitz, Google Ventures, and Index Ventures.

Education: Magic School

Magic School provides AI-powered tools to assist educators with lesson planning, content creation, and personalized student support. The company has raised $2.5 million in seed funding. Notable investors include Google for Startups and Reach Capital.

Retail: Intelligence Node

Intelligence Node offers AI-driven retail analytics for pricing, assortment optimization, and competitive intelligence. The company has raised $15 million across funding rounds. Notable investors include Cornerstone Venture Partners and Orios Venture Partners.

Accounting: Trullion

Trullion uses AI to automate accounting workflows, including lease accounting and financial reporting, for enterprises. The company has raised $33 million, including an $18 million Series A. Notable investors include Greycroft, Aleph, and Third Point Ventures.

Tax: TaxGPT

TaxGPT leverages AI to simplify tax preparation and filing for individuals and businesses. Specific funding details are limited, but it has raised an estimated $5 million in seed funding.

Procurement: Rohirrim

Rohirrim develops AI-powered procurement solutions to streamline supplier management and contract analysis. The company has raised $15 million in seed funding. Notable investors include Bessemer Venture Partners and General Catalyst.

Audit: Agentive

Agentive provides AI-driven audit automation tools to enhance efficiency and accuracy in financial audits. The company has raised approximately $10 million in early-stage funding.

Construction: TrunkTools

TrunkTools offers AI-powered construction management software to optimize project planning, scheduling, and resource allocation. The company has raised $20 million in seed funding. Notable investors include Greylock Partners and Innovation Endeavors.

Architecture: Swapp

Swapp uses AI to automate architectural design and planning processes, improving efficiency for architecture firms. The company has raised $11.5 million, including a $7 million seed round. Notable investors include Point72 Ventures and Entrée Capital.

Manufacturing: Squint

Squint develops AI-powered augmented reality tools to guide manufacturing workers through complex tasks and training. The company has raised $13 million in seed funding. Notable investors include Sequoia Capital and Menlo Ventures.

Supply Chain: Pallet

Pallet provides AI-driven supply chain optimization tools for logistics and inventory management. The company has raised $18 million, including a $14 million Series A. Notable investors include Bain Capital Ventures and 8VC.

Emergency Responders: Prepared

Prepared offers AI-enhanced communication tools for emergency responders, improving 911 call handling and response coordination. The company has raised $16 million in seed funding. Notable investors include First Round Capital and M13.

Homeservices: Drillbit

Drillbit develops AI-powered tools for home service businesses, optimizing scheduling, customer management, and service delivery. Specific funding details are limited, but it went through YC and I think a big round is probably coming.

Insurance Carriers: Sixfold

Sixfold provides AI-driven solutions for insurance carriers to streamline underwriting and claims processing. The company has raised $21.5 million, including a $15 million Series A. Notable investors include Salesforce Ventures and Bessemer Venture Partners.

Insurance Agencies: Kay.ai

Kay.ai offers AI-powered tools to help insurance agencies automate customer interactions and policy management. Kay is early, having just raised a $3M Seed Round led by Wing VC.

Video Game Development: Unakin

Unakin develops AI-driven tools to assist video game studios with procedural content generation and development workflows. The company has raised $2.5 million in pre-seed funding. Notable investors include Play Ventures and Y Combinator.

Government Contractors: GovSpend

GovSpend provides AI-powered analytics for government contractors to track procurement opportunities and market trends. The company has raised $10 million in growth funding. Notable investors include TFX Capital and Virginia Venture Partners.Real Estate: House Canary

House Canary offers AI-driven real estate analytics for property valuation, market forecasting, and investment decisions. The company has raised $65 million across multiple rounds. Notable investors include Alpha Edison and PSP Growth.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com