Linear #035: 'Stripe' For Insurance, 10 Mistakes First Time Founders Make, Good VS. Bad Sales Leaders

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Biz Story:

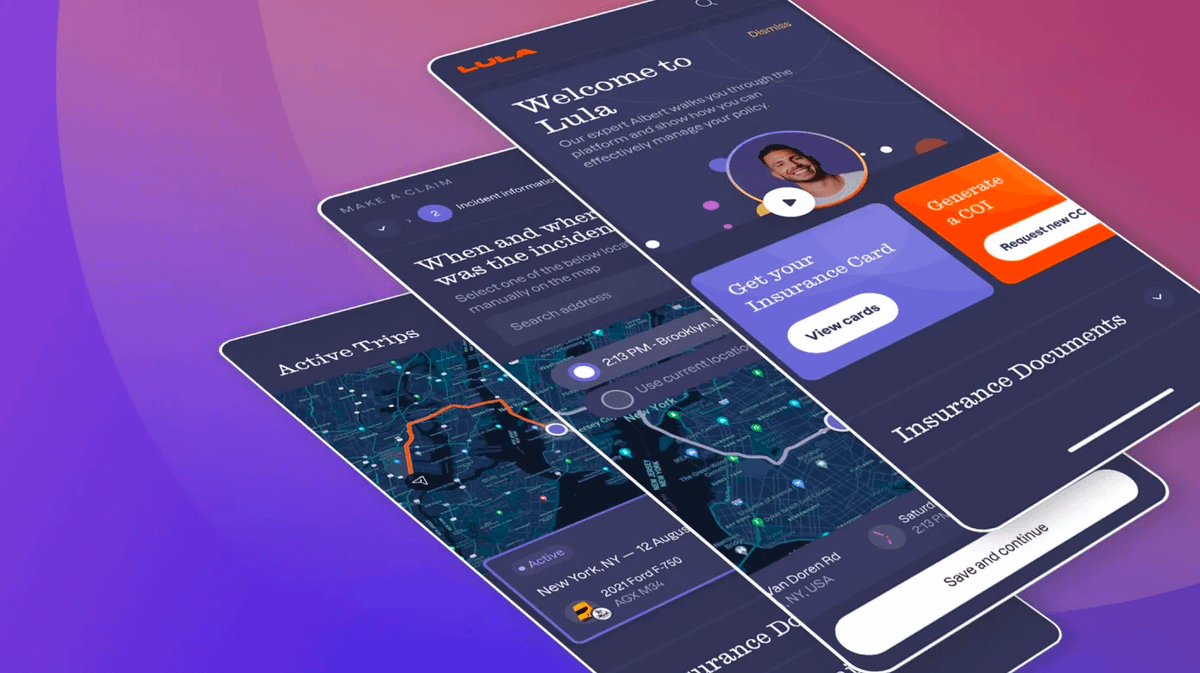

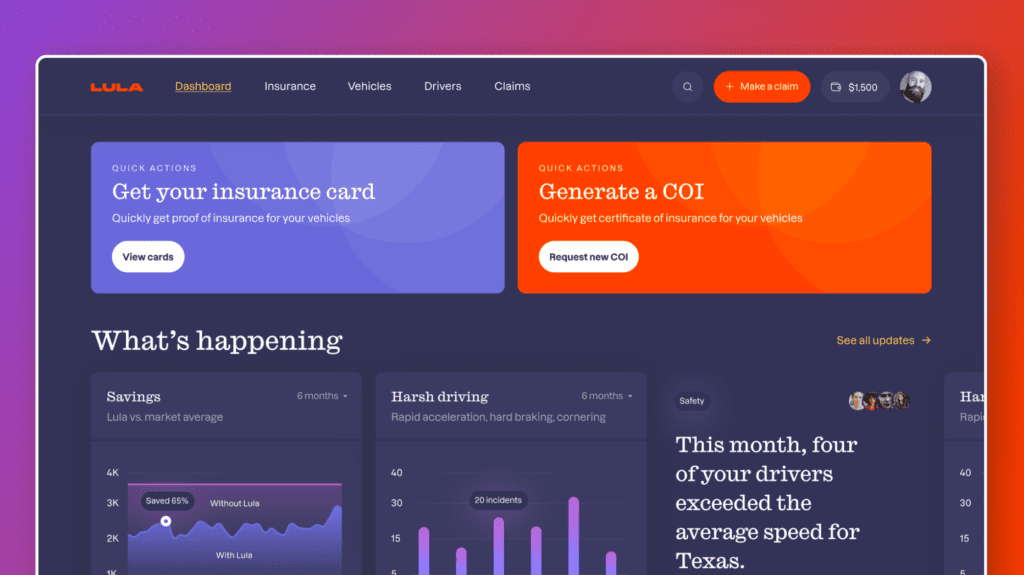

Lula: Stripe For Insurance

Is this the best company pivot in the last decade?

From car sharing app for college students to the "Stripe for Insurance".

These twin brother founders just announced a $35M round in the middle of fundraising winter.

Here's the story:

Meet Lula, an insurance infrastructure startup that allows companies to offer insurance products to their customers. Stripe became wildly successful by enabling any app to offer payments. Instead of offering embedded payments, Lula provides embedded insurance. 💳

The company was founded by Miami natives Michael Vega-Sanz and Zachary Porreca in 2019. They are twin brothers and sons of Puerto Rican and Cuban immigrants who grew up on a small family farm in Florida. Regardless of their humble beginnings, the two brothers had AMBITION...

They founded Lula as a car-sharing app for college students, called Lula Rides, in their college dorm room. Lula Rides scaled to more than 500 campuses in all 50 states before the pandemic shut it down. They they had to come up with something new or face an imminent death...

The brothers realized the vast amount of companies that wanted to vet their customers, insure their vehicles, and manage claims, but didn't really have the resources to do so. They took inspiration from Stripe and aimed to make this turnkey. Enter Chapter 2 of Lula...

In April of 2021, they launched their embedded insurance offering to the trucking industry, and had more than 1,500 companies sign up for it's wait list in just 4 days... They were on to something BIG...

Doubling down on the demand, the brothers raised an oversubscribed $18 million Series A round in mid 2021 co-led by Founders Fund and Khosla Ventures. Even Bill Ackman, the famous hedge fund manager participated... It's also rumored that ~40 VC's competed to lead the round.

Since 2021, Lula has evovled to offer risk management, claims management, and policy management tools. The result? Lula has grown to serve 99 customers in 2022 to nearly 4,000 as of July 2023.

That type of growth is very hard to come by in start-up land right now. In fact, it's nearly impossible to get a round done right now (especially without AI in your name). But, Lula is defying the odds, announcing a $35M raise led by NextView Ventures and Khosla this month.

The founders believe the round will take them to $100M+ in recurring revenue and profitability. I am cheering for them to pull it off, achieving those two things is quite the feat.

From raising chickens in rural Florida to a dorm-room car-sharing start-up, the two twin brothers are now running an insurance infrastructure titan that is racing towards $100M in ARR.

The American dream is alive and well...

One Vertical SaaS Breakdown:

Top 10 Mistakes First Time Founders Make (SaaStr)

Second-timers know the playbook and can execute against it faster. But often times, they also have a bit of healthy skepticism, a bit of baggage, from the last time. First-timers often know very little, but are baggage free. That can be very powerful.

I’ve had a chance to watch a whole cohort of SaaS first-time founders go from $1m to $10m ARR in 5 quarters or less (more on that here) and just been awestruck by how much better than me they are as founders, and how much better they’ve done quantitatively. In awe. And yet, they/we all tend to make the same mistakes. At least, some of them.

I thought I’d catalog them. You may only make 1 or 2. You may make all 10. Who knows. At least, consider using this list to challenge yourself to do even better. Even if you just blew out last month and last quarter.

Mistake #1: Hiring Too Inexperienced and Junior Managers and “VPs”. Stretch VPs can do amazing things if you get it right. More on that here. But a stretch VP is one thing. Hiring someone who’s never really been a manager at all, for a management role, for a true “owner” role … is usually a stretch too far. You can’t make someone who’s never been an owner into a VP. It just doesn’t work. It’s not enough to have worked at Slack / Yammer / Intercom. You have to have owned at least a big piece of the product. To be a true VP of Sales, you have to have hired at least a handful of reps that hit quota. For real.

Mistake #2: Being too cheap. This can be related to the prior point, but not always. “She’s too expensive. She needs $150,000.” It’s tough when you only took out $30k last year as CEO. I know. But … the market sets salaries. Not you. Don’t hire a junior resource at $80k instead of a senior one at $150k. You’ll lose money saving money here. Imagine that Director of VP of Marketing gets you just 2 more customers at $30k each. She’ll have more than paid for her salary difference right there, over than junior content marketer that can’t own anything. And remember — salary vests. A $120k salary is really only $10k a month (ignoring benefits, taxes, etc.). One senior hire is not a big a financial risk as it sounds, as long she or he ends up accretive in her first 90 days or so.

Mistake #3: Micromanaging too much, too long. This can be a tough transition for all of us. But ultimately, the only way you are going to get any leverage on your time is if you trust your team to take ownership of their functional areas. Even with their flaws and limitations. I know you wrote the 1.0 version of the app. I know you closed the first six-figure deal. And you just might be the best customer success manager the company will ever have. I know. But … let it go. Hire the best people you can, as experienced as you can … and let them run with it. You need leverage. You need to scale.

If you don’t stop micromanaging, at least around $4-$5m at the latest, you’ll hit a human capital wall.

And if you under-hire too much (Mistake #1) and/or underpay (Mistake #2) … you’ll never get out of this trap.

Mistake #4: Falling in love with Logos (especially in hiring). I know Box is an exciting company. I know you’ve heard of Salesforce. But … that doesn’t mean you should hire from there. Logos give you a false sense of security if you haven’t done it before. And in many cases, those logos are way, way too late stage for your company.

You do want been there, done that managers, directors and VPs. But don’t let the logo blind you to their flaws, or more importantly, blind you to the risks if they aren’t a stage-appropriate hire.

And don’t let a logo, especially, blind you to the fact that they may never have actually hired anyone directly before, or owned a number, or a product, or project, or lead commit, etc.

How many folks at Box today have owned a core feature? Have owned a true lead commit? Have hired an entire sales team under them, not just inherited one? Not. That. Many. But tons of smart folks have worked in these functional areas.

We’re all guilty here. Even fourth-timers. Just don’t let it blind you.

Mistake #5: Not moving, going all-in geographically, etc. If you need to be in the Bay Area — be there. Don’t hack it by moving to New York. Don’t spend 20% of your time in San Francisco. And the other way (geographically) — if you need to add a field sales team in London — just do it. Do it. Waiting to $10m ARR to see if you should go for it or not, is just way, way too late.

Yes, the newly distributed world has changed a lot. If you don’t need to be somewhere, don’t do it. But if you do — pick right.

Most importantly, realize that if the majority of your revenue is from U.S. customers, especially if you are more enterprise, you almost certainly need to be headquartered here in some fashion. Not your entire team, but probably your HQ. Even if it’s a smaller HQ than it would have been pre-Covid. (Yes, we’re all still learning here now).

Mistake #6: Not being merciless. This is different than being inhumane. Bad hires are always your fault. Most especially up to 50 employees or so, when you’ll be directly involved in the hiring process. If a hire doesn’t work out, you screwed up. You did. But be merciless. Make a change. Now.

Be merciless about going up-market (next point).Be merciless about raising prices. Be merciless about setting real quotas that maybe only your top reps can meet at first. Be merciless about requiring a true lead commit from marketing, not “best efforts”. Be merciless about security and the product roadmap. Be merciless about making sure your enterprise customers give you the highest possible NPS.

Be full of mercy. You will make so many mistakes. But be merciless in driving the company to where it needs to go.

Mistake #7: Not going up-market fast enough. If you have one $100k customer, you can get 2, and then 10. And if you have one $100k customer, you really think the next one can’t pay $150k? Of course they can. Don’t be scared. Don’t be timid. Push up market as fast and as hard as you can. Make the ask. Do it.

Don’t invent new categories of pricing if there’s no demand. But when you see yourself going more enterprise, into bigger deals, don’t be timid. Be grateful. Treat your customers with utmost respect and appreciation. But on deal sizes and going up-market … be merciless.

This isn’t to say all apps should go enterprise. If you can get to $5m, $10m, $20m+ with a freemium or self-serviced product, do that by all means. Don’t go upmarket if you’re purely, 95-100% an SMB product. But if you are going to go upmarket, if it’s starting organically already — then do it faster.

Mistake #8: Not focusing almost entirely on what’s working. There can be a huge temptation from $1m to $10m to find new categories, new types of customers, new products. Don’t. Find your natural pattern of customers (more on that here), small, medium and large. Figure out the organic ratio here. And just keep selling in that ratio, with an appropriate allocation of scarce resources.

If 90% of your revenue at $2m ARR is from SMBs … then, I know the enterprise logos feel good, I know it’s exciting to have Facebook as a customer … but the fastest way to $10m ARR is going to be from SMBs (mostly).

If 60% of your revenue at $2m ARR is from big customers … but the sales cycles are slow … so what. Shorten them. Don’t start looking for magic at the bottom of the market. That’ll just slow you down. Dramatically. Suck it up. Double down on what’s working. Even if it’s taking longer than you want.

Drive from $2m to $10m ARR on the path of least resistance. 9 times out of 10 the path of least resistance, the fastest way to $10m ARR, is just what you’re already doing. But better, with higher ACVs, and a more practiced sales and marketing engine. And with strategic upgrades to the team.

Mistake #9: Not backfilling enough. Once you’ve figured out how not to micromanage, and get out of the way … now you need to learn a new skill. How to backfill. Just enough. In the right places.

Don’t get mad because your VP of Product really isn’t that great at say, UI/UX. Don’t get frustrated because your VP of Marketing is great at generating leads, but her case studies are ugly and her prose is boooring. Don’t get all bent out of shape that your VP of Sales, even though she’s killing the plan, is too quantitative. Or is too qualitative. Or only wants to do big deals. Or only wants to do inside sales. Or doesn’t do great board slides. Whatever.

No VP has the full package of skills. Not one. And even if they do, they are biased in favor of what they did last time. Or at the very least, they are much better at some parts of the job than others.

As CEO and founders, your job isn’t to meddle in what your VPs and leadership team already know how to do. It’s to help backfill the areas they are a little weaker in. To help them get that extra help. To drop into the right deals, but not the ones they don’t need help on. To get on a plane when they can’t, or when they need a wing man. To spec out that one big feature they can’t see.

Whatever it is. Backfilling a great team is how you scale from $2m to $10m and beyond.

Mistake #10: Taking too much advice.

A lot of advice isn’t stage appropriate to you. A lot of advice isn’t ACV appropriate (someone doing $500k deals really can’t tell you how to do $5k deals).A lot of advice is too dated.A bunch of advice (especially VC stuff) has a bias or hidden agenda.Some of it is from pattern matching, but from folks without the operational experience to back it up. Be careful here.And worse — quite a bit of it is from founders that have built a product — but haven’t actually done it yet. Be super skeptical there. I’d almost entirely ignore advice from folks that haven’t at least gotten to $8-$10m ARR. Or at least, 2-3 stages beyond you.

One ‘How To’:

Good Sales Leaders Versus Bad Ones

Click the tweet photo above to see the breakdown