Linear #138: Data Is The New Oil (But actually this time), Triple Whale - Vertical AI for eCommerce

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

Data Is The New Oil

(But Actually This Time)

I remember hearing this periodically over something like a fifteen year period.

The statement was kind of true, but it never-sparked the oil analogy it exuded. Not quite like Jerry Jones striking oil in 12 of the first 13 wells he bought, with his first well yielding $4 million worth of oil alone.

I think the whole data is the new oil is actually real right now. There are a few reasons for this.

The big AI players (OpenAI, xAI, Anthropic, etc.) are all building their LLM’s based on the open internet. Their data comes from the trillions of information publicly available on the internet.

These things have gotten insanely smart in a very short amount of time. It’s absolutely wonderful. I enjoy them as much as the next person.

But think of all the quality information that is trapped behind log-in screens that these LLM’s can’t access…

I’m talking healthcare software systems, transportation ERP’s, whatever system your regional electricity system runs on, an ERP that owns the restaraunt space, the car dealership space, the cancer research space.

That’s what I’m really excited about. Industry-specific LLM’s. That’s where the magic is really going to happen.

If you are sitting on a system filled with proprietary, high quality data, make sure it NEVER makes it’s way into these horizontal tools. You are sitting on a Jerry Jones type of oil-field where you will have a few highly lucrative options…

Build your own LLM / AI Agent platform on top of

Partner with a company to build your own LLM / AI Agent platform

Sell it

In conclusion…

Data is finally the new oil.

AI has made it so.

Last call for Tickets. Prices Go WAY UP in ~2 weeks. Join us at the Vertical Software Summit:

We have so many amazing speakers BUT also important to point out that we are planning VIP dinners around the conference. I am curating dinners for registrants with VC’s, GE/PE shops, and acquirers. I wish I had this when I had my company…

If you need a free ticket too don’t hesitate to ask. Happy to give them out for folks that can get to Miami. Just reply to this email and let me know!

Triple Whale: Vertical AI for eCommerce

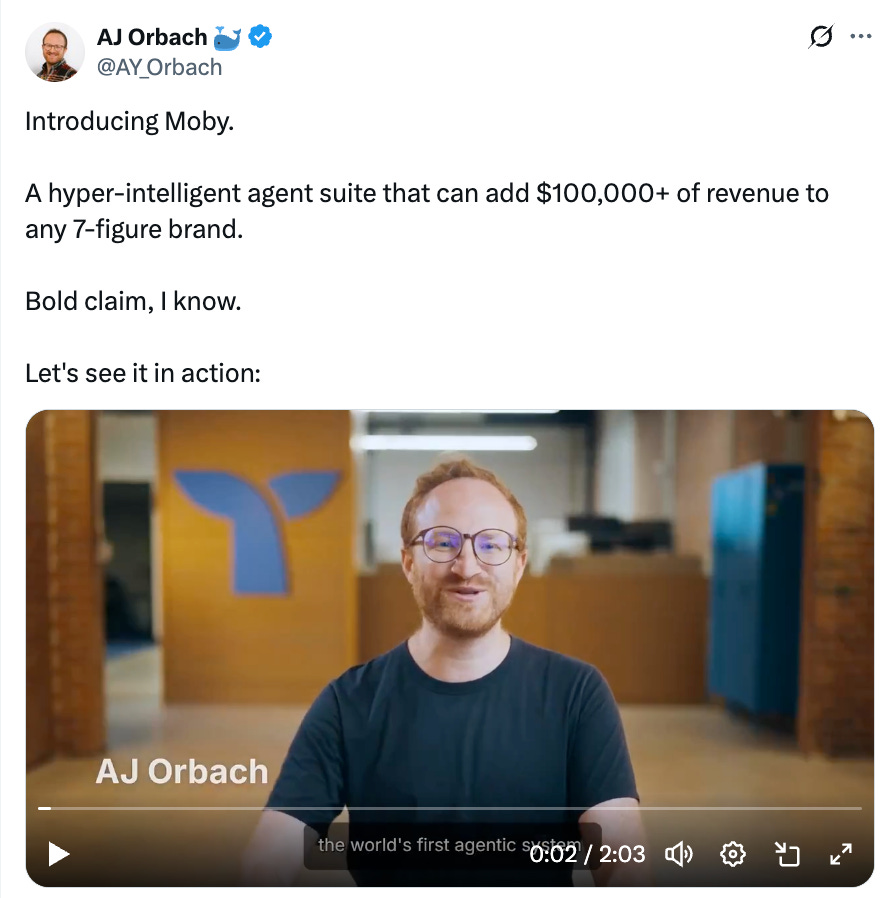

I came across Triple Whale via their launch video on X that blew up a few weeks back. This was the BEST launch video i’ve seen in a while with a crazy clear ROI promise. It is a case study in how to launch. So I just had to dig into the business and do a write-up on it for you…

While every other analytics company was building generic dashboards, three e-commerce operators were drowning in spreadsheets, manually copying data from Facebook to Shopify, trying to answer one simple question: where should we spend our ad dollars tomorrow?

That frustration became a $50+ million business in less than a few years. This isn't another SaaS success story. This is what happens when vertical market expertise meets AI-first product development. And the execution? Spectacular.

The year was 2018. Maxx Blank and his wife were running Madison Braids, a hair accessory brand doing solid eight-figure revenue on Shopify. Classic DTC playbook: Facebook ads, influencer marketing, and a lot of manual data wrangling.

Here's what their daily routine looked like:

Export data from Facebook Ads Manager

Pull Shopify analytics into CSV

Manually compile everything in Google Sheets

Try to figure out which campaigns were actually profitable

Make educated guesses about tomorrow's ad spend

Sound familiar? Every DTC operator has been there.

The breaking point came when Maxx found himself constantly fielding calls from AJ Orbach (who had joined the Madison Braids team) asking the same questions: "How are we trending? What's our ROAS looking like? Should we scale this campaign?"

"I was out with the kids and had to go back to get the laptop just to pull basic metrics. I thought, there's no way AI can't do my job better than this manual process." - AJ Orbach, CEO

That frustration led to a simple internal tool: a mobile-friendly dashboard that aggregated their key metrics in real-time. Think Robin Hood for e-commerce KPIs—refresh and see exactly where you stand.

They called it the Summary Page. And it worked so well for Madison Braids that other DTC founders started asking for access.

Founding Team

Here's what makes this founding team special: they're e-commerce operators who got sick of the tools available and decided to build what they actually needed.

AJ Orbach (CEO) is the product visionary who met Maxx as young entrepreneurs in Jerusalem. While most SaaS founders were still figuring out product-market fit in 2021, AJ was already betting the company on AI automation. His thesis? "There's no way AI can't do my job better than this manual process." He was right—and early.

Maxx Blank (COO) brings the business and marketing expertise that most technical founders lack. Before TripleWhale, he consulted with e-commerce businesses, learning every aspect of the industry. Then he scaled Madison Braids from zero to eight figures.

Ivan Chernykh (CTO) is the technical co-founder who joined to build the data infrastructure that makes everything else possible.

This combination is exactly what vertical software needs: deep market expertise (Maxx), product vision (AJ), and technical execution (Ivan). They didn't need to learn the market—they lived it. They didn't need to guess at product requirements—they felt the pain daily.

Most importantly, they had what AJ calls "mutual respect" for what each person brought to the table. That's rare in founding teams and absolutely critical for the long execution cycles that vertical software requires.

Product Evolution: From Summary Page to AI Agents

Most vertical software companies build one product and iterate. TripleWhale rebuilt their entire platform three times—and each evolution was driven by fundamental shifts in the market.

Phase 1: The Summary Page (2020-2021)

The original MVP was simple: aggregate data from Facebook, Google, Shopify, and email platforms into one dashboard. Mobile-first, real-time updates, and focused on the metrics that actually drive decisions.

Early traction was immediate. The DTC Twitter community latched onto it because it solved a universal pain point. But then Apple dropped iOS 14.5.

Phase 2: Triple Pixel (2021-2022)

Apple's privacy changes decimated Facebook's attribution data overnight. Suddenly, every DTC brand was flying blind.

While most analytics companies scrambled to build workarounds, TripleWhale made a bold bet: build first-party attribution from scratch.

The Triple Pixel became their moat. By tracking user behavior directly on-site and connecting it to ad performance, they could provide attribution data that Facebook couldn't. This wasn't just a feature—it was survival-level critical for their customers.

Phase 3: Moby AI (2024)

With clean data infrastructure in place, TripleWhale could finally build what they'd always envisioned: AI that actually understands e-commerce.

Moby wasn't just another ChatGPT wrapper. It was trained on billions of commerce events and spoke the language of ROAS, AOV, LTV, and BFCM from day one.

The beta launch was insane. 25% of their user base joined the waitlist immediately. Early users sent 40,000+ messages and built thousands of custom reports.

Phase 4: Moby Agents (2025)

This is where things get really interesting. Moby Agents aren't just answering questions—they're proactively running analysis, spotting anomalies, and making recommendations.

The Whalies 2025 Product Keynote - Watch the spectacular launch:

This 32-minute keynote showcases live AI agent demos and real customer success stories. The production quality alone tells you these guys understand brand building.

One early customer story from the launch says it all:

"I gave Moby context about our giveaway final day and asked it to analyze our previous performance. I followed its recommendations to a tee—exact scaling times, bid cap adjustments, everything. We hit our highest spend, highest profit, and highest revenue day ever. Beat our previous record by $200,000." - TripleWhale Customer

That's not a marginal improvement. That's print money territory.

Go-to-Market Motion: The DTC Twitter Playbook

Most B2B SaaS companies burn millions on Google Ads and cold outbound. TripleWhale cracked the code on community-driven growth.

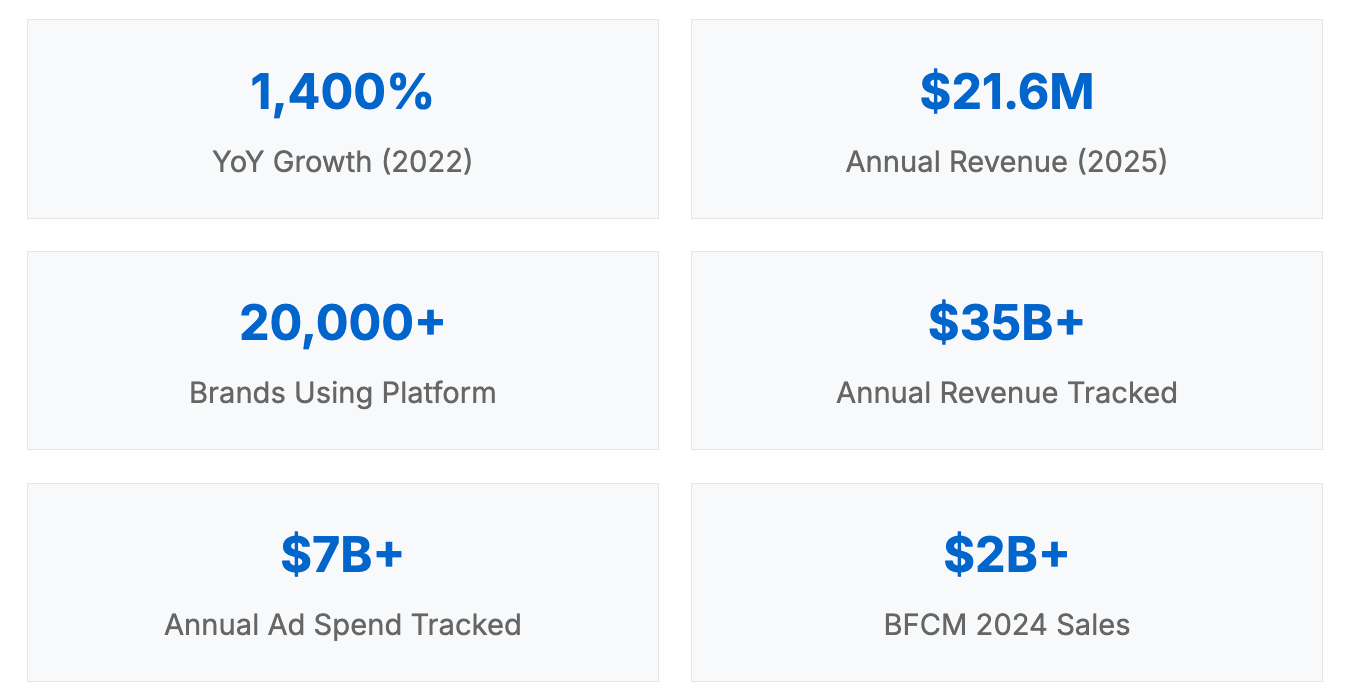

Let's put these numbers in perspective for vertical software operators:

$21.6M ARR with 196 employees = $110K revenue per employee. That's solid efficiency for a high-growth SaaS company.

$35B+ in tracked revenue means they're processing roughly 2-3% of all US e-commerce transactions

$7B in ad spend data gives them unmatched benchmark insights across every channel and vertical

20,000+ brands spans from $100K startups to $100M+ enterprises—that's product-market fit across segments

But here's the metric that really matters: brands see an average 42% increase in new customer revenue 90 days after signing up.

That's not attribution voodoo or correlation games. That's measurable business impact that shows up in bank accounts.

For context, most analytics tools struggle to prove any revenue impact. TripleWhale customers are literally growing 40%+ faster after implementation. That's the difference between nice-to-have and must-have software.

Revenue Growth & Customer Retention

The latest data shows TripleWhale hit $21.6M in annual revenue with a 196-person team. That's roughly $110K revenue per employee—solid for a fast-growing SaaS company.

More importantly, their customer success stories are getting ridiculous:

Shine On: +84% revenue increase, +86% ad spend efficiency, +12% AOV improvement

Origin Brand: Built a 4-day sale analysis in 5 minutes using Moby that would have taken days manually

Multiple customers: Reporting 6-figure revenue improvements within 90 days

Pricing starts at $100/month for basic dashboards, with their full suite at $400/month. For brands doing $1M+ annually, that's a no-brainer ROI.

The customer retention metrics aren't public, but based on their growth trajectory and expansion revenue, they're clearly doing something right.

Funding: When Shopify Writes Checks

The funding story tells you everything about TripleWhale's market position and growth trajectory.

Funding Timeline:

• 2020: $2.7M Seed (led by NFX)

• 2022: $24M Series A (led by Elephant)

• 2023: $25M Series B (NFX + Elephant + Shopify strategic)

The Series B is where things get interesting. When Shopify writes a strategic check, it's not just about the money—it's about validation and distribution.

"Triple Whale has built an excellent marketing analytics platform that equips multi-channel merchants with the marketing insights they need in a fast-evolving online retail landscape." - Sabrina Frias, Corporate Development Manager at Shopify

Shopify has visibility into every merchant's performance. They see which tools actually drive results and which ones are just dashboard theater. When they invest in TripleWhale, they're betting on a platform that measurably improves merchant success.

The timing also matters. This was February 2023—right when every SaaS company was struggling to raise. TripleWhale not only closed their round but did it with their biggest potential competitor as a strategic investor.

Vision: The Future of AI-Powered Commerce

Here's where TripleWhale gets really interesting. They're not just building better analytics—they're building toward full automation.

AJ Orbach put it perfectly in their recent keynote:

"The people that will be successful are managers of agents. That's going to be a new big role that will emerge. If you don't have an agent manager in your brand or agency, you should get one or turn one of your employees into that."

They're already seeing early customers hire people specifically to manage AI agents. That's not a feature request—that's a fundamental shift in how e-commerce teams operate.

The roadmap includes:

Full media buying automation based on real-time performance data

Inventory management with demand forecasting and automatic reordering

Customer lifecycle automation across email, SMS, and retention campaigns

Creative optimization with AI-generated ad copy and imagery

But the biggest opportunity? Becoming the operating system for e-commerce.

When every piece of data flows through TripleWhale and every decision gets augmented by their AI, they become indispensable. That's not just recurring revenue—that's permanent market position.

Why This Matters for Vertical Software Operators

The TripleWhale story offers several key lessons for anyone building vertical software:

1. Dogfooding is Your Unfair Advantage

Most vertical software fails because founders are outsiders trying to solve problems they don't understand. TripleWhale succeeded because Maxx and AJ were spending $50K+ monthly on Facebook ads and manually copying data into spreadsheets every single day.

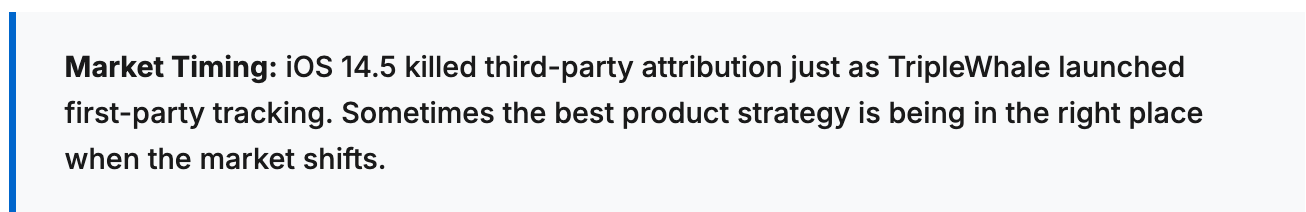

2. Market Timing Beats Perfect Products

iOS 14.5 could have killed TripleWhale. Instead, it became their biggest competitive advantage because they were ready with first-party attribution while everyone else scrambled.

The best vertical software opportunities come from regulatory or platform shifts that break existing solutions. Think GDPR for privacy tools, or SOX for financial compliance software.

3. Domain Expertise Makes AI Defensible

Generic AI is a commodity. ChatGPT can write decent ad copy for anyone. But Moby understands the difference between blended ROAS and channel ROAS, knows that BFCM performance predicts Q1 success, and recognizes seasonality patterns across thousands of e-commerce brands.

The AI moat isn't about having better models—it's about having better training data and deeper context. Generic AI tools will get commoditized. Vertical AI trained on proprietary datasets with deep domain knowledge will stay defensible.

4. Community-Driven B2B Actually Works

Most B2B SaaS burns millions on Google Ads and cold outbound. TripleWhale cracked organic growth through the DTC Twitter community—authentic engagement, not ads.

The key insight: Every vertical has its own community where operators gather to share insights. Find those communities, provide genuine value, and let word-of-mouth do the work.

5. Build Data Moats, Not Feature Moats

Competitors can copy features. They can't copy your data flywheel. TripleWhale's real moat isn't their AI—it's the $35B in revenue data and $7B in ad spend they've collected. Every new customer makes their benchmarks more valuable. Every transaction processed improves their algorithms.

In vertical software, the companies that win long-term are the ones that become the system of record for their industry. Not just another tool, but the central nervous system where all data flows.

6. Transaction Data > Analytics Data

Here's the difference between TripleWhale and every other analytics company: they process actual transaction data, not just marketing metrics.

The best vertical software doesn't just measure business processes—it becomes part of them. Payment processing, inventory management, compliance reporting—these create switching costs that analytics dashboards never can.

Ask yourself: How can your vertical software move from measuring outcomes to influencing them?

The Bottom Line

TripleWhale proves that the biggest vertical software opportunities aren't in building better versions of existing tools. They're in rebuilding entire categories around AI-first architectures with deep domain expertise.

The numbers tell the story: $50M raised, 20,000+ customers, $35B in tracked revenue, 1,400% growth, and Shopify as a strategic investor. But the real story is execution—solving fundamental problems with technical depth and market understanding that competitors can't replicate.

Every vertical is about to go through the same transformation that e-commerce is experiencing right now. The question is whether you'll be building the intelligence layer for your industry or buying it from someone else.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com