#136: VC's Invest In The Frontier: Lessons From History & What's Next, How To Structure Bonuses

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s newsletter is sponsored by Unit, the leading embedded finance platform for vertical SaaS.

Become the financial OS your customers rely on. With Unit’s Ready-to-Launch solutions, you can embed capital, banking, and bill pay in weeks - zero build required. Trusted by platforms like Bill.com, HoneyBook, and Homebase.

Learn more at unit.co

Alright, let’s get to it…

VC's Invest In The Frontier: Lessons From

Tech History & What’s Next

I’m a big proponent of studying history to understand what’s happening right now and what’s going to happen. AI is moving so fast that is tough to decipher what is next. One constant, is that VC’s are very good at investing in the frontier. This helps pave the way for where the opportunities are and what comes next…

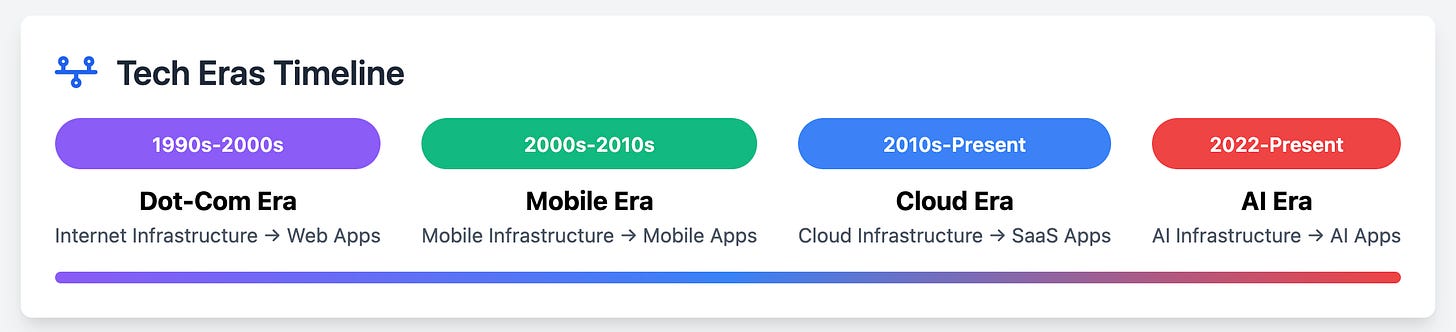

Let’s look at history to help us understand where we are:

Dot-Com Era (1990s–Early 2000s): The Internet Wild West

Back in the ‘90s, the internet was a crazy, unproven idea. VCs saw the potential and went all-in on infrastructure—think Cisco (backed by Sequoia) for networking gear and AOL (Kleiner Perkins) to get people online.

Risky? Hell yeah. Most folks were still using dial-up, and nobody trusted the web. But those bets built the pipes for what came next.

The App Layer Flip: Once the internet was stable, VCs pivoted to apps.

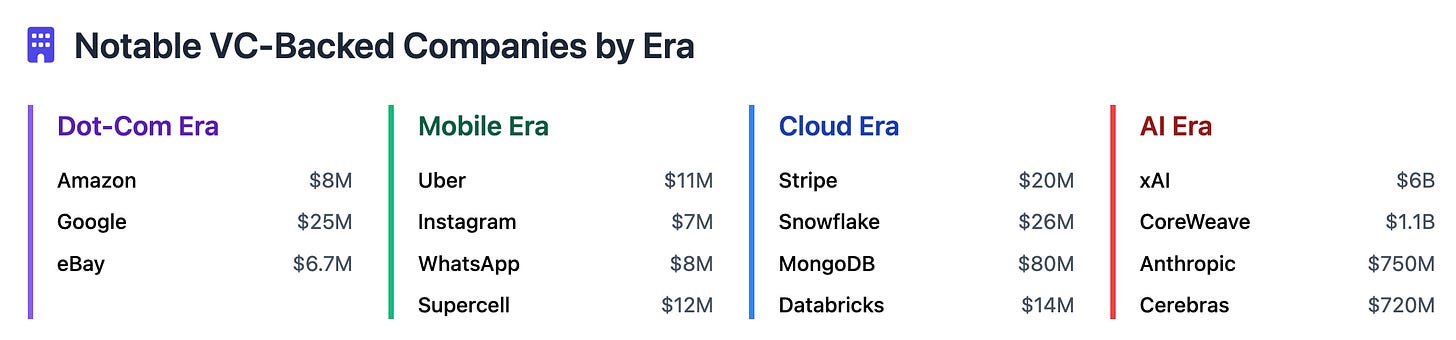

Amazon ($8M from Kleiner Perkins, 1996) made e-commerce real when people thought online shopping was a fad.

Google ($25M from Sequoia/Kleiner Perkins, 1999) turned search into a cash machine.

eBay ($6.7M from Benchmark, 1997) let strangers trade online.

These weren’t just companies—they were categories that rewrote the rules. The dot-com bust crushed the weak, but the winners became legends.

Takeaway: In any major tech innovation, Infrastructure is the initial frontier, and really sets the stage, but app-layer companies come next, and leverage a STABLE infrastructure to build massive companies. It’s also clear that there are almost ALWAYS a lot fewer winners in the infrastructure layer than there are in the app layer.

Let’s fast forward to the next big tech innovation…

Mobile Era (2000s–2010s): Smartphones Changed Everything

Before the iPhone dropped in 2007, VC was backing the enablers—Clearwire ($100M+ from Kleiner Perkins) for mobile broadband, Qualcomm for chips, etc. They backed the infrastructure technologies that made the iPhone moment possible…

The App Layer Flip:

The App Store and Google Play unleashed a startup frenzy.

WhatsApp ($8M from Sequoia, 2011 enabled international comms via internet.

Uber ($11M from Benchmark, 2011) turned your phone into a taxi cab.

Instagram ($7M from Benchmark, 2011) made photo-sharing a global obsession.

Supercell ($12M from Accel, 2011) proved mobile gaming was a cash cow.

These apps rode the smartphone wave to billion-dollar valuations, fast.

Takeaway: Mobile infrastructure was definetly more corporate-led, but VCs who bet on apps like Uber won big.

Noticing a trend? Let’s look at one final example…

Cloud Era (2010s–Present): The Enterprise Revolution

Cloud computing flipped IT on its head and VCs initially funded the backbone DigitalOcean ($40M from Andreessen Horowitz, 2014) for developer clouds, MongoDB ($80M from Sequoia/NEA, 2014) for databases. AWS led the charge, but VCs found their edge in what came next.

The App Layer Flip:

Dropbox ($6M from Sequoia, 2008) made file-sharing effortless.

Snowflake ($26M from Sutter Hill, 2014) redefined data warehousing.

Stripe ($20M from Sequoia/Andreessen Horowitz, 2012) simplified online payments.

Databricks ($14M from Andreessen Horowitz, 2013) blended cloud and early AI for analytics.

So how does all this relate to what’s going on in AI? Let’s explore…

AI Era (2022–Present): The Enterprise Revolution

The first stage is funding the infrastructure. Billions are flowing into LLMs and data centers—the infrastructure of tomorrow.

Anthropic ($750M from Menlo Ventures, 2023) is building safe AI models.

xAI ($6B from Sequoia/Andreessen Horowitz, 2024) is pushing scientific discovery with Grok.

CoreWeave ($1.1B from Coatue, 2024) is scaling GPU data centers.

Cerebras ($720M from Benchmark, 2023) is crafting AI chips.

Even energy’s getting love—Oklo ($25M from Mithril, 2023) for nuclear to power those hungry data centers. This is big, capital-intensive stuff.

The App Layer Flip (Is Just Beginning!): The LLM’s are very much horizontal apps built on top of infrastructure, but they have the API technology to allow ANYONE to build an industry-specific app that is trained on industry data. Agent platforms are still very much horizontal).

The Opportunity is NOW

We're currently transitioning from AI Infrastructure to AI App Layer

The next 2-3 years will see massive industry-specific vertical AI app companies get built.

Time to build Vertical AI Apps that leverage stable infrastructure :)).

Get building my friends.

Hear about the future of the Vertical AI App Layer from billion dollar vSaaS founders at the the vSaaS Summit !

How To Structure Bonuses That Work For Employees AND The Business

I'm a big believer in Charlie Munger's quote,

There are three primary metrics that drive the ultimate value of a software or technology company:

Annual Recurring Revenue (ARR)

Net Dollar Retention (NDR)

EBITDA (Typically it’s Free Cash Flow but folks recognize EBITDA more often)

I view these as the metric North Star.

Additionally, most companies leverage Objectives & Key Results / milestones for each team member to track their individual progress and performance. I often see bonuses be willy nilly or solely tied to an individuals attainment of their own milestones. I think that's wrong.

It has to be about "we" versus "I". Structuring a bonus plan were everyone gets paid on the company AND the individual goals creates the right alignment and incentives for all involved. BUT, it has to be simple! Here's an example...

If an employed makes $100K in base and has the opportunity to earn an incremental $40K via bonus I would structure their incentive plan like this:

25% Individual Milestone Attainment

25% Company ARR Plan Attainment

25% Net Dollar Retention Plan Attainment

25% EBITDA Plan Attainment

If the employee achieves their individual milestones over the 12 month period they pocket $10K incremental. If the company achieves the ARR goal they pocket another $10K. And another $10K for the Net Dollar Retention Plan. Another $10K for EBITDA plan.

I also do "uncapped" because I don't want people to stop if we're doing a great job. So if they company achieves 120% of the ARR plan they get $12K versus $10K. Same goes for their individual milestones and the Net Dollar Retention goal.

I also pay out bonuses 2X a year, some do it 4X, some just once. I've personally found 2X is the right cadence. Mid year and end of year.

Your software company is going to be valued primarily by ARR and Net Dollar Retention. Everyone achieving their individual goals should lead to these two areas being strong. Regardless if they work in accounting, product, or engineering.

If you're NOT tying an employees bonus to the ultimate value drivers of the business do your employees have the right mindset? Are they working on the right things?

This has worked for me but I'm curious to hear how you all are structuring bonuses. What works for you?

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com