#135: Are The New Vertical Software Leaders Just Vertical Specific Super Agents? What Will Kill Your Start-Up & What Won't

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by Rainforest, the embedded payment provider purpose-built for vertical software platforms.

Grow revenue with the only payfac-as-a-service provider optimized to help you drive more payments volume at higher margins, without risk or compliance headaches.

Learn more at rainforestpay.com

Alright, let’s get to it…

Is the New ERP just a Vertical Specific Super Agent?

I’m in thinking mode on where all this AI technology takes us over the next ten years. Every industry will look different, and no one really knows in what ways, but I have some ideas…

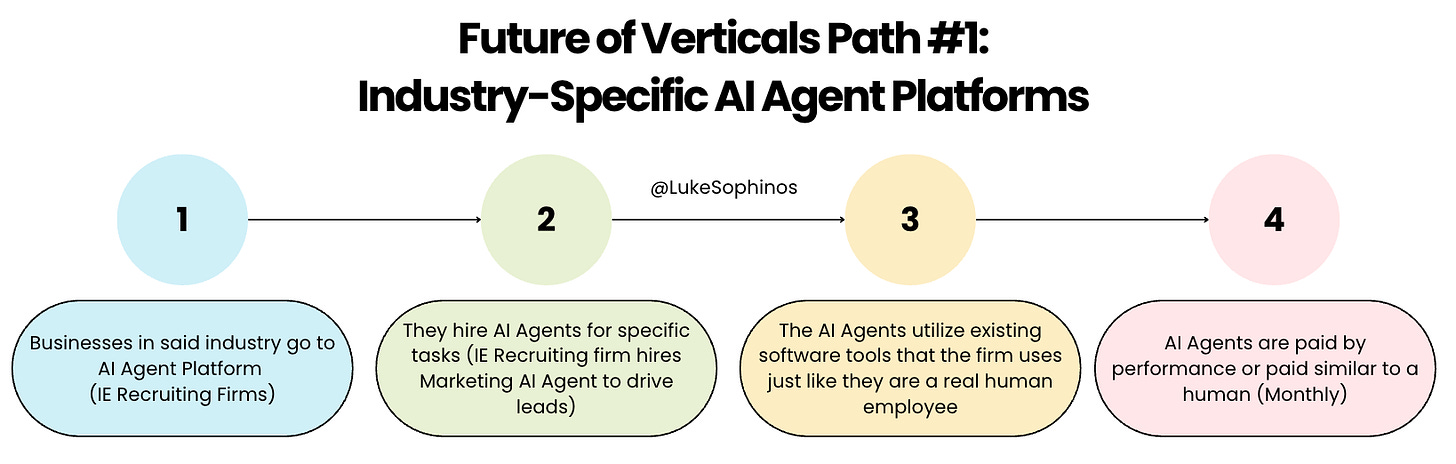

One path — Industry/Job-specific AI agent workforce platforms pop up. You go these platforms to buy AI Agents that interact with your existing vertical software tools just like they were human beings that we hired. You hire an AI Marketing Agent that does everything your marketing person does, an AI FP&A Agent that does everything your FP&A person does, etc.

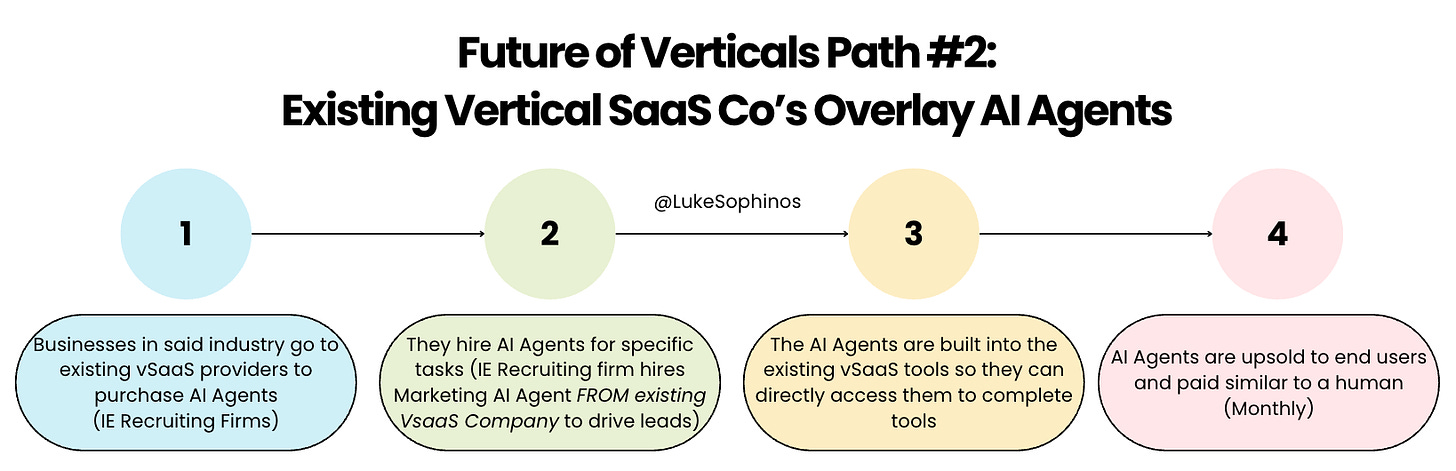

Another potential path — Existing vertical software platforms layer in AI Agent products on top of their data moat. You just go to your existing ERP/biz management vendor and are upsold on an AI product just like you would be on another SaaS product they offer. This is the most simple path but also potentially the highest friction one too. Why? Because many of these companies are just not AI-fluent and I see many of them moving VERY SLOW.

But I’d like to introduce a third path today…

One that I haven’t read about anywhere or heard folks talking about.

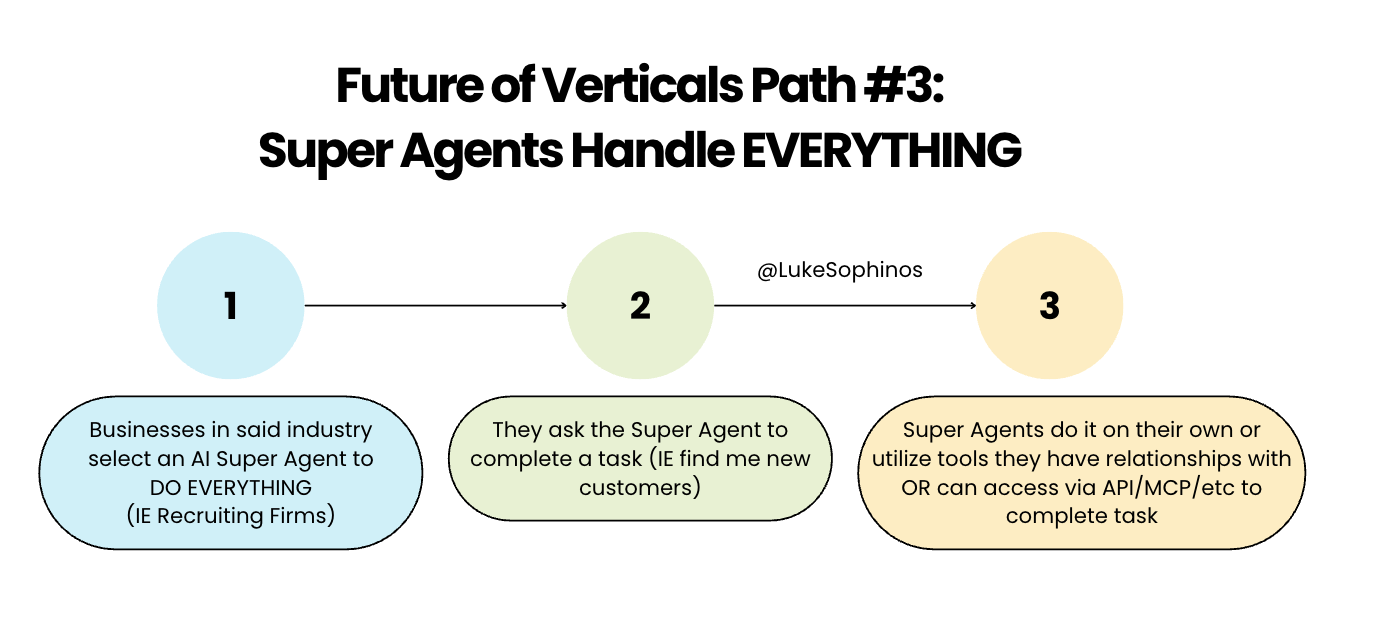

What if there no longer is an ERP or biz management system?

Could there just be a Super Agent for every industry?

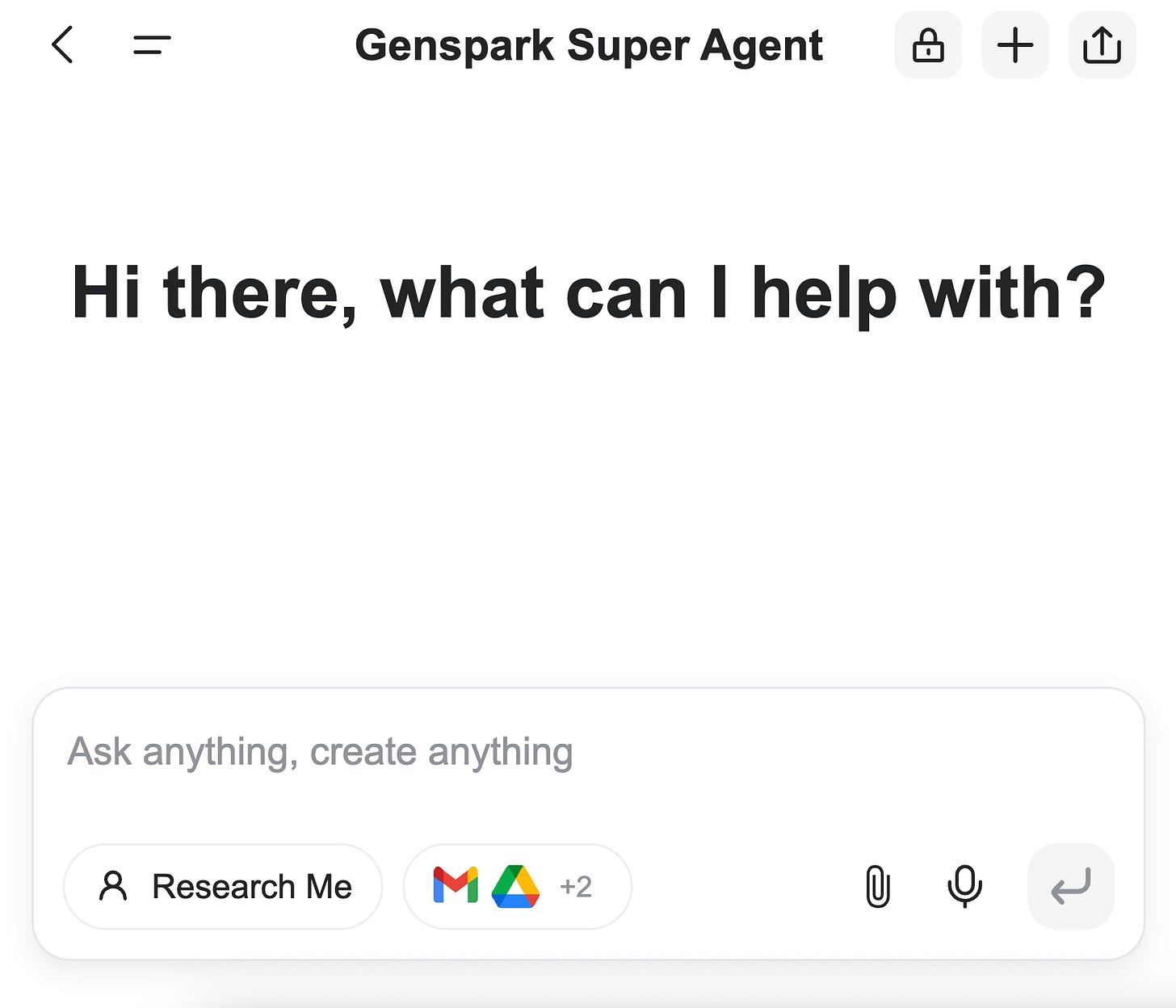

So what is a Super Agent? Well if you haven’t used one yet, it’s pretty mind blowing. It looks like the above, but it can generate docs, slide decks, financial models, go into third party apps and do data entry. It does a lot, and eventually it will do EVERYTHING.

It utilizes all sorts of other software tools to complete actions. IE it goes out and identifies an external tool it needs to use to complete any task that you want it to.

But eventually, if we ask it to do something, do we actually care WHAT external tools it uses? As long as their safe/secure, probably not…

Will companies just have to choose between a few different industry-specific AI Super Agents? Then all other software vendors will sell their tools that Super Agents use directly to the AI Super Agent companies so that they get used in the AI’s workflow?

I think this actually makes a lot of sense.

Customers would love to just have one tool to use. They just want the job done, they don’t want to have to communicate/integrate/deal with a bunch of different vendors.

If you’re playing around with any Super Agent tools like Genspark or ChatGPT Operator, you ask it to do something and it just goes and does it.

It will utilize third-party apps to get the job done, but we don’t have to tell it which third-party apps to utilize. It doesn’t care. It just cares about getting the job done - which is all really any business customer of software cares about.

Every industry probably shakes out a bit differently. But big change is coming to EVERY INDUSTRY.

What do you think? Agree/disagree? See anything else that happens?

Also — If you’re building an industry-specific Super Agent, I’d love to talk!

Hear about the future of Vertical AI from billion dollar vSaaS founders at the the vSaaS Summit !

(<50 seats left)

I think we will sell out in the next ~60!

(vSaaS founders/operators/investors only).

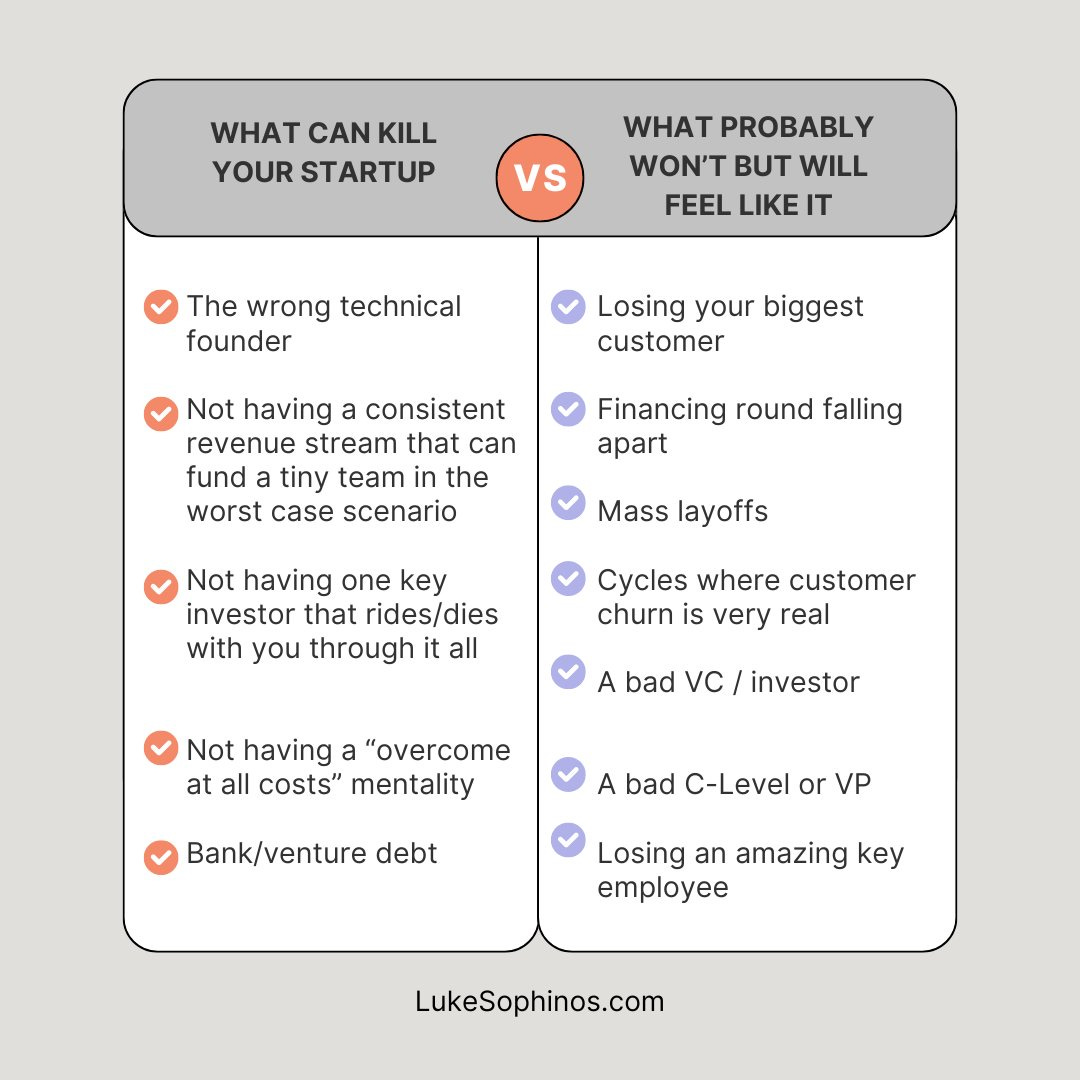

What Will Kill Your Start-Up & What Won’t

It may feel like the sky is falling at your early-stage start-up.

If we’re being 100% real here, it often is.

The challenges never really go away, the problems are still constant, but you just kind of get to use to it.

Here are the Items that feel like you’re startups going to die from but you can 100% overcome:

#1. Losing your biggest customer / contract

Look, it happens. At CourseKey we had something like ~$1M in ARR and signed a $600K deal. It was huge. We were high fiving all around. Still to this day it’s one of the biggest contracts I ever signed. But we were wayyyyyyyy ahead of our skis.

We oversold, we promised we could build all the custom/unique stuff this big enterprise customer wanted. We said we could do it in some insane timeline. It didn’t happen. They pulled out.

We had every intention of delivering but we weren’t able to. I thought it was over, how the hell were we going to come back from this.

The key here is to do it the right way. We owned up to our mistakes with the customer, let them out of it, and were good partners. Everyone walked away with complete and total respect for each other. They understood what happened, we didn’t fight them on the contract and make it ugly.

We dug in, acknowledged that we can’t oversell, put processes in place to ensure we didn’t. They didn’t trash us in the market, and we got better. We built back up that ARR amount with smaller contracts we could actually support at that time. It took time but we got through it. We learned from our mistakes. You HAVE to learn from your mistakes to overcome situations like this.

#2. Financing round falling apart

This is just a painful and unfortunate part of the game. Term sheets and LOI’s fall apart all the time. You can’t bank on anything happening. Plan for the downside always. Make sure you can survive to fight a day in the event the funding round doesn’t get done. I’ve raised something like 10 different rounds of capital. I’ve probably had 10 that I thought we’re done, term sheets, LOI’s, commitments, etc. and something happened. Sometimes it was me, it was our company, and sometimes it was the investor or something entirely out of our control.

It’s just the process. But if you always have a downside plan you’ll be ok. Never expect it’s getting done into the money’s in the bank. Don’t tell employees anything until that happens.

#3. Mass layoffs

There were a few times on our journey where we had to pull the trigger on the downside plan to survive. Things went wrong in our control and out of it. But because we were ready for the downside case, no matter how painful, and had the ability to make the decision, we did.

I’ve had to let go of ~50% of staff on two different occasions. It was awful.You know what’s crazy though. Layoffs are so good for culture building.

If you do it the right way, you show you actually really care, because you should. If you take 100% responsibility for folks having to go through this, and are completely transparent through the process, the ones that are ‘left’ will want to stay.

In both times we’ve done this we’ve bounced back so much stronger. On both occasions my smaller teams ended up producing MORE. I also was fortunate to hardly lose any of folks that I wanted to stay.

Layoffs can be a blessing — if you do them right. People told me that and I literally would say, “F*ck you. This is the worst situation ever.” Yes, yes I understand. But do it the right way and watch everyone bounce back significantly stronger.

#4. Cycles where customer churn is very real

Contrary to popular belief EVERY start-up I know goes through tough churn cycles. The numbers aren’t rarely amazing from the jump. You add too many non-ICP’s, you launch a new offering that wasn’t built correctly, it’s reality.

You have to take action and correct it. And you can.

My business EXPLODED during COVID. As an e-learning provider we grew 200%+ and raised a massive round from a Tier 1 Silicon Valley VC. I was on top of the world.

When COVID went away, a bunch of customers went away with it. We signed up customers that we shouldn’t have, a lot of our growth ended up being more artificial than I’d like to admit. It took us ~2 years to clean it all up. But we acknowledged it. We didn’t fight it. We found “reality”. And we were able to come clean with our board and explain the next ~24 months would be rocky but we were going to “cleanse” and turn it around. Guess what? We did.

You can too. EVERY company has this. Hubspot is famous for having absolutely awful custom retention for years and years in their early days. Now they retention is beautiful. This is the game.

#5. A bad VC / investor / board member

One bad apple around the table can be taken care of. You need a few people in your corner, and professional VC’s and investors will know how to handle it / mange this. It sucks but if your going the vc-backed growth route it just happens.

Almost every founder gets one of them. From what I’ve experienced and what I’ve seen, you can manage the situation in 99% of cases.

#6. A bad C-Level or VP hire

You’re human, you’re going to hire the wrong leaders. You’re going to have ultimate conviction that a particular persona type is the way to go and find out it was the exact opposite. It comes back to finding reality, admitting you made a mistake, and modifying. Start-ups that die from this hire the wrong people, and just don’t act. They say, “They’ll get there. They just need a bit more time.” From my experience, if you’re saying this it’s likely time to move on, irrespective of the pain.

I went through a few awful department heads that I thought were going to be INCREDIBLE.

You have to constantly re-invent and up-level the management team. This is what it takes. And it’s not just bad hires. You also have to move people down and out from the management team. They may have been fantastic at a certain stage of the business but aren’t the right person for the next phase. That’s ok. Just do it the right way.

#7. Losing an amazing / key employee

A few times I lost employees that I thought I couldn’t afford to lose. I really thought we were absolutely screwed. I came to found those all stars in 9/10 cases wanted to be involved in finding their replacement. They had everything documented. They supported ramp times. All star / key employees are who they are for a reason. They don’t want to leave you in a bad spot and they very rarely will.

Now there are Items that actually kill your start-up.

Avoid these at all costs:

#1. The wrong technical founder

If your a tech company building software and you or your co-founder just can’t do it, this is so hard to overcome. Equity gets messy, you give them way too much rope, and every launch continues to fail. This is really really hard to combat. Structure equity the right way out of the gate. Use significant vesting. Make sure this person is world class. They have to be.

#2. Not having a consistent revenue stream that can fund the tiny team in the absolute worst-case scenario / black swan situation

It’s important to get a ride or die customer or customer(s) that are innovators and want to build with you. You need to get to that MRR rate that can always fund the small team to make magic happen if things go to shit. If you don’t have this customer it can be very very scary.

#3. Not having one main/key investor and/or board member that rides or die with you through it all

Your board HAS to have someone that is all in on YOU. They will support you to the end. When your entire board loses confidence in you there’s no coming back from it. One does, that’s probably ok. But if you lose this key person you are in a world of trouble.

#4. Not having the ‘overcome’ any problem mindset amongst you, your co-founders, and (ideally) the whole management team

I’ve found people are just generally soft. It’s become ok to fail. I was not raised that way. If I signed up to do something, and especially if I took others people money to do that thing then I was making a commitment to do everything I could to get to the best outcome possible. Look, that doesn’t mean it won’t fail. But if you haven’t exhausted all options, you haven’t aimed to overcome everything, you haven’t shown your investor base that you are doing that day in and day out then you are in the wrong business.

Ideally this mindset is adopted by your whole company. But at a bare minimum the founders have to have it, and the management team really should have it. If the thing blows up and your investor base know you gave it your all ITS ALL GOOD. You will get another shot on a goal.

Too many people just use the, “I chose the wrong market, I can go make more money somewhere else, blah blah, blah.” That is bullshit if you ask me :-)

These are all based on experience as a founder/operator/investor.

I’m sure you could add some, and some of you may take away some, but I’ve found looking out for the latter and ensuring those are in a good place is hypercritical to success.

The former will happen and you can overcome it.

Just. Keep. Going.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com