#133: vSaaS-Focused Embedded Payments Providers, Layer's Seed Round, AI Is Here; What Happens Next?

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by the Vertical SaaS Bible.

1K+ pages of vertical SaaS case studies, industry breakdowns, scorecards, analysis, and operating learnings. Jam packed with content, it's my hope that it will help one of you build, operate, or invest in the next great vertical SaaS business!

Use code VSAAS-SAINT for 50% off.

One ‘How To’:

vSaaS-Focused Embedded Payments Providers

Many of you have read my playbook on embedded payments. The short story is, If you’re a vertical software and you haven’t prioritized embedded payments, you could be missing out on millions in potential revenue.

BUT, what I want to drill into here today is why you should NOT just go with the big payments providers (ie. Stripe) and how there are newer players purpose-built for vSaaS.

SaaS overall is getting more competitive, but embedded payments is getting easier. And your customers want embedded payments.

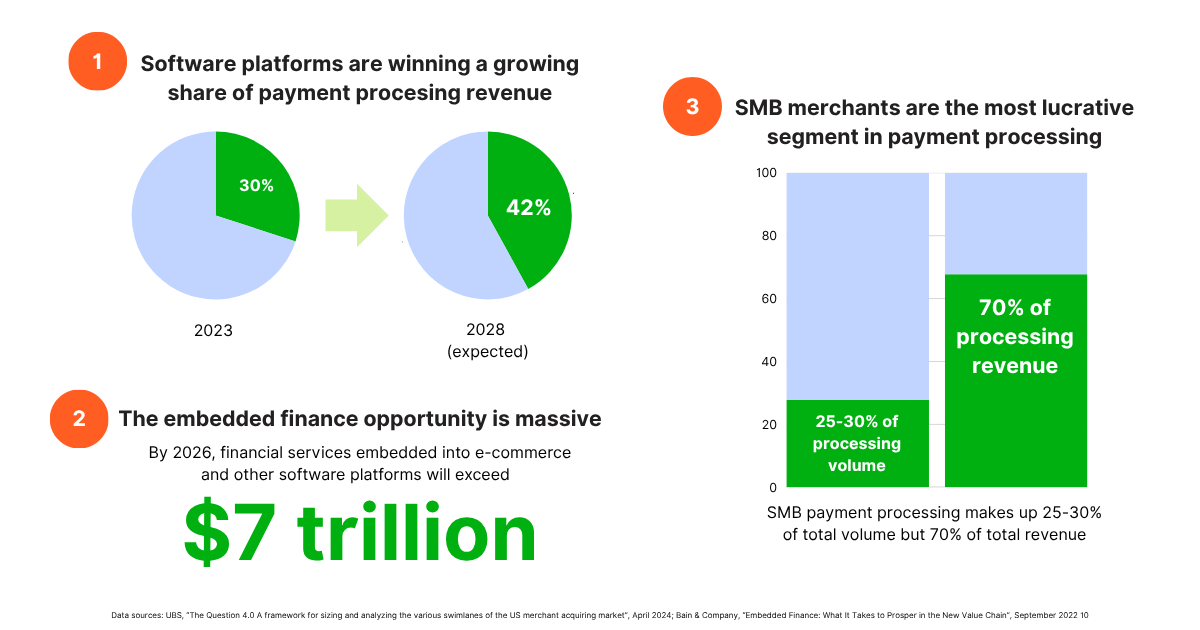

Merchants are voting with their processing volume as they migrate from legacy payment processors to modern vertical software platforms.

And the SMB merchants that many vertical software platforms cater to are a disproportionately lucrative segment of the payment processing market.

I’ve seen vertical software providers double their revenue by adding and optimizing embedded payments.

But too many founders just throw Stripe on top of their app and they don’t realize they're potentially losing out on millions. The revenue share given by Stripe is not very friendly.

Payment providers like Stripe have made it easy to add embedded payments to a software product, but they were never built or optimized for vertical software. If you want to realize that big boost in revenue and retention, you need to get the product, positioning, and customer experience right.

When I ran this play I was able to achieve a take rate nearly 2x what Stripe quoted me. 2X!!! That means for every $1M in revenue I earned with Stripe I actually earned $2M by going elsewhere. That’s big…

One company I’ve become a big fan of in this space is Rainforest.

Why? Well because they’re one of the few payment providers purpose-built for vSaaS platforms, so you can earn revenue when your customers get paid on your platform.

Integrating payments correctly requires a deep understanding of the dynamics of your market and the strategy/capabilities of your platform as that intersects with what’s possible with payment tech and economics. There’s no one-size-fits-all profit-maximizing strategy, even for two different platforms in the same industry.

That’s where a company like Rainforest comes in.

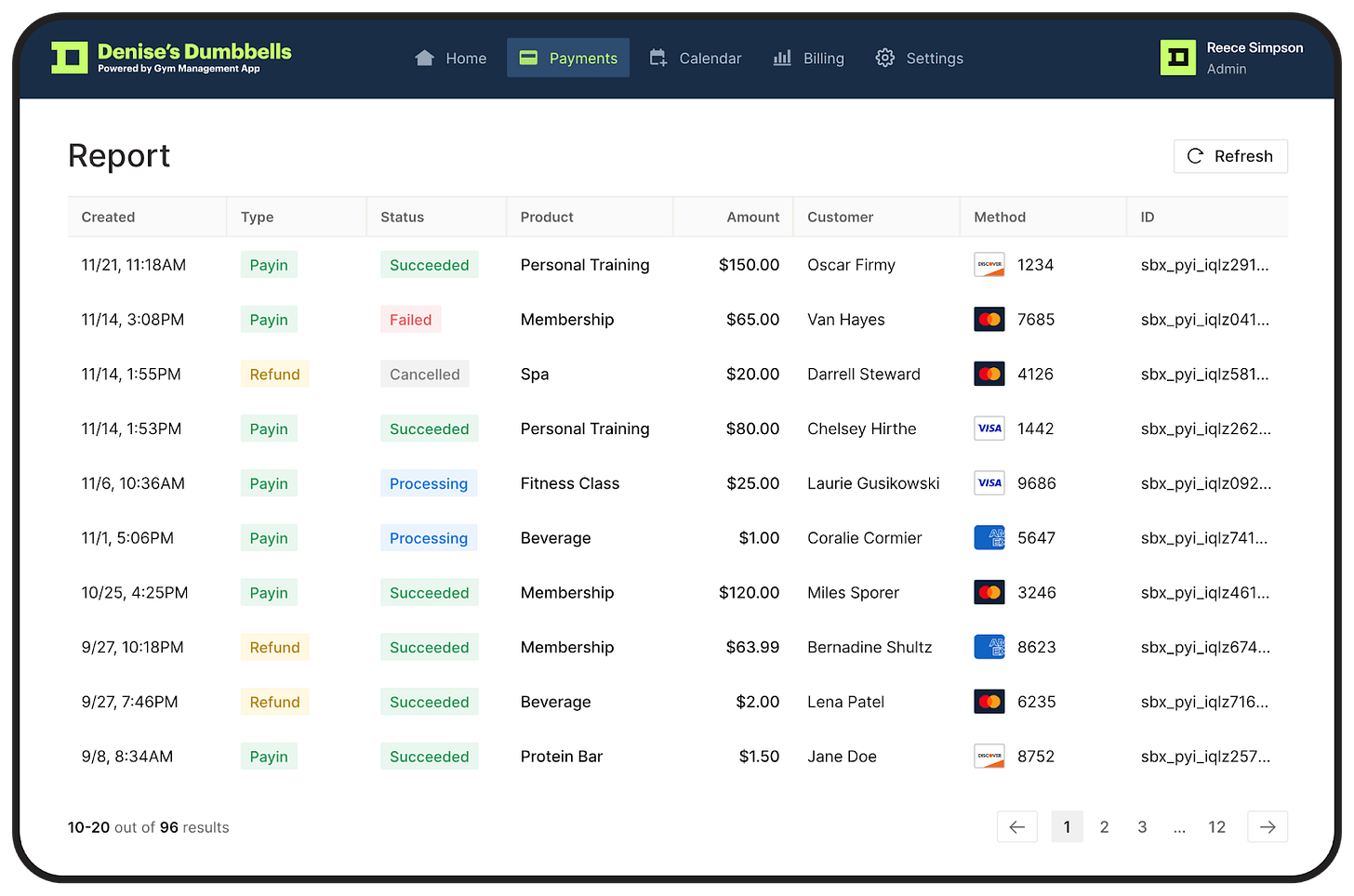

It’s important that your product is optimized to help you deliver a great payments experience to both merchants and end customers right out of the box.

Just like we talk about the benefits of vertical over horizontal software, going with a payments partner purpose-built for vSaaS is substantial:

Faster time to value: Complete your integration in days (not months) with customizable, low-code, embeddable components

Own the merchant relationship and experience: Put your brand front and center with fully embedded merchant onboarding, payments, reporting, and chargeback management

Penny perfect reconciliation and in-context reporting: Make reconciliation easy (for you and your customers) with platform-defined metadata and penny-perfect deposit reports

Offload payments risk: Reduce risk, reduce friction, and keep the money flowing with platform specific underwriting

A partner with deep expertise: Grow your payments volume, margin, and revenue with high-touch support and bespoke strategy

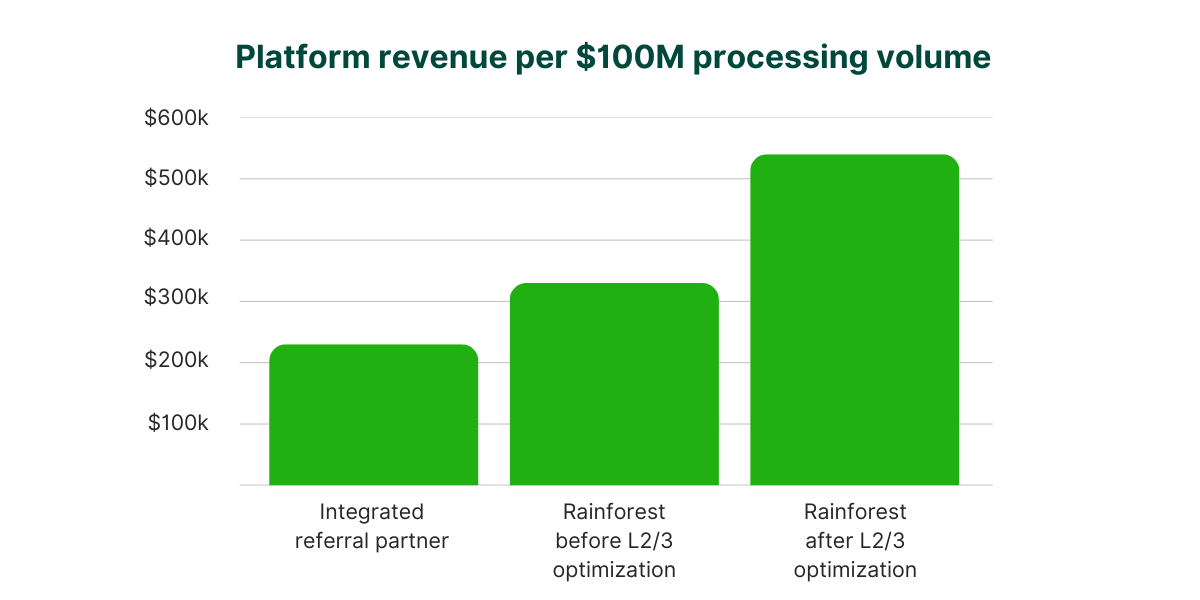

Here is an interesting study on a client who more than doubled their payment processing margin compared to their previous provider.

Now they earn $540k on every $100M in processing volume.

If you have any questions on this drop me a line – happy to help as I’ve run this play and it changed the trajectory of my business.

And If you want to launch or optimize your embedded payments offering, I recommend talking to my friend Aaron Steinberg at Rainforest.

One Biz Story:

Layer raises $6.6M Seed led by Emergence

Embedded tooling is crucial to the vSaaS ecosystem. Once you own key control points with the customer, adding payments, credit, insurance, payroll, etc. massively improves revenue and retention. We know this. We talk about it a lot :-)

But a new up-start called Layer has emerged focused on embedded accounting.

One of the interesting pieces with accounting is the fact that Quickbooks absolutely dominates the SMB landscape. Grok just told me ~85% of SMB’s in the U.S. use it.

Quickbooks is a monopoly, but it SUCKS. Ask any user of it and they do not like it.

But accounting SaaS start-up after start-up have tried to impact this and just haven’t made a dent. Layer has emerged focused on beating out Quickbooks by sitting within the vertical software platforms that SMB’s are using every day to run their shop.

This is smart, and a different approach.

Let’s hope this is the path to finally upend Quickbooks longstanding monopoly.

One vSaaS Breakdown:

AI Is Here. So What Happens Next?

If you haven’t used AI yet to automate a significant amount of work you use to do manually you are incredibly far behind. I’m not here to talk about that or debate you on it. This one’s for the folks that are also seeing the writing on the wall. I’m seeing computers do things I never thought would happen in my lifetime.

So my take on what is happening is basically this:

Software is no longer going to be used by people.

People will direct AI with what to do - by text, voice, or click.

AI will use software platforms to achieve the things that people direct it to achieve.

That basically means that every single job where someone utilizes software to achieve it will go away. That’s pretty mind numbing seeing that that is virtually every white collar job there is.

Just to give one concrete example, I have now created very good financial models with AI. I talked to it about tweaking assumptions, changing capital requirements, headcount, this or that, and it executed on it like my former CFO, BUT, it did it immediately.

I have had numerous experiences like this lately and it’s so powerful I’m now becoming nervous about it. So I’d like to talk about how to position yourself to not be out of a job in the next five years and to lean into the moment versus run from it (which is what most are doing)…

Path #1: LLM

LLM companies are going to become the new infrastructure of the internet. Everything will run through them just like everything for the last 20 years have run through operating systems by Microsoft or google. This will most likely by a duopoly or triopoly of LLMs. Jury is out on who this becomes but these will become the biggest companies in the world. Unlike the internet / app era I believe all search and horizontal software will be eaten by these companies in addition to the business suite. The AI is so good there will be no reason to leverage anything else.

Path #2 Vertical AI

On top of LLM’s will be vertical specific operating systems. They will use the LLM’s but tailor them / tweak them / train them on industry specific data and workflows. I foresee this looking very similar to vertical software today - 2-3 big winners per industry, but there won’t be room for point solutions any more, as the ability to spin up capabilities here will be so simple.

Why won’t the LLMs move into specific industries? Well they probably will move into some of the biggest ones - healthcare, finance, etc. just like Google/Microsoft have but they will be so busy fending off competition and gobbling up horizontal systems that I personally don’t see it. I also think most industries just won’t be worth their time as these companies get so big.

How I see this playing out is in every market there will be a war between AI native systems and legacy systems that add on AI.

In some markets, the incumbents will move to slow and get eaten alive, in others they will move quickly enough and maintain their dominance. Every market will be a toss up with one of the two winning.

Path #3 Own Service Businesses (Ideally non-white collar ones)

Owning real service businesses, and juicing then with vertical AI I think is going to be a very good place to be. These businesses will only get more profitable. They may not have tech-esque multiples but I think this is a very smart play for folks to think about over the next decade. Buying these now and replacing employees with AI and technology over the next decade is a good move. Service businesses that require blue collar / hands on work is probably the smartest place to be. I’m worried about white collar service businesses given that if AI automates the work here away why do they need a service provider? They’ll just go directly through a technology provider.

But what jobs will be safe?

I think from a human standpoint, your probably only safe if you are an owner; executive, enterprise seller, or a builder (ie you can use AI incredibly well to create new products, or you can actually create AI). Every company will use their own AI to automate a material amount of jobs and the winners in every category above (with the exception of the service businesses) will be much smaller from a headcount perspective and much bigger from a revenue/profit/ebitda standpoint than industry giants of today. That’s wild to think about…

The time is now to position yourself for success.

A few ways I’m think about it:

Become EXCELLENT at leveraging AI

Buy that service business you’ve been too scared to pull the trigger on

Build an AI native vertical operating system

Sound the alarm so your vSaaS business gets off their ass and builds and deploys agents internally and for your customers

Seriously consider sending your kids to a trade school

I know this is a lot to take in. But the more I use AI the more I’m thinking about what’s going to happen. You can run from it or you can master it. I think mastering it is a much better path for those that choose it.

I think we will sell out in the next few weeks. Grab your ticket!

(vSaaS founders/operators/investors only).

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com