#129: Most Vertical Software Markets Have Monopolistic Attributes, The Story of Playbypoint: vSaaS for Padel

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by Rainforest, the embedded payment provider purpose-built for vertical software platforms.

Grow revenue with the only payfac-as-a-service provider optimized to help you drive more payments volume at higher margins, without risk or compliance headaches.

Learn more at rainforestpay.com

Alright, let’s get to it…

Most Vertical Software Markets Have Monopolistic Attributes

A few definitions I’d like to start with to set the table for us today…

Monopoly: A market where a single seller dominates the supply of a good or service, with no close substitutes available. This gives them significant control over price and output.

Duopoly: The same as the above but two firms dominate.

Triopoly: The same as the above but three firms dominate.

One can debate what the definition of “dominates” equates to when talking about a monopoly, but let’s just use 30% or greater as an example…

If I look at ANY of the roughly 1K+ industries in the states, and then look at how many of them have 1–3 vertical software companies that control ≥70% of the marketshare it is more than half.

I asked my AI, and they estimated ~40%. I think it’s higher, so I gave my AI ten industries at random and this is what it came back with:

ALL TEN I gave the AI HAD monopolistic tendencies.

Maybe that was just weird luck of the draw but I still think this happens in most industries.

If you are in an industry where this is not the case, pat yourself on the back. That’s awesome. Go and build a monopoly there.

But for the rest of us I want to talk about the playbook I ran in the trade school space at CourseKey (now Portico), as I feel like I’ve seen it play out in real-time over the last 11 years. But more importantly how this may look differently with AI today AND TAKE A LOT LESS TIME.

The play I ran:

Step #1. Build something that the monopolies SUCK at or DON’T OFFER that is mission critical.

Step #2. Achieve market scale with that particular solution.

Step #3. Repeat Step 1/2 multiple times until you have a product suite of these tools and you’ve reached some solid scale, maybe it’s $5-10M of ARR.

Step #4. Raise money to buy a boot-strapped ERP so you have an end-to-end solution.

Step #5. Compete with the monopoly head-on — you’ll probably win, because you’re the young up/comer that everyone in the industry likes and they all hate the monopoly at this point.

This playbook really works. I’ve seen it first hand work — my old biz is in step #5 and they are currently kicking the old monopoly’s ass (they made a huge strategic error by trying to expand into a new market and raised a bunch of debt to do it and is now selling for parts) but that’s a story for another time.

So how can this look different in an AI era? Well the most obvious point, is that you can probably run the exact same play much faster. But let’s think more creatively here. Here are a few questions I’m pondering deeply as of late…

Can you build Vertical AI Agents that access and pull out all of a customers data that the monopolies have shut off access to for decades? If so, can you build a slick, modern, AI powered ERP on day two as the switch over issue will no longer exist?

Can you build a Vertical AI tool that can replace an employee 100% in a certain industry, that doesn’t even interact with the monopolies software? IE find employees that use software at the fringes / non ERP’s and replace them entirely with AI. If you’re replacing employees 100%, you’ll probably end up being able to charge more than the business management systems and stay in your own lane.

How do you build Vertical AI that doesn’t require data integration? EVERY company that is growing at lightning speed isn’t requiring it. Harvey doesn’t need access to the legal management software. There literally just a safe GPT lawyers can use and firms don’t want them using ChatGPT with confidential info. Could it be that simple?

I know a lot of you wan’t a silver bullet but there isn’t one.

It takes deeply studying an industry, and making a strategic bet, going “all in” per say…

I hope these questions help you get that thought process started.

One ‘How-To’:

How To Get Your Ticket To The Vertical Software Summit 2025 :-)

I have capacity for ~200 folks and we’ve already blown past ~100.

Grab you ticket before their gone (vSaaS founders/operators/investors only)

One Biz Story:

The Story of PlayByPoint

I have a confession to make.

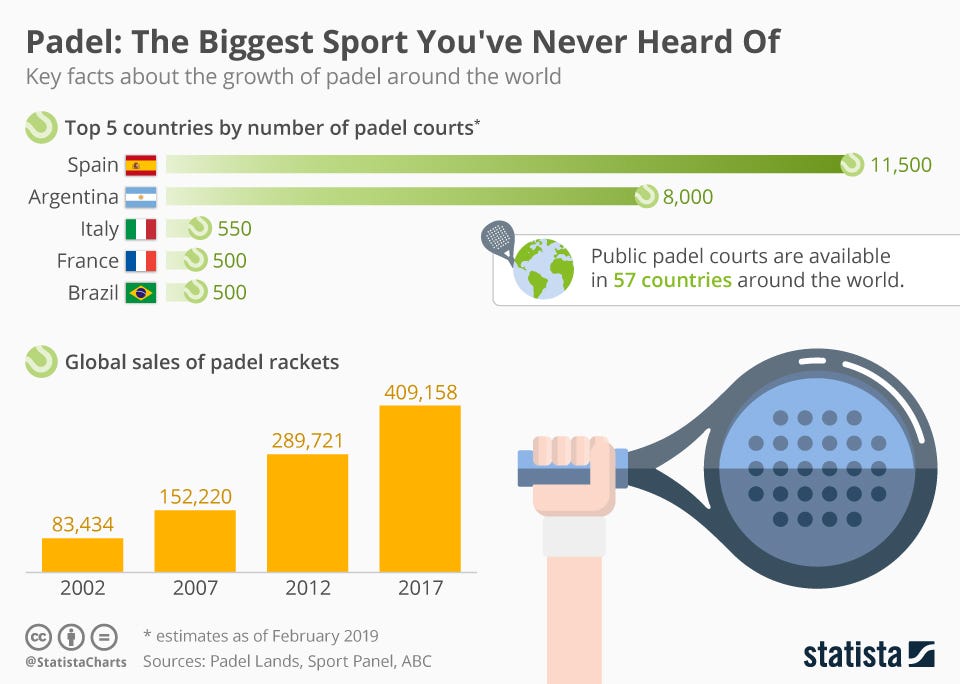

I am deeply addicted to a new up and coming racket sport, called Padel.

It' has taken over Miami and it is coming to your city soon. This is NOT pickleball, this is a crazy high intense game where you burn 1K calories every time you play.

I’ve been playing ~3x a week for the past 1.5 years and I’d be remissed not to do a breakdown on the vertical SaaS powering all of these new clubs.

Before we get into PlayByPoint this is a friendly reminder that WHENEVER you see a new industry popping up, it is almost ALWAYS a good idea to be the software provider that powers them and ride the wave into market domination.

Dutchie did it with Cannabis as dispensaries started popping up everywhere, Procore was early, and squandered for years before it rode the Mobile wave, many companies like EPIC took off once regulations required digital records, etc.

Alright, let’s dig into PlaybyPoint…

PlayByPoint, a leading racket sports booking and club management SaaS platform in the U.S., was founded in 2016 by Andres Robelo, who serves as CEO. The origin story centers on addressing inefficiencies in racket sport facility management:

Inspiration: Robelo identified a gap in the U.S. market where many racquet clubs relied on outdated methods (e.g., pen-and-paper or generic booking systems like Mindbody) for court reservations and club operations. Initially focused on tennis court bookings, PlayByPoint aimed to streamline the process for players and club owners.

Pivot to Padel: As padel gained traction in the U.S. post-2019, PlayByPoint expanded to serve padel clubs, capitalizing on the sport’s growth (454 courts by 2023). The platform adapted its tennis-focused software to padel’s unique needs (e.g., doubles play, social events).

Vision: Robelo emphasized a “product-oriented” approach, prioritizing the club experience. The goal was to digitize the entire customer journey, from booking to post-game engagement, ensuring clubs could manage operations and grow their player base.

Context: Founded in Miami, a hub for padel growth, PlayByPoint aligned with the sport’s rise, driven by its social nature and accessibility, mirroring trends seen in Europe.

PlayByPoint Product Suite: A Comprehensive Offering

PlayByPoint offers a SaaS platform tailored for racket sports clubs, including:

Court Booking System: Online and mobile app reservations with real-time availability, supporting peak/off-peak pricing.

Club Management Tools: Membership, billing, and scheduling for lessons, tournaments, and events.

Player Engagement Features: Social matching, event management, and post-game notifications.

Analytics and Reporting: Insights on occupancy, revenue, and player retention for optimization.

Padel-specific features include group bookings and integrations with club amenities, ensuring a seamless experience.

Product Costs: Estimated Pricing

Exact pricing isn’t public, but based on industry standards, PlayByPoint likely uses a subscription model with monthly fees of $100–$5,000, depending on club size, plus 2–5% transaction fees on bookings.

Small clubs (1–2 courts) might pay $100–$500/month, while large clubs (6+ courts) could pay $1,500–$5,000, with setup fees of $1,000–$5,000.

Players pay clubs directly (e.g., $55/player/hour at Padel Haus), with PlayByPoint likely taking a cut.

Padel Market Size: A Rapidly Expanding Ecosystem

2022: The padel sports market was valued at ~$327 million

2024: The padel sports market grew to ~$425M (Brainy Insights)

Projections:

By 2033: The padel sports market is forecasted to hit $0.5–$0.87 billion (12.93% CAGR), and the padel court market could reach $0.79–$2.5 billion (8.1–8.9% CAGR).

By 2026: The entire padel ecosystem is anticipated to reach $6 billion, driven by court construction, equipment, and digital platforms.

Let’s look at Padel court growth as a driver:

United States:

2019: Fewer than 20 courts.

2023: 454 courts across 56 venues, with ~100,000 players.

2024: Over 100 new venues planned, suggesting ~600–700 courts by year-end. Miami leads as the U.S. padel capital, followed by Florida, Texas, California, and New York.

Density: Only 1 court per 1.3 million inhabitants, compared to Spain’s 335 courts per million, indicating massive growth potential.

Projection: Forecasts suggest 30,000 courts by 2030 if growth accelerates.

How Big Can PlayByPoint Get?

Padel’s Explosive Growth:

Forecasts predict 30,000 courts and 10 million players by 2030, a 100x increase in courts and 100x in players from 2023 (100,000 players).

Global Market: 40,000 courts in 2022, projected to hit 70,000–85,000 by 2026, with a $6 billion ecosystem by 2026.

Early-Mover Advantage:

Like Dutchie (founded 2017, ~50–60% cannabis POS share), PlayByPoint (founded 2016) entered padel early, serving premium clubs (e.g., Padel Haus). Its tennis roots give it a head start over padel-only platforms like Playtomic in the U.S.

Network Effects: As more clubs adopt PlayByPoint, players flock to its app for bookings, creating a virtuous cycle, similar to Dutchie’s dispensary-consumer ecosystem.

Scalable SaaS Model:

High-margin subscriptions and transaction fees scale with court growth. Estimated $1.7–$2M revenue from ~100 clubs could grow to $10–$50M with 500–1,000 clubs by 2030.

Monopoly/Duopoly Potential:

The U.S. padel SaaS market is nascent, with PlayByPoint and Playtomic as key players. Capturing 50–70% of U.S. padel clubs (like Dutchie’s cannabis share) is feasible, especially if it dominates premium markets (e.g., Miami, NYC).

Valuation Potential: If PlayByPoint monopolizes the space it could hit $500M–$1B by 2030 if padel scales as projected.

Buckle up!

Will be fun to see what happens here.

PS — if the founders of PlayByPoint read this newsletter, let me invest :-) !!!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

That's a nice one, very interesting! Good job Luke