#128: The Story of ForeUp: Golf Course vSaaS, Does AI Threaten Vertical Software?

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by Rainforest, the embedded payment provider purpose-built for vertical software platforms.

Grow revenue with the only payfac-as-a-service provider optimized to help you drive more payments volume at higher margins, without risk or compliance headaches.

Learn more at rainforestpay.com

Alright, let’s get to it…

ForeUp: From BYU to Golf Course Software Leader

ForeUP was founded in 2011 in Pleasant Grove, Utah, by three BYU students: Evan Teshima (CEO), Joel Hopkins, and Joel Ragar. The idea for ForeUP was born in a BYU entrepreneurship class, "Creating New Ventures," taught by angel investor John Richards. Evan, then a business management student, was inspired by Richards’ philosophy that anyone could start a company, regardless of experience or resources. This class sparked Evan’s entrepreneurial journey, leading to the creation of ForeUP.

Initially, the team explored a social media platform for golfers, aiming to connect players of similar skill levels for tournaments and meetups. However, after lukewarm responses from golf courses and challenges with API integrations for tee time bookings, they pivoted. Feedback from golf course operators revealed a critical pain point: outdated, clunky point-of-sale (POS) systems that resembled relics from the days of Oregon Trail. Many courses still relied on paper-and-pencil methods or basic Excel spreadsheets, highlighting a clear need for a modern, integrated solution.

This insight led ForeUP to develop a cloud-based POS and tee sheet software tailored specifically for golf courses. By addressing the industry’s unique challenges—such as managing tee times, pro shop sales, food and beverage operations, and customer relationships—ForeUP quickly gained traction. Their first customer was The Ledges of St. George, a Utah-based golf course that embraced ForeUP’s approach to streamline operations. This early success validated their pivot and set the stage for rapid growth.

The Golf Course Software Market: Size and Scope

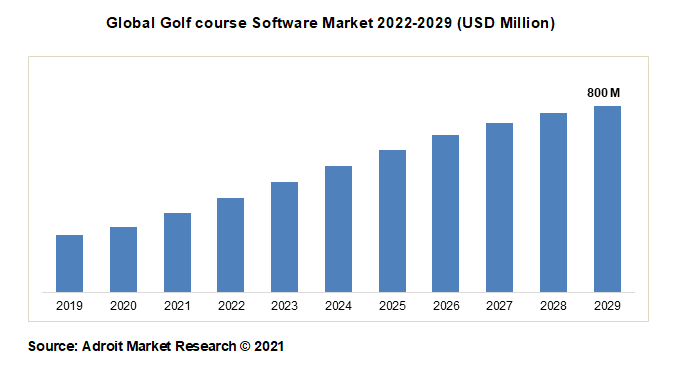

According to industry reports, the golf course software market is projected to reach $800 million by 2033, growing at a compound annual growth rate (CAGR) of 7.5% from 2026 to 2033. .

In the United States, there are approximately 16,000 golf courses, ranging from public and semi-private clubs to high-end resorts.

These courses generate significant revenue, with the golf industry as a whole contributing over $84 billion annually to the U.S. economy.

A substantial portion of this revenue flows through tee sheet management, with up to 80% of a golf course’s revenue tied to efficient tee time scheduling and related services.

ForeUP’s Product Suite:

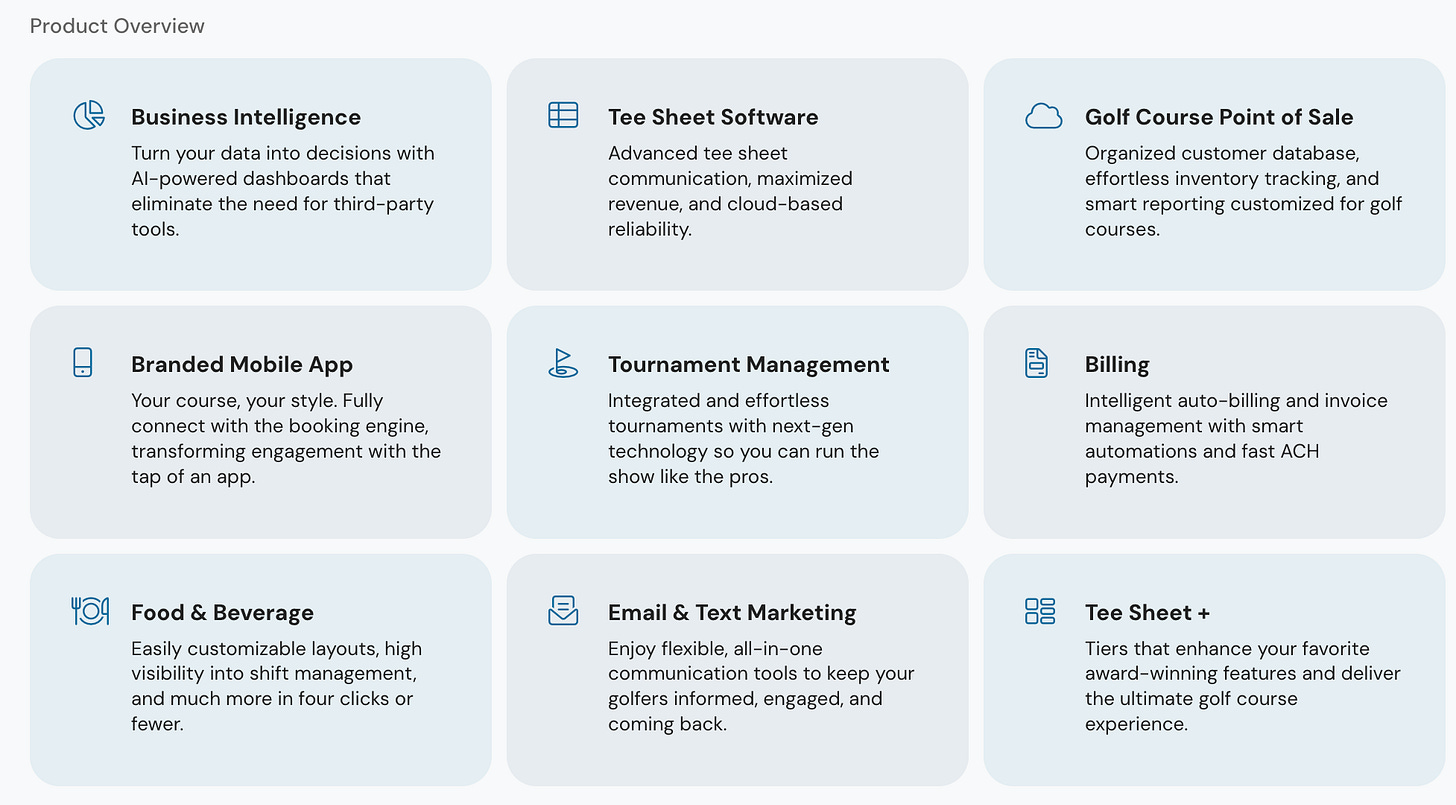

ForeUP offers an all-in-one, cloud-based platform designed to streamline every aspect of golf course management. Built with input from course owners and operators, the software integrates seamlessly across various functions, reducing the need for multiple disparate systems. Here’s an overview of ForeUP’s key features:

The platform’s open API enables integration with third-party tools, giving it a competitive edge over rivals like GolfNow, which lack similar flexibility.

Pricing:

While they don’t list their pricing, user reviews suggest that ForeUP’s pricing is competitive within the industry, particularly given its comprehensive feature set.

For context, similar golf course software solutions typically charge monthly subscription fees ranging from $100 to $1,000+, depending on the number of users, features, and course size. ForeUP also offers a free trial, allowing courses to test the platform before committing.

Customer Acquisition Strategy

ForeUP’s customer acquisition strategy leverages the golf industry’s tight-knit community, where word-of-mouth and reputation are paramount. As Evan Teshima noted, “Everybody knows everybody. Word spreads pretty quickly.” The company has focused on the following approaches:

Founder-Led Sales: In the early days, the founders personally handled sales, building direct relationships with course operators. This hands-on approach helped ForeUP understand customer needs and refine their product.

Industry-Specific Solutions: By addressing the unique challenges of golf courses—such as outdated POS systems and fragmented operations—ForeUP positioned itself as a trusted partner for course managers.

Strategic Partnerships: ForeUP’s integration with Supreme Golf, the world’s largest tee time booking site, has expanded its reach. The 2019 partnership and equity investment from Supreme Golf allowed ForeUP to tap into a broader network of courses and golfers.

Customer Base: A Growing Network of Golf Courses

As of 2024, ForeUP serves over 2,300 golf courses across the United States and beyond, making it one of the leading providers in the golf course software market.

Notable clients include Disney World, Torrey Pines, Bethpage State Park, and Talking Stick, showcasing its ability to cater to both high-profile resorts and smaller public courses. In New York alone, ForeUP has 61 booking engines installed, outpacing competitors like GolfNow.

Revenue

While exact revenue figures for ForeUP are not publicly disclosed, industry estimates suggest the company generates approximately $15 million annually, based on its customer base and market positioning.

This figure aligns with ForeUP’s growth trajectory and its status as a leading player in a market expected to reach $775.3 million by 2030.

Fundraising: A (Basically) Bootstrapped Success

ForeUP’s financial journey is a testament to the power of bootstrapping. The company raised a modest $200,000 in convertible debt in 2011 through a convertible note, with an initial valuation of $1.5 million (potentially dropping to $500,000 if additional funding wasn’t secured). This funding came primarily from John Richards, a Utah-based angel investor and co-founder of the BoomStartup tech accelerator, along with some seed funding from BoomStartup itself.

Facing a near-death experience when the convertible note matured, the founders narrowly avoided significant dilution by paying back investors with interest, thanks to a loan from family members and strategic negotiations.

A legendary chess match between Evan Teshima and John Richards over a $50,000 equity difference became a defining moment in ForeUP’s history, highlighting their scrappy, resourceful approach.

In 2021, ForeUP was acquired by Clubessential Holdings, a Battery Ventures company, in a deal that marked a significant exit for the founders and early investors. While the acquisition price was not disclosed, it was described as a “windfall” for the team, surpassing Richards’ previous best investment, Omniture. The acquisition allowed ForeUP to continue its growth under a larger umbrella while maintaining its focus on golf course innovation.

ForeUP’s future is bright, with plenty of room left to grow for the acquirer.

One ‘How-To’:

How To Get Your Ticket To The Vertical Software Summit 2025 :-)

I have capacity for ~200 folks and we’ve already blown past ~100.

Grab you ticket before their gone (vSaaS founders/operators/investors only)

One vSaaS Breakdown:

Does AI Threaten Vertical Software?

Glad to welcome Nic for another crossover piece today. He runs Euclid, a new VC fund focused on Vertical AI. Check out his substack, Euclid Insights, for more.

“AI is killing Vertical Software.”

We’re convinced few people ever actually believed this statement.

Which is interesting, because the perception of this proposition—or at least that it was an active debate, somewhere in VC and founder land—seems to be fairly widespread. The only person that said this earnestly for sure was David Friedberg on the All In podcast several years ago. As the founder (of Climate Corp, which sold to Monsanto for $1B) and someone with deep scientific experience and passions, he was one of the more thoughtful commentators.

So when in late 2023, the “besties” submitted their predictions for worst performing asset in the coming year, I (Nic) was piqued when Friedberg said Vertical Software. Clearly, I wasn’t the only one. My friend Andrew Oved at Reformation posted this writeup the following week. He summarized Friegberg’s rationale as shared on the pod nicely:

“AI has enabled companies to build, with no-to-low code, their own internal software solutions at a much lower cost than the price of purchasing comparable software from a 3rd-party. As a result of this new ability to build internal tools more seamlessly, there will be increased churn and pricing compression resulting in deflationary SaaS pricing power.”

Friedberg also shared an anecdote to illustrate the point. An engineer at his company–presumably Ohalo–replicated a supply chain data management tool they had been paying >$50k annually for prior. That allowed them to churn off the SaaS product. And he guessed they might open-source it or sell it for cheap. Surely, Friedberg continued, many more talented devs will find other such opportunities, to the chagrin of many SaaS vendors.

As with most “annual predictions,” this vision was pretty far off the mark, at least for 2024–Vertical AI has been taking off in ways few models have. You might say: perhaps David was right about the trend, just a few years early (the most painful kind of right for VCs). Perhaps AI is quietly killing Vertical SaaS as we speak and soon all but the biggest, most horizontal software platforms will be rebuilt internally thanks to Loveable, Retool, Bubble, Replit, Cursor, Windsurf, Bolt.new, and whatever comes along next. Further, might AI automate and democratize software development to the extent that most SaaS is just walking dead?

Friedberg’s “ambitious engineers” can do much more today, no doubt. But even armed with AI, they aren’t going to reproduce, say, ServiceTitan. Could they rebuild its very first incarnation, a desktop app with basic trade business management features, 10x faster today? Probably. But to replace ServiceTitan, that engineer would have to resign, raise capital, compete with alternatives, and build it into the platform it is today.

The relevant AI threat level today, then, has nothing to do with industry. It comes down to an individual product’s scale, complexity, and defensibility. Simple SaaS tools of all stripes are at risk. Just as startup wedge products, in the face of better teams and more funding, are too.

So we agree “tools” are replaceable but at-scale platforms are not. But where do we draw the line? Or if the line is moving as AI evolves, will it approach an asymptote or is SaaS facing slow but sure obsoletion? The past offers a helpful way to begin on these questions.

The history of technology is defined by progressive cycles of “layer commoditization.” We’re all familiar with the canonical examples: electric looms threatening the textile industry, mechanized manufacturing in autos, tractors in farming, ATMs in banking, etc. We wrote recently about a double-commoditization, in which Salesforce pulled compute from on-prem to SaaS, followed by AWS pulling it to a new IaaS layer. Each cycle sees the following:

Innovation: Some core aspects of the process are automated, increasing speed and allowing workers to reallocate time, albeit with some adaptation.

Pushback: Reasonable fears around loss of control and obsoletion of the worker causes pushback, with some hailing the end of X (as we know it).

Commoditization: The process is democratized, barriers to entry fall, a new “layer” in the process is born… but ultimately the market thrives with newfound productivity.

We have seen the same before in software development itself. In the early 1950s, Grace Hopper invented the first compiler, the grand daddy of dev tools. Compilers translated human-interpretable “languages” into machine code, which up until that point programmers had to write by hand (or in barely abstracted assembly language), dealing with all the nuances of that particular computer. Then, in 1954, John Backus of IBM and his team–amazingly, of fewer than 10 people–created FORTRAN (short for Formula Translator), the first (successful) high-level programming language. Existing programmers, however, pushed back. As Backus put it, “the resistance of the priesthood was such that the whole thing was likely to be ignored.” Languages–skeptics said–were less elegant, less controllable, and (unsaid but obvious) they had the potential to make some jobs obsolete. Despite those fears, the productivity gains were undeniable, running the majority of IBM’s code within 5 years. From 1950 to 1970, the number of programmers employed in the US would grow 30-50x.

In the era of LLMs, a new cycle of layer commoditization is underway in software development. Satya Nadella, CEO of Microsoft, laid out the ultra-bull case in a recent episode of an All In spin-out, BG2. “The notion that [SaaS] business applications exist, that’s probably where they’ll all collapse, right in the Agent era… once the AI tier becomes the place where all the logic is, then people will start replacing the back ends, right?” His vision was pretty hand-wavy but I’d agree with the bearishness around traditional SaaS UIs and input-heavy systems of record. Just like with FORTRAN, lower-level activities are getting commoditized for both users and developers, allowing us to focus time and energy on the higher-level architectures and workflows that matter. Moreover, new layers are developing–obviously in LLM infrastructure but perhaps also in agentic communication or host-side data provisioning to agents.

So like in cycles prior, there will be losers.

We see three main categories of vulnerable SaaS…

Primarily, developers of hyper-niche tools that are easily replicable with AI support.

SaaS providers offering a service LLMs have subsumed (e.g. Chegg, Grammarly, Dragon).

Incumbent SaaS providers who simply don’t offer LLM functionality at parity quickly enough, or hold on too tightly to outmoded cash-cow products (to play out over the longer-term, as we envisioned in our essay on the development of systems of intelligence here).

If development-support AI continues to improve, however, will the line keep moving to the point where ever more established SaaS platforms are vulnerable? Is there a coming wave of “Windsurf churn” off known-name software platforms?

A quick analogy may help illustrate why I think this progression is likely asymptotic rather than indefinite. Imagine a pair of super-sneakers that imbues basketball players with a lifetime of conditioning. Overnight, high-school bench warmers become NCAA-competitive. Even the best NBA pros improve. But the impact isn’t nearly as drastic–the Currys and LeBrons already have a lifetime of training, and much of their relative edge is driven by nuanced game-sense. Its enhancing effect, in other words, is logarithmic. The higher-level you already are, the less it will help. And I think the same is more-or-less true for software businesses. Now add that everyone gets the shoes.

AI may be forcing SaaS to evolve in new ways but predictions of its demise are either drastically overstated, or more likely, just the latest iteration of an age-old marketing tactic. On the contrary–at least in Vertical Software in particular–there’s a strong argument to be made that AI is a massive accelerant.

We (Nic and Luke) are both betting that Vertical AI is a pillar in the future of SaaS, that every job in every industry will have an AI co-pilot that helps them do their job better. With some occupations, Vertical AI will be able to sufficiently do a specific job in a specific industry end-to-end.

Companies will be full of humans and digital AI employees BUT to infer that the business management systems and ERPs will fall into a black hole… well, we just don’t see it happening.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com