#126: Vertical Software's Integration Problem, The Story of Abridge (Vertical AI for Clinicians)

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by the Vertical SaaS Bible. 1,000+ pages of vertical software case studies, operating playbooks, and how-to’s. It’s every vSaaS nerds dream!

Grab a copy if you haven’t yet :-)

Alright, let’s get to it…

One vSaaS Breakdown:

Vertical Software's Integration Problem

& How Vertical AI May Combat It

Glad to welcome my friend Nic for a crossover piece today. He runs Euclid, a new VC fund focused on Vertical AI. Check out his substack, Euclid Insights, for more.

There are over a thousand industries documented by the Department of Labor. Car Dealerships, Law Firms, Doctors Offices, Fuel Dealers, Jewelry Stores, the list is massive. For every one of those industries there is a host of vertical software applications that serve them.

The major industry-specific software player in nearly every vertical is almost always the system of record – the business management system or ERP – the place every person in a business is supposed to go to to log every single interaction happening within that particular business.

One of the biggest challenges with Vertical Software achieving significant scale, is that in A TON of industries, the business management system has shut off integrations. They don’t allow third-party tools (IE start-ups or new kids on the block) to access this data. Or, if they do, they only allow third-party vendors to selectively access a subset of their broader data set.

For instance, Epic Systems (the 800-pound gorilla of hospital records) is notorious for high integration fees and complex, unique deployments for each customer. Likewise, entrenched software like Yardi in real estate or Dentrix in dentistry hold critical data but weren’t built to easily share it. These monopolistic vertical platforms “throw their weight around” to maintain leverage or extract integration tolls. Sometimes, intentions may not be competitively malicious but the demand just hasn’t been there to build an open-data ecosystem like a Salesforce or Toast.

It’s a great strategy for a big legacy software provider. They’ve built the integral platform of their space, and they know how incredibly painful it is for their customers to leave. So while, their NPS probably goes down over time as customers feel this frustration, and they are unable to adopt new technology that they believe will improve their business, most of them, just, stay on the sh*tty old school system…

VERTICAL AI IN PARTICULAR

A few weeks ago, I (Nic) hosted a Roundtable focused on key challenges for early-stage Vertical AI companies (we wrote more about it here). Attendees included founders from a wide range of verticals, including healthcare, supply chain, retail, construction, and insurance. And one problem in particular stood out. One founder shared his dilemma: "There are certain customers who say, 'Hey, this is amazing, but if it doesn't integrate with our core system, we just can’t use it.'"

Once, again, however the incentive or ability for incumbents to facilitate the sort of connectivity a Vertical AI company needs is often just not there. A few other founders chimed in: “A lot of these legacy [providers] are not tech forward and don't have open APIs. Many don't want to integrate our product for competitive reasons, and more just don't have the engineering teams to even build open APIs.” Moreover, the philosophy of open data has in a lot of cases bled down into buyer management. “CIOs and execs will not let you have access to their systems of record,” another CEO reflected. “It's just like a no-go for them.”

While integration challenges have plagued software since the earliest enterprise systems, it’s becoming an especially acute problem for Vertical AI.

SOLUTION

There are a lot of creative strategies founders have deployed to get around this. The most common strategy is building a wedge product, achieving that “selective” data integration element with the source of record, then expanding into a few more modules, before swallowing the frog and offering your own management system / ERP. This works, it’s just typically a ten year plus journey. I (Luke) ran this exact play in Trade Schools and it took 11+ years to make it happen.

A second way to get around this is building data extraction products that go into these systems and pull out the data so that customers can move away easier. The big legacy companies don’t like this, typically sue, but we’ve also seen this work. A bit of a cautious / scary strategy but it can work.

The third and final way I’ve seen folks make this work, is by building a janky integration like a timed file drop. These can leverage import / export functionality from an existing ERP system. As one founder from the roundtable put it, “We reverse-engineered [it]...there were no API integrations. [So we] crawl into a Windows machine and inject things into a database.” This works, but typically is only acceptable by small to medium sized customers. Medium to large companies won’t accept the security risk or the lack of real-time data. Which leads to what’s probably the most common solution right now: simply trading flat files.

Now this is how things have been the last decade or so, but Vertical AI is a really exciting opportunity because if the vertical AI app can actually replace a full time employee, vertical AI tools can charge slightly less than that particular salary, and in many verticals actually end up being more costly than the industries management system.

But in most cases the Vertical AI employee still has to interact with the business management system / ERP. And in some ways, the need for data will be even greater in the AI era than it was for the first few waves of SaaS. In many vertical workflows, some of the most important data doesn’t exist in any system of record. It lives in email threads, paper files, phone calls, or simply employees’ heads—pure tribal knowledge.

Vertical AI often aims at precisely these unstructured processes—one reason it holds so much promise—but that means integration in the traditional sense doesn’t capture everything. A legal AI solution might need to read contract comments exchanged over email or analyze negotiation behaviors, none of which reside in an official Case or Practice Management System like Clio. A construction AI solution might glean insights from foremen’s daily logbooks or on-site photographs. These rich data sources fall outside typical SaaS integrations. As a result, vertical AI developers must broaden their notion of “integration” and get creative beyond the standard SaaS API.

So how do we overcome this data challenge for Vertical AI? Here are a few ideas…

Option #1: Kludge

We’re seeing a lot of founders with Vertical AI employee offerings basically get log-in credentials from the customer, and the AI employees are able to directly work out of the ERP system.

This is an AMAZING workaround, but it’s messy and definitely a legal gray area. A recent court case brought this question to the fore. Last year, Real Time Medical Systems (RTMS, a provider of analytics to nursing facilities) sued EHR PointClickCare for using tactics like CAPTCHAs and account restrictions to block its automated access to patient data, despite customers authorizing that access. In March, the court ruled in favor of RTMS, stating PointClickCare’s actions likely violated open EHR legislation and constituted unfair competition. The decision hopefully sets a precedent for software openness—but healthcare also has special protections in this regard (via the 21st Century Cures Act and other laws) that other verticals may not.

And there are legitimate concerns with every Vertical AI company trying to kludge its own workarounds. Compliance weighs heavily given regulations like HIPPA and GDPR. But a poorly orchestrated ecosystem could also be vulnerable to prompt injection attacks or the exposure of sensitive credentials. Both OpenAI and Anthropic are actively working on defenses in this regard (e.g., Anthropic’s content classifier during computer vision steps). So long-term prospects for this AI workaround are across verticals remain quite unclear.

Option #2: Partnership

Be the AI partner to the legacy software provider / ERP. If you can actually go and partner with the legacy company (who probably thinks AI is a trend and just helps them figure out how to cook dinner), and build out a whole host of vertical AI employees while leveraging their data set. If you do this, you can probably become bigger in scale than the management system. Why? Because your product gets compared to an employee’s salary versus a typical per seat SaaS contract.

I don’t think enough folks are actually trying this, and so many legacy companies would rather take a 10% commission from you then to go build this all out on their own. This statement is obviously very industry dependent but my experience is so many of these shops are running 10-15 years behind.

This creates some down-stream risk as they wake up but you can probably build your own ERP by the time that happens. I think you could do it much faster than Option #1 as well.

Option #3: Segmentation

Go SMB. The business management system / ERP is far less sticky with smaller customers. They typically are much more modern / open systems with API’s, because they don’t have the lock-in power the ERP’s have with mid-market and enterprise businesses. You can likely leverage their data any which way you want here. Just make sure the SMB segment in a particular industry is big enough for you to build the size of business you’re aiming for. You also have to build an incredible product that delivers on it’s promise because competition here is typically pretty ruthless.

Option #4: Wedge Selection

Focus on offering Vertical AI that doesn’t need to interact with the ERP / System of Record. There are plenty of opportunities and industries where you can provide a ton of value and build a big business without needing to touch it. Think AI Sales Agents trained on everything in a particular industry. AI Customer Suport Reps for a particular industry. The list goes on. You can even charge by performance (IE leads delivered, tickets closed, etc.). If the performance is good enough they will gladly key this info in to their management system.

Option #5: AI Infra

Bet on the AI data infrastructure ecosystem to help alleviate this problem in the near-term. There are two developments we see as particularly promising here.

The first is the rise of standardized agentic communication frameworks. Last year, Anthropic announced the Model Context Protocol (MCP), an open standard designed to solve the combinatorial explosion of AI-to-tool integrations. MCP enables AI systems to dynamically fetch external data and execute tools in a standardized, model-agnostic way: a “USB-C port for AI applications.” Built on a client-host-server architecture\, MCP lets AI applications (clients) access resources hosted by external services (servers) via a coordinated environment (host). For Vertical AI founders, frameworks like MCP may offer a way to decouple integration logic from their core product and reduce reliance on brittle, one-off connectors.

Second, Vertical AI may have options that are less reliant on behavior change of legacy systems or even users themselves.The emerging concept of AI-driven “computer use” extends traditional RPA (which can already click buttons in a scripted way) by adding flexibility and understanding. An AI agent can interpret new situations or adapt to slight changes in the interface that would break a rigid script. OpenAI recently released, for example, ChatGPT “Operator.” It uses a new Computer-Using Agent (CUA) model that combines GPT-4’s vision (image understanding) with reinforcement learning for advanced operation of a cloud-based browser on the user’s behalf. They could, for example, instruct Operator to “find and book a reservation next week at the highest-rated Italian food restaurant that has outdoor seating.” You can see how a more powerful enterprise version would be valuable for Vertical AI startups. And of course, many startups—like Adept, with >$400M raised—are targeting such B2B use cases directly. Computer Use is fairly nascent and not ready for prime-time but we expect that to change fast.

CONCLUSION

So that’s our quick riff on the problem statement. It’s not perfect, and it’s ever changing, but these are a few ways to attack the challenge.

Now we would love to hear from you all – what are other creative ways to solve the integration problem with Vertical AI? What have you seen work that I have not listed above?

Reply to this email or jump into the comments.

One ‘How-To’:

How To Get Your Ticket To The Vertical Software Summit 2025 :-)

I have capacity for ~200 folks and we’ve already blown past ~100.

Stoked at the demand.

But don’t miss out.

Grab your ticket before they go — vSaaS founders / operators / investors only!

One Biz Story:

The Story of Abridge - Vertical AI For Clinicians

Abridge, founded in 2018 and headquartered in Pittsburgh, has built a vertical AI tool that is designed to transform patient-clinician conversations into structured clinical notes in real-time, integrating seamlessly with Electronic Health Record (EHR) systems like Epic.

Its technology aims to reduce the administrative burden on clinicians, enabling them to focus on patient care.

Market Size and Context

The U.S. healthcare market presents a significant opportunity for Abridge, with approximately 1.1 million active physicians as of January 2025, according to consumer health data.

This large clinician base faces high burnout rates, with nearly half reporting feelings of burnout, primarily due to administrative tasks like documentation. The clinical documentation market, part of the broader healthcare AI sector, is poised for growth, driven by the need for efficiency and cost reduction.

Founders and Origin Story

Abridge was founded on March 1, 2018, by Dr. Shivdev Rao (CEO), Florian Metze (CSO, left in 2019), and Sandeep Konam (CTO, involved as of March 2025), originating from the Pittsburgh Health Data Alliance, a collaboration between the University of Pittsburgh, UPMC, and Carnegie Mellon University.

Dr. Rao, with a bachelor’s in history from Carnegie Mellon (2001) and medical training at the University of Pittsburgh, was inspired by an ophthalmologist’s high-efficiency surgical platform during his undergraduate studies. His residency in Internal Medicine at the University of Michigan and cardiology fellowship at UPMC further shaped his vision to improve patient care at scale through technology.

Konam, with a master’s in robotics from Carnegie Mellon (2017), and Metze, an associate research professor at Carnegie Mellon since 2009 focusing on speech recognition, brought technical expertise. Rao’s experience as a practicing cardiologist highlighted the need for better clinical communication, leading to Abridge’s mission to "power deeper understanding in healthcare through purpose-built AI"

First Customer

It seems likely that UPMC, based in Pittsburgh like Abridge, was the first major customer, given their early partnership announced in May 2020.

This collaboration involved using Abridge’s technology for telehealth visits during the COVID-19 pandemic, addressing communication gaps and enhancing patient experience. This early adoption by UPMC, a key player in the Pittsburgh Health Data Alliance, underscores the local ties and initial validation of Abridge’s technology.

Integration with Epic’s System

Abridge integration with Epic, began in August 2023 when it became the first "Pal" in Epic’s Partners and Pals program Abridge and Epic Integration.

I can’t underscore how big this was for Abridge and it is a valuable lesson for all vertical software founders. Instead of trying to go around EPIC, build hap-hazard integrations, Abridge went direct and became a key AI partner for them. Too many start-ups DON’T TRY THIS. I get the big bad ERP of the space may not play ball but try. Always try.

Overview of Abridge’s Product Suite

Abridge’s product suite centers on its generative AI platform for clinical documentation, with key components including:

Abridge for Clinicians: A mobile app for recording and summarizing patient conversations, available for free on app stores, designed for real-time note generation

Abridge Inside: An enterprise solution integrated within Epic, supporting workflows from Haiku to Hyperdrive, ensuring seamless use within existing EHR systems.

Contextual Reasoning Engine: Launched in 2025, this tool generates billable notes at the point of care, integrating system and revenue cycle requirements into AI models.

Pricing

Abridge’s pricing is not publicly disclosed, reflecting its enterprise focus and likely customized subscription models or licensing fees negotiated with health systems. It’s fair to say it is likely very expensive!

Number of Customers

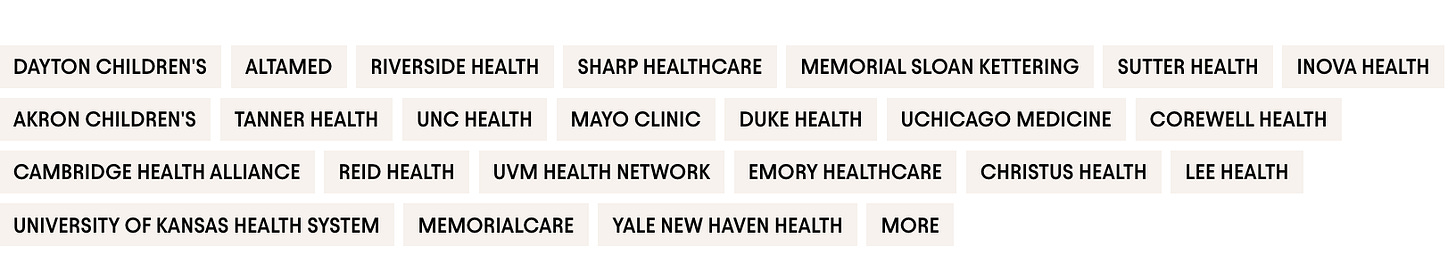

As of 2025, Abridge has partnerships with over 100 health systems across the U.S., including major institutions like Johns Hopkins, Kaiser Permanente, Duke, Mayo Clinic, and UPMC. Recent press releases indicate enterprise-wide implementations at Duke Health, Johns Hopkins, Mayo Clinic, and UNC Health, representing tens of thousands of clinicians. While exact numbers of individual clinicians are not disclosed, the scale suggests significant penetration, especially given the rapid expansion since early 2024.

Revenue & Fundraising Figures

Abridge has raised approximately $460M in total funding across multiple rounds, with key milestones including:

Seed and Series A (2020): $15M, led by UPMC Enterprises and Union Square Ventures, with participation from Bessemer Venture Partners and others.

Series A-1 (2022): $12.5M, led by Wittington Ventures, with existing investors like UPMC Enterprises and new ones like Yoshua Bengio

Series B (2023): $30M, details not fully specified in public sources.

Series C (February 2024): $150M, led by Lightspeed Venture Partners and Redpoint Ventures, valuing Abridge at $850M.

Series D (February 2025): $250M, co-led by Elad Gil and IVP, with investors including Lightspeed Venture Partners, CVS Health Ventures, Redpoint Ventures, and NVentures, bringing the total to around $460M.

Investors include a mix of venture capital firms, strategic healthcare investors, and angel investors, reflecting strong confidence in Abridge’s potential.

Abridge’s revenue for 2023 was reported at $7.6M, reflecting its early growth stage and increasing adoption across health systems but given how much they’ve raised I would guess they have been tripling YoY. My guess? They are around ~$100M ARR run rate.

Outlook for the Future

Abridge is addressing a critical pain point in healthcare: clinician burnout due to documentation. With over 100 health system partnerships and deep integration into Epic, the company is scaling rapidly, potentially reaching a multi-billion-dollar valuation if it maintains its trajectory.

Their biggest risk is whether or not EPIC builds the same thing in house and crushes them — just as they’ve done to so many in the healthcare space.

I wonder if they will try to expand to compete head on with EPIC or if they can play nicely together over the long haul.

Will be interesting to see how it plays out!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com