#125: Vertical AI Doesn't Solve the vSaaS GTM Problem, vSaaS Penetration, The Story of FullSteam

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by the Vertical SaaS Bible. 1,000+ pages of vertical software case studies, operating playbooks, and how-to’s. It’s every vSaaS nerds dream!

Grab a copy if you haven’t yet :-)

Alright, let’s get to it…

One vSaaS Breakdown:

Vertical AI Doesn’t Solve The Vertical SaaS GTM Problem

You can have the greatest product on God’s green earth but…

An industry will still require a long sales cycle

An industry will still be segmented poorly

An industry will have bureaucracy that is incredibly difficult to overcome

An industry will still only buy face to face or over fancy dinners

Every VC in the Valley has gotten very excited about Vertical AI. A lot of that excitement is valid, if your AI product can actually eliminate W-2’s and tap into human capital costs, you should be excited.

The problem that many tourist VC’s aren’t thinking about is how difficult/painful customer acquisition is in so many industries.

If you’re a founder thinking about starting something, or an investor thinking about investing, or an acquirer thinking about buying a vertical AI business, you have to go deep on customer acquisition and go-to-market motions. IMHO, you have to go as deep as you do here as you go on your product.

A few examples

Education almost always has a downright awful GTM motion. The greatest product on the planet will still take a decade to achieve some scale.

Government is incredibly difficult and painful, and the only vSaaS companies we’ve seen achieve some strong scale here have been roll-ups, or hung in there for 15+ years.

Have you ever seen an EdTech or a GovTech start-up achieve $10M ARR in <3 years?

I haven’t…

These are two very generalized examples, but the underlying point here is don’t go all-in on vertical AI unless you are incredibly comfortable with the go-to-market motion and the time it takes a typical SaaS company to acquire a customer.

Entrepreneurs need to think about innovating BEYOND their product and their idea. The best founders treat their go-to-market in the same way as their product. Think Dropbox’s early distribution hacks, Loom’s early referral engine, Uber’s is another beautiful example.

The vSaaS world has been incredibly dry here.

We all need to think about this at the same level of detail as our ideas.

Otherwise the Vertical AI promise in many industries will take 10+ years to culminate and be littered with failed companies.

Let’s ensure we don’t follow the same playbook with the same results that our previous vSaaS friends / predecessors have.

Me included.

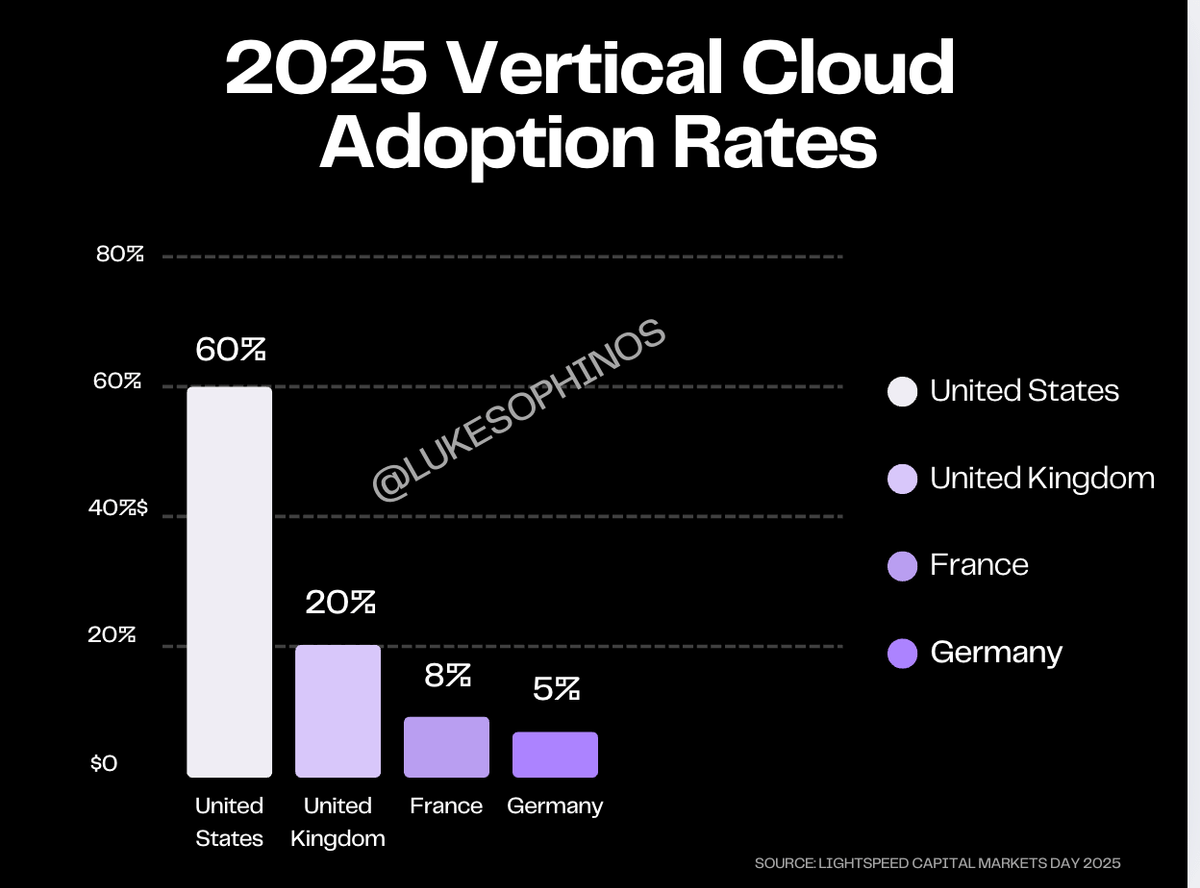

One Crazy Stat:

Vertical Cloud Solutions Market Penetration

It's still very early…

One Biz Story:

The Story of FullSteam:

I’ve been thinking a lot about Vertical Software acquisition companies lately. Did a deep dive on Alpine a few weeks back. Today, let’s take a look at the folks at FullSteam and their epic climb over the last few years…

Fullsteam, founded in 2018 by CEO Michael Lawler in partnership with Aquiline Capital Partners, has emerged as a significant player in the vertical SaaS landscape, buying up $1M-$10M ARR shops, implementing payments, and holding them for the long haul. The payments playbook is well-known in vSaaS, but FullSteam has created an entire holding company with that as its core thesis.

Business Model and Operations

Fullsteam operates as a holding company focused on acquiring and scaling vertical SaaS businesses that serve highly specialized industries. Their core strategy involves purchasing founder-led software companies, integrating a proprietary payments platform, and providing operational support to enhance growth and profitability.

This model is designed to create end-to-end business management systems tailored to industry-specific needs, leveraging centralized operations, technology, and payments capabilities.

The company’s aggressive acquisition strategy, with over 70 acquisitions reported as of May 2023, in only five years (!) underscores their commitment to consolidating niche markets.

Leadership and Vision:

Michael Lawler, the CEO and co-founder, brings extensive experience in payments and software integration, having held leadership roles at companies like Heartland Payment Systems and Official Payments.

His vision, articulated in public statements, is to address the convergence of business management software adoption and merchant payment processing, a trend increasingly relevant for small businesses. Lawler’s partnership with Aquiline Capital Partners, a private investment firm with $7 billion in assets under management, has been instrumental in scaling Fullsteam from A-Z.

Acquisition Strategy and Metrics:

Fullsteam targets vertical SaaS companies with strong product-market fit, recurring revenue, and growth potential, typically with annual recurring revenue (ARR) in the $1M–$10M range.

Their focus is on businesses with low gross churn rates, ideally below 10%, indicating strong customer retention, and efficient customer acquisition cost (CAC) to lifetime value (LTV) ratios, which benefit significantly from payments integration.

The persona of their acquisition targets is often a founder-led company with a loyal customer base but limited resources for scaling sales, marketing, or payment infrastructure.

An example of this strategy in action —

Their acquisition of IntegraPark in March 2022, a Houston-based company founded in 2001, providing accounting management solutions for parking businesses. By integrating Fullsteam’s payments technology, IntegraPark can streamline transactions, reducing manual errors and improving operational efficiency, a model they replicate across their portfolio. They can also SIGNIFICANTLY juice revenue by taking a piece of every transaction.

Payments Integration and Value Addition:

I wan’t to go deeper here because it’s so important… Fullsteam’s proprietary payments platform, MezzoPay, is a cornerstone of their value proposition. They developed cloud-first and designed for integration with vertical software, it enables seamless, secure, and scalable payment processing tailored to each industry’s needs. For example, MezzoPay, embedded in Maestro PMS, allows hotels to process transactions directly within their property management system, eliminating third-party gateways and reducing friction. This integration can increase revenue per customer by 2–5x through transaction fees, improve customer experience by reducing manual errors, and enhance operational efficiency through Fullsteam’s support in sales, marketing, and product development. This transformation is critical for acquired businesses, turning them into more competitive, profitable entities and enhancing their appeal to customers and future investors.

Financial Backing and Scale

Fullsteam has secured significant capital to fuel its growth and acquisition strategy, with two major funding rounds:

In December 2021, they closed a minority investment from Sixth Street, a global investment firm with over $55 billion in assets under management, with financial details not disclosed.

In May 2023, they received a major investment from Aquiline Capital Partners (lead investor) and the Abu Dhabi Investment Authority (ADIA), with ADIA becoming a significant minority investor, though exact amounts were not disclosed.

These rounds, backed by deep-pocketed investors, have enabled Fullsteam to pursue rapid expansion, building on their portfolio of 70 acquisitions as of May 2023. They have not disclosed totals, but given how big these funds are, they are NOT writing small checks. My guess is they’ve raised $200M+.

Estimating their scale, with an average ARR of $5M per acquired company (a conservative estimate for vertical SaaS), their portfolio could generate $350M–$500M in ARR.

Adding payments revenue, which can double or triple software revenue, total revenue is probably in the $500M–$1B ARR range.

Valuation multiples for private SaaS companies, assuming 5x ARR, suggest Fullsteam could be valued at $5B+.

Look at their website for god sake.

This is CRAZY.

Other SaaS aggregators, such as Constellation Software (market cap ~$90B, operating globally) Banyan Software, Alpine, and Valsoft also acquire vertical software companies. Fullsteam’s marketed differentiation is owning the payments technology.

Future Outlook:

Fullsteam is well-positioned for continued growth in the vertical SaaS and payments space, driven by their aggressive acquisition strategy and strong investor backing.

The rise of embedded fintech, where payments are seamlessly integrated into software, is a significant tailwind, likely increasing their portfolio value by enhancing lifetime value (LTV) and reducing customer acquisition cost (CAC).

The trend of small businesses increasingly adopting digital payments and software aligns with Fullsteam’s model, suggesting potential for further consolidation of niche SaaS markets.

One ‘How-To’:

How To Get Your Ticket To The Vertical Software Summit 2025 :-)

I have capacity for ~200 folks and we’ve already blown past ~100.

Stoked at the demand.

But don’t miss out.

Grab your ticket before they go — vSaaS founders / operators / investors only!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com