#121: Vertical Software Summit, 2024 Private/Public Metrics Review, Thiel Fellow Alumni Weekend,

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today's newsletter is sponsored by Orbital, the Zoominfo for companies selling to SMBs.

Get your TAM in a box, find contacts not on LinkedIn, and enrich vertical-specific attributes using our AI platform. Today, Orbital powers the fastest growing vSaaS companies across any SMB vertical – from home services to fitness & wellness.

Check it out: withorbital.com

Alright, let’s get to it…

One Exciting Update:

The Vertical Software Summit Is Official !!!

5 years ago there wasn’t a Vertical Software Email Newsletter.

So we created Linear — what your reading now :-).

Upon reflection over the past few months, I came to the conclusion it was time to also create a flagship event for vertical software founders, operators, and investors. Why? Well, because, there wasn’t one…

We all deserve ~2 days a year to share notes, get inspired, and learn from each other to grow our companies into the leaders of the industries that we serve.

A lot of the top folks in vertical software have graciously accepted invites to come to this and share their wisdom — Ilir Sela (Founder & CEO of Slice), Kyle Norton (CRO of Owner.com), Alex Jekowsky (Founder & CEO of Cents), Jeremy Yamaguchi (Founder & CEO of Cabana), and a bunch of other killer vSaaS investors and acquirers.

So I’m super excited to unveil it to you all today!

We are capped around ~200 folks and just released early bird tickets for founders, operators, investors, and vSaaS vendors — this is the cheapest they will be so act quick, I think we will run out of room pretty fast.

Check out the full schedule at the link below.

I hope to see you in Miami in October for what will be an incredible event for the vertical software community.

One vSaaS Breakdown:

SEG Annual Report

Software Equity Group dropped their 2024 annual report. Always enjoy this one, packed with some solid information. Let’s dive into it…

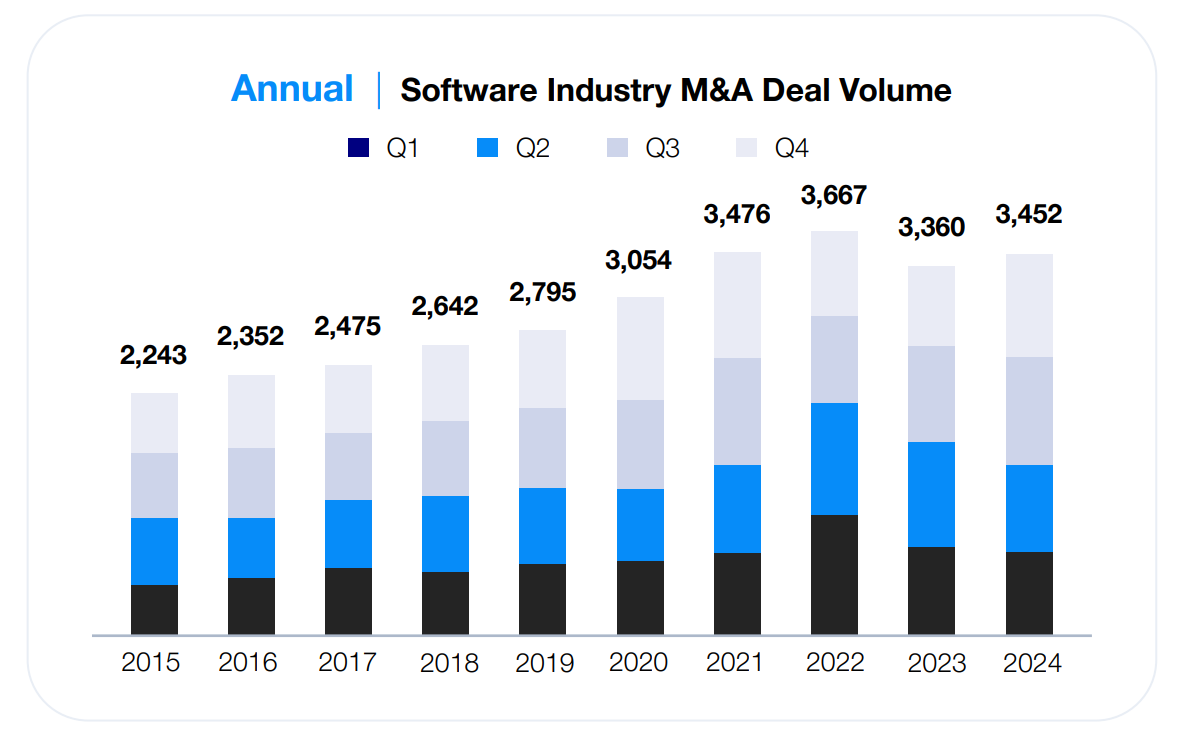

Starting with Private Markets and M&A Deal Volume, 2024 rebounded from 2023 slump. I expected 2025 to bounce back stronger but given all the tariff noise in the world we may see dry powder continue to sit on the sidelines.

We’re still way up over the long term…

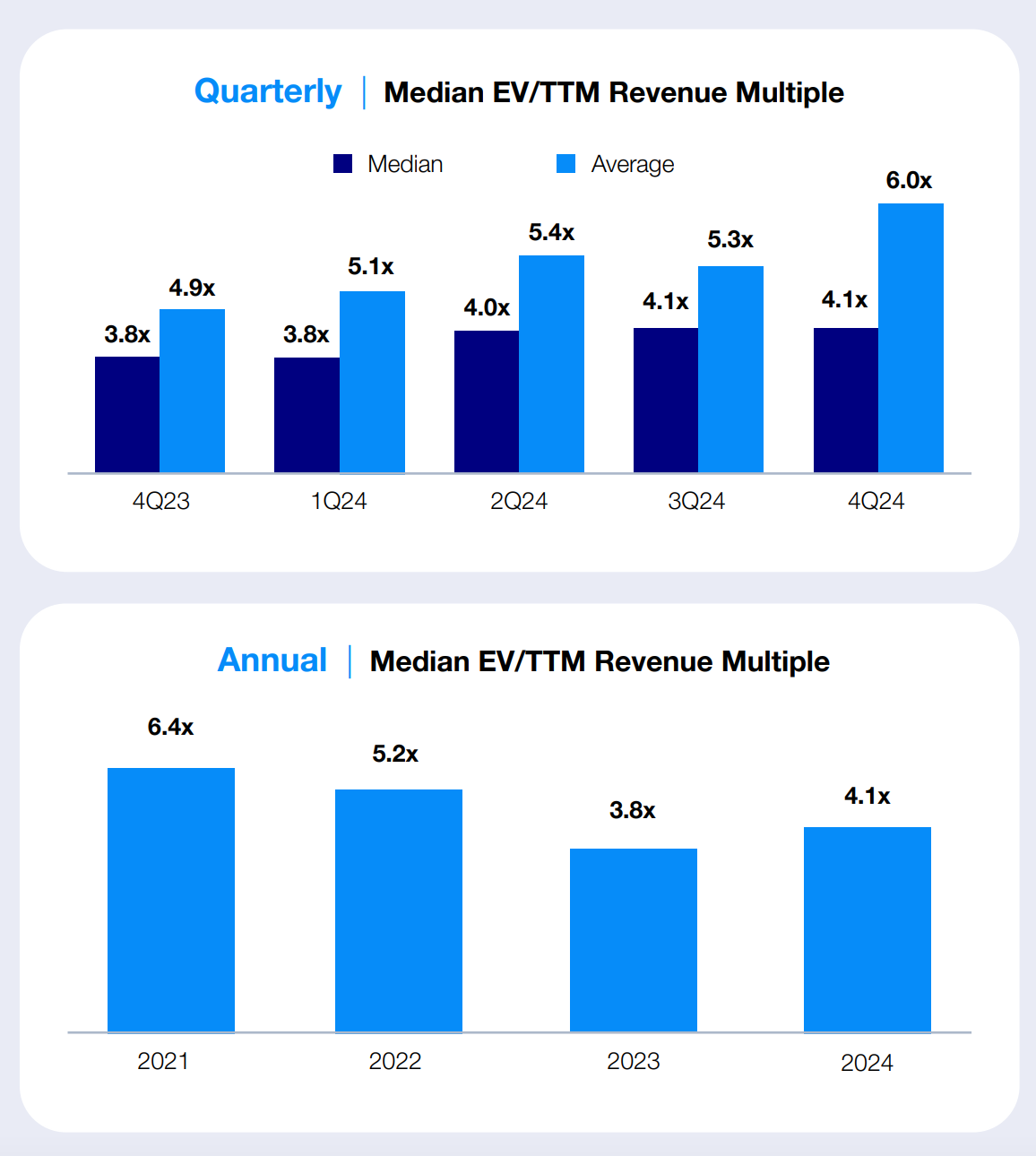

You’re vertical SaaS business is probably not worth 10X. Intellectual lazy thinking by most founders to just assume that. I use to do the same thing.

A better baseline is 5X. But you still need to be growing 20%+ ideally profitable or near-break even.

If you want to sell you have to get profitable. It’s just how it goes. I wish I learned that lesson sooner.

This one was interesting, looked at SaaS companies that sold and what they specifically did. Content & Workflow management was by far the most popular. Good for vSaaS founders :-).

Was surprised to see FinTech so low…

Zooming into vSaaS specifically, these were the most popular verticals when it came to M&A over the last two years.

No surprise Healthcare was at the tippity top of the list.

Now shifting to public markets, the group that sets the baseline for the rest of us… Here was the median metrics across publicly traded SaaS companies:

SaaS as an asset class got getting absolutely smoked in 2024 relative to more traditional index funds. Remember - you’re investors are competing with other places cash can be invested. We need to see a better performance in 2025.

Rule of 40 is a beautiful metric that I recommend every SaaS company adopt. I didn’t look at this enough during my operating tenure. The math is really simple — your growth rate + profit margin. So if you’re growth rate is 30% YoY and your profit margin is 20% your rule of 40 would be 50. The better the rule of 40 the higher your multiple.

And, as always, retention is the lifeblood of SaaS businesses. The better the retention the better the multiple…

Good things to think about for my founder/operator friends out there…

You’re whole company should be focused on the below metrics. They should also be bonused on them. Do that and your already better than most private SaaS businesses.

Some form of NPS / Customer Happiness that is non-bias

Annual Recurring Revenue (ARR)

Growth Rate

Net Revenue Retention

Gross Logo Retention

EBITDA

Just focus on the above and make sure everyone else at your company is focused on the above. Make ONE PERSON responsible for the ownership of ONE METRIC.

Friendly reminder to go check out MeetingHero.AI for free!

MeetingHero.AI automatically analyzes your digital calendar, and sends you meeting prep insights on the person(s) you’re meeting with via email and/or calendar. It’s crazy powerful and very helpful - and it’s available 100% FREE for 7 days to our readers. Updates so no credit card required.

One Biz Story:

Thiel Fellowship Alumni Weekend

I joined the Thiel Fellowship in 2016 — it’s an awesome group of ~300 or so folks that have built iconic companies like Loom, Figma, OYO Rooms, and Ethereum. I’m a very underperforming Thiel Fellow in relation to the others — 10% of fellows have built a billion dollar company. 30% have built a company valued at $100M+

We recently had our alumni weekend — I love these events because I get to hear about new verticals / start-ups / interesting places this crew is spending time. There were some companies that were just absolutely ripping. I wanted to share two opportunities that those looking for their next thing can take a look at.

#1. Software for AI Infrastructure

The folks that had experienced growth I literally could not even fathom are building SaaS tools up and down the AI infrastructure stack. Think SaaS for AI Servers, or SaaS that visualized the chip supply chain. It’s worth going deep here and studying EVERYTHING that has to happen behind the scenes OpenAI to show you that little text box. Some growth rates I heard were $2M to $180M, and $5M to $50M. This is just crazy BUT if you think about all of the money pouring into these GenAI products there are some big vSaaS opportunities behind the industries servicing them.

#2. Dandy / Dental

It’s easy for us to all think about software but those that had a unique physical product backed by a SaaS business were quite intriguing. Dandy is one of those examples - with ZERO dental background - they realized that the fake teeth market was incredibly antiquated. You’d have to go visit the dentist multiple times and it takes weeks for you to get something that should have a ~24 hour turn around. This is a multi-billion dollar business with VERY REAL / SIGNIFICANT revenue and profit. It’s worth thinking to yourself… Where else are their Dandy-esque opportunities in the world?

The theme of the weekend was also about how hard building businesses is. We talk about all the good things, the glory, etc. But the reality is that every Thiel Fellow is chewing glass and walking through hell. EVERY company with TechCrunch headlines and big press lines has overcome multiple near-death experiences and times were they thought they were totally f*cked.

Don’t forget that in the journey. Building a business is constantly getting punched in the face and just accepting it.

The folks with the largest pain tolerance are the ones that win.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com