#120: My Former CTO's New Start-Up, Alpine Investors Roll Up Machine, Shrink Your ICP Don't Grow It

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by MeetingHero.AI

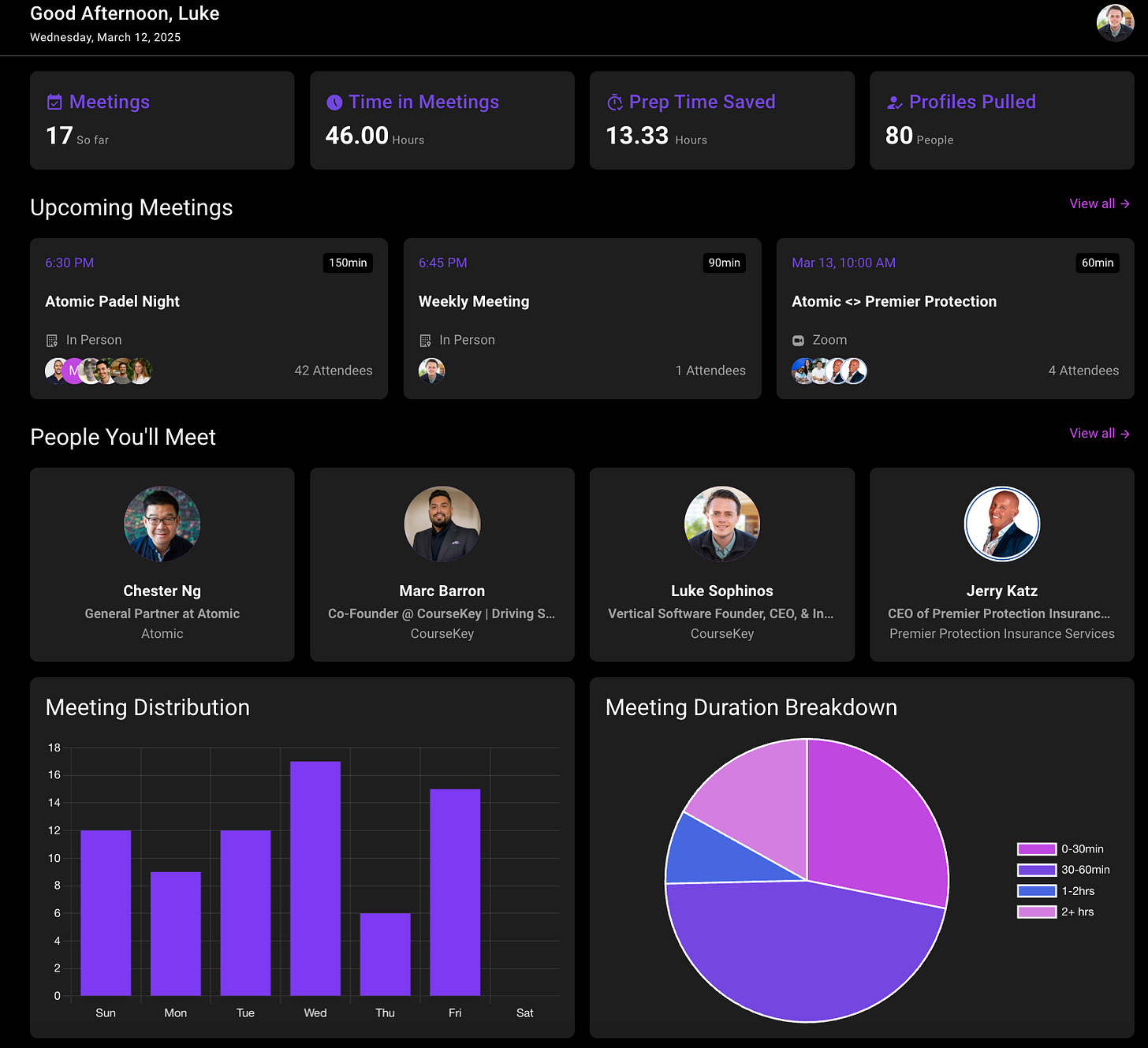

MeetingHero.AI automatically analyzes your digital calendar, and sends you meeting prep insights on the person(s) you’re meeting with via email and/or calendar. It’s crazy powerful and very helpful - and it’s available 100% FREE for 7 days to our readers.

One Biz Story:

My Former CTO’s New Start-Up

I founded my last company, CourseKey (vertical SaaS for Trade Schools), with an incredible Co-Founder & CTO.

He has a very inspirational story — fleeing Iraq due to religious persecution, ultimately ending up in America not knowing english and with no money to his name, and rising above and ultimately achieving the American Dream. I did a full write-up on him if you’re interested in a heart-wrencher / heroes journey type of story.

But after selling CourseKey last year, Fadee is on to his next adventure and I wanted to highlight a really powerful tool he has built.

It’s called MeetingHero.AI and t’s something I wish existed for the last ten years.

It’s really simple but really powerful —

Connect your Gmail or Outlook

The AI analyzes the internet and gets all the data it possibly can grab on the person or persons you’re about to meet with

The AI sends you an email and/or calendar invite ~10 minutes before with a ton of interesting information on the person you’re about to meet with

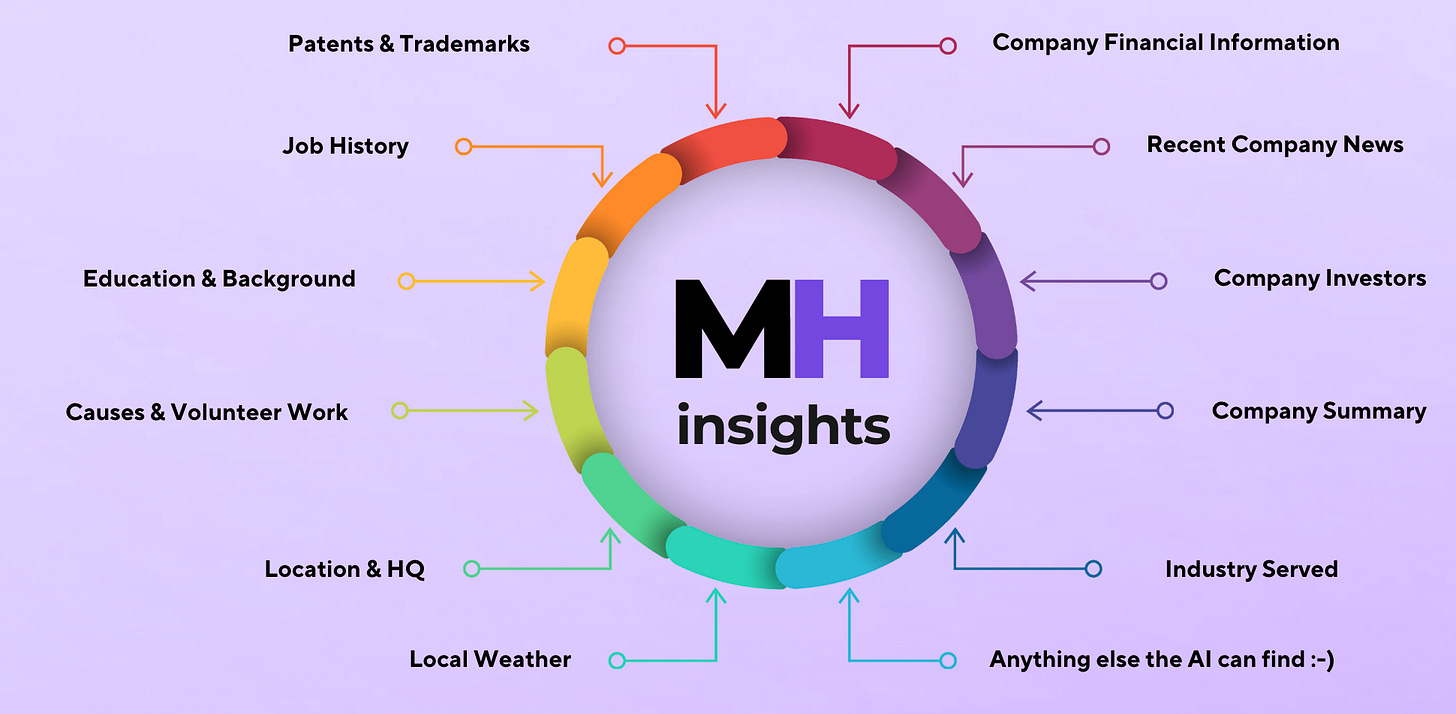

The AI pulls a lot of really helpful information like:

If you’re like me, you also like having these directly in your calendar, so it can put it there as well as your e-mail inbox:

It also has a bunch of really cool dashboards / insights:

It has a 7 day free trial, then he is basically charging nothing, like ~$4.2 a month.

Hope you all enjoy it as much as I do!

Can check it here:

One Sneak Peak:

I’m hosting a two day event THIS October and bringing the top vertical software founders, operators, and investors to Miami, Florida.

Limiting it to ~100 folks and already have lined up an absolutely INCREDIBLE group who have founded, built, scaled, invested, and sold iconic vertical SaaS companies.

More to come soon, but if you’re interested in being apart of it / applying to attend, reply to this email so I can add you to the comms list!

One vSaaS Breakdown:

Alpine Investors: The Roll Up Machine

Alpine Investors, established in 2001, stands out as a well-oiled machine with a mission to build enduring companies through strategic industry roll-ups. With a huge emphasis on vSaaS companies. Let’s examine their history, leadership, business model, portfolio, targeted industries, and fundraising, ensuring accuracy and depth based on available research.

Historical Context and Founding

Founded in 2001 by Graham Weaver, Alpine Investors began in a San Francisco pizza parlor, reflecting a humble start driven by Weaver’s frustration with Wall Street culture. The firm’s inception was rooted in a vision for a people-first approach, contrasting with traditional private equity models. This foundational ethos has guided its growth, with the firm now managing over $18 billion in assets under management.

Co-Founders and Their Backgrounds

The leadership team comprises four founding partners, each with distinct educational and professional backgrounds:

Graham Weaver: As founder and managing partner, Weaver holds a BS in Engineering from Princeton University, graduating with highest honors and serving as captain of the national championship lightweight crew team, and an MBA from Stanford Graduate School of Business (GSB). With over 20 years in private equity, he started Alpine post-Wall Street, also teaching a top-rated strategic management course at Stanford GSB.

Billy Maguy: A founding partner since 2004, Maguy earned BS and MS degrees in Industrial Engineering and an MBA from Stanford GSB. His prior roles included business development for a technology startup and management consulting specializing in strategy and mergers and acquisitions.

Dan Sanner: Joining in 2002, Sanner graduated from Dartmouth College. His early career involved directing a successful turnaround of an Alpine portfolio company and a two-year period investing for a family office based in Hong Kong, shaping his approach to deal-making.

Mark Strauch: A founding partner, Strauch attended Northwestern University - Kellogg School of Management. With over 30 years of experience, he previously served in CEO roles for venture and private equity-backed businesses, contributing to Alpine’s investing strategy.

This diverse expertise underpins Alpine’s people-first philosophy, emphasizing talent development and leadership.

Business Model and Operational Strategy

The firm focuses on control buyouts and add-on acquisitions, particularly in software and services, with total enterprise values up to $1 billion, as seen in its ninth fund strategy (Alpine Investors Fund IX). It employs unique programs like CEO-in-Residence and CEO-in-Training, providing leadership to portfolio companies during management transitions, ensuring growth and operational efficiency. This approach, recognized in Inc.’s Best in Business list for 2024 under Business Model Strategy fosters a virtuous cycle of financial and personal fulfillment.

Portfolio Overview:

Alpine’s investment portfolio is extensive, with over 650 investments and 44 exits. The portfolio spans multiple sectors, including media, software, healthcare, business services, consumer services, and consulting services, with a geographical focus on the United States, Canada, Europe, and Australia. Notable examples include:

Mindful, a customer experience platform.

AirDNA, focused on vacation rentals.

Sierra Interactive, a real estate software leader.

This diversity reflects Alpine’s strategy of targeting lower middle-market companies for consolidation and growth.

Industries Targeted for Roll-Ups:

Alpine’s roll-up strategy focuses on fragmented industries, leveraging acquisitions to consolidate and drive market share. Key focus areas include:

Software and Services: A large and growing market, Alpine uses platforms like Alpine Software Group (ASG) to acquire and build vertical SaaS companies, such as Sierra Interactive, addressing niche markets like legal technology and property management.

Healthcare: The firm targets professional education, with Axcel partnering with KMK Optometry for comprehensive optometry board exam preparation, entering the healthcare education sector.

Business Services: Includes managed IT services through Evergreen Services Group and commercial access solutions via Cobalt Service Partners, with multiple acquisitions since 2023, enhancing operational scale.

Residential Home Improvement: Apex Service Partners focuses on HVAC, plumbing, and electrical services, aiming to build leading local brands, while Vertex Service Partners targets home improvement, both invested in 2023.

Education: Investments like FEV Tutor, a research-based online tutoring platform, aim to impact K-12 education outcomes, with Alpine’s partnership announced in recent updates.

These industries, often characterized by fragmentation and under-served technology needs, allow Alpine to create value through consolidation and operational improvements, as seen in testimonials from portfolio company founders.

Funds Raised: A Detailed Timeline

Alpine has raised nine flagship funds since its inception, reflecting its scaling ambition and investor confidence. The funds, with amounts and years, are as follows:

Totaling $9.197 billion, this aligns with the firm’s reported $18 billion AUM, accounting for unrealized gains and portfolio growth. The fact that their funds continue to get bigger and bigger and their frequency of how quickly they are raising these is quite something.

These are the types of firms that buy a majority of lower-middle market vertical SaaS companies and many of them just absolutely crush it.

One ‘How-To’:

Shrink Your Ideal Customer Profile (ICP)

Don’t Grow It

Standard TAM advise is to find a giant industry and go after. That’s great advise for a non-operator and it typically comes from a non-operator.

My transparent opinion of this approach is it’s intellectual lazy.

What actually works when you're running a business?

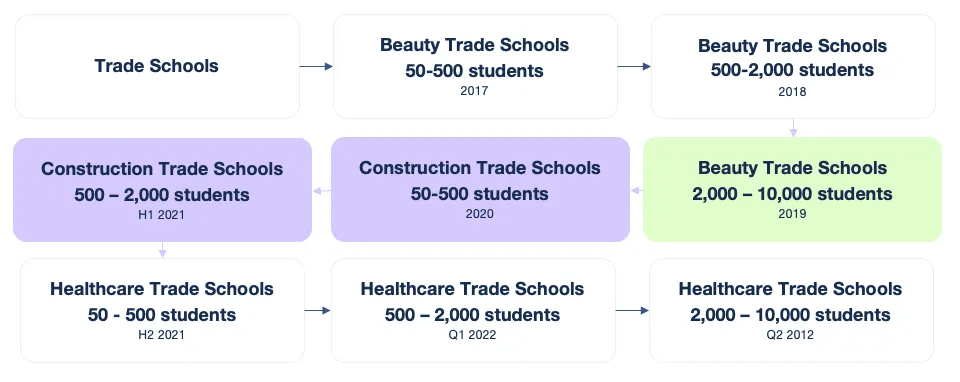

You break down your TAM into an ideal customer profile that is VERY SMALL.

You monopolize it.

Then you move to the next one.

You make the small segment of customers the happiest you possibly can before expanding the ICP.

Below is an example of how we did it with Trade Schools:

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com