#115: 4 Thoughts on Investment Bankers, Vertical SaaS Job Board, Monographs Series B

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One ‘How To’:

4 Thoughts On Investment Bankers

I get asked the question a lot,

“Should I use an investment banker to sell my company?”

It’s a straight forward question with a complicated answer. While you will have to make the decision that’s best for you, here’s a few thoughts I have about bankers and deciding whether or not to use one…

#1. A banker is just another vendor, even though they act like they’re unicorns

For some reason bankers act like they are very difficult to work with and they only select the absolute best companies. First time founders fall for this trick. Look it’s smart of them — it’s the hot girl at the bar approach. The harder they act like they are to work with the more likely you are to want to work with them.

In reality, this just isn’t the case. Of course they want to work with great companies, it sure makes their life easier. But they are vendors just like anyone else. And as long as they think there is a decent chance of you getting purchased they WILL work with you. So just don’t fall for the gamesmanship when selecting one.

#2. They tell you want you want to hear 90%+ of the time

I remember getting a few pitches from bankers and leaving the meeting thinking to myself, “Damn this is awesome, I did not think our company was so valuable.” Only to present it to the board and my trusted advisors and get a reality check, “Luke — bankers tell you what you want to hear. Expect 20-30% less.” Gut punch.

But it’s true, most of them really gas you up, if they told you something you didn’t want to hear, most people would choose not to work with them. Especially when they know the other bankers pitching are taking this approach.

Just know their beautiful presentation of your companies value is probably not reality.

#3. Everything is negotiable

Bankers typically structure deals with an up-front fee — $50K, $100K, $500K, etc. It all depends on how big your company is but think of this is them getting some “skin in the game” from you. From there they take a percentage of the transaction — usually 1-3%. Again - percentage is tied to how big the company is. Most are around 1%.

Just remember that everything with them is negotiable, never take the first offer. My strong belief it that you should *always* structure it on incentive basis. As little up-front as possible, and then give them more for the higher price you end up getting. A super simple example I’d aim for is something like this

$25K up front

0.5% for <$30M

.75% for $30M - $35M

1% for $35M- $40M

1.25% for $40M - $45M

1.5% for $45M-$50M

2% for $50M<

#4. The right banker is valuable, but most aren’t

Bankers are going to HATE ME for saying this but I’m sorry my friends, I truly believe it. Bankers are like Real Estate Agents.

There are AMAZING ONES but most, quite frankly, suck. You’ve probably experienced this first hand, you may have an absolutely incredible real-estate agent who found you off-market listings, who negotiated like crazy, who got everything you asked for and then some.

But you’ve also had a real-estate agent that had a software tool auto-send you 2 listings a week that you had already seen on Zillow like 250 times. You finally buy something and you say to yourself at the end of the process, “What the hell did they actually do for me?” And then to add insult to injury they hand you a $50 Applebees gift card and you never hear from them again.

This is the SAME EXACT story with bankers. If you find a great one, hold on to them forever. But the pareto principle is even more severe here, for every 5 good investment bankers there is probably 95 awful ones.

In conclusion, it’s a tough decision. But do your diligence, call a bunch of founder friends — those that used one and those that didn’t — make sure you select right if you do decide to hire a firm.

One Vertical SaaS Breakdown:

Vertical SaaS Job Board

One of my good-friends launched a really cool modern ATS built with AI. If you know anything about the ATS space, it hasn’t evolved much and pretty underwhelming. A few big players that no one seems very happy with.

When he told me about it, I let him know there wasn’t a dedicated job board for all the open vertical software / vertical AI jobs out there.

He spun it up for us out of the kindness of his heart :-).

If you know of anyone looking for a vertical SaaS job — send them here:

Thanks to Brandon and the Scalis team for hooking it up for our community! Reply to this email if you want us to post or highlight your job openings!

One Biz Story:

Monograph’s $20M Series B

Monograph - vertical SaaS for Architecture firms just raised a big time Series B round led by Base10 partners.

There founder did a write up here, but I wrote about them ~2 or so years ago so wanted to refresh you all on the company:

Three MIT alumns have raised ~$30M to build a vertical software platform exclusively for architectural firms. It’s a $350B+ market that, at the surface level, seems like a blue ocean opportunity. Let's take a closer look at their start-up, Monograph:

Monograph is a cloud-based project management software designed exclusively for architecture and engineering firms. The software helps firms manage their projects, employees, and finances with ease.

It was founded by design technologists with backgrounds in architecture: Robert Yuen, Moe Amaya, and Alex Dixon.

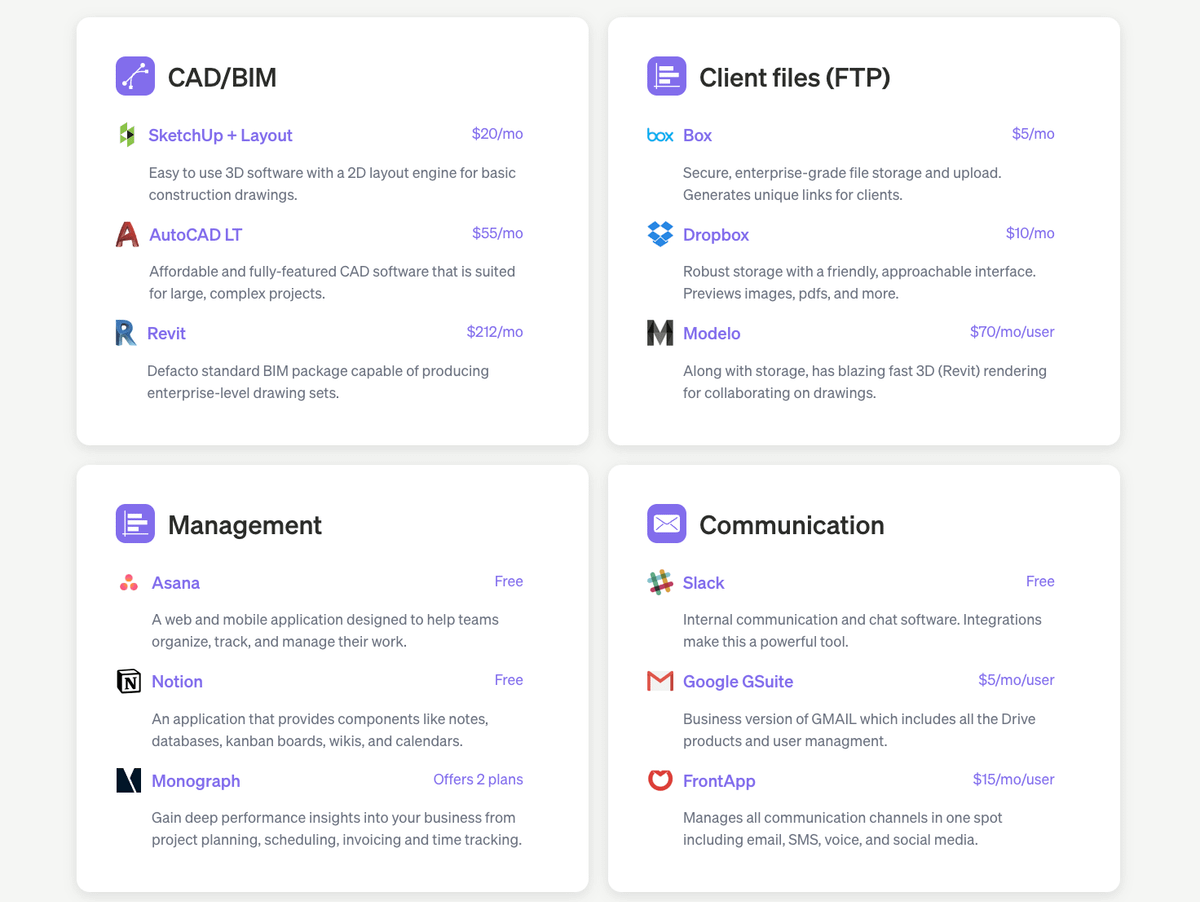

The company was started after they realized that most architecture shops "had no idea" whether or not projects were going to come in ON TIME and ON BUDGET. Additionally, the industry has historically operated via a sea of point solutions:

CAD: AutoCAD

Files: Box, Dropbox

Communication: GMail, Outlook

Management: Asana

Visualization: Rhino3D

Accounting: Quickbooks

Materials: MaterialBank

The goal? Bring it all into one place.

They started very simply. By initially building websites for architecture firms. Then moving fully into helping manage the business side of running a firm. One of the founders had this to say about the early days:

Monograph’s first customer was HDG Architecture, a firm based in San Francisco. The software helped HDG Architecture meet deadlines without stress by tracking project progress in real-time and dynamically resourcing projects based on different needs. From there, they continued to steadily grow their customer base and sign up firms that were running an aggregate of $125M of projects.

In March of 2020 they leveraged that momentum to raise a Seed Round led by Homebrew. WHY the firm invested:

Monograph’s product suite includes a complete set of tools for managing tasks, tracking time, and invoicing clients. The software features interactive Gantt charts, dashboards, and reports that allow firms to manage their projects and employees through each step of the project.

Monograph’s go-to-market strategy is to target small to medium-sized architecture and engineering firms. Architecture is a notoriously difficult market to sell into. My hunch is customer acquisition is done primarily through heavy marketing & outside sales reps.

Today, they offer two different product lines:

Track: offers time tracking, invoicing, payments, and basic budgets.

Grow: the enterprise offering, that layers in a lot more.

Typically, vSaaS management solutions are pretty expensive, i'd guess their ACV is north of $50K.

Continuing the momentum from their Seed Round, Monograph took advantage of a hot SaaS market and, in May 2021, raised a $7.4M Series A. Only a few months later they raised $20M Series B. Investors here were firms Index Ventures and Tiger Global.

Monograph’s revenue figures are not publicly available. However, the company has reported that $500 million worth of projects have been executed on the platform. My guess? With 50-ish employees on LinkedIn, their probably close to profitability and in the ~$10M ARR range.

Given the raise in '21 w/ Tiger, the valuation they have to grow into is likely sizeable. But with an ambitious vision, and solving a true problem, Monograph can overcome this and become a ONE STOP SHOP for architecture and engineering firms.

Here's to the team and what's next!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com