#111: How To Find The Right GTM Motion, vSaaS AI Agent, Reid Hoffmans New Vertical AI Start-Up

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One ‘How To’ :

How To Find The Right GTM Motion

I get asked this question ALL THE TIME.

To be honest, your GTM motion is probably more important than your product. And it’s where 99% of people fail and just don’t build the type of business they set out to.

The best founders don’t even launch a product without feeling confident in the GTM motion. Some industries are just slogs - education is one of those. It’s painfully brutal. You can have the best product on god’s green earth and it’s still probably going to take a decade to see some scale.

You HAVE to think about GTM motion the same way you think about your product idea. They work hand and hand.

A good product without users is a shitty product. And, unfortunately, some industries just aren’t set up in a way where they can quickly adopt something that they NEED.

So theres a few key things I strongly recommend doing before going all-in on your vertical or industry.

Study ALL THE COMPANIES that have significant traction and their GTM motion. Is it sales-led? Is it marketing-led? How long did it take them? What’s their ACV and how does that contribute to their GTM?

Test, test, test. Spin up some vaporware. Act like you have the best product this industry has ever seen. Try a marketing-led GTM and advertise on digital channels. Test a sales-led GTM and see how long it takes to get to a contract stage. Product-led? Spin up a v1 and see if the expansion into newer product/lines or freemium conversion actually works.

Track channels with an insane level of intensity and intellectual honesty. What’s working? What’s not? If this persists, how long will it take me to build the size of company I ultimately want to build?

I’ve had concepts and ideas I was ecstatic about. The market needed it. The customers were begging for it. But the GTM motion just wouldn’t work. Or it was too painful, or too long. I abandoned ship.

DON’T fall into the GTM motion trap. Too many founders don’t even THINK ABOUT THIS until 1-2 years in. That’s a painful time to come to the realization that it’s going to be a long, painful, slog…

Validate your GTM motion like you validate your product.

So. So. So. Important.

One vSaaS Breakdown:

vSaaS AI Agent

For those that missed it last week, a reader launched an AI platform for vSaaS founders/operators/investosr after hearing my process on a podcast.

They also figured out a way to make the AI way cheaper. So check it out here :-)

The amount of time I spend researching industries, finding vSaaS opportunities, or companies is, let’s just say, A LOT. And this guy built an AI that does it all for you.

I was, at first, skeptical.

But after using it for a while and experiencing the power first hand I told him we have to package this up and give it to the community.

So we did that, and let me tell you about a few things that it does…

First, there are two separate apps, one for founders/operators and one for investors/buyers. Select what you are…

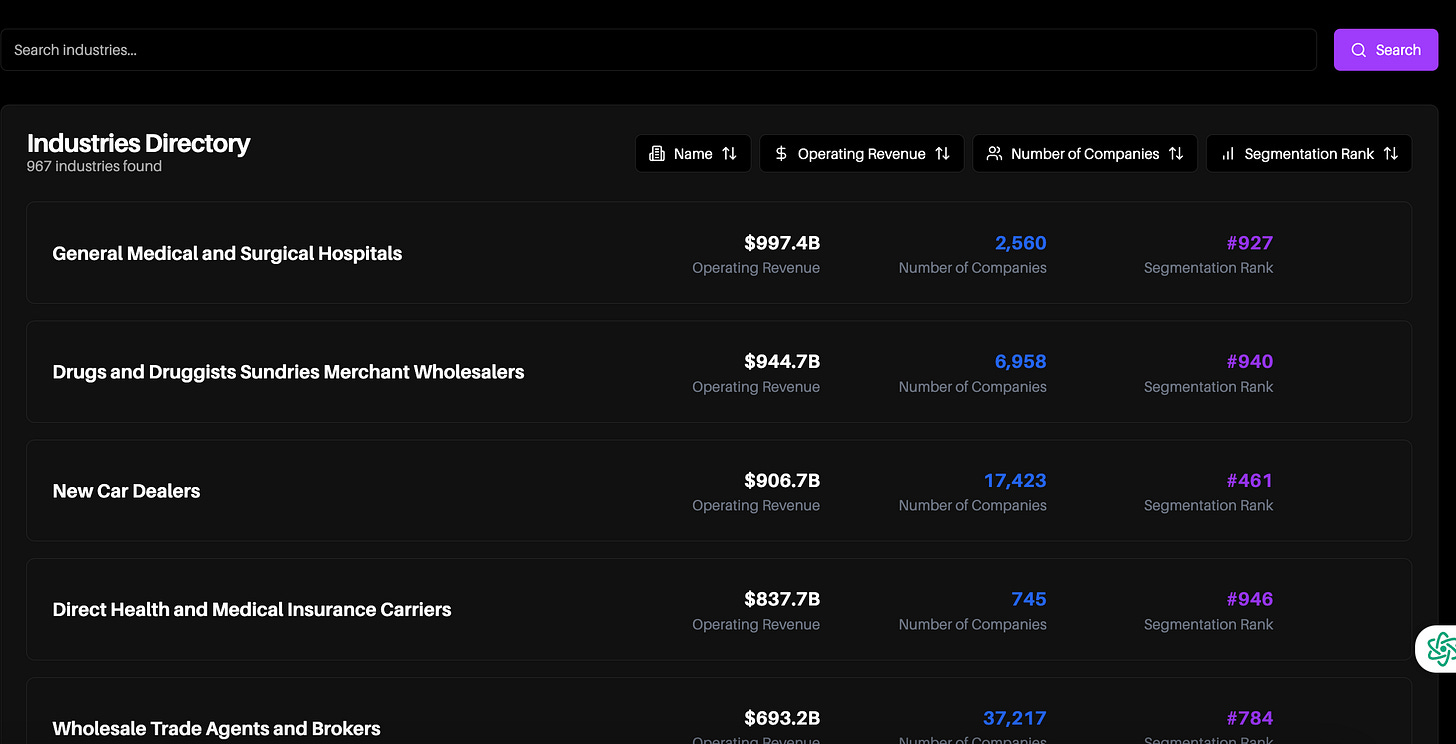

Then, you can jump into an industry list that ranks ranks roughly ~1K different industries.

Once you pick an industry, the AI will generate a report in ~30 seconds. That report is mind blowing it will include a detailed overview of the market, the end-to-end operational process, the existing vSaaS landscape, where there are vertical SaaS, payments, and AI opportunities, and a list of all the interesting companies that are attacking the space.

If you’re an investor or acquirer, you can literally get a list of all the SaaS companies serving the space that the AI can find, and their estimated revenue, employees, growth rate, profit, etc.

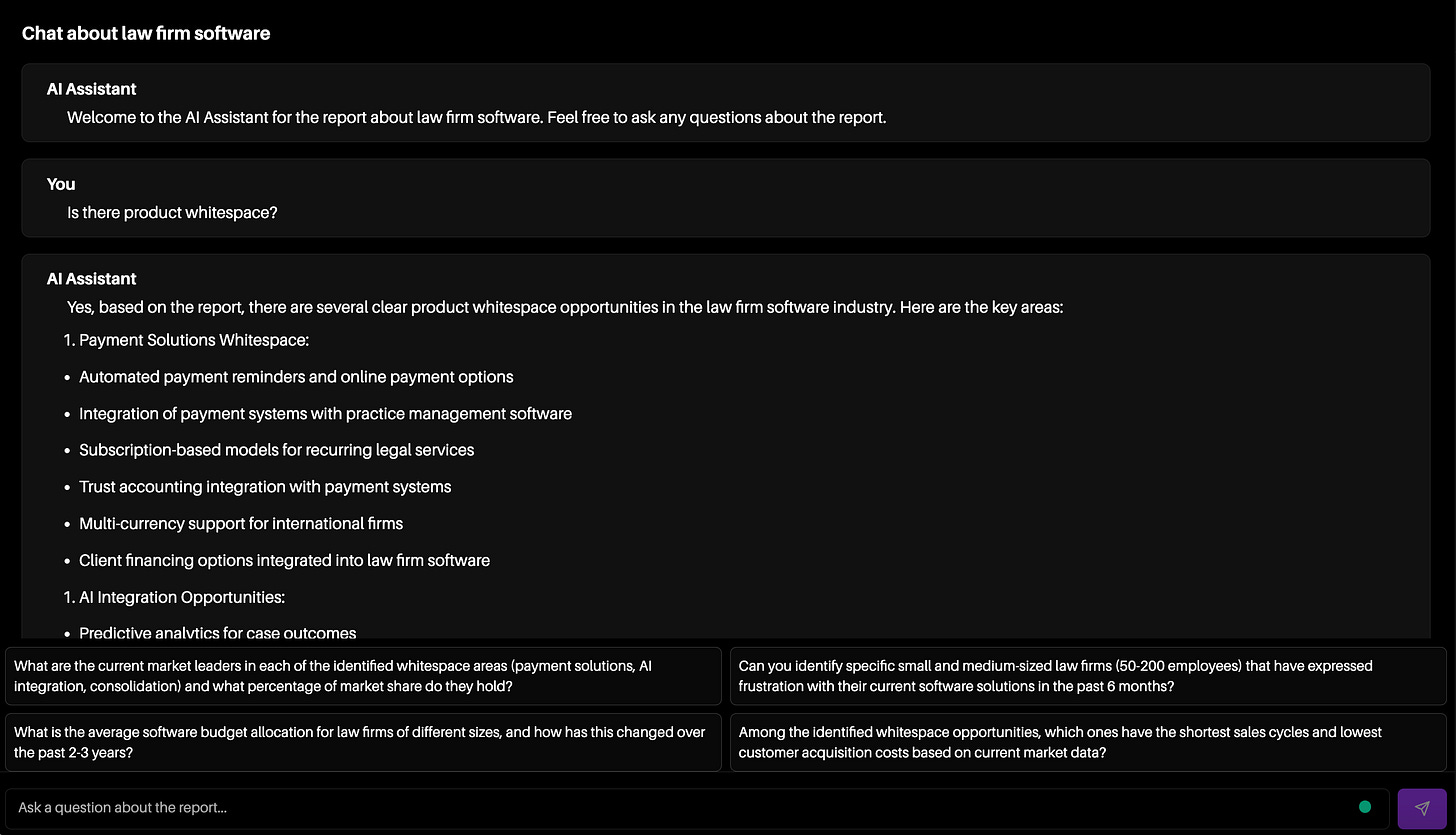

It doesn’t end there. Next you can literally chat with the AI and have it do work for you. You can have it do things like:

Draft an email to the CEO of Service Titan about us potentially acquiring his business

Give me a list of 100 businesses in the sector and draft a cold email for me to send to them to try and get a meeting

Help me identify a good wedge product for the industry

First, there are two separate apps, one for founders/operators and one for investors/buyers. Select what you are…

Then, you can jump into an industry list that ranks ranks roughly ~1K different industries.

Once you pick an industry, the AI will generate a report in ~30 seconds. That report is mind blowing it will include a detailed overview of the market, the end-to-end operational process, the existing vSaaS landscape, where there are vertical SaaS, payments, and AI opportunities, and a list of all the interesting companies that are attacking the space.

If you’re an investor or acquirer, you can literally get a list of all the SaaS companies serving the space that the AI can find, and their estimated revenue, employees, growth rate, profit, etc.

It doesn’t end there. Next you can literally chat with the AI and have it do work for you. You can have it do things like:

Draft an email to the CEO of Service Titan about us potentially acquiring his business

Give me a list of 100 businesses in the sector and draft a cold email for me to send to them to try and get a meeting

Help me identify a good wedge product for the industry

We’ve pre-populated a bunch of question samples in the app to get your juices flowing.

We’ve made it so you can try it out for free here.

PS — AI IS EXPENSIVE so you only get one report for free and then it costs some dough. But if any of you spend a fraction of the amount of time I have as a founder OR operator OR investor OR buyer then this thing will pay for itself with one report :-).

Anyways, love this community.

Can’t believe two of our readers built it for us.

Huge shoutout to Ash Nouruzi and Don Dang and Y for bringing it to life.

Try it out and let us know what you think! We’ve pre-populated a bunch of question samples in the app to get your juices flowing.

One Biz Story:

Reid Hoffman’s New Vertical AI Start-Up

(From The Observer)

Armed with $24.6 million in funding, a new startup from LinkedIn (LNKD) co-founder Reid Hoffman and cancer physician Siddhartha Mukherjee is looking to make a splash in the already-crowded world of A.I.-enabled drug discovery. Known as Manas AI, the venture aims to combine A.I. with computational chemistry and innovations in biology to accelerate treatments for cancer and rare diseases.

“Manas AI is breaking down barriers that have slowed medical innovation for decades, which will lead to exponential positive impact in our ability to treat human disease,” said Hoffman, a prominent investor in A.I. in recent years, in a statement. “A.I. will have a lasting and positive impact on humanity, and for years I have been focused on helping realize the potential of this technology.”

Hoffman co-led Manas’ recent seed round alongside the VC firm General Catalyst. Greylock Partners, a VC firm where Hoffman previously served as a general partner, also participated in the round, the startup announced today (Jan. 27). The company will use the seed capital to develop clinical programs, A.I. platforms and its drug candidate pipeline.

Manas AI will host its systems on Microsoft (MSFT)’s Azure cloud computing platform and leverage Microsoft’s “deep domain knowledge in A.I.” for drug development, the startup said. Hoffman is a board member of Microsoft. This isn’t the first time Hoffman has embarked on an A.I. venture with ties to Microsoft. In 2022, he co-founded the generative A.I. startup Inflection AI, which struck a nine-figure licensing deal with Microsoft last year.

Hoffman’s co-founder, Mukherjee is a cancer researcher and associate professor at Columbia University who notably received a Pulitzer Prize for his 2010 nonfiction book The Emperor of All Maladies. “Our mission is simple yet profound: to transform how we discover and develop life-saving medicines,” Mukherjee said in a statement, adding that he believes the company will “drastically reduce the time and cost it takes to bring game-changing new treatments to patients.”

While the company plans to eventually branch out to other diseases and conditions, its initial focus will be on developing oncology treatments for cancers like triple-negative breast cancer, prostate cancer and lymphoma.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com