#110: A Crazy Powerful New AI Agent, 9 Keys To Monopolizing Your Industry (Part 2)

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One ‘How To’:

To start this off, our community asks me two very specific questions on a near daily basis…

#1. How do I know what industry/vertical to build a solution for?

#2. How do I find the right market and accompanying start-up to invest in or acquire?

I’ve wrote a lot of posts ad nauseam that answer these two questions. In fact I recently went on a podcast to talk about my process at length.

One of our community members was listening to that podcast and decided to make an AI Agent that literally does this all for you.

I ACTUALLY CAN’T BELIEVE IT.

He trained the AI on 10 years of our vertical SaaS content…

IT’S GOING TO TAKE MY JOB 😭

The amount of time I spend researching industries, finding vSaaS opportunities, or companies is, let’s just say, A LOT. And this guy built an AI that does it all for you.

I was, at first, skeptical.

But after using it for a while and experiencing the power first hand, I told him we have to package this up and give it to the community.

So we did that, and let me tell you about a few things that it does…

First, there are two separate apps, one for founders/operators and one for investors/buyers. Select what you are…

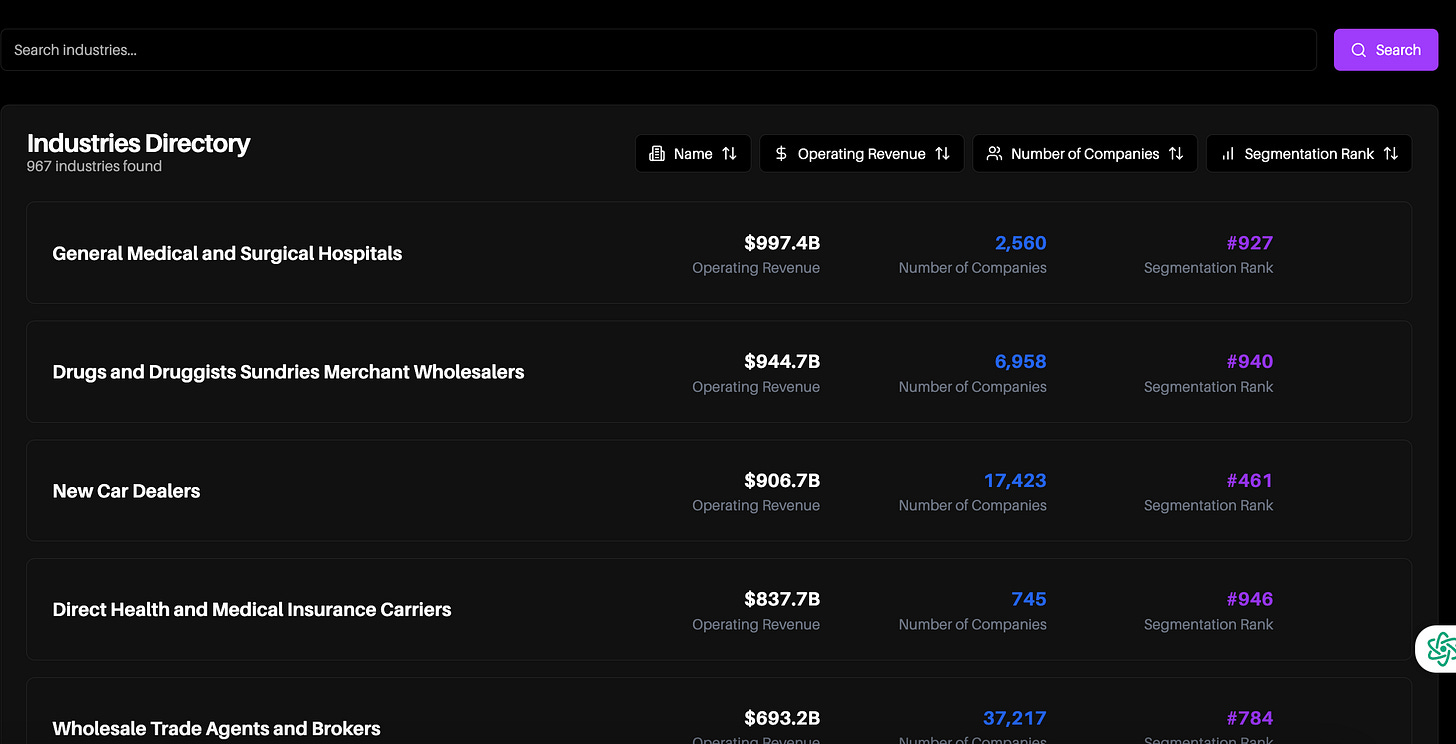

Then, you can jump into an industry list that ranks ranks roughly ~1K different industries:

Once you pick an industry, the AI will generate a report. That report is pretty mind blowing, it will include:

A detailed overview of the market

End-to-end operational process overview

Existing vSaaS landscape serving the industry

Where there are vertical SaaS, payments, and AI opportunities are

Be patient while the reports generating, it takes ~5 or so minutes :-)

If you’re an investor or acquirer, you can literally get a list of all the SaaS companies serving the space that the AI can find, and their estimated revenue, employees, growth rate, profit, etc.

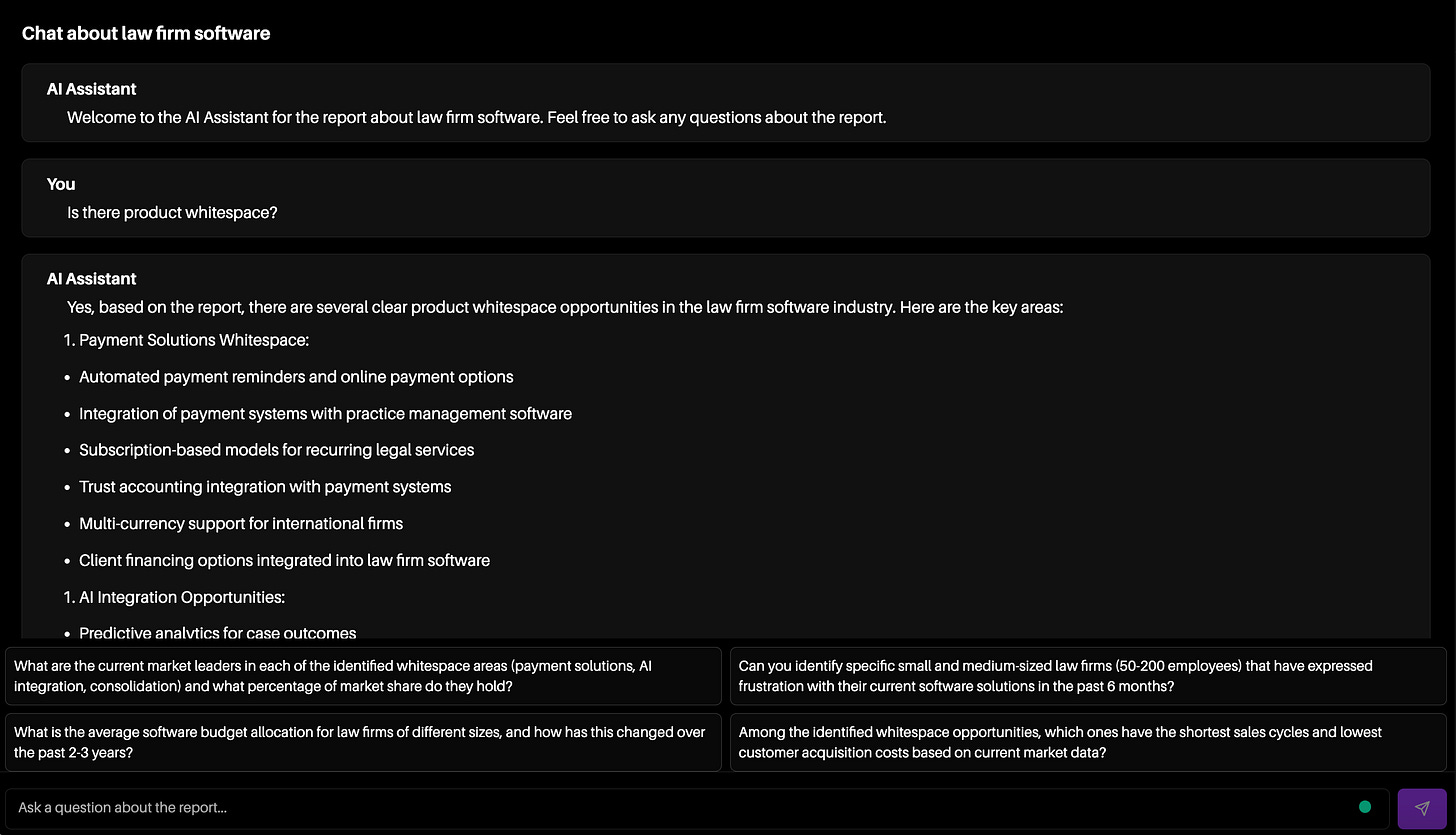

It doesn’t end there. Next you can literally chat with the AI and have it do work for you. You can have it do things like:

“Draft an email to the CEO of <Insert Company Name> about potentially acquiring his business”

“Give me a list of 100 businesses in the sector and draft a cold email for me to send to them to try and get a meeting about building a software solution for them”

“Help me identify a good wedge product to build for this industry”

We’ve pre-populated a bunch of question samples in the app to get your juices flowing.

Anyways, it’s really badass and I’m excited for you all to get your hands on it :-)

We’ve made it so you can try it out for free here.

PS — AI IS EXPENSIVE so you only get one report for free and then it costs some dough. But if any of you spend a fraction of the amount of time I have as a founder OR operator OR investor OR acquirer then this thing will pay for itself with one report :-).

Anyways, love this community.

Can’t believe two of our readers built it for us.

Huge shoutout to Ash Nouruzi and Don Dang for bringing it to life.

Try it out and let us know what you think!

One vSaaS Breakdown:

9 Keys To Monopolizing Your Industry (Part Two)

Last week we went through Keys 1-5 on how to monopolize your industry. Today, we’re wrapping it up with Keys 6-9. Hope you enjoy :-)

Key #6: Payments Is The Holy Grail In vSaaS

The Only Way To Build A Massive vSaaS Business Is Getting a % Of Industry Spend.

The best way to illustrate this is just looking at the massive difference in TAM that payments typically creates. Below is a quick analysis on the restaurant market…

So the above isn’t big enough for a VC. But if you layer in payments and take 1% of each transaction, the TAM 10X’s over night…

The Only Way To Build A Massive vSaaS Business Is Getting a % Of Industry Spend. Below is Toast’s revenue breakdown from their IPO prospectus. 83% (!) is coming from payments.

Every vertical SaaS player of serious scale has proven this. Toast, Duck Creek, Blackbaud, Vacasa, Service Titan, etc. You have to nail this.

Not only do payments add a huge revenue layer, but they also create stickiness IE higher retention. My friends at Tidemark recently proved this…

Too many vSaaS companies just throw Stripe into their platform and don’t get surgical on negotaiting take rates. YOU CAN get 0.75-1.25% take rates and you need to treat this negotiation with payment vendors with incredible focus. It makes a MASSIVE difference on your business.

Key #7: There Are Fantastic Embedded Opportunities Beyond Payments

We are starting to see more and more vSaaS companies prove payments-esque opportunities. Excited for a lot of IPO’s in 2025 so we get more data but I’m hearing a lot about Embedded Ads. In last weeks edition we talked about how Uber has crossed $1B in embedded ads revenue. Wild.

Here are some product ideas to think about for your space:

LMS

Payroll

Time Clock

Turbotax-esque Compliance

Banking

Text

CRM

Ads

e-Signature

Doc Management

Capital

Surveys

Chat

Key #8: Vertical AI Is THE Biggest Opportunity SaaS Has Seen In Two Decades

All the value of AI is not being realized because the data opportunity is really trapped behind log-in screens. AI can’t mine the oil out of the oil field because it’s reliant on the open internet.

If you’re sitting on a vast set of industry-specific data you are sitting on an oil field.

Key #9: Don’t Ever Forget It. Retention Is The Lifeblood of Vertical SaaS Businesses

This one is self explanatory, and I this tweet burns in my mind, it should probably burn in yours too…

Those are your 9 keys. Execute those and you'll own your own monopoly.

Easier said than done :-)

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com