#096: Big & Transformative Partnerships, Slice CRO's Interview (Lot's of Nuggets), The Story of Slice

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One ‘How To':

Big Transformative Partnerships.

Partnerships can be really tough for vSaaS companies. Sometimes you spend a ton of time and energy and they don’t yield the fruit you’re looking for.

One example of partnerships I encourage vSaaS founders and operators to pursue is embedded ones. Why? Because once you own a key workflow you can add in embedded payments, insurance, payroll, etc. which is significantly faster than building it on your own. Especially when it’s something that requires strong expertise or a lot of tech resources to make happen — embedded insurance is a great example of this.

I like keeping tabs on my Linear audience, so today I’m putting Kayna, an embedded insurance provider back in the spotlight. These guys just announced another major partnership – this time, with the leading global advisory, broking and solutions company WTW (NASDAQ: WTW). This is an example of a transformative partnership and I want to break it down for you all…

Why is this a big deal?

According to recent reports, WTW note that the embedded insurance market was valued at US$63.1 Billion in 2022 and is expected to reach US$482.8 Billion by 2032 with a CAGR of 22.6%. This boom is largely driven by North America and China, and WTW and Kayna are well placed to seize this opportunity to deliver the solutions that meet modern-day demands.

Why does it matter to you?

This is a perfect demonstration of a strong vSaaS partnership. If you can handle the tech side and take a slice while still getting the level of insurance (or anything related to your industry) expertise for your customers you will win.

I caught up with Kayna CEO Paul Prendergast a couple of times this year and he is focused on driving lots of new types of data-led, automated, simplified insurance business, tapping into huge distribution opportunities across property, general liability, workers’ compensation, commercial auto and umbrella liability insurance solutions, and doing all the heavy lifting for vSaaS platforms and their customers.

So why embed insurance? I think a lot of vSaaS companies have not done it yet and there is a lot of low hanging fruit opportunity.

A few examples…

Top-line growth using embedded insurance as an expansion model! The platform earns on every policy sold with oversight on real-time activity.

It puts insurance at your customers fingertips! Capacity to further leverage platform data to completely change the insurance experience for customers. Prefilled-forms, actual real-time insurance metrics data trusted by underwriters to support the right-sized insurance specific to each individual customer.

Value add beyond the policy purchase including alerts when coverage level needs to be updated to mitigate risk for the customer.

No overhead burden on this one. It’s a full-service solution.

Here is a visual for you all to really understand how this works with insurtech as an example:

Insurance is simply one example of a beautiful partnership opportunity for vSaaS. Once you own a key workflow in an industry, you can begin to layer cake payments, insurance, payroll, benefits, AI, and more.

Where else are you guys seeing embeds other than payments really moving the needle?

PS -- if any of my Linear friends are based in New York and looking to nerd out on embedded insurance, my friend Paul, founder of a great insurtech business, will be there November 6th. Drop him a line to sync up!

One vSaaS Breakdown:

Interview with Slice’s CRO

Jason Lemkin recently sat down with Slice’s CRO for an AMAZING discussion on vertical SaaS.

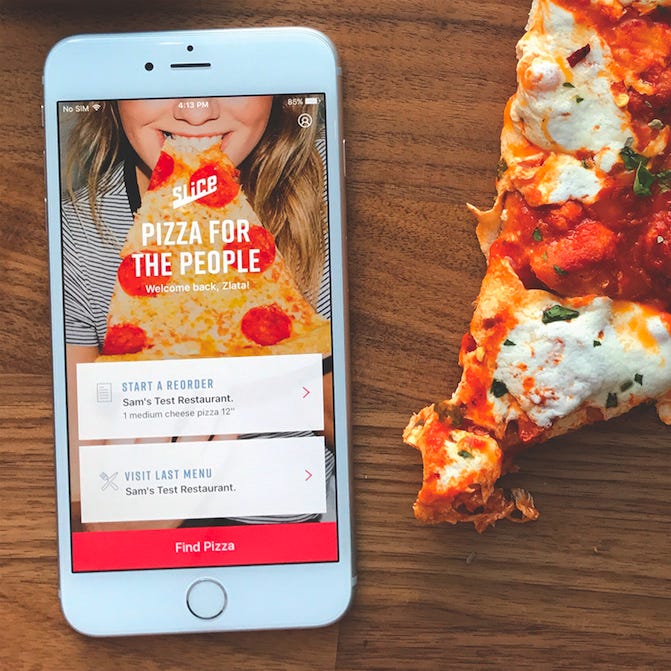

If you are unaware of Slice, I broke down the business a year or so ago and reposted below, but for a quick recap they are an all-in-one vertical SaaS for Pizza Shops.

The beautiful thing about Slice is it’s hyper-hyper focused. They are not just building for restaurants, they are building for pizzerias.

Ten years ago, VC’s would laugh you out of the room for going that niche.

Slice has laughed right back, with a SaaS business that has exceeded $100M+ in ARR.

Here are a few goldmines I pulled from the video:

“Dominos Pizza is a vertical SaaS business.”

It’s a multi-billion dollar company receiving tech-like multiples because it gives all the technology, services, and operations infrastructure that a pizza shop owner needs to be successful. We’re offering the same thing to independent pizzerias without taking an ownership stake.

“Death of the Point Solution in SMB Vertical SaaS

The vast majority of industries that are dominated by SMB’s WANT an all-in-one solution, not a myriad of point solutions. The result is the horizontal players that offer point solutions and spray and pray across sectors are going to go extinct. You have to get to all-in-one as SMB’s that operate in the real-world want one tool and one tool only.

“Our goal is 100% market share”

In vertical SaaS you only serve one master. In horizontal SaaS you serve many. In Slice’s case, they are so hyper-focused that they can literally solve EVERY problem that a pizza shop has.. This creates the ability for them to DESTROY the competition, as the competition is going after “restaurants” or selling solely a POS.

“Revenue is no ones ‘job’. It is an output of their job.”

It’s a multi-billion dollar company receiving tech-like multiples because it gives all the technology, services, and operations infrastructure that a pizza shop owner needs to be successful. We’re offering the same thing to independent pizzerias without taking an ownership stake.

“I spent my career looking for Michael Jordans of sales. What I missed was Michael Jordan shot 1,000 free throws a day. Now, I just look for the sales rep that is shooting 1,000 free throws a day. That’s the one that’s going to crush.”

This one speaks for itself :-)

“How do you give someone value before they make a decision?”

In vertical SaaS you can’t pressure folks. You can’t ruin your reputation. In these niche verticals, everyone will know your name relatively quickly. You have to plant a lot of seeds and give people significant value before they ever purchase anything.

I love Slice and am very bullish on it.

What are some other verticals within a vertical that you could think about replicating a Slice-esque model for?

A few ideas that come to mind…

Software for a specific type of restaurant - Sushi

Software for a specific type of luxury - cars, hotels, homes, etc.

Software for a specific type of sport - basketball, football, soccer, etc.

& here’s the video for those that want to listen to the full segment:

One Biz Story:

Slice: vSaaS for Pizza Shops

This Albanian immigrant built a $1B company by creating software for pizza shops.

It's a big business, having recently crossed $100M in revenue.

This is the inspirational story of Slice 🍕

Slice is a software operating system for independent pizzerias. The business supports over 19,000 independent pizza shops across 3,000 cities. It's roughly double the size of dominos and has become the nation's largest pizza network.

Slice offers a full suite of software tools for mom and pop pizzerias. Some include: -Point of Sale -Online Ordering -Custom Websites -Marketing Services -Discounted Supplies

But like many software unicorns, Slice has very humble origins... Ilir Sela, founder of Slice, immigrated to New York City from Macedonia when he was just 10 years old. To support the family, his grandfather, uncle, and father operated pizzerias in Manhattan in the 70s.

Sela, born into the pizza business, saw how family pizza shops struggled to compete with national chains like Dominos or Papa Johns. As the world moved online, this problem only grew worse. Small pizzerias had no expertise in the internet.

Sela saw an opportunity. He aimed to build a tool that would enable small pizza shops to have the same software infrastructure as the big guys. Previously having sold an internet biz for $500K, Ilir used the capital to go all-in on solving the problem, & in 2010, founded Slice.

Almost all vertical SaaS companies start out with a simple wedge product. Something easy to implement, with little friction, and can provide a lot of value quickly. Slice was no different, launching initially with online ordering.

His first customers were friends and families, but something magical was happening for them. Average orders increase from $18 to $30 when his clients moved from phone-only ordering to online. That was the "aha!" moment.

Ilya hustled to expand to 80+ independent pizzerias throughout New York City completely bootstrapped. $40M of transactions were flowing through the Slice platform and in 2015 they raised their first financing round.

Slice didn't stop there. With a maniacal focus on the customer, Ilya realized there were A LOT of other areas that they could help out. They expanded into customized websites that made it easy for a small shop, with 0 web design skills, to have a beautiful online presence.

One of my favorite parts about Slice is it provides MORE than just software. As their network grew to thousands of pizzerias they entered into the group purchasing space.

One of the values of Dominos and other large providers, is using their scale to drive down the price of supplies like ingredients, pizza boxes, beverages, etc. Slice took a page out of these successful franchises book, and launched a supplies tool. A beautiful recurring model.

Vertical SaaS always seems small on the surface. An entrepreneur pitching software for pizza shops 10 years ago was likely told frequently that the TAM was way too SMALL. Or, "why wouldn't pizza shops just use a horizontal tool like Toast or Square?"

Ilya has proven them wrong. Pizza is a BIG market. The US pizza market is ~$44 billion, with over 75K pizza shops in the US, and ~40k of them being independent pizzerias.

Today, Slice serves over 19K pizza shops in the US and says it's saved them over $265 million. $1B of pizza sales have flown through the Slice Platform and they crossed one of the ultimate SaaS milestones - $100 million in revenue.

@IlirSela tweeted this recently:

8 years ago I was operating @slice as a bootstrapped company when I reached out to a number of great leaders in the restaurant tech space — @wileycerilli is the only one who responded. He opened so many doors for me which helped me scale to what is now a >$100M revenue company.

We're now starting to see others replicate what Slice has done for pizza in other restaurant categories. Odeko just raised a $53M to do the same thing for independent coffee shops...

Ilya proved that the American dream is alive and well, and that there is so much opportunity in Vertical SaaS. It's been fun to watch @IlirSela, thanks for being an inspiration to us all!

And a friendly reminder to go grab the 1,000+ page bible on all things Vertical SaaS. Industry breakdowns, scorecards, how-to’s, vSaaS company case studies, and much more!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com

Awesome write up, Luke! Fully agree with the value of embedded partnerships, and insurance is a great case study. We've seen embedded payments emerge as critical functionality for Vsaas, and at Hurdlr we're seeing that open the door for deeper embedded accounting functionality. VSaas misses out on potential revenue and adds friction by forcing user to go to another provider (usually QBO) to manage their finances. To be an all-in-one solution for a vertical, embedded finance and financial management are gonna be table stakes for VSaas looking to be the category leader.