#094: Venture Buyouts (VBO's), Metropolios VBO

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One vSaaS Breakdown:

Introducing Venture Buy Outs

I’ve talked about the different types of Vertical SaaS businesses ad nauseam.

To quickly set the stage, what are they?

Traditional vSaaS: 100% SaaS businesses building an industry specific software platform and selling it to businesses within that sector. Examples: CourseKey (Trade Schools), Toast (Restaurants), OpenGov (Local Governments).

Digital Franchise: A SaaS business + a digital franchise / business in a box and offering it to companies within a particular industry. Supporting operators with playbooks. Examples: Slice (Pizza Shops), Moxie (Medspas), Fora Travel (Travel Agencies).

Vertical Integration: Reinventing a traditional company and covering everything from A-Z. Examples: Tesla (Cars), One Medical (Doctors Offices), Tend (Dentist Offices), Lambda School (Higher Education)

Vertical AI: Job-specific AI that start as a co-pilot (partial job automation), and then eventually becomes an agent (equivalent of a full time employee). Examples: Harvey (Lawyers), Delphina (Data Scientists), Nuance AI (Medical Assistants).

But what WAS NOT in my bingo card for 2024 was a new model that I’m incredibly excited about. It’s so early it doesn’t even have a name - well I’ve seen a few different ones that don’t make sense to me so today I’m drawing a line in the sand and telling you all about a new type of vSaaS…

Venture Buy Outs.

So WTF is a venture buyout?

It’s when an early-stage company…

Builds a game changing product for a specific industry

Buys companies in that specific vertical

Implements their game changing technology that results in the end business dramatically increasing margins

Runs an M&A playbook at venture-scale.

Now I know a bunch of you are reading this and saying, “Luke — this is literally just private equity.”

It’s not, and let me explain.

It sits somewhere between Private Equity and traditional VC.

Private Equity backed services businesses add in a “veneer” of tech-enablement. The reality is they are not technology businesses. They are financial engineering to realize margin improvement and proclaiming that tech is making a big impact when it’s really not.

Additionally, I’m talking about Seed stage companies buying a business, before PE players would EVER get involved.

There are a few tailwinds that are making it a very interesting time to run this playbook…

Vertical AI: If you have a co-pilot offering that can eventually turn into an agent, you can buy businesses, remove significant amount of headcount costs by leveraging AI employees instead of real humans. Now I know AI is probably not QUITE there, but there are some really interesting industries where AI can achieve 50-75% of what a full time employee is currently doing.

VC Proclamations: Slow Ventures, General Catalyst, Euclid Ventures, Founders Fund, Equal Ventures, a16z, and a few other firms have come out with posts proclaiming they want to fund companies with this model.

Interest Rates: With the recent interest rate cuts, there is a lot of debt on the sidelines wanting to get deployed. You have to be cautious here but it is easier now than it was earlier this year.

Early Success Stories: Metropolis, Splash Ventures, and a few other companies below have laid the foundation for this model and achieved some level of success, so VC’s are starting to get a better understanding of the model.

Now a big question I’ve been getting recently,

Do I buy the company first or build the product first?

Well, that’s a tough question…

Slow Ventures came out saying you should absolutely build the product first. You have to prove the margin accretion before going out and investing a significant amount of capital into M&A.

That makes sense, but the flip side of that is that you don’t really know what product will really move the needle until you actually own a sandbox you can play in. How many of us see “case studies” from SaaS companies that are probably not all that they seem? I talked to a fund buying up call centers, and they said we would have had no clue what to build until we owned one.

I think the answer to the question probably comes down to your capital situation. If you have a strong capital position, I’d probably buy first. If not, go the cheaper/scrappier route. Cozy up to a small business, work with them as a key design partner, throw them some equity to really sit in the business, observe it, and build something that can greatly reduce costs and/or increase revenue.

Another question I’ve been getting a lot,

How the hell do I structure the company?

Most firms I’m talking to want to see the traditional Delaware C-Corp parent company that has an LLC that rolls up to it for the acquisitions. VC’s need to fund Delaware C-Corps, so doing anything else will result in making it tough to get the company financed.

A quick disclaimer… I’m in learning mode here (as everyone else who is writing about the topic, if they tell you otherwise, they are lying), but based on numerous

Now for a few friendly warnings…

You need to be very careful with who you raise money from with this approach. I’ve talked to a few founders who have horror stories because they partnered with a traditional PE firm to run this playbook, folks that have 5 year holding periods. This IS NOT who to raise from. You need long-term patient capital that looks more like VC then PE.

This is a highly complex company / playbook to build. It takes incredible operators and is not for the faint of heart.

Whenever you’re doing something “new”, VC’s really struggle to write checks. It’s counterintuitive, because they shouldn’t be, but they are. They like writing checks into business models that are completely understood. This is new. It will take a lot of education.

Make sure that you are building something that can tremendously result in margin accretion. This whole playbook fails if you don’t have a seriously game changing product.

DO NOT get over-leveraged on debt with this model. Debt is dangerous. I’ve lived it first hand. I’ve spoken to many founders recently running this play whose companies have collapsed because they were financing much of their acquisitions via debt. That can seem incredibly attractive, but when times are tough it can KILL companies. I’d try to stay sub 25% for acquisitions and get as much seller financed as humanly possible.

Some example companies:

Metropolis: Parking Lots

Electric Sheep Robotics: Lawn Care

Splash: Pool Cleaning Companies

Carbon Health: Primary Health Clinics

LedgerUp: Bookkeeping / accounting

Hippo: Insurance

Hadrian: Manufacturing

If you want to go deeper on the topic, some friends of mine have written some great articles on the subject, all with differing opinions…

The AI First Roll Up. Euclid Ventures

Turning customers into investments. Cautious Optimism.

Tech-Enabled Consolidation of Insurance Brokerages. Equal Ventures.

Growth Buyouts: the Dawn of the GBO. Slow Ventures.

Are tech-enabled vertical roll-ups the future or the past? Tidemark Capital.

A few thoughts on VC-backed rollups. Andrew’s Substack.

One Biz Story:

Metropolis: Venture Buy Out For Parking Lots

Given that we’re talking Venture Buy Outs. A pulled a case study on one of the early successes running this playbook for your re-reading. It’s on Metropolis. A venture buyout for parking lot operators…

Paying for parking is a total pain in the ass.

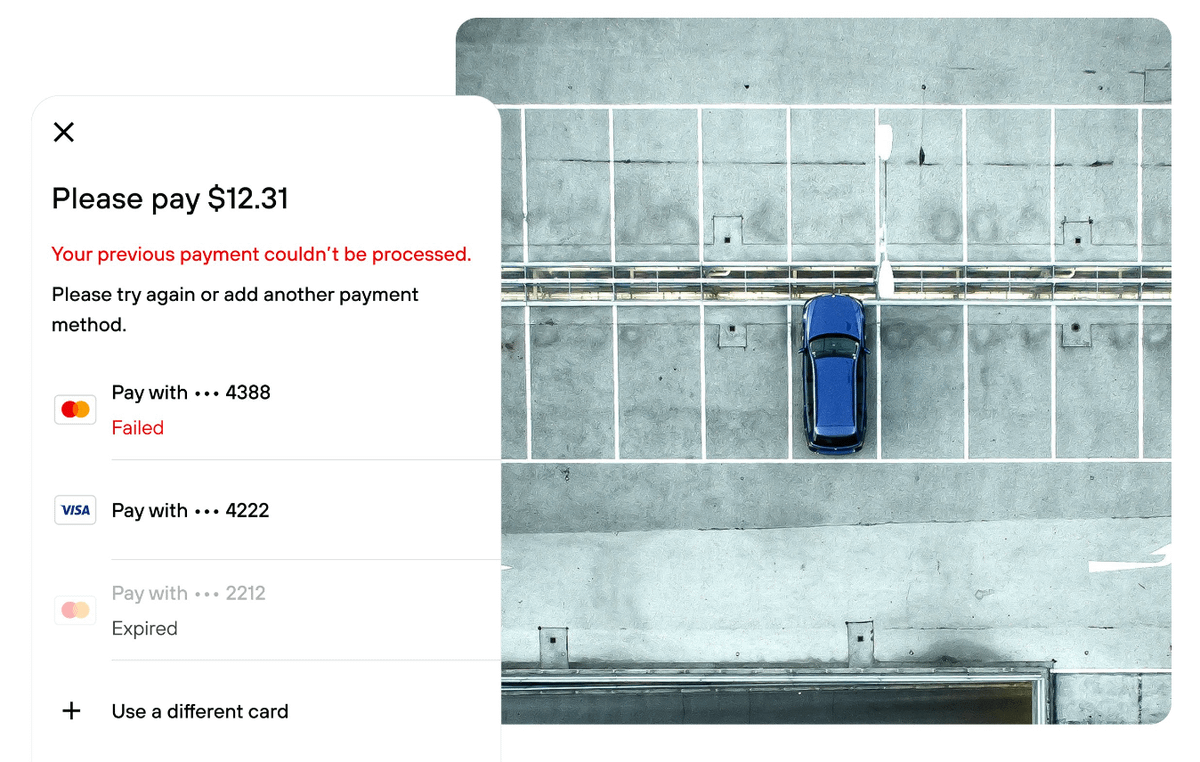

Metropolis as a computer-vision company enabling consumers to drive in and drive out of lots have their cards charged automatically.

And they have raised nearly $2B to solve the problem.

Let's dive in:

Founded in 2017 by Alex Israel, Courtney Fukuda, Peter Fisher, and Travis Kell. This isn't Alex's first rodeo. In 2009, he co-founded ParkMe. ParkMe aimed to revolutionize navigation by addressing parking challenges. In 2015, he sold ParkMe to INRIX.

So why start another company in the parking space? The team recognized the inefficiencies in traditional parking management. They dealt with it everyday at their previous company. They envisioned a future where AI and computer vision could revolutionize the industry.

Imagine if people could drive in and drive out and have their cards charged automatically.

No toll booths. No dealing with angry parking attendants.Essentially Amazon check-out for parking...

The crew got to work.

Initially starting with a computer vision platform they would sell to parking lot owners.

Computer vision platform enables seamless parking transactions.

Drive-in, drive-out payment for consumers.

Facility management SaaS for real estate owners

How it works:

Cameras are installed in parking facilities capture real-time video.

AI algorithms analyze the video feed to identify vehicles, license plates, and parking spaces.

Checkout-free payment: Drivers enter and exit without manual transactions.

And it's working...

Tody Metroplois customer base is quite impressive. 6M+ drivers already benefit from Metropolis. 40+ markets in major cities, with continuous expansion.

But the team faced what all vSaaS companies struggle with: Trying to get legacy incumbents to adopt new and innovate technologies.

They decided to start acquiring parking lots in addition to selling their software/hardware to existing parking lot management companies.

They've gone all out here as of recently...

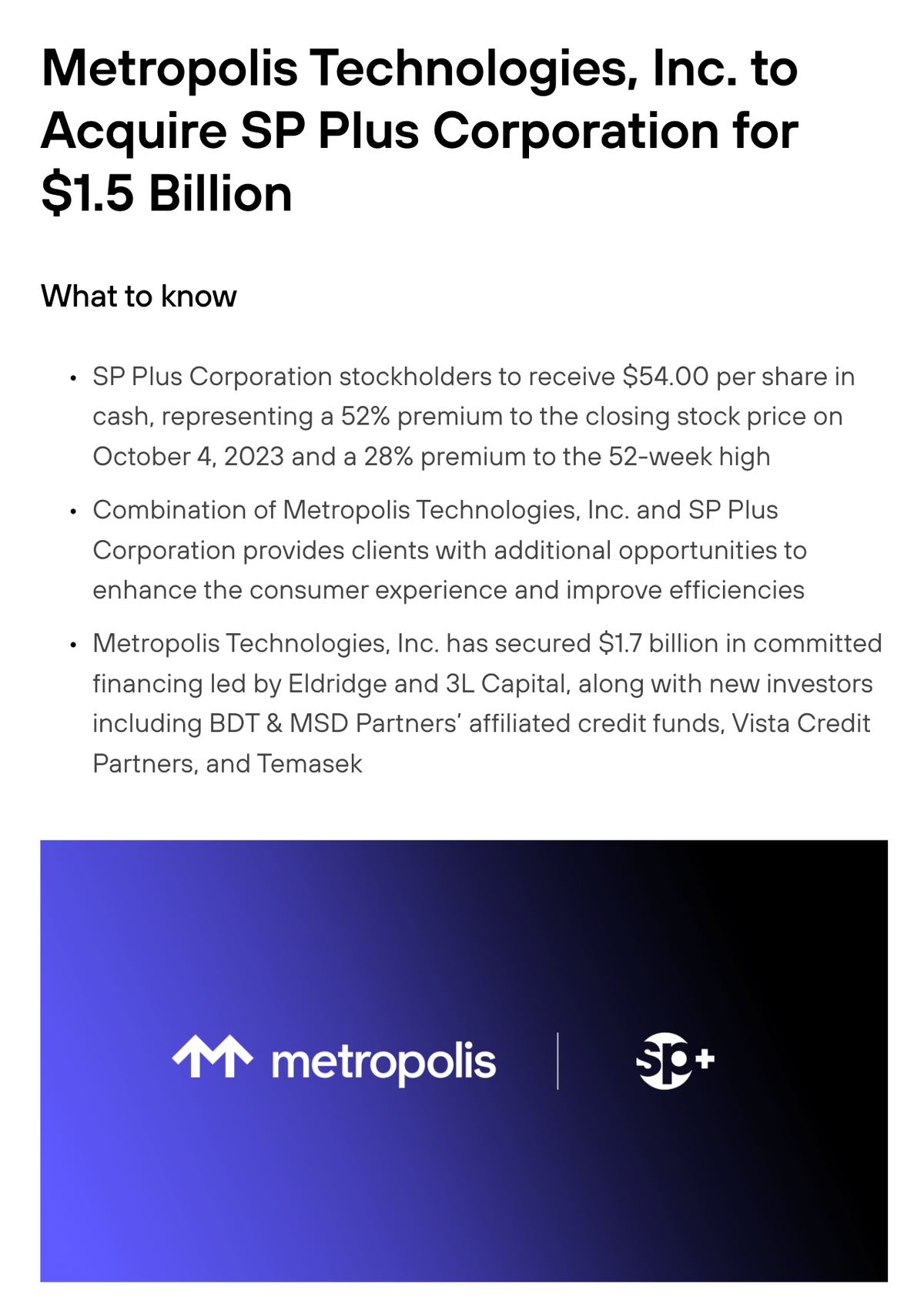

In October 2023 Metropolis announced they were acquiring SP Plus for a whopping $1.5 billion.

And the funding continues to stack up. Especially with the strategy of purchasing parking lots. Let's take a look at the round by round history:

Seed Round (2019): $20 million led by Zigg Capital led this initial funding round.

Series A (2021): $41 million led by 3L Capital

Series B (2022): $167 million led by 3L Capital & Assembly Ventures

Series C (2023): $1.1 Billion led by 3L Capital & Eldridge Industries

Buying parking lot companies and selling software into other parking lot companies at the same time is an interesting approach. Some are calling this vertical SaaS 2.0

Excited to see how this all plays out. Regardless, the tech is AWESOME. It simply doesn't make sense that we stop at parking kiosks and spend 5 minutes paying for parking. If you live in any kind of urban area you deal with this ALL THE TIME.

Kudos to the @metropolisio team. Cheering for you to build a category defining business here!

One ‘How To’:

Go get the vSaaS bible for nearly 100 operating playbooks with a few of my favorites including…

Key Focus Areas At Each Revenue Stage Of Your vSaaS Business

What Will Kill Your Startup & What Won't

How To Identify Outlier Talent

B2B Product Development Philosophies

Building A Triple Threat vSaaS

Using Maslow's Hierarchy of Needs to Build Products

All B2B Products Eventually Converge

Vertical Specific App Stores

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com