#093: The State Of GTM, The Leading Indicator of Sales Rep Success

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Todays newsletter is sponsored by Check, the leading payroll infrastructure provider and pioneer of embedded payroll.

Check makes it easy for any SaaS platform to build a payroll business, and already powers 60+ popular platforms supporting 20M+ employees such as Wave, Homebase, and HousecallPro .

Alright, let’s get to it…

One vSaaS Breakdown:

The 2024 State of GTM

Iconiq Capital released a great report on the State of Go-To-market in 2024. They analyzed a sizeable amount of companies to draw conclusions on how 2024 is going relative to 2023.

I plucked some of the most interesting pieces of the report for you all…

2024 has been a much tougher year for GTM then 2023. All lagging indicators are proving that. ARR growth, retention, unit economics, sales productivity, quota attainment, and late renewals ALL DOWN.

Look at the difference in YoY ARR growth… SaaS just gets harder each and every year.

If you have ~110% Net Dollar Retention you are in the top quartile.

That’s nearly 10% lower than the year prior (!).

Measures of Sales & Marketing productiivty have declined for most in 2024, with the exception of big $200M+ ARR companies.

The result of worse sales productivity? Less reps achieving quota…

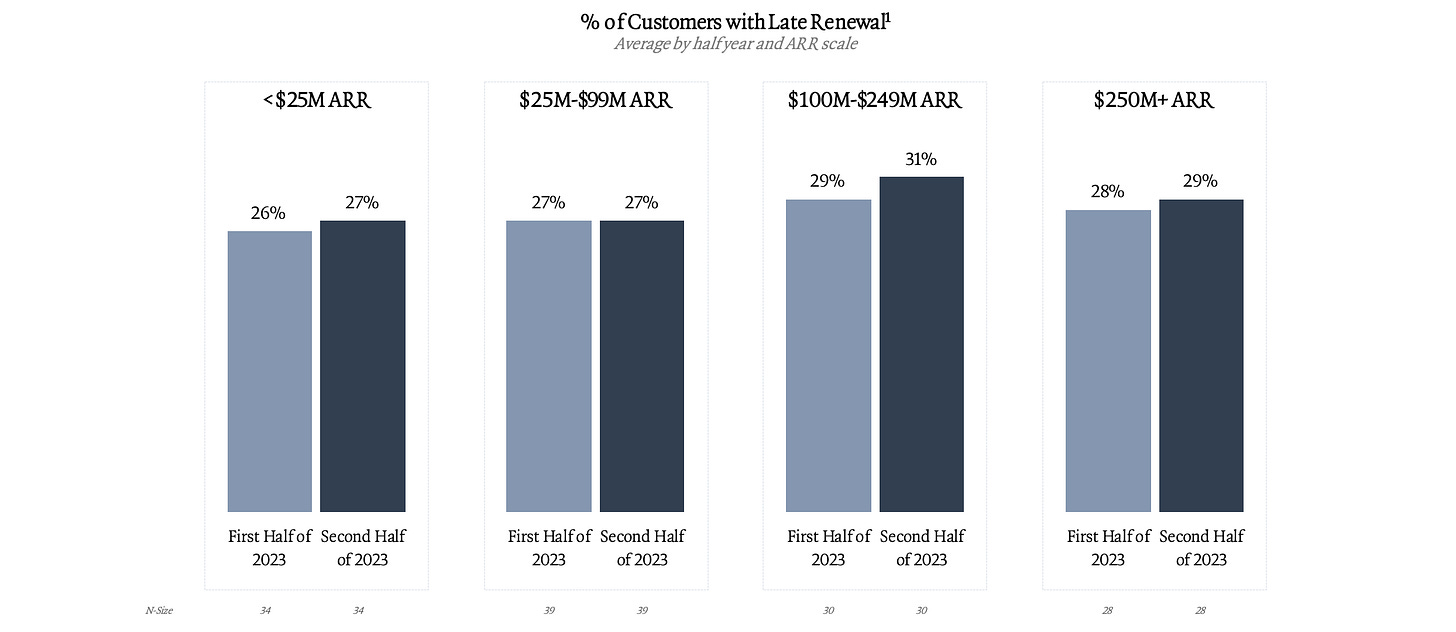

An interesting stat here. ~25% of SaaS customers renew late. Time to look at implementing auto-renewals or late fees!

Conversion rates may be showing signs of recovery, with win rates increasing.

Are you closing 1/3’rd of your the prospects you demo? If not, you or are below average…

More and more companies are shifting away from 100% inside sales teams and adding an outside, top-down sales component.

Funny how we totally shifted from 100% inside sales teams during COVID to claims that “Inside sales is dying.”

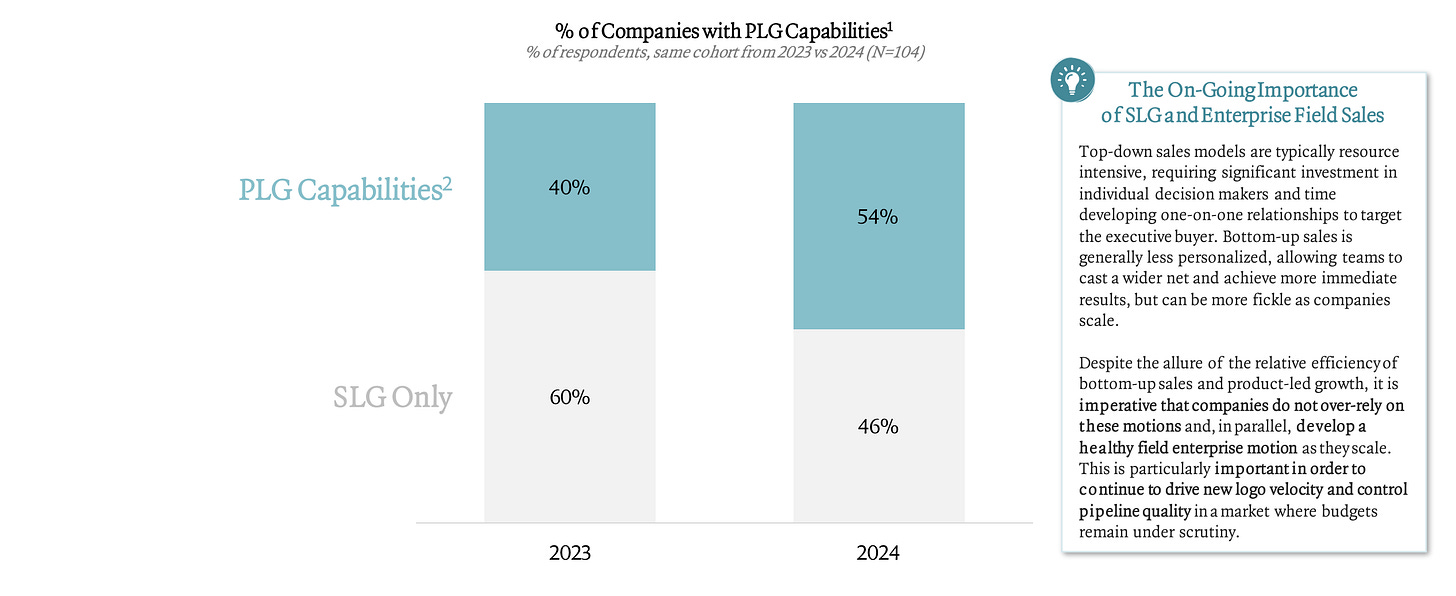

Another thing more and more companies are doing? Adding product-led growth functions / capabilities. PLG companies typically always grow faster IF you can pull it off within your industry.

You can also look at moving away from segmenting sales reps based on geography and creating more specialization. Geo is still the most popular option, but more and more companies are focusing them on other things, which likely increase ramp time but improve results when they get there.

Shout out to Iconiq Capital for a great analysis. If you’d like, You can take a look at the full report here.

One ‘How-To’:

The #1 Leading Indicator Of Sales Rep Success

Selling to mid-market and enterprise?

There is a direct correlation with the performance of your sales reps and how much time they spend on airplanes.

If you aren't kicking and screaming when you see reps in the office it's probably time to start.

This is a hill I will absolutely die on.

As Andrew Ross Sorkin says, “There is no news in the building.”

One Biz Story:

Have you seen the Vertical SaaS Bible yet? I’ve got SO MANY vSaaS business break downs there on vSaaS players you may have never even heard of that are absolutely killing it. A few include…

💈 Squire: vSaaS for Barber Shops

👨🔧 Service Titan: vSaaS for Field Services

🏦 nCino: vSaaS for Banks

🌿 Dutchie: vSaaS for Dispensaries

🧬 Veeva: vSaaS for Life Sciences

🅿️ Metropolis: vSaaS + M&A for Parking Lots

🍕 Slice: vSaaS for Pizza Shops

🏛️ OpenGov: vSaaS for Local Governments

🚧 Procore: vSaaS for Construction

🎥 Wrapbook: vSaaS for Media Companies

🍽️ Toast: vSaaS for Restaurants

🪖 Palantir: vSaaS for Defense

🦷 Weave: vSaaS for Dental Practices

I’ve extended the 50% discount period (just use the code BIRTHDAY).

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com