#090: Leveraging Credit To Drive Feature Adoption, Publicly Traded vSaaS Analysis, Hebbia AI

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by the Vertical SaaS Bible. 1,000+ industries, 500+ investors, ~100 playbooks and case studies on vertical SaaS. It’s a cheatcode for vSaaS founders, operators, and investors.

Alright, let’s get to it…

One ‘How To’:

Leveraging Credit To Drive Adoption

How do you win in vertical SaaS?

Step #1: You own a key control point.

Step #2: You expand your product line deeper across the lifecycle.

Step #3: You eventually become THE PLATFORM / source of record for the entire industry, that the businesses within the vertical use you for nearly everything.

I recently came across a new company, Vaya that helps vSaaS companies achieve all three of these things. How? They offer an embedded credit solution that gamifies product adoption and feature attachment by marrying contextual credit offers to your most critical features.

This is an incredibly unique offering and I wanted to go deeper on it, so I asked the Vaya team to send me over some specifics about how this is currently working for vSaaS companies.

Let’s look at a few examples…

A vSaaS company that offered an industry-specific software platform increased their attach rate for their merchant banking account by more than 50% in just one quarter by making a credit offer contingent on their SMB customer first opening an account to receive loan proceeds. Fintech offerings are a common expansion path for many vSaaS companies, and they use Vaya to drive adoption of products like payments, expense management, merchant banking, and insurance.

Another product expansion path is commerce. Vaya helped a Shipping vSaaS company launch gamified embedded credit platform. Their customers are able to access higher and higher levels of credit as they increase their daily shipping volume. A similar approach can be applied to volumes across invoice, inventory and so on.

Vertical SaaS companies servicing SMB’s typically spend between $1,000 and $3,000 on customer acquisition, but, if they’re offering a free trial, over 80% of customers don't progress beyond the free trial phase. One Vaya customer solves this problem by requiring their SMB customers to integrate their accounting data to access credit offers during the free trial. Incentivizing users to complete steps like data integration which are known to enhance retention can be made easier by incentivizing customers to take those steps using credit offers.

Core to the gamification engine they use to drive product adoption is a vertical credit platform designed to deliver credit offers contextualized to customer workflows within your software.

You built your vertical SaaS because you understand the nuance and specialization your industry demands. But why I am so excited about Vaya is that vSaaS companies no longer have to settle for one-size-fits-none credit solutions. Reach out to my friends at Vaya by dropping a line hello@embedvaya.com.

I think they offering a fascinating value prop for vSaaS companies to leverage credit to improve utlization.

One vSaaS Breakdown

Public vSaaS Companies

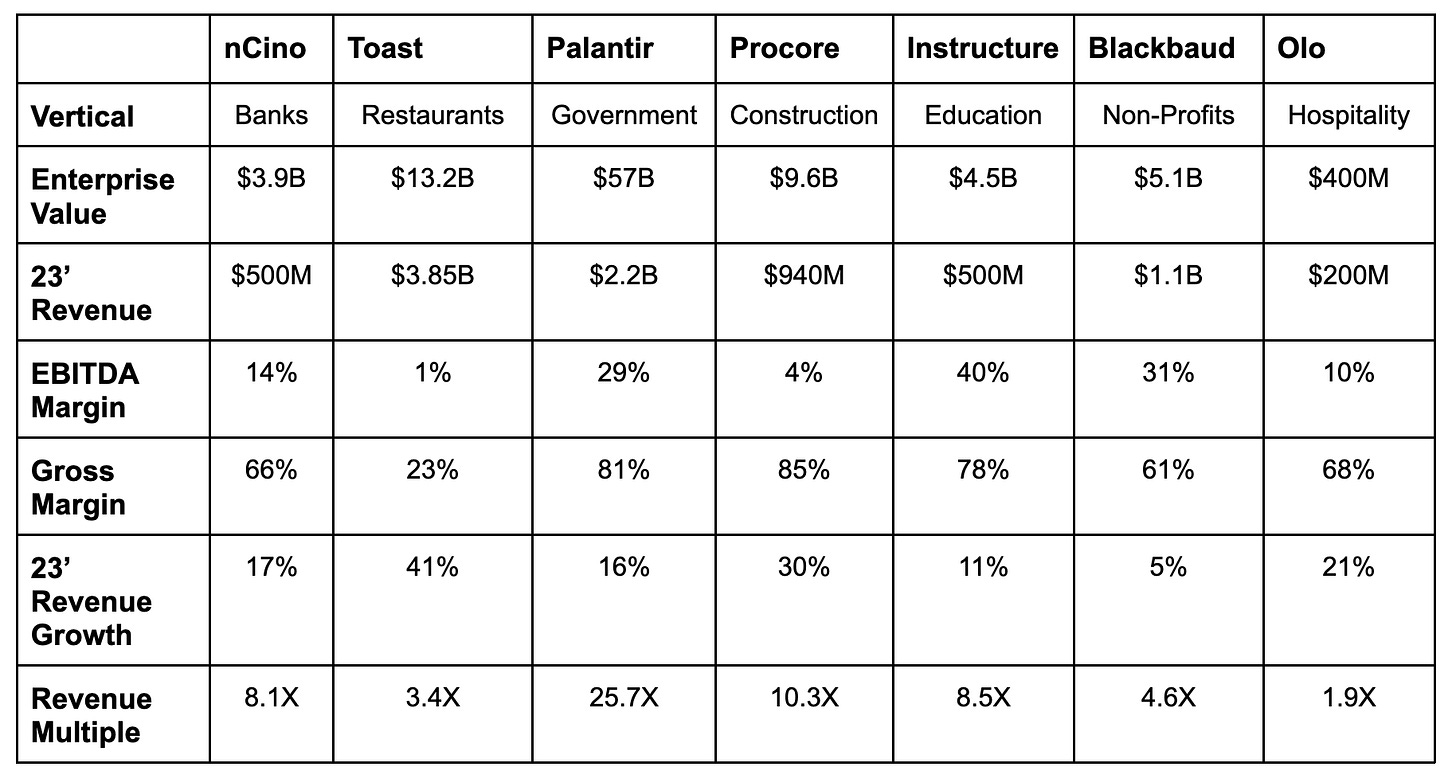

Let’s take look at 7 popular publicly traded vSaaS companies and their 2023 numbers…

A few notes…

nCino is attacking banking using a sales-led GTM. 17% growth is pretty good given the banking vertical is top heavy. Big dogs make up the lions share. They are also printing 14% EBITDA every year, so pretty efficient business. Surprised to see only 66% profit margin. Assume this comes from the hands on nature of having to serve the enterprise. 8.1X is solid though, I’d be happy with this. They are executing.

Toast is always hammered on their multiple. Why? The lions share of their revenue is transaction based, as opposed to SaaS. I don’t think theres a lot they can do about this, given restaurants have horrible margins so they just can’t spend a lot on SaaS. Growth is so impressive, 41% at $3.85B but what happens when this starts to really slow down? Getting valued at 3.4X with that revenue growth is brutal.

I can’t quite wrap my head around why Palantir is sitting at an absurd 25.7X multiple. Feels like we are still back in 2021. I know their contracts are massive, and their retention is locked in but this multiple doesn’t feel like the SaaS world we’re living in in 2024. Overvalued.

Procore is kicking ass, still growing at 30% with $1B in revenue. 10.3X is heavy but their margins are incredible and the construction industry is so so big. Also the market is segmented beautifully. Lot’s of variety in SMB/MM/ENT. Still have a lot of room.

Pretty surprised to see Instructure sitting at a 8.5X multiple. Education is such a tough vertical. If they don’t start dominating international soon they are going to be in big trouble. They also need to add more product, they’ve been slow to capitalize on AI. A big PE just bought them so sure we’ll see a pretty big shift in strategy.

Blackbaud looks really healthy eveyrwhere excdept growth rate. They’ve really really slowed down - 5% total. How can they juice this?

Olo is small for a public company, only $200M of revenue. I assume they are heavy transaction based as well, which is why the multiple is really tough, only ~2X. Surprised they went public this early.

Call to action:

There are 1,000+ industries that need industry-specific software and AI.

Many of which are big enough to support SaaS companies that can get to public scale.

You don’t have to look at these industries from a traditional SaaS lense — there are many new ways to build a vSaaS companies. Vertical AI, Buy-outs, digital franchises, etc.

Use this as inspiration to get started :-)

One Biz Story:

Hebbia AI

A former door-to-door jewelry salesman is aiming to create the AI interface for knowledge work.

That's a big vision, and he's raised nearly $200M from world class investors to do it.

A quick case study on Hebbia AI:

Hebbia AI was founded in 2020 by George Sivulka. George is much more than a former jewelry salesman, his background is incredibly impressive.

His first "real" job at 16, was working on software for satellite landmine detection at NASA. He also did physics research on dark matter for the U.S. Energy Department. Sivulka recently dropped out of his Stanford PhD program in computational neuroscience to start Hebbia.

He started by solving the search engine problem with AI in financial, medical, and legal fields. In these industries, analysts spend a ton of time digging through documents to answer complex questions.

They partnered with these organizations to spin up a private database of their data, and then allow the analysts to get answers to complex questions.

Questions like,

"Analyze all of our research reports, what can we do to accelerate R&D?"

But that was just the start.

Today, Hebbia positions itself as the interface for Artificial General Intelligence (AGI). They launched their new product, Matrix, which is designed to go a step further , and actually deploy AI Agents to complete complex tasks guided.

Some of examples of how this works in practice:

Financial Due Diligence: Integrates with data rooms to answer specific questions about financial documents.

Market Research: Pre-indexes company filings and research for quick insights.

Knowledge Management: Stores and surfaces relevant insights from a firm’s knowledge base.

Contract Analysis: Extracts and interprets key information from contracts.

Drug Development Analysis: Synthesizes clinical study results.

It seems they are solving a serious problem.

Hebbia has seen significant growth, with a 15x increase in revenue over the past 18 months, and claims profitability at $13M of revenue. They recently raised a $130 million Series B funding round at a valuation of $700 million.

Hebbia also claims strong customer retention rates, particularly in the financial services sector. Their AI solutions are used by 30% of asset managers for tasks such as due diligence and asset pricing. Customers appreciate the efficiency and accuracy of Hebbia’s tools, which have become integral to their workflows.

Employee growth is rapidly growing. Quick LinkedIn figures show 143% YoY growth here and about to hit the ~100 employee mark.

It will be interesting to see how Hebbia evolves. AI today feels a lot like the internet did in 1999. Everyone is tweaking/testing/iterating. There is no proven playbook.

One things for sure though...

Hebbia has a beautiful vision for the future --

Where AI is fully integrated into knowledge work, taking on complex tasks and significantly enhancing productivity.

I'm excited to see industry specific AI agents Hebbia deploys, and the massive value they add for organizations.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com