#085: The Latest on SaaS & AI Multiples, Breaking Down Bains Top 50 vSaaS Startups, Exec Offsites

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by the Vertical SaaS Bible, a digital library of 1,000+ industries ranked on segmentation, size, and opportunity, 500+ investors, 100+ playbooks on founding and operating a vertical SaaS business.

Evan Lyseng, Senior Analyst at AltaML had something very kind to say about it,

"Luke is one of the sharpest minds in Vertical SaaS. I often return to his newsletter for insights, playbooks, dynamics, and stories across hundreds of verticals. His grasp of new TAM expansion strategies and GTM tactics is exceptional. I'd encourage others looking to invest or build in software to check it out."

Alright, let’s get to it…

One Biz Story

The Latest on AI and SaaS Multiples

I scoured the latest AI and SaaS multiple reports and summarized them all for you.

Here’s the latest on SaaS:

The SaaS markets absolutely crashed in November of 2021. It’s been a brutal ~3 years for a lot of us. That trend continues but it looks like we’ve bottomed out…

How fast your growing ARR has a big impact on the multiple you can expect for your business…

And of course, retention, the lifeblood of SaaS can really lift your multiple. Tie this in with a strong growth rate and you will see a premium.

Industry matters. And of course, EdTech is always the ugly step child :-) Where I’ve spent the last decade! Tough market.

Now, do you want your mind blown?

Compare that to what we’re seeing in AI start-ups…

Here are the top companies Valuations, Revenue, and multiple…

Far different from the top dogs in SaaS, who are trading at ~15X.

But, looking at all AI companies that have announced, their pre-seed and seed valuations are still insanely higher than SaaS…

One interesting thing to note here is a ton of these dollars are coming from corporate VC’s. Which has not been the historical case in SaaS.

It’s also not clear how much these corporate VC’s are investing in $$ versus cloud credits.

The conclusion? This can’t last forever. But man is it a good time to be an AI start-up compared to SaaS. Why do you think everyone is throwing AI in their name these days, even older companies 😭 😭

One vSaaS Breakdown:

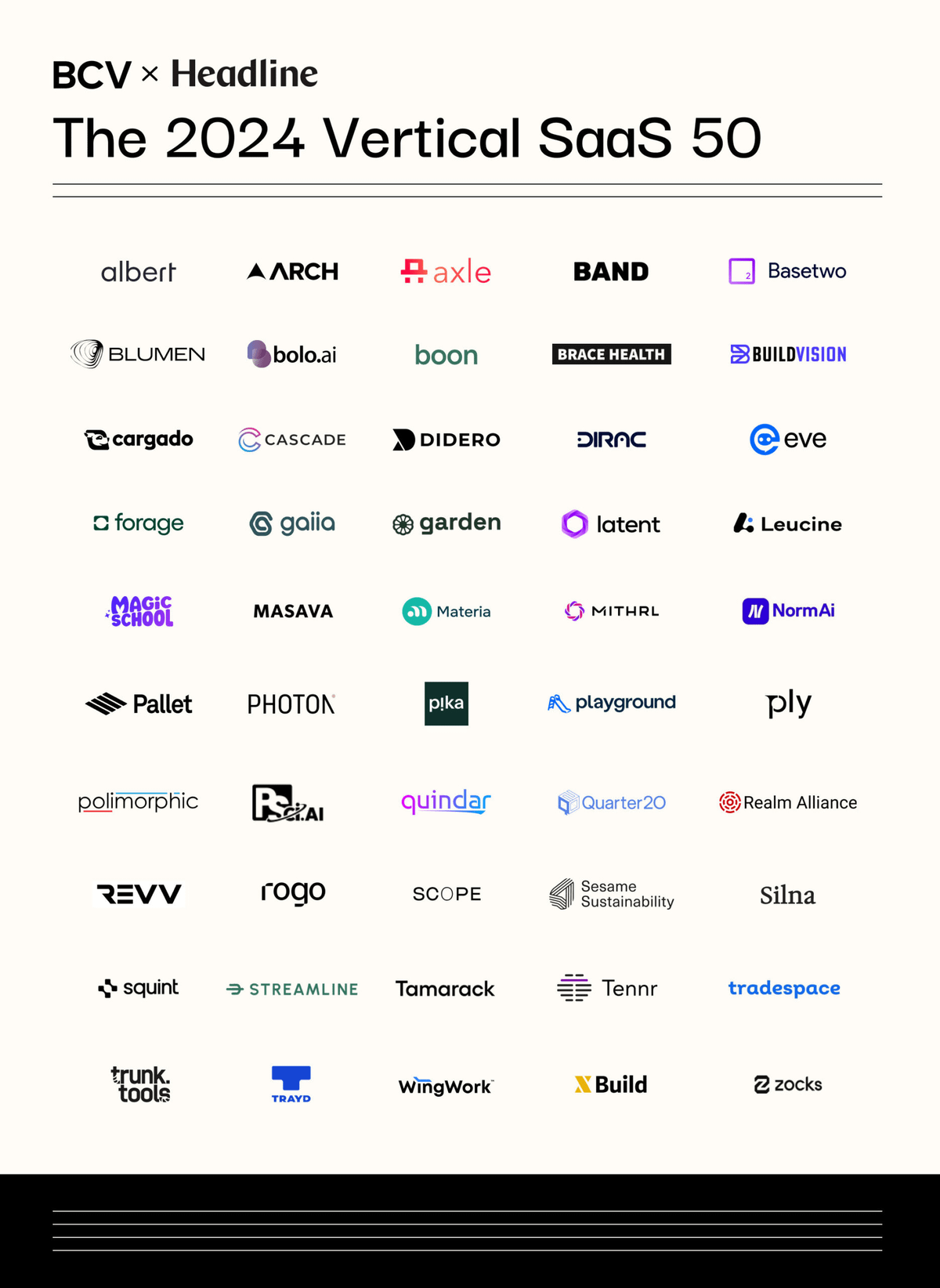

Breaking Down Bain Capital & Headlines Top 50 Emerging Vertical SaaS Companies

Bain Capital & Headline just released their 2024 Top 50 Emerging Vertical SaaS Companies List.

They didn’t actually share what the companies did other than a few highlights they called out.

So I decided to do it to get a better idea of where the latest and greatest vSaaS companies are focusing.

Here it is:

1. Albert: Provides AI-driven marketing solutions.

2. ARCH: Architectural design collaboration.

3. Axle: Streamlines healthcare operations with SaaS solutions.

4. BAND: Provides collaborative tools for musicians and artists.

5. Basetwo: Infrastructure automation.

6. Blumen: Plant care and gardening app.

7. Bolo Ai: AI-driven customer support.

8. Boon: Employee benefits administration.

9. Brace Health: Orthopedic care coordination.

10. Buildvision: Construction project management.

11. Cargado: Logistics management platform for cargo transportation.

12. Cascade: Sustainability and environmental compliance.

13. Didero: AI-driven content moderation.

14. Dirac: Audio technology for high-quality sound processing.

15. Eve: AI-powered event planning & management.

16. Forage: Career development and job matching.

17. Gaiia: Sustainable fashion supply chain.

18. Garden: Home gardening and landscaping solutions.

19. Latent: AI SDK

20. Leucine: Nutritional supplement and health optimization.

21. Magic School: AI for Schools

22. Masava: Large file transfer for creative professionals.

23. Materia: Material science and engineering solutions.

24. Mithril: Gaming community engagement platform.

25. NormAI: Workplace inclusion and diversity analytics.

26. Pallet: Sustainable packaging and supply chain management.

27. Photon: Photonics and laser technology solutions.

28. Pika: Energy-efficient building design and construction.

29. Playground: Childcare management software for schools and centers.

30. Ply: Feature SDK's

31. Polimorphic: Customizable workflow automation.

32. Psci AI: Procurement AI Software

33. Quindar: Data analytics for industrial processes.

34. Quarter20: Sustainable materials sourcing.

35. Realm Alliance: Real estate investment management.

36. Revv: Car calibration vSaaS.

37. Rogo: Ride-sharing and transportation services.

38. Scope: AI-driven social media analytics.

39. Sesame Sustainability: Sustainability reporting.

40. Silna: Data analytics for retail and consumer behavior.

41. Squint: AR & AI for Manufacturing

42. Streamline: Workflow automation and process optimization.

43. Tamarack: Real estate investment and property management.

44. Tennr: Sports and fitness coaching platform.

45. Tradespace: Construction project collaboration and management.

46. Trunk Tools: Data integration and transformation.

47. Trayd: Industrial IoT and predictive maintenance.

48. WingWork: Freelancer management platform.

49. Build: Construction project management and scheduling.

50. Zocks: Inventory management for e-commerce.

A couple of thoughts here…

First -- I LOVE Squint AI - AI & AR for manufacturing.

A ton of hands-on workers still do not have the power of the internet at their close fingertips while working. Squint is trying to change this.

Second -- I really like ARCH, they are building an AI Co-Pilot for investment firms that uses AI to analyze & automate to tax automation, capital calls, distributions, and LP reports. Very cool.

Finally -- Cargado. They are building cross-border logistics software.

Logistics is massive, and honing in on cross border makes a lot of sense to me. Massive, massive, industry. I'd bet a lot of this is crazy antiquated...

One ‘How To’:

Exec Offsites

Are you having an offsite AT LEAST 2X a year with your management team?

My perspective: They are literally THE MOST valuable / important meetings of the year. They solidify alignment, and create the roadmap for the rest of the company for the next ~6 months.

If not, why not? Maybe time to rethink that!

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Reply to this email or shoot us a note at ls@lukesophinos.com