#076: The Legendary Brad Jacobs, How To Run Board Meetings, Bootstrapper vSaaS Opportunities

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kayna, a leading embedded insurance solution for vertical SaaS companies.

Check out their white paper to see how your vSaaS company can add an entirely new revenue stream by embedding insurance into your platform.

Alright, let’s get to it…

One Biz Story

The King of Boring Businesses

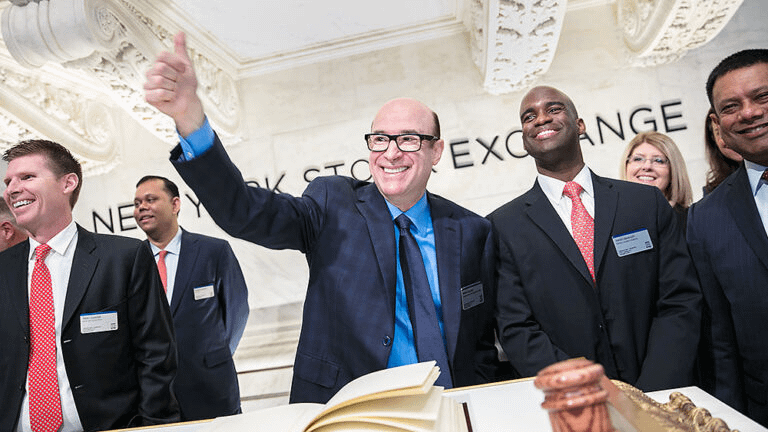

This guy has built 7 different BILLION DOLLAR companies. How? By turning boring industries into billion dollar gold mines.This is the INSANE journey of under-the-radar billionaire, Brad Jacobs:

Meet Brad Jacobs, a business titan who turns boring industries into billion dollar gold mines through a combination of vertical SaaS and M&A.This strategy has led him to take over multiple industries and landed him at a net worth of $4B+ Let’s dive into his journey....

In 1979, at 23 years old, Jacobs founded Amerex Oil Associates, an oil brokerage firm.It operated as an over-the-counter energy brokerage specializing in various commodities related to the energy industry.

He started the firm with just a few thousand bucks to his name. Within just four years, he grew it into $4.7 BILLION in annual brokerage volume. How?? Focusing on speed of information.

At that time (there was no internet) everyone in the oil trading business relied on a daily newsletter from McGraw Hill. Jacobs and Amerex cobbled together a global IT system. It was basically an early version of the internet. Every time an Amerex employee learned something useful about buyer/seller activity or the price of oil, they entered it into their database.

The process took hours instead of days. It may seem trivial now, but it was a MASSIVE advantage in the pre-internet days. It allowed their firm to capitalize on information earlier than other traders in the space.

The result? Jacobs sold in '83 when he reached $4.7B in volume.

He then moved on to found his next company, Hamilton Resources. He struck gold again, growing it to $1B in revenue over 6 years through a combination of crude oil trading, pre-finance, and refinery-processing deals. But he saw big banks beginning to enter the space...

Seeing that these guys could potentially crush him, he made the wise decision to parlay what he'd built into a new industry.

That industry? Waste Management.

Jacobs realized that the 2 largest waste companies in the US were doing half a BILL in profit. He thought to himself how hard could it be to have pick up trash, put it somewhere else, and send out an invoice? As he explored the industry, he realized the big guys focused on major cities, and a ton of independent mom & pop haulers/landfills dominated smaller regions...

Through an M&A strategy, he consolidated a ton of SMB's into one business, & drove efficiencies through their own mapping tech. The company, United Waste, had a motto that literally stated what they were doing, “Large Enough to Serve, Small Enough to Care”. He took it public in '92 and eventually sold it to Waste Management $2.5 BILLION.

Jacobs is the king of M&A and consolidating fragmented industries. But of course, he didn't stop at United Waste Systems. Following the sale, he went on to run the exact same playbook a few more times with INCREDIBLE results...

In 19997, Jacobs founded United Rentals after realizing that 85% of the construction rental market was owned by SMB's. He bought up construction rental businesses in different geos, and accelerated their revenue by creating software to better understand real-time rental rates. This enabled his business to price far more efficiently than the competition.

Demand high? Increase the rental price.

Demand low? Drop the rental price.

In 1 year he grew it to $1B in revenue. ONE YEAR.

He was the biggest player in the industry and took the company public.

But of course, Jacobs didn't retire and head to the beach.He ran the same M&A + vertical SaaS playbook yet again in the LTL (less-than-truckload) space.

His company, XPO, grew revenues to $6.5B, with cash flow of approximately $1B. Today it has a market cap over $10B!!!

In October of 2023, Jacobs announced he was going to enter the building supplies space. Will he do it again? At this point, who wouldn't give this guy their entire net worth for him to pursue it? I'm sure banks/funds/you name it are lining up...

Regardless of all the success, Jacobs has proven that M&A & vSaaS can be a wildly successful playbook. This is much more than a traditional P.E. play, he raises massive $ to just go after 1 vertical with 1 business. Just look at his companies trajectories relative to others...

What a fascinating guy and a fascinating journey...

One ‘How To’:

How To Structure/Run Board Meetings

I've run quarterly Board Meetings for the last 10+ years. I've had great Board Meetings and really tough ones. Here's the format/approach I've found that works:

Agenda:

Section 1: Whatever is most critical / you have to discuss

--Management team enters--

Section 2: CEO Summary

Section 3: Customer Story

Section 4: Financials

Section 5: Prior Quarter / Next Quarter or Year Performance

--Management team exits--

Section 6: Housekeeping

Section #1. Most Critical / Pressing Item

There is always something critical to discuss. Something you need to get on the table for everyone to discuss. It typically comes down to a few things:

Runway/Cash/Financial

Strategy Adjustment/Modification

Big Challenges/Issues

Team Gaps

I recommend Section #1 flows something like this:

The Problem/Challenge

Supporting Data/Commentary

Varying Paths Forward

The Recommendation

Here's a good EXAMPLE of a Section #1:

The Problem/Challenge:

Our venture debt partner is requiring us to refinance out of our loan, sell the business, or raise incremental capital.

Supporting Data / Commentary:

How we got here

Now that we're here, here's the data reality

Varying Paths Forward:

Lay all the paths out that you could take - show no bias, just give every potential option given the existing circumstances.

Path #1: Raise incremental capital

Path #2. Refinance out of the debt with Firm XYZ

Path #3. Sell the business

The Recommendation:

Explain your recommendation, and why you think it's the right one. MAKE SURE you have solutions in mind.

PS -- you should meet with all BOD members ahead of time, and get their color/input. None of this should be a surprise to them.

Now that you're through the heavy stuff, it's time to move onto...

Section #2: The CEO Summary

This is important.

I typically follow the below format:

Refresher on what the world looks like if we win

Current Strategy to achieving this

What's working / not working

Learnings

Section #3: Customer Story

It's really important to talk about the customer. Too many board meetings forget this.

Amazon is famous for spending 90% of the time doing this.

Share a few stories of success, share some challenges. Put the board in their shoes for a moment.

Section #4: Financials

Here it's time to go through the few key financial slides. I recommend:

ARR Bridge Slide (MOST IMPORTANT!)

Runway

P&L

Burn Multiple

Path To Profitability

Section #5: Prior Quarter or Years Performance & Next Quarter or Years Plan

I always break these down into sections each department leader presents on...

Sales & Marketing Slides

Strategy

ARR Bookings Plan vs Actual

QoQ Pipeline Analysis / Review

Major Deals Won/Lost & Reasons Why

Team Performance

Next Quarter or Years Forecast

Customer Success Slides

Strategy

Retention Bookings Plan vs Actual

QoQ Bottoms Up Churn Analysis / Review

Major Deals Won/Lost & Reasons Why

Team Performance

Next Quarter or Years Forecast

Product Slides

Strategy

Product Roadmap

What We're Building & Why

Plan vs. Attainment (What did we ship vs. what did we say we would)

Next Quarter or Years Forecast

Section #6. Housekeeping

Here it's the classic check the box items.

Prior Meeting Minutes Approvals

Compensation Approvals

After, I leave & the board has a closed door session without the CEO. It's important for them to discuss & provide feedback to you after the meeting.

And just like that you've run a great board meeting!

One vSaaS Breakdown:

I find new industries every day where a bootstrapped vSaaS would do well.

Verticals that arre probably not big enough for a vc-backed company but still interesting opportunities.

A few today:

🏅 Sporting Good Stores

🚌 Charter Buses

💀 Tattoo Parlors

🎢 Theme Parks

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: