#075: The Full Stack Playbook, Two Interesting Thoughts, Get On Airplanes

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kayna, a leading embedded insurance solution for vertical SaaS companies.

Check out their white paper to see how your vSaaS company can add an entirely new revenue stream by embedding insurance into your platform.

Alright, let’s get to it…

One vSaaS Breakdown:

Full Stack Companies

Full stack companies have been interesting for some time (ie. One Medical). But a new crop of full stack is popping up with M&A as a key strategy (ie. Metropolis, Splash).

I asked @MichaelStenclik, who co-founded & scaled Tend Dental w/ this approach, to break it down for us:

First off, let's talk the advantages of building a full stack business:

Capture more of the TAM – when a SaaS product might have category comps or IT budgets that limit pricing power, you capture the entirety of the value created

Don’t have to worry about sales cycle times – your employees are the users of the product

You have a high degree of visibility into usage of the product – what’s working, what’s not, what you need to tweak, and can iterate quickly

Next, the disadvantages of full stack businesses:

Capital efficiency – services have true marginal costs, and often material capital expenses – utilization becomes paramount

Speed to scale – takes a long time to build new markets and acquire new locations

Operational complexity – a lot more things to get right, and humans are inherently more challenging to manage than code

Multiples for services based businesses have historically been unfavorable, and it can be hard to bring investors along

So when is this strategy right for you?

TAM might be too small on SaaS fees alone

Sales cycles are really long and/or expensive

The path to capital efficient growth with tech is well understood

Ok, so let's go to it....

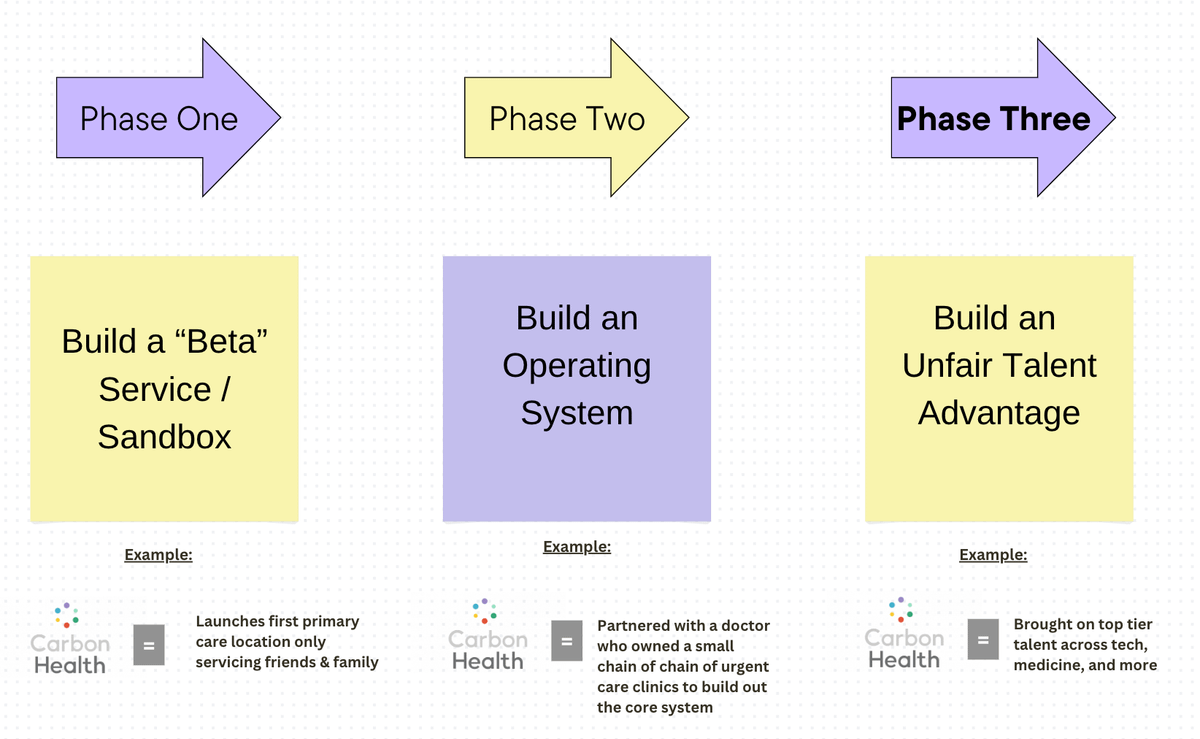

Here's the step-by-step approach to building a fully vertically integrated business:

Phase #1: Build a “beta” service / sandbox

What’s the most capital efficient way to spin up your service?

New Build vs. Acquisition

Buy off shelf software to start seeing customers ASAP

Start collecting customer feedback on what’s working, what can be better

Phase #2: Build an operating system

Brand identity

Kit of parts for new builds

Software stack that covers end to end service experience – progressively bring in house things that are unique to your model

New market launches, collateral, shared services, etc.

Phase #3: Build an unfair talent advantage

Who is the key revenue driver in your business? Make their job easier – take work off of their plate that can be managed by product

Provide a path to growth – in many SMBs promotions are less common. Can scale change that?

Commission based comp – if revenue is higher than average company in category, everyone wins

Equity based comp – if margins are better than average company in category, everyone wins

Benefits – often poorly considered and an easy lever to win early

Phase #4: Expand margins

Drive new customer volume at favorable CAC

Roll out margin accretive services

Labor arbitrage using AI or low cost resources

Leverage scale to increase price, or decrease marginal costs

Right size overhead to match frontline services

Phase #5: Optimize capital stack to fuel growth

Use cash proceeds from existing platform to fuel market expansion

With predictable cash flows, find favorable debt terms to maximize return on equity

In the current environment, there’s been a serious shift toward cash flowing tech businesses. Full stack, if done right, can give you that virtually overnight.

But, you'll get many different answers on whether or not this play fits into the traditional venture capital model...

I'm personally a big fan of these businesses, and think a new capital stack needs to emerge that sits between VC and PE to fund them.

One Biz Story Two Interesting Thoughts:

One ‘How To’:

Getting On Planes = Sales Hack

How many customers did you visit f2f in the last year?

If you're selling $25K+ ACV deals and your not doing this your leaving a lot of $$$ on the table.

Get on planes.

F2F selling really really works.

One More Thing:

Participate in the vSaaS Benchmark Study!

Building software for a specific industry and eager to learn what success looks like (especially from a venture fundraising perspective), and how you stack up among your peers? You’re in the right place, because I have partnered up with OMERS Ventures, Mosaic, and Benchmarkit to gather the data for what we hope will become a set of useful, cross-industry benchmarks for vertical SaaS and software businesses that should benefit the whole community.

By participating in this survey, which should take just a few minutes of your time, you’ll help yourselves and other founders like you:

Know your goalposts as a vertical software company (instead of having to rely on ill-fit comparisons to horizontal software providers)

Know your goalposts within your own vertical (with the proviso that we get enough volume in each respective category – so share with your peers and competitors!)

Know what investors are going to care about and grade you against when considering an investment

If you’d like to participate, follow this link.

Survey responses will not be linked to your email and will be held strictly confidential by Benchmarkit and OMERS Ventures. Individual responses will only be accessible by Benchmarkit and OMERS Ventures (including related OMERS entities) and will not be shared with any third parties except on an aggregated basis. Aggregate results of this survey will be shared with participants in August.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: