#074: Investor Update Template, The Story of Roofer.com, vSaaS Benchmark Report

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kanmon, a leading embedded commercial financing solution for vertical SaaS companies.

Check out their post on financing for growth to see how the SMBs that use your vSaaS platform think about strategic expansion.

Alright, let’s get to it…

One ‘How To’:

Investor Update Template

If you've raised $$ it's important to send investor updates.

I sent weekly updates for my first 2 years.

I sent monthly updates for the next 3 years.

I've sent quarterly updates for the last 5 years.

Here's the template I've found works best for Investor Updates:

Slide #1: Re-state who you are as a company and what you are trying to achieve.

Example:

CourseKey - vertical SaaS for Trade Schools.

Our goal: Build a one-stop shop SaaS platform that handles everything a Trade School needs.

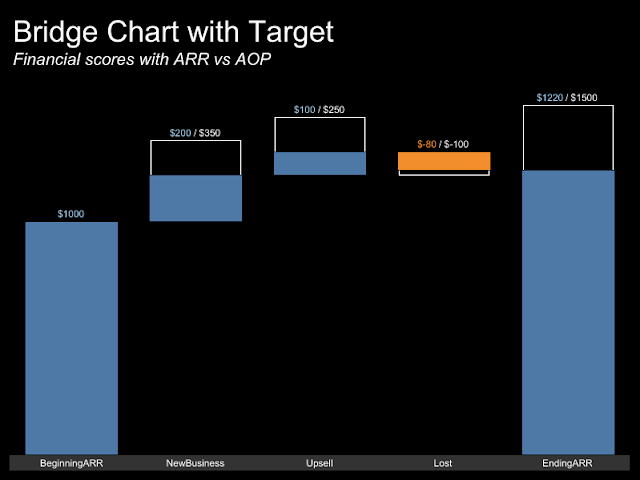

Slide #2. ARR Bridge Chart

So many Shareholder reports have so much noise, this always cuts right through all of it. This chart cuts through all the noise and clearly states how the business is doing. I get compliments ALL THE TIME on this slides clarity.

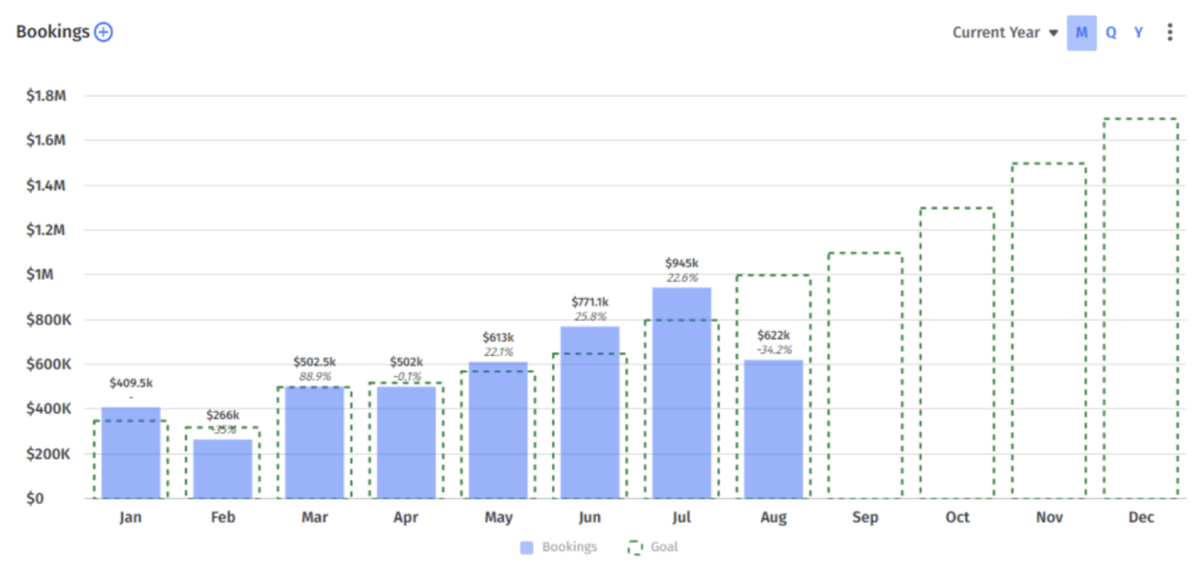

Slide #3: ARR Bookings vs Forecast

How are we doing on bookings relative to our forecast? If you're serving SMB's I'd report on this monthly. If MM/ENT I'd do quarterly.

Slide #4. QoQ Net Dollar Retention (NDR) & Gross Dollar Retention (GDR) Plan vs. Actual (DETAIL)

The holy grail of SaaS companies is retention. This chart shows exactly how we are doing on NDR & GLR QoQ relative to our plan.

Slide #5. Product Roadmap Plan vs Actual

What are we building? Why are we building it? PUT THIS VERY SIMPLY (Revenue generating, Retention generating, tech debt) How are we performing on product delivery relative to plan QoQ?

Slide #6. Org Chart & Hiring Plan vs. Actual

How many folks? What gaps are there? What's the hiring plan going forward & why. Asking for help here on a key hire!

Slide #7. Runway Chart

Default alive / dead? How close are you to profitability? When do you run out of cash?

Slide #8. ARR Over Time

Now zoom out and look at the big picture. How are we doing from an ARR standpoint YoY? Good to actually pull in your burn multiple here as well...

Slide #9. Customer Success Story

Too many companies forget to talk about their customers. Don’t be one of them!

Slide #10. Commentary / Asks

Sum it all up!

10 Slides. That's it. Don't overdo it.

Cut to the chase and cut through the noise.

Your investors will greatly appreciate it in the good times and the bad ones!

One Biz Story:

Roofer.com

There are nearly ~100K roofing companies in the U.S.

A new up-start is buying up roofing companies, implementing vertical SaaS & drone technology to accelerate growth and cut down costs.

The full breakdown of Roofer .com ⬇️

Founder and Founding Story:

Roofer.com was founded by Nathan Mathews, who previously worked at Empyrean Investments as a Management Consultant and attended the University of Pennsylvania. He saw first hand the opportunity in roofing by working at a PE fund.

Imagining a world where folks would no longer have to go out to properties, climb on roofs to inspect them, and instead leverage drones. He saw the cost benefit of this approach. He also felt that roofing companies could be operated significantly better. So he jumped in.

So how does it actually work?

Roofer .com uses AI and drone tech to conduct roof scans. The Drones capture high-res photographs of roofs, covering every detail. This analysis provides damage reports, roof life estimations, and automates a re-roofing quote if it's needed. By leveraging their tech, they offer a fast & accurate roof diagnostic and completely kill the estimation phase that costs money and time.

Their playbook?

Buy up roofing companies

Implement their operating playbook and technology

Drive revenue and efficiency

Repeat

Roofing Market Size:

The roofing industry is massive, with a market size valued at $102.4 billion In the U.S., there are over 96,000 roofing companies. The industry is projected to reach nearly $150 billion by 2030. PERFECT for a vc-backed opportunity.

First Acquisition:

Roofer .com's first acquisition was buying up Bearded Brothers Roofing & Restoration in Texas. Talking to the founder, they've completely transformed this business and are massively growing revenue in what was pretty much flat. They just recently bought their second roofing company, an outfit out of North Carolina. If they can do the same thing they did with the first acquisition, the sky is the limit...

M&A can be a crazy growth lever if structured right. The amazing thing about it is that they are buying these co's for <20% down. They pay off the debt within a few years of buying the biz, strictly on profits.The more they push growth and cut costs, the faster they do this.

Funding:

Roofer.com raised $7.5 million in a seed round led by Mucker Capital in January of this year. I presume they'll be going out for a Series A in the next year or so...

In conclusion…

Their fusion of AI and roofing expertise positions them for significant growth. It's definetly early days. But I'm excited to see what Nathan and the team do.

What do you think? Will they take over the roofing industry?

This is a BIG opportunity...

One vSaaS Breakdown:

Participate in the vSaaS Benchmark Study!

I have partnered up with OMERS Ventures, Mosaic, and Benchmarkit to gather the data for what we hope will become a set of useful, cross-industry benchmarks for vertical SaaS and software businesses that should benefit the whole community.

If you’d like to participate, follow this link.

Have a product or service that would be great for our audience of vertical SaaS founders/operators/investors? Drop us a line.