#073: Embedded Lending, 100 Vertical AI Start-Ups, Roadshow Sales Hack, vSaaS Benchmark Study

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kanmon, a leading embedded commercial financing solution for vertical SaaS companies.

Check out their post on financing for growth to see how the SMBs that use your vSaaS platform think about strategic expansion.

Alright, let’s get to it…

One vSaaS Breakdown:

Embedded Lending Can Do WONDERS For vSaaS Companies

I talk to a lot of vSaaS companies that think about adding payments, but there is SO MUCH more you can add to drastically improve revenue. One that doesn’t get talked about enough is embedded lending.

So many vSaaS companies are sitting on massive lending opportunities and don’t realize it yet. Let me give you a concrete example…

At CourseKey, we’ve built one of the largest SaaS companies for Trade Schools in the country. Students can leverage financial aid to attend a trade school, but most still owe some out of pocket expense.

With an embedded lending offer, we could offer a tuition loan option to a student in real-time right in our app. This is one simple example, but this applies to virtually every vSaaS business in some shape or form.

Once you identify the opportunity, launching an embedded fintech product with a partner involves careful planning and strategic decision-making. Below is a step-by-step guide to help you navigate this process effectively, drawing on insights from Kanmon's successful practices in the embedded lending space. I’ve been watching Kanmon and am a fan of what they are doing, basically a plug-in play embedded lending solution…

Step 1: Assess Your Business Needs and Customer Challenges

Begin by identifying the unique financial challenges your customers face. Kanmon excels in creating solutions tailored to specific business environments, offering highly configurable and white-labeled products. This approach ensures that the solution fits seamlessly into your existing operations, enhancing the customer experience and meeting precise needs.

Step 2: Choose the Right Partner with Strong Credentials

Evaluate potential partners based on their expertise, leadership, and track record. A provider like Kanmon, led by industry veterans, offers a depth of experience and a proven ability to innovate within the commercial lending space. Check the provider's history, leadership background, and customer testimonials to gauge their reliability and strategic fit.

Step 3: Examine the Solution Set and Integration Capabilities

Analyze the range of solutions the provider offers. Ensure they can address the diverse financial needs of your customers. Kanmon's API-driven platform allows for rapid integration—typically within weeks—enabling faster launch times and scalability. This step is crucial for maintaining operational flexibility and responsiveness to market demands.

Step 4: Ensure a Seamless Customer Engagement

It's essential that the lending experience is intuitive and integrated naturally into your platform. Focus on providers that support a truly embedded lending process, minimizing friction for end-users. Kanmon's approach to creating user-friendly borrowing journeys enhances overall customer satisfaction and loyalty.

Step 5: Verify Compliance and Data Security Standards

Confirm that your chosen provider adheres to relevant regulatory standards and employs robust security measures to protect sensitive data. Providers like Kanmon prioritize high compliance and stringent security protocols, which are essential for protecting both the platform and its users.

Step 6: Analyze the Economic Impact and Revenue Opportunities

Understand the financial implications of integrating an embedded lending solution. Consider revenue-sharing models and assess the potential for new revenue streams. Kanmon offers models that not only align with your financial goals but also provide opportunities for growth and profitability.

Step 7: Look for Long-term Support and Partnership

Choose a partner committed to ongoing support and collaboration. Ensure they manage servicing, collections, risk, and compliance, as Kanmon does, to guarantee a smooth and continuous operation. This support is vital for sustaining the partnership and ensuring its long-term success.

Step 8: Prioritize Innovation and Market Responsiveness

Select a partner known for their innovation and ability to adapt to market changes. Kanmon's commitment to redefining commercial lending with bespoke solutions allows its partners to stay competitive and responsive to evolving market demands.

Conclusion

By following these steps and focusing on strategic partnerships, businesses can successfully integrate embedded lending solutions that enhance customer value, improve engagement, and drive growth. A thoughtful approach to selecting the right partner, akin to Kanmon's proven strategies, can transform your financial service offerings and ensure sustained success in the fintech ecosystem.

One Biz Story:

Vertical AI Start-Ups

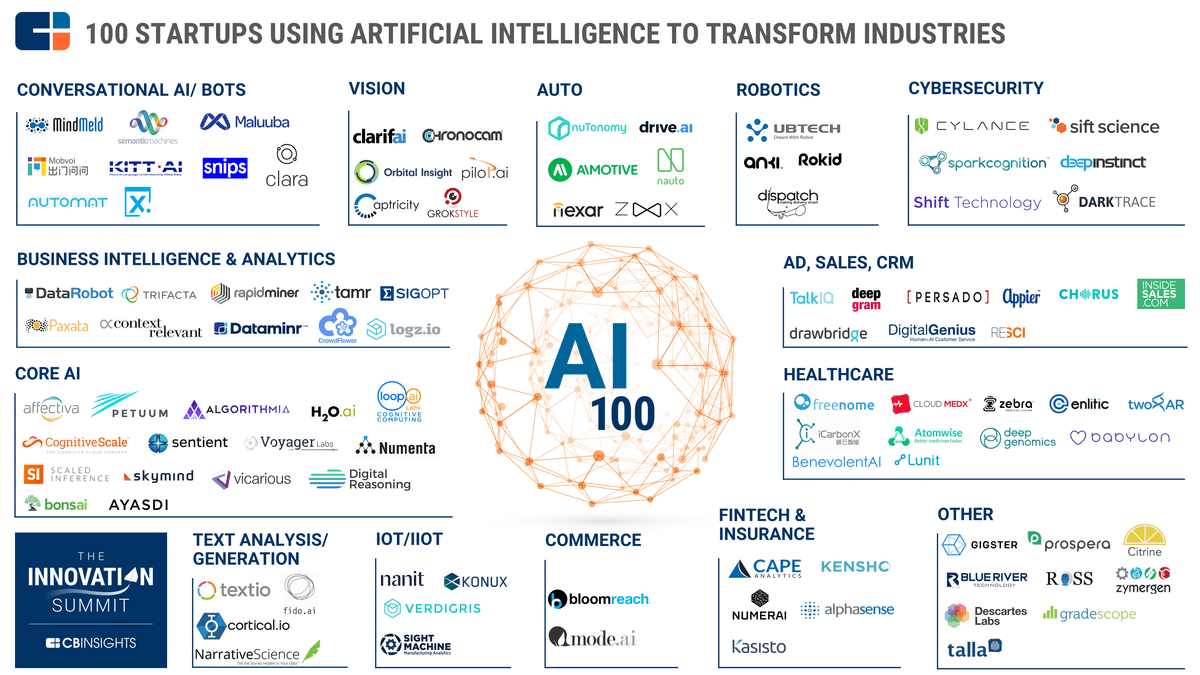

I’ve been seeing some pretty interesting ‘Vertical AI’ start-ups lately. Came across a Crunchbase report with 100 of ‘em.

Any interesting ones you’ve seen?

One ‘How To’:

The Power Of Roadshows & How You Can Add Millions In ARR By Leveraging Them:

I’ve leveraged a little-used tactic to sell millions of dollars worth of software. What you ask? Roadshows. Spending 1-3 months traveling to meet prospects to drive more bookings. It’s not as simple as getting on the road, though. DESIGN is the most important part of the roadshow.

Let’s start there…

Your roadshow needs a purpose.

“I’m going to be in [City], will you meet with me?” doesn’t count. That’s BS.

2 examples of a strong purpose:

You’re launching a new product

You’re established in a space and you’re entering an adjacent market

Who should go on the road?

It’s usually handled by a CEO or leader at the company, but seasoned AEs can do it too. The higher the rank, the more successful it will likely be. If a CEO owns it, they’ll have a much higher meeting attainment rate than an AE.

Who should you visit?

I target 80% prospects + 20% existing customers. It also depends on the purpose/intent, but if it’s a new product launch the more net new customers you can get on board the better.

Which accounts should you target?

Marquee ones. The goal of the roadshow is to get face-to-face meetings with top prospects. If you’re launching a new product—the better accounts you can ‘launch’ it with, the more opportunity you’ll have to create a domino effect post-launch.

How should you reach out?

Warm introductions. Never do cold outreach to attain these meetings. Ensure you have a great introduction into the account. This is hyper-critical.

What gets people to take the meeting?

Besides the warm intro, what’s in it for the customer? Why would they want to meet with you? It’s not enough to say you’ll fly out to see them. Here’s an example:

“We’re launching a new product and will be investing millions into it. We want to ensure we’re building the right thing for the space and so we’re willing to get on a plane to come see you, bring you lunch, and get your feedback.”

That usually works pretty well.

How much work is it?

A lot. If you don’t spend the proper time designing every little step, it WILL NOT be successful. You’ll be living out of a suitcase for a while. Take the time in advance to make it pay off.

What’s next?

Go for it. Spend the proper time & energy setting it up. I incorporate one a year for our business & ensure it’s in my annual planning work ahead of a new year. Every time I’ve planned a roadshow it has worked IF I included every member of the executive team in the design. Marketing, Sales, Success, and Product. Everyone needs to be bought in.

By ‘it worked’ I mean it generated millions in new bookings.

And customers love it.

Try it out and let me know how it goes!

One More Thing:

Participate in the vSaaS Benchmark Study!

Building software for a specific industry and eager to learn what success looks like (especially from a venture fundraising perspective), and how you stack up among your peers? You’re in the right place, because I have partnered up with OMERS Ventures, Mosaic, and Benchmarkit to gather the data for what we hope will become a set of useful, cross-industry benchmarks for vertical SaaS and software businesses that should benefit the whole community.

By participating in this survey, which should take just a few minutes of your time, you’ll help yourselves and other founders like you:

Know your goalposts as a vertical software company (instead of having to rely on ill-fit comparisons to horizontal software providers)

Know your goalposts within your own vertical (with the proviso that we get enough volume in each respective category – so share with your peers and competitors!)

Know what investors are going to care about and grade you against when considering an investment

If you’d like to participate, follow this link.

Survey responses will not be linked to your email and will be held strictly confidential by Benchmarkit and OMERS Ventures. Individual responses will only be accessible by Benchmarkit and OMERS Ventures (including related OMERS entities) and will not be shared with any third parties except on an aggregated basis. Aggregate results of this survey will be shared with participants in August. Legal & disclaimers

PS — Have a great solution for our audience of vertical SaaS founders, operators, investors, and students? Reach out to us!