#071: The Hybrid vSAAS Playbook, Veeva: A vSaaS GOAT, Products That You Can Verticalize

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kanmon, a leading embedded commercial financing solution for vertical SaaS companies.

Check out their post on financing for growth to see how the SMBs that use your vSaaS platform think about strategic expansion.

Alright, let’s get to it…

One vSaaS Breakdown:

Defining A New Type of vSaaS Company: The vSAAS HYBRID

Investor: M&A is NOT something early stage software companies do.

Founder: I promise you it can be an incredible value lever, but OK.

—5 years later @ IPO—

Investor: F*ck, he was right

Let’s expose a MYTH with a new playbook...... ⬇️

There's a really new / early company building approach that is starting to make some waves. I'm calling it hybrid vSaaS companies. I don't think it really has a name yet. So What is it? It's when a vSaaS company leverages M&A to:

Perfect the product

Scale

Let's dive in...

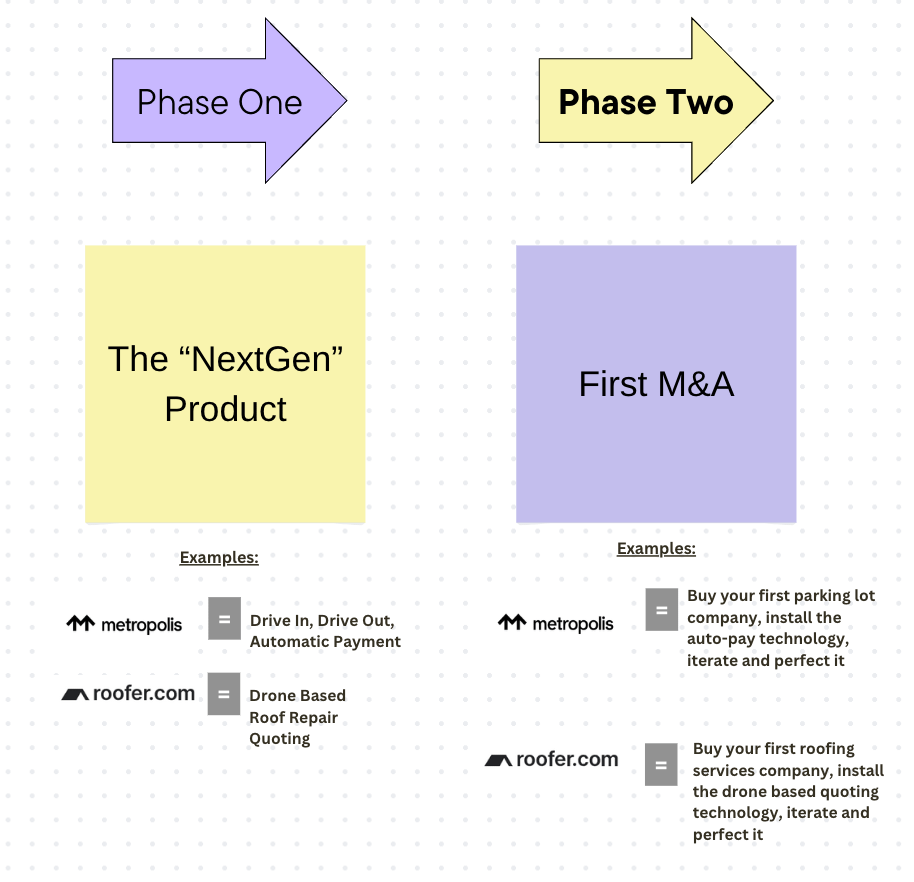

Phase #1: The "NextGen" Product

You have to start with a product that is new/innovative can really propel businesses within an industry forward.

Example:

Metropolis has created "drive-in / autopay" parking lot tech.

Roofer has created drone-based roof surveying tech.

Phase #2: First M&A

Next step? Buy a biz in the industry you're building for. Improve/perfect the tech. Demonstrate you can buy a biz, and the tech really improve it's value / efficiency.

Example:

Metropolis w/ parking lots.

Roofer with a roofing services company.

Phase #3: Surround your "NextGen" product with a vSaaS Operating / Management System

Build a classic suite of vSaaS technology. Make it better than what exists today. Drive further value in the business you've acquired.

Phase #4. Scale M&A While Also Selling Your Products To Other Incumbents

Assuming you’ve PROVEN you can drive value and structure M&A the right way it’s time to RAMP it up.

While you scale M&A you also can begin to sell your tech/vSaaS to other companies that you're not buying.

Phase #5: Achieve $1B Value via Blended Valuation

Your business will be broken into two parts, the SaaS part and the businesses that you've purchased.

Metropolis SaaS revenue is valued like any other SaaS co.

The parking lot co's they own are valued like other parking biz's.

Please note that I am really OVERSIMPLIFYING this whole process. It way more complex than this. But, at a minimum, I hope it's something you decide to go deeper on.

It's an interesting new approach in vSaaS company building and we're going to see more & more companies do this.

What did I miss? What do you think? The entrepreneurs and founders that are building companies with this playbook have been blowing my mind on this approach lately !!

One Biz Story:

Veeva: vSaaS for Life Sciences

An early Salesforce employee built a $32B vertical SaaS company for the life sciences industry.

He only raised $7M before going public at a massive valuation of $4.4B. All in just 6 years.

The story of Veeva, an amazing software business you've never heard of:

Peter Gassner is the CEO and Founder of Veeva Systems, a cloud software provider for pharmaceutical and biotech companies. Their customers include Pfizer and Abbvie.

In 2013, Veeva IPO'd just 6 years after it launched at a $4.4B valuation.It is one of the most capital-efficient businesses in software history.

VCs thought Veeva's market was too small, and that they were crazy to only be focusing on one industry.Peter only raised $7M for Veeva — talk about creating value and valuation simultaneously.

In 2007, Peter met Matt Wallach at a tech conference. They hit it off immediately and bonded over their love for cutting-edge software solutions. They saw a gap in the life sciences industry and knew they could fill it with cloud-based software. And, Veeva Systems was born.

Combining their skills (Peter, an exec for 20+ years and Matt, a sales exec for healthcare tech companies), they founded Veeva Systems in January 2007.

With their flagship product, Veeva CRM, Peter and Matt have taken over the life sciences industry. Their cloud-based CRM system was a game-changer, making sales and marketing more efficient for pharmaceutical and biotech companies.

Salesforce had a horizontal focus and didn't meet the unique needs of the life sciences world. Veeva changed that & the software was a hit.

AstraZeneca, the $180B pharmaceutical behemoth, saw a:

29% ROI

30% annual cost savings

All directly from its use of Veeva CRM.

In 2010, Veeva added Vault, a content management system for regulated industries, to their offerings. Vault ensures secure content sharing with third parties while staying compliant with regulations.

Veeva's platform is divided into two main parts:

Veeva's Commercial Cloud focuses on their CRM system, while the Development Cloud revolves around their content management system, Vault.

Veeva categorizes its products based on their maturity and popularity. CRM and Commercial Content are well-established and popular. Other products in Veeva's ecosystem are early but have potential for rapid growth.

It only took Veeva 7 years to generate $100M+ in ARR with fewer than 200 customers. They are doing some serious WHALE HUNTING. In January 2022, they generated $1.48 billion in ARR, a 26% YoY growth, with a gross margin of 84.8% and a total business EBIT margin of 27.3%.

Veeva started as a CRM built on top of Salesforce. with a low SaaS gross margin of 72.3%. But they improved, now hitting 84.8% gross margins. Today, only 30% of their subscription revenues come from products built on top of Salesforce.

Veeva has been growing by 25%+ each year for the past 5 years, even though they were already making over $500 million every 12 months. And during the pandemic (2020–2021), their growth sped up.

Veeva's main focus is on doing right by customers, promoting employees, and creating a great work environment.

In 2021, Veeva became the first public company to convert to a public benefit corporation (PBC). That means they have a legal duty to take care of their employees, customers, and community — not just shareholders.

"Speed - that's the thing you're most likely to lose. As you get big, you get slow, and you get bureaucratic.

We specifically call out that we're okay with inefficiency because if you want speed and autonomy and you're big, you have to be okay with inefficiency."

~ Peter Gassner, Veeva Co-Founder & CEO

Veeva is a case study in leveraging both SPEED and EFFICIENCY while scaling. Something incredibly rare in Silicon Valley. We all have much to learn from Veeva -- one of the GOATS of vertical SaaS.

One ‘How To’ News Clipping:

I talked about Kayna a few weeks ago and how it’s making moves as a leading embedded digital insurance solution for vSaaS companies.

Well, my timing was right — they just announced a big partnership with AEGIS London to offer embedded, real-time, mandatory property insurance options to commercial loan applicants when they're in the application process. That means closing loans faster.

This is a really cool use case as AEGIS London mutual insurance company serves the needs of the North American energy industry.

I’m thinking about some interesting embedded insurance applications for my business. If you are too ping them here.