#070: All B2B Products Eventually Converge, BI As A Wedge, The Story of Equipment Share

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kayna, a leading embedded insurance solution for vertical SaaS companies.

Check out their white paper to see how your vSaaS company can add an entirely new revenue stream by embedding insurance into your platform.

Alright, let’s get to it…

One vSaaS Breakdown:

At Scale, All B2B Products Converge

This single tweet is the smartest / most accurate thing I’ve come across in some time.

All B2B products eventually converge. I’ve seen it over and over again. You probably have to. This is even more profound / true in vertical software.

At some point, every SaaS vendor in a particular space is hearing the same requests from the market/customers. They ALL build solutions to the problems they hear. Then they move on to the next one.

Eventually you’ve solved nearly everything and you’re really just making marginal improvements here and there. All the vendors within that space begin to look really similar.

Maybe a few things are different, but as the market ages, grows up, and evolves, the vendors fill in all the gaps with software solutions.

So what does this mean for you? It means your SaaS offering HAS to eventually become the source of truth / record or you’ll get crushed.

I’m going to say it again, because it’s so important…

If you do not eventually become the source of truth / erp / whatever your industry calls it YOU WILL GET ERODED.

It happens slowly, and then really quickly.

Theres a million reasons you’ll be told why you should NOT venture into that territory:

Rip & replace

Long sales cycles

Tough implementations.

It's a zero-sum game.

Blah blah blah. They’re all accurate. They’re 110% accurate actually.

But at some point you have to eat the frog. You have to compete with those big systems. Or you’ll get eroded.

It will happen slowly at first. Then really quickly.

Get ahead of it.

One ‘How To’:

Business Intelligence As A Wedge

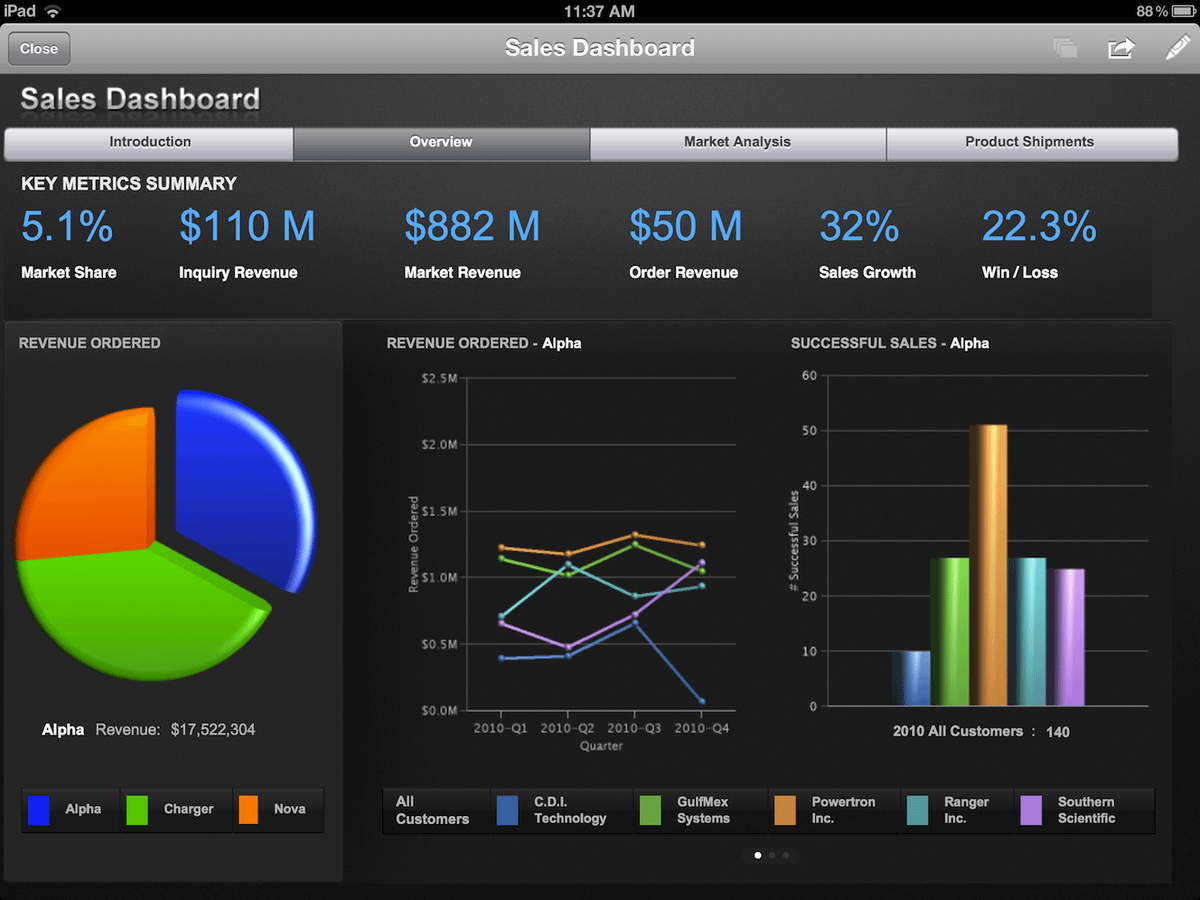

Industry Specific Business Intelligence is a low-hanging wedge opportunity in A LOT of verticals.

People forget so many verts lack IT. The result? Horizontal solutions just don't work.

Find an industry & connect the industry tools they use into a white labeled BI product.

One Biz Story:

Equipment Share: Vertical Software for Construction Equipment

These two brothers grew up in a SOCIALIST COMMUNE in Missouri.

They left, and today run a $2 BILLION dollar revenue business.

This is the incredible story of EquipmentShare:

William and Jabbock Schalcks grew up in a communist theocracy in Missouri. But that didn't stop the brothers from being entrepreneurial from a very young age. They started their first company around 10 years old, building and renting out sheds.

The brothers love for entrepreneurship continued, and they would go on to start a biz buying and selling computer parts. The brothers had NO personal property and all the money that they made had to be given to the commune. So in their late twenties, they decided to leave.

The two continued their entrepreneurial endeavors and ultimately stumbled upon something that would be BIG. They identified the pain of finding equipment for construction businesses so they set out to build a marketplace for contractors to rent equipment to each other. In 2014, while at a start-up event in Columbia Missouri, the two pitched their idea and emerged as winners. They decided to go all-in on the concept, officially incorporating EquipmentShare and focusing on a rental marketplace.

Since then, they've evolved from a simple marketplace to a full-service platform that digitizes construction workflows. The evolution has been quite something:

Equipment Rental Marketplace -> Asset Tracking -> Asset Utilization Monitoring -> Labor Management -> And more...

Eventually, the company had expanded so drastically into every aspect of construction businesses that they launched their very own construction operating system.

The T3 OS. A one-stop-shop platform for construction businesses.

One key advantage that they have now, which was likely a disadvantage in the early days, is that they offer their own hardware that can integrate with any equipment brand or model. These include machine tracers, Bluetooth tags, jobsite cameras, and cloud-connected keypads.

Today, EquipmentShare services construction companies of all sizes. Their marketplace acts as great 'wedge' product that gets customers in the door and leads many to their full software/hardware offering. I've written a lot about wedges in the past (https://twitter.com/lukesophinos/status/1685998784382488577)

EquipmentShare has raised a total of $2.4 billion through a combination of debt and equity. In May 2023, it raised $640 million in debt financing from Capital One. In April 2023, it raised $290 million in equity financing from various investors. Quite the fundraising tear.

EquipmentShare reportedly had around $2 billion in annual revenue in December 2022. The company has more than 4,000 employees across 165 locations in the US as of August 2023. $2B in revenue in 9 years is QUITE the scale-up.

Is an IPO on the horizon? My guess is it has to be coming soon...

Excited for the founders and team to ring the bell. What they've achieved from humble Missouri beginnings is quite the tale.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: