#069: The 4 Types of vSaaS Companies, The Story of Metropolis, Digital Franchises

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

Today’s episode is brought to you by Kayna, a leading embedded insurance solution for vertical SaaS companies.

Check out their white paper to see how your vSaaS company can add an entirely new revenue stream by embedding insurance into your platform.

Alright, let’s get to it…

One vSaaS Breakdown:

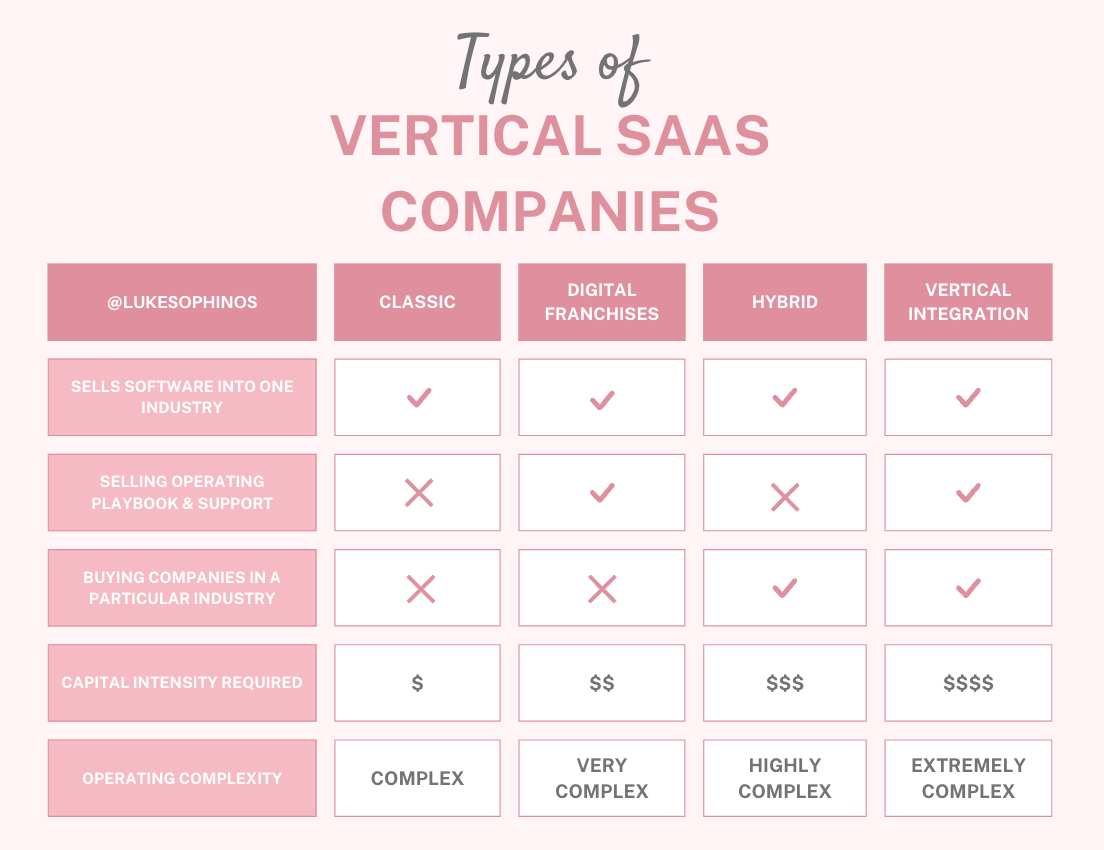

The Four Types of vSaaS Companies Today

I'm seeing 4 sets of vSaaS companies today...

Let’s go deeper…

Classic

100% SaaS businesses building an industry specific software platform and selling it to businesses within that sector.

Examples:

CourseKey (Trade Schools)

Toast (Restaurants)

OpenGov (Local Governments)

Digital Franchise

Building a SaaS business + a digital franchise / business in a box and offering it to companies within a particular industry. Supporting operators with playbooks.

Examples:

Slice (Pizza Shops)

Moxie (Medspas)

Fora Travel (Travel Agencies)

Vertically Integrated

Buying companies within said industry, layering in their own vSaaS solution to drive efficiencies, changing operations to meet their standard.

Examples:

Splash Ventures (Pool Cleaning)

Carbon Health (Doctors Offices)

Roofer (Roofing Companies)

Hybrid

Buying companies within said industry, layering in their own vSaaS + operations AND selling their vSaaS to other companies within that industry.

Examples:

Metropolis (Parking Lots)

LedgerUp (CPA Firms)

#2, #3, and #4 are all relatively new and I'm excited to see how they play out. What are other examples? What are pros/cons of these approaches?

One Biz Story:

Metropolis: Software & Hardware for Parking Lots

Paying for parking is a total pain in the ass.

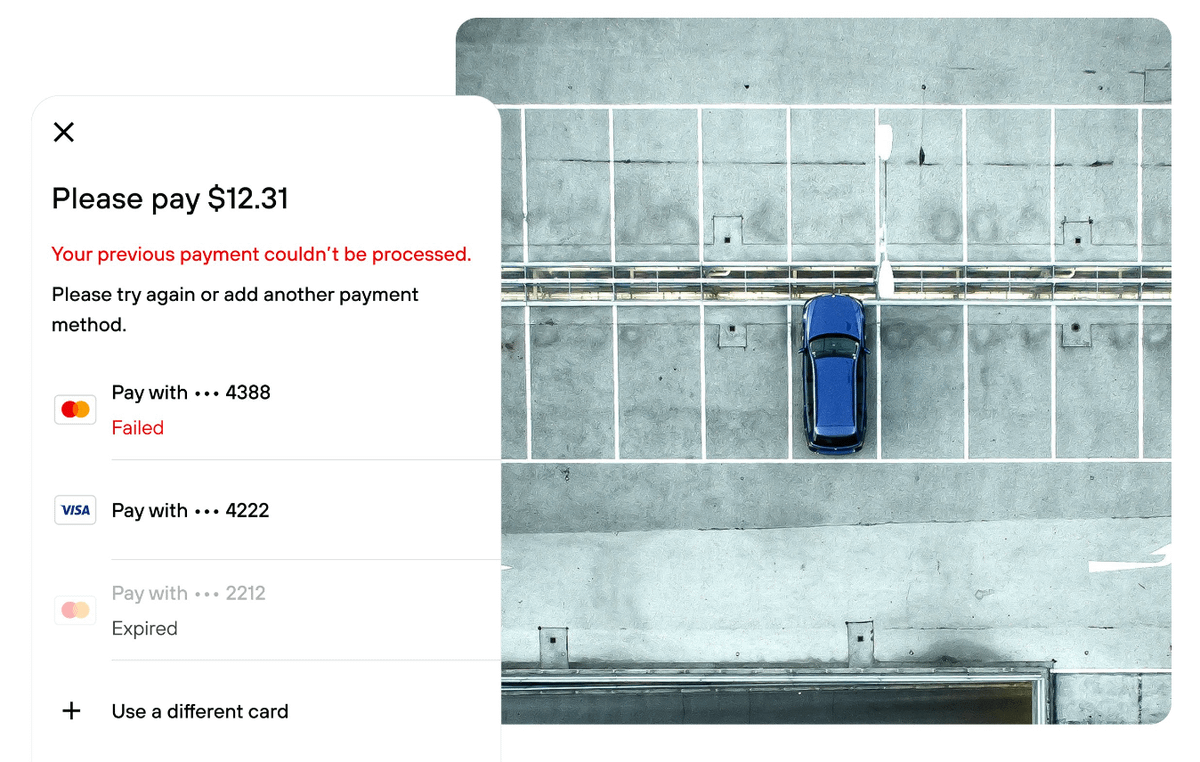

Metropolis as a computer-vision company enabling consumers to drive in and drive out of lots have their cards charged automatically.

And they have raised nearly $2B to solve the problem.

Let's dive in:

Founded in 2017 by Alex Israel, Courtney Fukuda, Peter Fisher, and Travis Kell. This isn't Alex's first rodeo. In 2009, he co-founded ParkMe. ParkMe aimed to revolutionize navigation by addressing parking challenges. In 2015, he sold ParkMe to INRIX.

So why start another company in the parking space? The team recognized the inefficiencies in traditional parking management. They dealt with it everyday at their previous company. They envisioned a future where AI and computer vision could revolutionize the industry.

Imagine if people could drive in and drive out and have their cards charged automatically.

No toll booths. No dealing with angry parking attendants.Essentially Amazon check-out for parking...

The crew got to work.

Initially starting with a computer vision platform they would sell to parking lot owners.

Computer vision platform enables seamless parking transactions.

Drive-in, drive-out payment for consumers.

Facility management SaaS for real estate owners

How it works:

Cameras are installed in parking facilities capture real-time video.

AI algorithms analyze the video feed to identify vehicles, license plates, and parking spaces.

Checkout-free payment: Drivers enter and exit without manual transactions.

And it's working...

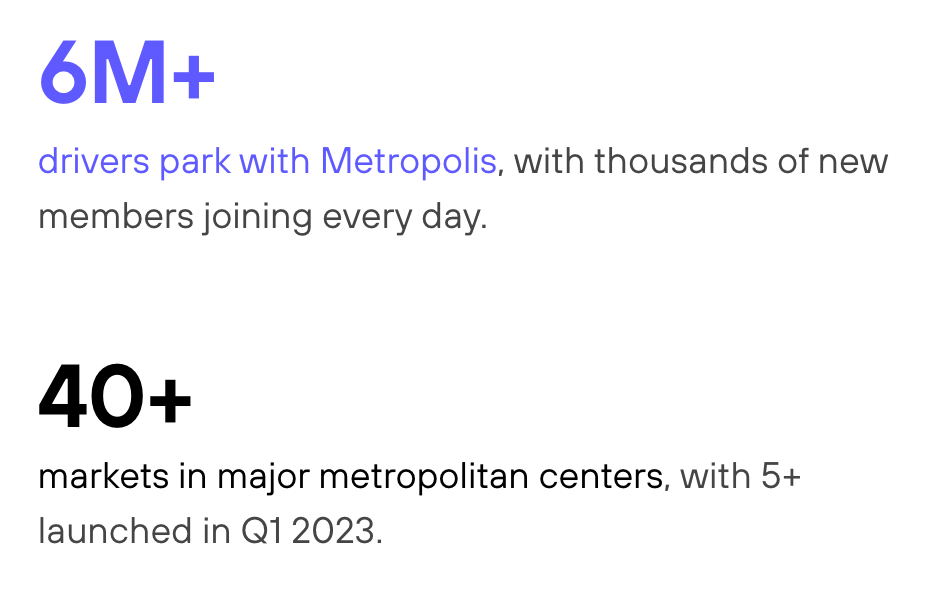

Tody Metroplois customer base is quite impressive. 6M+ drivers already benefit from Metropolis. 40+ markets in major cities, with continuous expansion.

But the team faced what all vSaaS companies struggle with: Trying to get legacy incumbents to adopt new and innovate technologies.

They decided to start acquiring parking lots in addition to selling their software/hardware to existing parking lot management companies.

They've gone all out here as of recently...

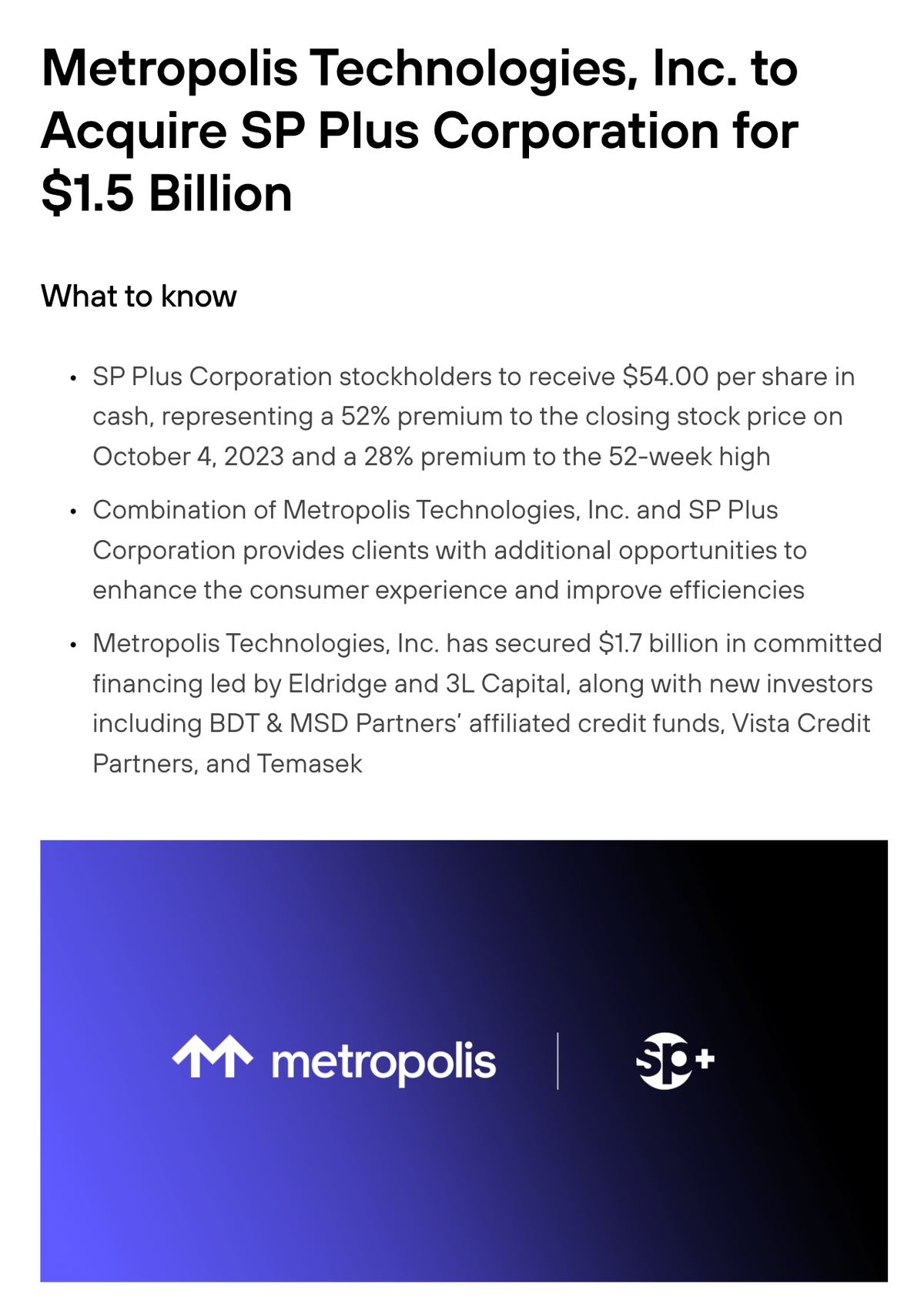

In October 2023 Metropolis announced they were acquiring SP Plus for a whopping $1.5 billion.

And the funding continues to stack up. Especially with the strategy of purchasing parking lots. Let's take a look at the round by round history:

Seed Round (2019): $20 million led by Zigg Capital led this initial funding round.

Series A (2021): $41 million led by 3L Capital

Series B (2022): $167 million led by 3L Capital & Assembly Ventures

Series C (2023): $1.1 Billion led by 3L Capital & Eldridge Industries

Buying parking lot companies and selling software into other parking lot companies at the same time is an interesting approach. Some are calling this vertical SaaS 2.0

Excited to see how this all plays out. Regardless, the tech is AWESOME. It simply doesn't make sense that we stop at parking kiosks and spend 5 minutes paying for parking. If you live in any kind of urban area you deal with this ALL THE TIME.

Kudos to the @metropolisio team. Cheering for you to build a category defining business here!

One ‘How To’:

Digital Franchises Overview

Forerunner did a good breakdown here on franchises today versus vc-backed companies creating "digital franchises". If you’re thinking about starting one of these it’s a great place to start.

Slice for Pizza is one of the best examples of someone killing it with this approach. Moxie for Medspas is another earlier stage one.

What other industries could this work really well for?

From their article:

“Digital franchises share the benefits with their offline counterparts, but have a few distinctions:

Marketing Automation: While all franchisors help with marketing, DNFs also focus on acquiring customers for their franchisees through digital channels. These tools provide SEO, keyword buying and look-alike targeting — at a greater investment than a solopreneur might achieve on their own. If needed, off-hours CX could be an option to ensure leads are processed quickly.

Unified Platform: From CRM to e-commerce to workflow, DNFs provide one platform for their franchisees. This leverages both software best practices, while also reducing any need for integrations. Benchmarking and best practices can be built into the platform, so that standards are easier to meet.

Financial Services: By centralizing payments, DNFs can understand the success of individual businesses. These insights give DNFs the ability to understand where franchisees are at with growth and provide cash advances to make that growth less of a burden on the franchisee.

Online Community: Starting a business can be both lonely and challenging, but through the power of online community, DNFs can provide the peer-level support and guidance needed to be successful. Along the way, many franchisees can become amazing friends.”

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: