#065: The Classic Vertical SaaS Playbook, Value Prop Builder, vSaaS For Trucking

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One vSaaS Breakdown:

The Classic Vertical SaaS Playbook

VC: Your market’s too small, I'm out.

Founder: I promise you it’s not, but OK.

—5 years later @ IPO—

VC: Fuck, he was right

Let’s expose a BIG myth.....

Vertical software CONSTANTLY gets labeled as SMB SaaS, micro SaaS, etc. The truth is, you can build massive billion-dollar businesses within specific verticals that look small at the surface.

How? Let’s break it down…

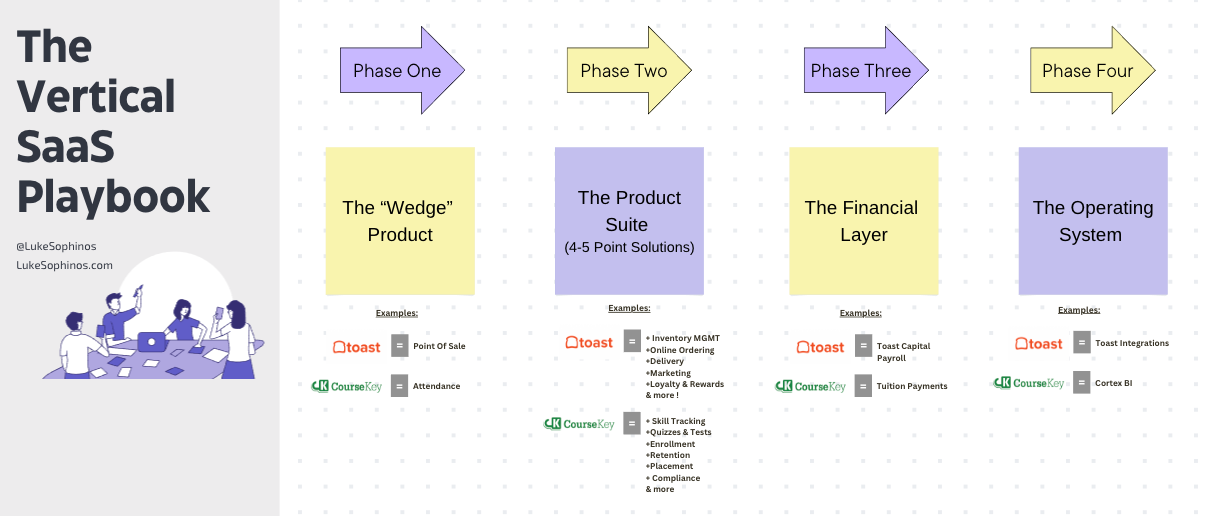

Step #1 ($0-$1M ARR): Find your ‘wedge / get in the door' product.

A good wedge product is:

Relatively easy to build/implement

Little competition

Creates customer delight

Reputation prover

Toast's wedge was a simple POS on a tablet, not a machine.

Step #2 ($1-$10M ARR): Expand into a product suite

In vertical software, you've created great relationships w/ customers who loved your “get in the door product." Now it’s time to add 4-5 more. Your existing customers WILL tell you what they need in adjacent areas.

Listen to them!

Step #3 ($10-$100M ARR): Add a financial layer

Corporate cards, mobile payments, etc. ARR will skyrocket.

If you’re the suite for your vertical, there's no reason to keep using other (horizontal) SaaS.

I have a $500K/yr customer billing via PAYPAL for god's sake. We're changing that.

Step #4 ($100M-$1B ARR): Become the Integrator / marketplace / connector

Many verticals have no platform or connector: something that allows users to use all the solutions in their ecosystem frictionlessly. Ot's like your iPhone App Store, Amazon TV, Shopify’s App Store, Procore’s Marketplace, etc.

Do this & your moat will be incredible.

You can get to enormous run rates in these "nichey" markets with this playbook. Just look at Toast’s surface level market size:

There are 700K restaurants in the US. At $10 a month that’s a $84M TAM. Which IS NOT a venture-scale opportunity. But if you look at their playbook, over time their customers’ customers also became their customers—with the introduction of P.O.S. software.

They took a piece of every transact. Now they serve every restaurant and every person who eats at a restaurant. Which is MASSIVE.

Vertical SaaS has a playbook and it works. We’ve seen it with Procore, Toast, Veeva, etc. In fact, I've broken down 100+ vSaaS companies over at lukesophinos dot com and they almost ALL look like this.

Now the natural next question is...

Who does it BIG TIME next? Maybe you?

One ‘How To’:

A Simple Framework To Nail Your Elevator Pitch:

One Biz Story:

AtoB: All-In-One Finance Software for Trucking

The "Stripe" for Trucking was valued at $800 BILLION at an estimated 40x ARR multiple. Founded in 2020, this Silicon Valley FinTech is building the financial infrastructure for the trucking industry. How big can they get? Can they overcome a massive multiple? Let's dive in:

AtoB was founded by Vignan Velivela, Harshita Arora, and Tushar Misra. The group hails from big tech having worked at companies like Uber, Cruise, & Deutsche Bank. They are also from elite universities including Carnegie Mellon and UC Berkeley.

Initially, they aimed to fix city transportation issues by creating an "Uber for buses". If I had a dollar for the amount of times I've heard that pitch... But, when the pandemic hit, they swiftly adapted to address a critical need in the trucking industry: Fuel Costs.

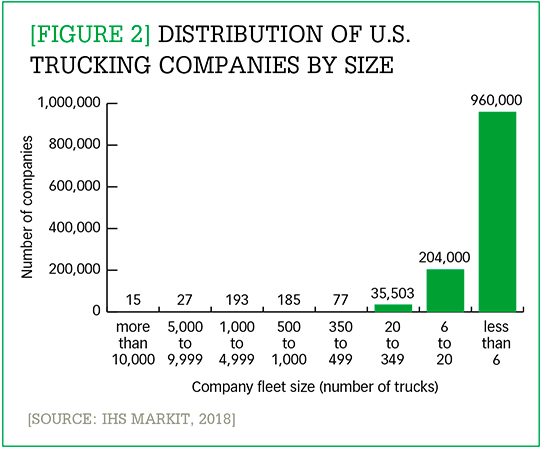

Trucking moves 71% of all the freight in America, & nearly 6% of all the full-time jobs in the country are in trucking. One of these companies main concerns? The cost of gas. So they set out to create a "Stripe" for truck drivers, focusing on fuel payments and financial tools.

The group got to work, and were connected with Stotland Trucking. As a big player in transportation, they encountered several obstacles with existing providers including: •Handling invoices •Frequent problems with physical cards not working •Terrible customer support

They made the leap with AtoB and became their fist customer. The benefits: •A 10% reduction in total fuel costs. •$3,000 annual savings on fuel fraud •6 hours saved per week on finance management using AtoB’s Dashboard.

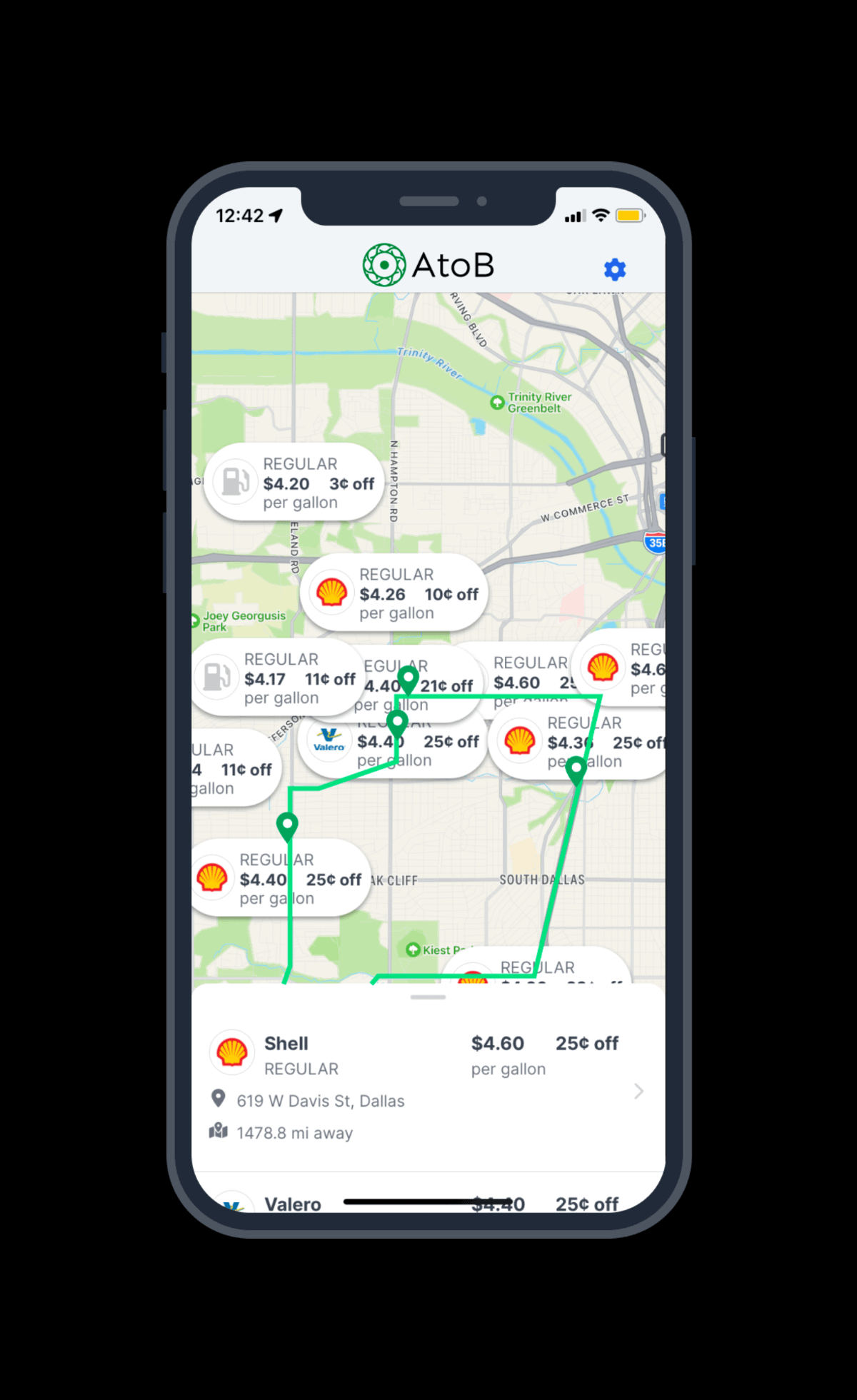

How'd they do this? AtoB's product is pretty sweet... Fuel Cards: A card with up to 84¢ off per gallon at preferred fuel stations. Driver App: An app that pre-plans routes with gas station stops where the cheapest fuel is. Instant Payroll: Simple/clean driver payments

Moving beyond their first customer, AtoB acquires customers through a few different channels: •Content Marketing •Inside Sales/Cold Outreach •Paid Ads •Trade Shows •Affiliate Marketing My guess is Inside Sales & Trade shows are the biggest drivers of new logos.

In August of 2022 AtoB raised $155M at an $800M valuation led by Elad Gil and General Catalyst. Given they offer a card, we don't know how much of this was equity / debt for their credit servicing. But that Series B round brought AtoB’s total debt and equity raise to $230M (!).

It was reported that 2021 revenue was around $2M but 2022 was going to go to ~$20M. I couldn't find any further information here but seeing that a big raise happened towards the end of 2022 the growth must have been impressive.

Even if revenue grew to $20M in '22, that would put them at 40X ARR. Today, the fastest growing SaaS companies are at 10-15X ARR. AtoB is likely facing what most SaaS businesses are, and aiming to use that capital to MEET last round's value at much lighter revenue multiple.

They are definetly making strides. In 2023 they announced the landing of a BIG FISH. Uber Freight decided to leverage AtoB for their entire operation and are embedding their tooling directly into their app. Boom!

What AtoB is building is exciting, and they will figure out the financial piece. Every company that raised in this era, mine included, has or are facing the same thing. Here's to AtoB, i'm excited to watch them build the financial infrastructure for the trucking industry.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: